web3.0

web3.0

MicroStrategy announced that it will add another $500 million to Bitcoin! However, the stock price fell by nearly 8%.

MicroStrategy announced that it will add another $500 million to Bitcoin! However, the stock price fell by nearly 8%.

MicroStrategy announced that it will add another $500 million to Bitcoin! However, the stock price fell by nearly 8%.

This site (120bTC.coM): MicroStrategy, the dominant Bitcoin holdings among listed companies in the United States, announced late yesterday that it plans to target qualified institutional investors. Private placement of US$500 million worth of convertible senior bonds due in 2032.

Continue to increase your position in Bitcoin

MicroStrategy explained in the announcement that the convertible senior bonds issued this time will meet the following basic conditions:

Belonging to micro-strategy unsecured senior debt, they will pay interest to investors and are scheduled to be settled semi-annually on June 15 and December 15 of each year starting from December 15, 2024.

After June 20, 2029, MicroStrategy can redeem some or all of the bonds with cash.

Bond holders have the right to require MicroStrategy to repurchase all or part of their bonds with cash on June 15, 2029.

The interest rate, initial conversion rate and other terms of the bonds will be determined at the time of pricing of the offering.

However, more importantly, MicroStrategy stated that the proceeds from the bond issuance will continue to be used to purchase more Bitcoin: MicroStrategy intends to use the net proceeds from the sale of these bonds Proceeds will be used to purchase more Bitcoins and will also be used for the company’s general purposes.

MSTR fell nearly 8% at the opening

Since MicroStrategy announced its continued investment in Bitcoin in August 2020, its stock (MSTR) has started a skyrocketing mode, and with the Bitcoin bull market With the arrival of the epidemic, it has entered a concentrated outbreak cycle. After announcing multiple positions this year, the stock price has often been stimulated.

But this time, although MSTR rose 3.1% before the U.S. stock market opened, it fell all the way, closing at $1,483.88, down 7.47%. Although Bitcoin also performed poorly last night, MSTR fell even deeper, and repeated attempts to increase positions seemed to be gradually unable to lift the stock price.

Bitcoin once shot up to US$70,000 after the CPI was announced the night before yesterday, but then continued to fall. It once hit a low of US$66,258 at 0:00 on the 14th. At the time of writing, the price was US$66,630, down 2.4% in the past 24 hours. %.

MicroStrategy Bitcoin’s floating profit is 6.73 billion US dollars

However, although Bitcoin is still fluctuating, according to the latest data from bitcointreasuries, MicroStrategy’s current Bitcoin position is 214,400 BTC. Buy The cost is approximately US$7.543 billion, the current total value reaches US$14.276 billion, and the account floating profit is as high as US$6.73 billion.

Micro Strategy Bitcoin Position

The above is the detailed content of MicroStrategy announced that it will add another $500 million to Bitcoin! However, the stock price fell by nearly 8%.. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1664

1664

14

14

1422

1422

52

52

1316

1316

25

25

1267

1267

29

29

1239

1239

24

24

Analyst: Trump's election may trigger global inflation again, which may not necessarily be beneficial to Bitcoin

Jul 19, 2024 am 02:20 AM

Analyst: Trump's election may trigger global inflation again, which may not necessarily be beneficial to Bitcoin

Jul 19, 2024 am 02:20 AM

This site (120btc.coM): The U.S. presidential election has entered the last four months, and the battle between former U.S. President Donald Trump and current U.S. President Joe Biden, representing the Republican Party, is heating up. But since Trump was shot last weekend, his support and exposure have soared rapidly in the community. Because of his pro-cryptocurrency stance, it has also stimulated the rise of Bitcoin, betting that Trump's victory will create a regulatory environment conducive to the growth of cryptocurrency. Analyst: Trump’s election may once again trigger global inflation. In addition to Trump possibly providing a friendly regulatory environment for cryptocurrencies, another possibility that the market generally believes will boost the sharp rise of cryptocurrencies is: the Federal Reserve is maintaining long time

U.S. Senator Cynthia Lummis proposes: Let the United States buy 1 million Bitcoins

Jul 29, 2024 am 07:04 AM

U.S. Senator Cynthia Lummis proposes: Let the United States buy 1 million Bitcoins

Jul 29, 2024 am 07:04 AM

This site (120BtC.coM): Republican Senator Cynthia Lummis of Wyoming, who has long supported the development of cryptocurrency, did not disappoint her supporters. She announced the latest legal proposal she is about to promote at Bitcoin 2024, the U.S. Bitcoin Conference, this morning (28): Let the U.S. Treasury Department buy 1 million Bitcoins within 5 years! One million Bitcoins, if converted using the current market price at the time of writing, is approximately US$68 billion. Cynthia Lummis stated that the main reason for listing BTC as a national reserve is to “offset the impact of the depreciation of the U.S. dollar.” Cynthia Lummis said: Bitcoin is a rapidly growing reserve of value. In the past four years, it has grown by about 55% per year. At the same time, the U.S. dollar has grown by about 55%.

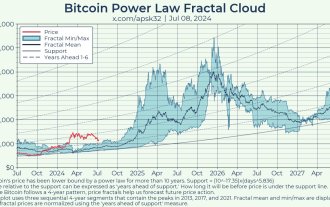

Bitcoin Power Law Indicator Prediction: The rise will accelerate in the coming months! It is expected to increase by 4 times by the end of 2025

Jul 16, 2024 pm 05:27 PM

Bitcoin Power Law Indicator Prediction: The rise will accelerate in the coming months! It is expected to increase by 4 times by the end of 2025

Jul 16, 2024 pm 05:27 PM

This site (120bTC.coM): Mt.Gox, once the world’s largest Bitcoin exchange, started repayment in July. In addition, the German and American governments have also recently transferred large amounts of Bitcoin to exchanges. The two are considered to be the most recent The two major factors that have dragged down the price of the crypto market have many analysts with different opinions on what the price trend of Bitcoin will be in the second half of 2024 and in the future. Recently, anonymous engineer Apsk32 analyzed the latest Bitcoin (BTC) price on the Gradually climb up within the support zone. End of 2025: Price expected to rise 4x Apsk32 points out that the price of Bitcoin seems to follow a certain weekly trend.

ApeCoinDAO proposes to open a Boring Ape themed hotel in Bangkok, Thailand! APE pays room fees and empowers BAYC

Jul 22, 2024 pm 03:36 PM

ApeCoinDAO proposes to open a Boring Ape themed hotel in Bangkok, Thailand! APE pays room fees and empowers BAYC

Jul 22, 2024 pm 03:36 PM

This site (120BTc.coM): ApeCoinDAO, the decentralized autonomous organization of the NFT blue chip project Bored Ape (BAYC) ecological token APE, launched a new proposal AIP-448 on the 19th, planning to build a prime location in the center of Bangkok, Thailand The goal of opening an ApeCoin themed hotel is to enhance the exposure of Boring Monkey IP, the popularity and practicality of ApeCoin, and create actual income for DAO. The current results show that more than 4.8 million APEs have agreed to the proposal, with a support rate of 89.47%, and only 565,000 APEs have voted against (10.53%). The voting is expected to close at 9 a.m. on August 1. The community plans to open an APE themed hotel, hoping to increase the popularity of Boring Ape.

The Starknet ecological project ZKX, which raised tens of millions of dollars, announced its closure! Token ZKX flash crash

Jul 31, 2024 pm 01:50 PM

The Starknet ecological project ZKX, which raised tens of millions of dollars, announced its closure! Token ZKX flash crash

Jul 31, 2024 pm 01:50 PM

This site (120btc.coM): ZKX, a derivatives trading platform on Starknet with a financing background of tens of millions of dollars, announced its closure due to low user participation and serious lack of revenue. The founder of the protocol, Eduard Jubany Tur, called on users to withdraw funds before the end of August. As soon as the news came out, ZKX tokens fell by more than 34.8% during the day. ZKX, which has a strong financing background, is the first derivatives trading platform on Ethereum L2Starknet with self-custody and community governance. ZKX aims to provide sustainability to users on StarkNet and Ethereum through decentralized nodes and excellent trading experience. Futures and other derivatives. It is reported that the agreement was completed for 4 months in July 2022 and June this year respectively.

Trump vows not to sell US government Bitcoin! Is it really that simple?

Jul 29, 2024 pm 02:47 PM

Trump vows not to sell US government Bitcoin! Is it really that simple?

Jul 29, 2024 pm 02:47 PM

This site (120bTC.coM): At 4 o'clock on Sunday, Beijing time, U.S. presidential candidate Trump officially took to the main stage of Bitcoin 2024, the Bitcoin conference, and expressed his political views on the cryptocurrency industry in front of many Bitcoin supporters. One of the highlights is that Trump said: If elected president, he would never sell Bitcoin owned by the US government. “The federal government owns nearly 210,000 Bitcoins, or 1% of the total supply. But for too long, our government has violated a basic principle that every Bitcoin enthusiast knows: HODL.. Never sell your Bitcoins Bitcoin. As the final part of my plan today, I am announcing that if elected, my administration’s policy would be for the United States to retain 1 of all Bitcoins it currently holds or acquires in the future.

Buy a supercar with Bitcoin! Ferrari will accept cryptocurrency payments in Europe

Jul 25, 2024 am 12:43 AM

Buy a supercar with Bitcoin! Ferrari will accept cryptocurrency payments in Europe

Jul 25, 2024 am 12:43 AM

This site (120bTC.coM): According to Reuters, Italian supercar manufacturer Ferrari said on Wednesday that European customers will be able to use cryptocurrency to purchase supercars before the end of July. In order to meet the needs of wealthy customers, Ferrari partnered with cryptocurrency payment service provider BitPay in October last year to take the lead in accepting customers to make payments using Bitcoin, Ethereum and USDC in the United States. Now this service will be expanded to the European market at the end of the month. It will be further extended to other countries by the end of 2024. It is reported that after receiving the customer’s cryptocurrency payment, BitPay will immediately convert the cryptocurrency into legal tender, providing Ferrari dealers with protection from price fluctuations, and will not charge additional fees to the customer.

Musk: I have a soft spot for Dogecoin! Bitcoin and cryptocurrencies have advantages but will not be promoted

Jul 30, 2024 pm 07:36 PM

Musk: I have a soft spot for Dogecoin! Bitcoin and cryptocurrencies have advantages but will not be promoted

Jul 30, 2024 pm 07:36 PM

This site (120BtC.coM): The "Bitcoin Conference 2024" ended successfully over the weekend. Although Tesla CEO Elon Musk did not make a surprise appearance, he talked about cryptocurrency in another public occasion. On July 28, local time, Musk participated in an event hosted by the "Tesla Silicon Valley Owners Club" via video. During the hour-long conversation, he discussed topics such as technology, space exploration, and sustainable development. and was asked for his latest thoughts on Bitcoin. Musk said: I will not promote cryptocurrency, at best I will just joke. If you see me touting cryptocurrencies, that’s not really me. I do think Bitcoin and other cryptocurrencies