U.S. stocks and U.S. bonds were closed for one day yesterday due to Memorial Day, but there will be heavy data later this week (GDP and Fed-favored PCE inflation data) is released, so it is considered a "short but busy week".

Source: SignalPlus, Economic Calendar

In terms of digital currency, Bitcoin once again exceeded the $70,000 mark during the US trading session yesterday after trading sideways for nearly a week. , the market’s bullish enthusiasm seems to have finally been swayed by the continued inflows into ETFs. Considering that U.S. stocks are closed for the holidays, analysis platform Santiment characterized this wave of rise as an encouraging sign, as it proves that BTC can rise and fall with TradFi. It can also perform well when the correlation is not so tight.

Source: TradingView; Farside Investors

But things didn’t go smoothly. Just after BTC exceeded 70,000, news came from the market: Mt. Gox’s cold wallet transferred 12.24kBTC to an unmarked address, worth approximately US$840 million. Mt. Gox's creditors were hit hard when the exchange collapsed in 2014. The exchange has struggled to recover funds for repayment over the past decade, and today's transfer on the BTC chain is seen by some traders as a potential dump. Suppressing the negative catalyst, the BTC price subsequently fell sharply to below 68,000 at the peak of the day.

Source: Twitter

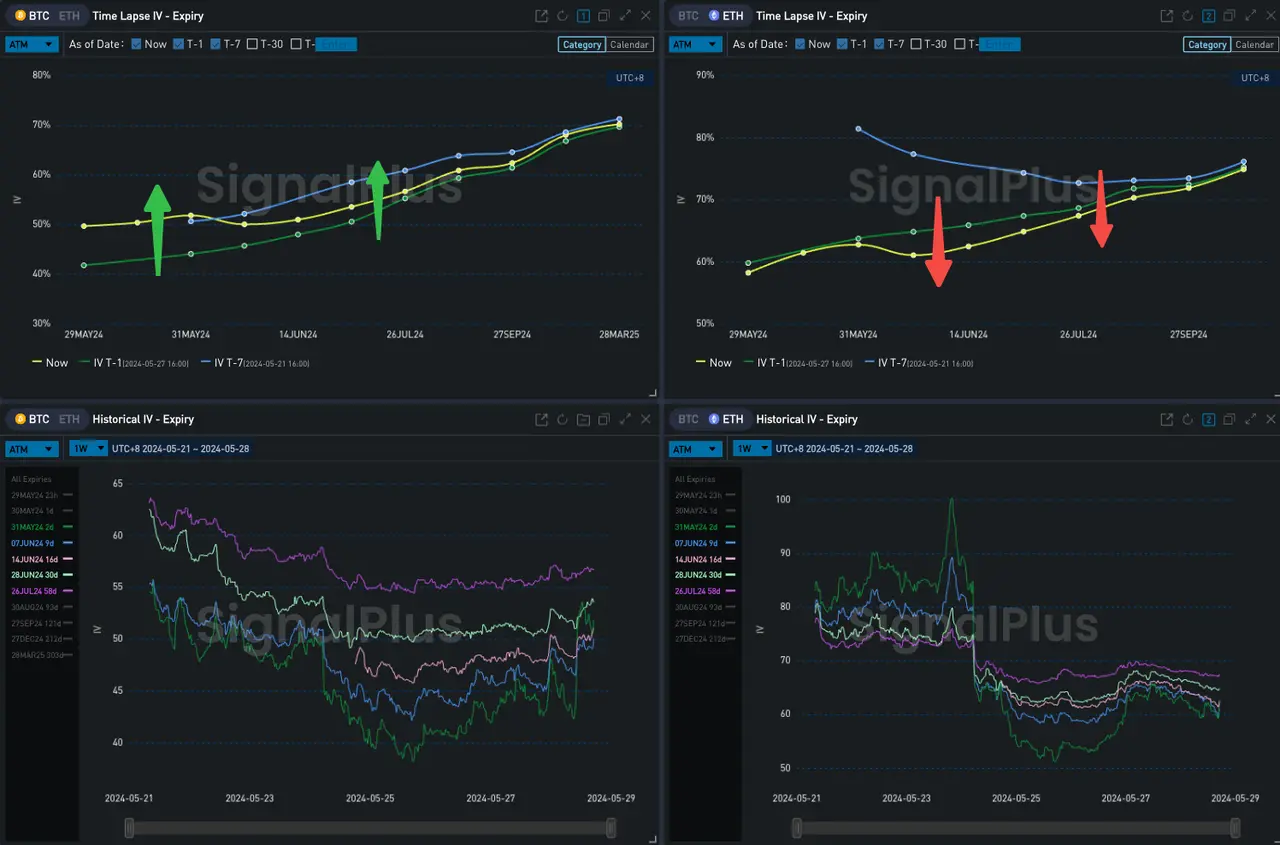

In terms of options, the market’s focus has once again returned to BTC. The rollercoaster market in the past 24 hours and the market's concerns about potential selling pressure have raised the implied volatility. The IV curve has been flattened and higher as a whole. The volatility smile has also quickly tilted towards put options after the price fell. From the perspective of transactions, BTC The largest transaction was also a group of Short Risky (450 BTC per leg) in June, selling 75,000-Call and buying 65,000-Put as protection, with a net Premium of approximately 2 BTC.

Source: Deribit (as of 28MAY 16:00 UTC+8)

Source: SignalPlus

Source: SignalPlus

Data Source: Deribit, ETH transaction overall distribution

Data Source: Deribit, overall distribution of BTC transactions

Source: Deribit Block Trade

Source: Deribit Block Trade

The above is the detailed content of SignalPlus Volatility Column (20240528): Recalling Mentougou. For more information, please follow other related articles on the PHP Chinese website!