Technology peripherals

Technology peripherals

It Industry

It Industry

Five new items of personal income have been added to the 'Income Tax Details' of the Personal Income Tax App, and the settlement method remains unchanged.

Five new items of personal income have been added to the 'Income Tax Details' of the Personal Income Tax App, and the settlement method remains unchanged.

Five new items of personal income have been added to the 'Income Tax Details' of the Personal Income Tax App, and the settlement method remains unchanged.

According to news from this site on June 24, The Paper reported that in the "Income Tax Details" of the Personal Income Tax App, five new items of personal income are newly displayed, namely business income; interest, dividends, bonus income; property rental income ; Income from property transfer; incidental income.

Customer service at tax hotline 12366 stated that these five items of personal income are indeed newly displayed items this year, mainly to allow people with the above personal income to check their income and personal tax details on the personal tax app .

This site inquired about the "Personal Income Tax Law of the People's Republic of China" and found that personal income subject to personal income tax includes nine items, namely:

(1) Income from wages and salaries

(2) Income from remuneration for labor services

(3) Income from royalties

(4) Income from royalties

(5) Income from operations

(6) Income from interest, dividends and bonuses

(7) Income from property leasing

(8) Income from property transfer

(9) Incidental income

12366 Customer service stated that the final settlement refers to the annual final settlement of personal income tax, that is, the "Personal Income Tax" Among the first four items of personal income mentioned in the Law, the five newly displayed items of personal income are mainly for inquiry and display, and do not change the settlement method.

The above is the detailed content of Five new items of personal income have been added to the 'Income Tax Details' of the Personal Income Tax App, and the settlement method remains unchanged.. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1664

1664

14

14

1423

1423

52

52

1317

1317

25

25

1268

1268

29

29

1246

1246

24

24

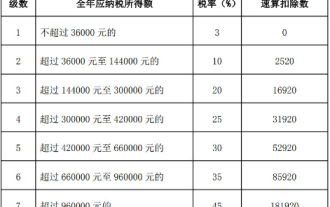

'Personal Income Tax' Tax Rate Table Latest in 2024

Mar 05, 2024 pm 07:20 PM

'Personal Income Tax' Tax Rate Table Latest in 2024

Mar 05, 2024 pm 07:20 PM

With the continuous development of the times, personal income tax rates are also constantly adjusted. The latest personal income tax rate table for 2024 has been released, which is an important reference for every taxpayer. Let us take a look at the latest personal income tax rate table for 2024! The latest personal income tax rate table for 2024 I, tax rate table 1, comprehensive income tax rate table 2, salary and salary tax rate table 3, transitional salary and salary tax rate table 4, withholding and prepayment tax rate for residents’ personal labor remuneration income table 2, annual personal income tax Calculation formula 1. Personal income tax payable = taxable income × applicable tax rate - quick calculation deduction 2. Taxable income = annual income - allowed deduction 3. Allowed deduction = basic deduction fee of 60,000 yuan + special items

Personal income tax rate calculator

Mar 05, 2024 pm 11:40 PM

Personal income tax rate calculator

Mar 05, 2024 pm 11:40 PM

The calculation of personal income tax is very complicated. Most players do not know how to calculate personal income tax. Click on the link https://www.gerensuodeshui.cn/ to enter the tax rate calculator. Next, the editor will bring it to users. Personal income tax rate calculator online calculation portal, interested users come and take a look! Personal Income Tax App Tutorial Personal Income Tax Rate Calculator Tax Rate Calculator Entrance: https://www.gerensuodeshui.cn/ 1. Personal tax calculation formula 1. Payable income = pre-tax salary income amount - five insurances and one fund (individual Payment part) - expense deduction amount 2. Tax payable = payable income × tax rate - quick calculation deduction number two

How to declare personal income tax app How to declare personal income tax app

Mar 12, 2024 pm 07:40 PM

How to declare personal income tax app How to declare personal income tax app

Mar 12, 2024 pm 07:40 PM

How to declare personal income tax on the app? Personal Income Tax is a very practical mobile software. Users can declare some businesses on this software, and can also make tax refunds on this software. As long as the user downloads this software, he or she does not have to wait in line offline, which is very convenient. Many users still don’t know how to use personal income tax software to file returns. The following editor has compiled the reporting methods of personal income tax software for your reference. Personal income tax app declaration method 1. First, open the software, find and click the "I want to file taxes" button on the homepage; 2. Then, find and click "Annual Comprehensive Income Summary" in the tax declaration here.

How to correct declaration records in personal income tax app

Mar 14, 2024 pm 03:04 PM

How to correct declaration records in personal income tax app

Mar 14, 2024 pm 03:04 PM

The Personal Income Tax App is an official app that facilitates users to conduct tax enquiries, payments, registrations and even business transactions. In our lives, this app can help us understand our tax situation in real time. So if we use the Personal Income Tax App If an error is found in the declaration record, how to correct it? This tutorial guide will provide you with a detailed step-by-step guide. First of all, we first enter the personal income tax app, click on the handle & check option, and then in the handle & check option, you can see the query of the declaration record and find it in the record. Click on the record we want to correct and pull the page to You can see the correction button at the bottom, click Correction to make corrections

How to fill in the special additional deduction declaration for personal income tax in 2024

Apr 01, 2024 pm 04:01 PM

How to fill in the special additional deduction declaration for personal income tax in 2024

Apr 01, 2024 pm 04:01 PM

In the process of filing personal income tax, special additional deductions are an important policy measure, which provide taxpayers with more opportunities for tax reduction and exemption. Therefore, in this article, the editor has prepared the step-by-step process for filing special additional deductions for personal income tax. Let’s learn together. Steps and procedures for claiming special additional deductions for personal income tax 1. Open the personal tax APP, select [Common Business] on the homepage, and then select [Fill in special additional deductions] 2. Scope of special deduction items: children’s education, continuing education, serious illness medical treatment, housing loan interest , housing rent and support for the elderly, infant and child care. According to the relevant policies and regulations of the national tax department, the Personal Income Tax Law determines the scope of the following special deduction items: Children’s Education 3. At the bottom of the page, you can select [One-click import], so that you can fill in last year’s declaration with one click.

How to cancel the tax refund declaration on the personal income tax app? The process of canceling the tax refund declaration on the personal income tax app

Mar 12, 2024 am 11:50 AM

How to cancel the tax refund declaration on the personal income tax app? The process of canceling the tax refund declaration on the personal income tax app

Mar 12, 2024 am 11:50 AM

How to cancel the personal income tax refund application? Personal income tax is a very popular mobile phone software. The functions on this software are very powerful. Users can perform many operations in this software. For example, they can declare on this software, and then they can also do it on this software. For tax refunds or a series of other operations, many users want to know how to cancel a declaration on this software. The editor below has compiled the methods for canceling a declaration for your reference. Personal Income Tax App Tax Refund Declaration Cancellation Process 1. Enter the Personal Income Tax Mobile App and click to declare annual income calculation. 2. A declaration prompt pops up on the page, click on the declaration details. 3. Then click Done. 4. Click on the submitted withdrawal

How to get a personal income tax refund in 2024_A complete introduction to the personal income tax refund operation process

Mar 20, 2024 pm 07:26 PM

How to get a personal income tax refund in 2024_A complete introduction to the personal income tax refund operation process

Mar 20, 2024 pm 07:26 PM

Have you filed personal income tax returns? You can make an appointment on March 1st. Make an appointment in advance and declare in advance. If you see that you have to pay taxes, your worries will finally die. So how to refund the personal income tax refund? Friends in need, please come and take a look below. How to get a personal income tax refund in 2024. After installing and registering the personal income tax APP, you can click "Income Tax Detail Inquiry" on the homepage to view the income and declared tax amount of the previous year. Select "Annual Comprehensive Income Summary", the system will automatically fill in the relevant data, and the user needs to check whether the information is accurate. If you need to modify it, you can click "Standard Declaration" to make adjustments. 3. Check the basic personal information, remittance place, amount of tax paid and other information, and submit the declaration after confirming that it is correct. 4. Then you need to select the corresponding card to ensure that it can

Personal income tax rate table latest in 2024

Mar 05, 2024 pm 12:20 PM

Personal income tax rate table latest in 2024

Mar 05, 2024 pm 12:20 PM

Each resident pays different taxes every year, but most users don’t know what the personal income tax rate table is. Next is the latest personal income tax rate table for 2024 brought to users by the editor. Interested users should hurry up Come and take a look! Personal Income Tax App Tutorial: Personal Income Tax Rate Table 2024 Latest 1, Tax Rate Table 1, Comprehensive Income Tax Rate Table 2, Wage and Salary Tax Rate Table 3, Transitional Wage and Salary Tax Rate Table 4, Resident Personal Income Tax Withholding and Prepayment Tax Rate Table 2. Annual personal income tax calculation formula 1. Personal income tax payable = taxable income × applicable tax rate - quick calculation deduction 2. Taxable income = annual income - allowed deduction 3. Allowed deduction = basic deduction expense 60,000 Yuan + special project