Compiled by: Jordan, PANews

In May, most indicators of the cryptocurrency market fell. This article will use 11 pictures to interpret the crypto market conditions in the past month.

1. In May, the adjusted total on-chain transaction volume of Bitcoin and Ethereum fell by 4.4% to US$390 billion. Among them, the adjusted on-chain transaction volume of Bitcoin fell by 4.7%, and that of Ethereum fell by 4.7%. The transaction volume on the FangChain fell by 3.9%.

#2. After adjustment in May, the transaction volume on the stablecoin chain fell by 20.5% to US$879 billion; the supply of issued stablecoins increased, and the increase It was 0.5%, rising to US$141.9 billion. The market share of the US dollar stable currency USDT increased to 78.8%, while the market share of USDC dropped slightly to 17.1%.

3. Bitcoin miners’ income dropped to $963 million in May, a drop of 46%. Additionally, Ethereum staking revenue increased by 4.1% to $267 million.

#4. In May, the Ethereum network destroyed a total of 26,747 ETH, worth US$91.7 million. Data shows that since the implementation of EIP-1559 in early August 2021, Ethereum has destroyed a total of approximately 4.3 million ETH, worth approximately US$12.1 billion.

5. In May, the transaction volume of the NFT market on the Ethereum chain dropped sharply again, with a drop of 27.8%, further falling to approximately US$344 million.

6. The spot trading volume of compliance centralized exchanges (CEX) fell in May, falling by 22.5% to $68.9 billion.

7. The spot market share rankings of major cryptocurrency exchanges in May are as follows: Binance was 79.4% (an increase from April) and Coinbase was 10.1% , Kraken is 3.4%, and LMAX Digital is 1.8%.

8. In terms of crypto futures, the increase in open interest in Bitcoin futures in May reached 12.9%; thanks to the approval of the spot Ethereum ETF by US regulators , Ethereum futures open interest increased by 52%, hitting a record high; in terms of futures trading volume, Bitcoin futures trading volume fell by 21% in May to $1.26 trillion, and Ethereum futures trading volume increased by 0.2%.

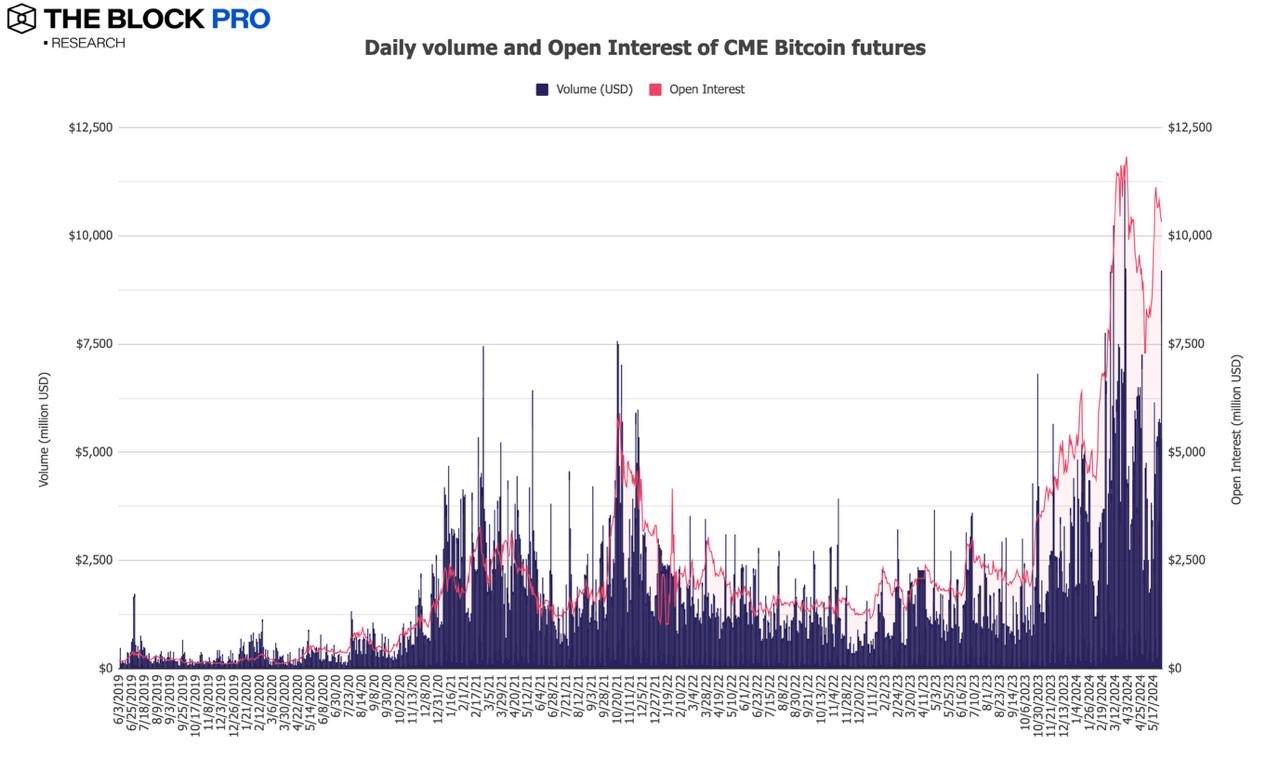

9. In May, CME Group’s open interest in Bitcoin futures increased by 15.9% to US$10.3 billion, and the daily avg volume decreased. 9%, down to approximately $4.35 billion.

10. In May, the average monthly trading volume of Ethereum futures decreased to US$692 billion, a slight increase of 0.2%.

11. In terms of cryptocurrency options, the open interest of Bitcoin options rebounded in May, with an increase of 30.5%, and the open interest of Ethereum also increased, with an increase of 41.4%. %. In addition, in terms of Bitcoin and Ethereum options trading volume, Bitcoin options trading volume reached US$46.8 billion, a decrease of 1.2%; Ethereum options trading volume reached a new high of US$31.4 billion, an increase of 19.2%, setting a record high.

The above is the detailed content of 11 charts explaining the crypto market in May: Spot ETF approval helped multiple Ethereum indicators hit record highs. For more information, please follow other related articles on the PHP Chinese website!