Original title: "The Rainmakers of the Crypto Market"

This newsletter focuses on analyzing the protocols that generate the most significant fees (including blockchain and decentralized applications). We focus on these The reasons for the agreement mainly include:

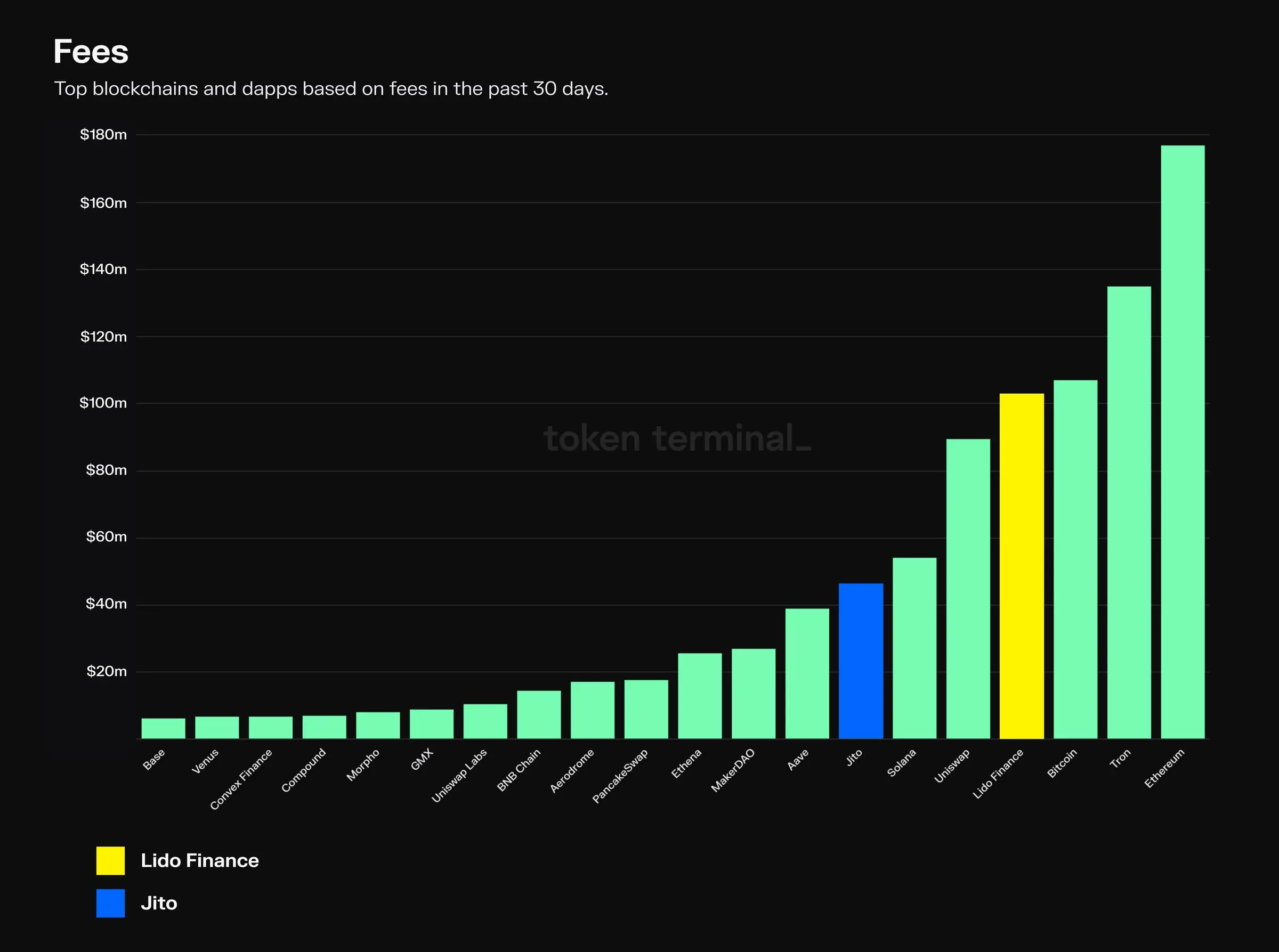

Which agreements are users more likely to pay for services? What types of services do these agreements provide and what are their business models? What is the total amount actually paid by users? Which specific market segments are more popular than others? Are there any protocols that dominate certain market segments? By analyzing a detailed chart, we will take a deep dive into the industry trends in the cryptocurrency market.

Let’s explore in detail!

Protocols focused on include: Ethereum, Tron, Bitcoin, Solana, BNB Chain and Base.

Main fees come from general blockchains

Out of the top 20 protocols, 5 are layer 1 (L1) blockchains and only 1 is a layer 2 (L2) blockchain.

Ethereum has had the highest fee output in the past 30 days, reaching approximately $180 million. Although Base’s average transaction fees are relatively low at around $0.03 (compared to Ethereum L1’s $4.5), Base also managed to break into the top 20 due to increased user activity at the L2 level.

With the exception of L1 and L2 blockchains, all other protocols in the top 20 fall under the decentralized finance (DeFi) category.

Key protocols: Lido Finance and Jito.

Lido has the highest fee generation among all crypto applications

Jito operates two different businesses: Liquidity Staking (JitoSOL) and Maximize Extractable Value (MEV) Market, the former through AUM-based management Profitability is achieved through fees, while the latter is profitable through MEV tips collected from validators (this chart only includes MEV tips).

In contrast, Lido focuses on liquidity staking as a business, earning commissions through staking rewards collected from depositors. Lido generates roughly twice as much fees as Jito, but Jito is growing faster.

Lido has $3.35 billion in pledged assets under management, while Jito has $160 million. Lido has a fully diluted market capitalization of $190 million, compared with Jito's $250 million.

Key protocols: Uniswap, PancakeSwap, Aerodrome, Uniswap Labs and GMX.

Uniswap DAO dominates the DEX category with monthly fees approaching $100 million

Uniswap DAO has the highest fee output in the DEX space. Notably, Uniswap Labs is considered as an independent entity that makes money by charging users to plug into the Uniswap protocol using the official Uniswap Labs front-end application.

Compared to other DEXs in the top 20, Uniswap DAO’s fee output is approximately twice theirs.

Aerodrome, as a Base-based DEX, has twice the fee output of its underlying L2 blockchain.

Key protocols: MakerDAO and Ethena.

Ethena has the potential to surpass MakerDAO in terms of fees

MakerDAO and Ethena dominate the decentralized stablecoin issuer space. The largest stablecoin issuers in the market, such as Tether (USDT) and Circle (USDC), are not included because their fees and revenue are primarily generated off-chain.

Ethena is expected to be launched in November 2024, while MakerDAO was already online as early as November 2017.

Protocols focused on include: Aave, Morpho, Compound and Venus.

Aave is the fourth largest fee generator in the cryptocurrency space.

In the lending category, Aave dominates, with a $30 million fee gap between it and second-placed Morpho.

While Compound and Aave both launched in 2020, Aave has managed to surpass Compound in terms of active loans and fee generation.

Although Aave leads the entire lending field, Venus has a clear lead in the BNB chain’s lending market, with approximately 90% of fees currently coming from its operations on the BNB chain.

This part mainly introduces the blockchain for application deployment.

Most of the top fee-based applications choose to deploy on multiple blockchains.

In the crypto space, most of the top 20 fee-based applications are deployed on Ethereum (both L1 and L2).

It is worth mentioning that asset issuers (such as stablecoin issuers and liquidity pledge providers) mostly adopt single chain management, and their core products (stablecoins or LST) act as bridge assets on multiple other chains. Role.

In this top 20, Aerodrome is the only application starting from the L2 blockchain (Base).

What are the fees?

The fee refers to the total amount paid by the end user of the agreement service.

Different market sectors have different fee structures, as each sector’s protocols have their own unique business models:

What is the difference between fees and income?

What is the difference between income and income?

When should expenses, income or benefits be considered?

As a rule of thumb, investors should focus on fees in the early stages of a protocol, when monetization has not yet begun, and on revenues and/or gains in the stages where monetization has already begun:

Also, keep an eye on the following ratio:

The above is the detailed content of Rainmakers in the Crypto Market: A Look at the Top Fee-Based Protocols. For more information, please follow other related articles on the PHP Chinese website!