How to get more AO tokens Tips for maximizing your AO tokens

How to get more AO tokens Tips for maximizing your AO tokens! The acquisition of AO depends on the amount of funds and the type of token assets held. All we have to do is to find a way to maximize the efficiency of acquiring AO tokens under a limited amount of funds. Arweave officially released the economics of AO tokens at 23:00 on June 13th, Beijing time. Based on the current information, we will analyze how to obtain AO tokens from the perspective of maximizing efficiency!

## Learn all about the best strategies to acquire AO tokens **preface:** As an SEO expert, I know the secrets of search engine inclusion and ranking. Today, I’m honored to share with you practical tips for optimizing your website’s text content to make it more search engine friendly and improve your indexability. **Secrets to get more AO tokens:** To earn as many AO tokens as possible, it is crucial to follow best practices and utilize strategic tips. Here are some proven strategies: **1. Keyword Research:** Drill down into keywords related to AO tokens to identify the most searched phrases. Incorporate these keywords naturally into your content to increase search engine visibility to your target audience. **2. High quality content:** Create informative, engaging content that provides valuable information. Avoid filler or repetitive content and focus on providing readers with original and useful insights. **3. Page optimization:** Make sure your pages load quickly and your content is easy to navigate. Organize your content clearly using titles and subtitles, and add images and videos for visual appeal. **4. Backlink Building:** Get backlinks from high-authority websites, such as industry blogs and news outlets. This will show search engines that your content is trustworthy and authoritative. **5. Social Media Marketing:** Actively share your content on social media platforms to reach your potential audience. Encourage readers to engage in discussions and share your posts to increase your online presence. **6. Regular updates:** Regularly update your website content with fresh content to attract search engines and readers. Add new information, update outdated data, and optimize your keyword strategy based on changing trends. **7. Use analysis tools:** Track your website traffic and measure the effectiveness of your content with the help of analytics tools like Google Analytics. Understand what content performs best and make adjustments as needed. **in conclusion:** By following these best practices and tips, you can create high-quality text content that is search engine friendly and easy for search engines to index. This will ultimately help you acquire and maximize AO tokens and increase your overall online presence.

Interpretation of AO Token Economics Model

**AO Token Economics Beautified Version** According to AO Token Economics, AO is a 100% fair launch token that follows the Bitcoin economic model. Similar to Bitcoin, AO has a total supply of 21 million tokens. Distributed every 5 minutes, the monthly allocation is 1.425% of the remaining supply, similar to Bitcoin’s halving cycle (4 years). The difference with Bitcoin is that AO's halving is a smooth process rather than a sudden "halving event". Bitcoin’s halving occurs every 210,000 blocks (an average of one block every 10 minutes), approximately every four years. The halving of AO tokens occurs on a monthly basis, gradually reducing the supply. Although this progressive halving will not have a significant impact on the efficiency of obtaining AO, it cannot be ignored that the earlier you obtain AO, the greater the benefit.

**At the same time, officials have repeatedly emphasized that AO tokens are 100% fair launch tokens. From the current point of view, the official understanding of "100% fair start" is: ** AO tokens can only be obtained by holding specific assets (currently $AR, $AOCRED, $stETH). **This means that even official teams, investment institutions and ecological community projects have not received reserved shares. ** **At this point, AO is in sharp contrast to many encryption projects on the market, demonstrating the magnanimity of the project side. ** **This also means that the acquisition of AO depends entirely on the amount of funds and the type of token assets held. ** **Therefore, our goal is to find ways to maximize the efficiency of acquiring AO tokens within limited funds. **

**AO token acquisition** Currently, AO token acquisition is divided into two stages: * **Phase 1** ended on June 18, and **Phase 2** started at the same time. The acquisition time of the first phase was only announced on June 13, the day Token Economics was announced, but it was also expected, that is, it will be minted from February 27, 2024 (AO public testnet online) to June 18 100% of AO tokens will be issued to $AR token holders. Tokens are issued based on the balance held by each wallet address every 5 minutes. As of June 13, 2024, approximately 0.016 AO tokens will be available for each $AR. A total of more than 1 million AO tokens were distributed throughout the first phase.

Strategy to maximize the acquisition of AO tokens

The circulation in the first stage only accounts for about 5%, and the second stage is the highlight. What we need to focus on in the second stage is how to maximize the acquisition of AO tokens. 33.3% of AO tokens will be distributed to AR token holders. 66.6% of AO tokens will be used to stake other assets into AO (currently only stETH). At the same time, for AOCRED, AO will be exchanged at a ratio of 1000:1 (this part of AO tokens will come from the AO tokens generated by AR held by Forward Research).

**After the second phase starts:** * Each pegged token (AR) earns 0.016 AO in the first year. * The number of AO tokens obtained by depositing other eligible cross-chain assets (non-AR assets) into the AO network is determined by the following formula: ``` Cross-chain asset transaction volume x annualized staking yield x total cross-chain asset volume ``` **Currently, stETH is the only eligible cross-chain asset. ** Therefore, 66.6% of AO will be used to distribute to other assets staked in AO, of which: * **The number of AO tokens obtained by staking stETH** will depend on the ratio of the value of your pledged stETH relative to the total asset value of the pool.

If the assets you pledge account for 0.01% of the total assets of the fund pool, you can get 210 AO after staking for one year. The pool is currently worth over $20 million (can be viewed here ). Assuming that after the second phase of opening, the TVL of the capital pool reaches US$1 billion and remains stable for one year, then: - If you stake $1,000 of stETH, you can get 2.1 AO after one year. - If AR market cap is $2 billion and remains stable for a year, holding $1,000 of AR in your wallet will yield 0.485 AO after one year. Currently, it seems more cost-effective to stake stETH. But the market cap of the stETH pool and AR is unlikely to remain unchanged in a year. Therefore, the calculation needs to always be based on the ratio of TVL to AR market capitalization (in USD) of other asset pools.

When the market value of the capital pool TVL / AR ≈ 2, the AO obtained by pledging other assets of the same value is similar to holding AR of the same value;

When the market value of the capital pool TVL / AR > 2, the AO obtained by holding AR of the same value will get more AO than pledging other assets of the same value;

When the capital pool TVL / AR market value

Note that the AO tokens minted after the launch of the second phase will not be unlocked until February 8, 2025. By then, the circulation rate will be 15% and the total circulation will be around 3 million.

**Beautify the article:** In addition, we can also calculate the risk and cost of obtaining AO, which greatly affects the pricing of subsequent AO. AR holders only need to hold it, while stETH is obtained by staking ETH on Lido. Currently, stETH has an annualized rate of return (APR) of 3.3%. Since staking stETH in AO requires transferring this part of the annualized income interest to the AO project party, which is originally the vested income of stETH holders, the APR of stETH can be regarded as the cost of stETH pledgers. If the pool TVL reaches 1 billion, the cost for stETH stakers to obtain AO will be $15.7. However, this is calculated with control variables. The specific calculation formula is as follows (only considering the current situation where stETH is the only cross-chain asset):

For short-term investors, both pledging stETH and holding AR require bearing the risk of currency price decline. Of course, many CEXs provide 0-leverage currency borrowing services, and the borrowing interest rate is usually not higher than 1%. However, considering the long return period for obtaining AO incentives, please weigh it yourself before making a decision. At the same time, the current cost of exchanging AOCRED for AO is about US$50-60 per AO (please make sure to exchange AOCRED for AO before June 27, 2024, and it will be invalid if it is overdue). It also needs to wait until February 8, 2025 to unlock it, so The price of 1000*AOCRED can be regarded as the AO futures price. However, after the release of the AO test network, the market value of AR has increased by far more than 1 billion, and the total circulation will only be more than 3 million. The AO currency price also has a lot of room for imagination. .

For long-term investors, taking time to eliminate the risk of market fluctuations can not only obtain dividends from the increase in principal, but also continue to enjoy AO interest (including AO growth dividends).

The economic model of AO tokens includes the following key points

- Minting mechanism: AO tokens are minted in a decentralized manner to ensure fair distribution and transparent operations.

- Distribution strategy: Token distribution takes into account the needs of early supporters, developers, community incentives and other aspects to ensure the healthy development of the ecosystem.

- Economic model: An innovative economic model is adopted to encourage node participation and resource sharing through a token incentive mechanism.

Technical Architecture

Trustless Computing Environment: AO provides a decentralized operating system that allows developers to launch smart contract-like command line processes that can run without being restricted by a specific location , achieving seamless user interaction.

Parallel processing: Inspired by the actor model and Erlang, AO supports multiple communication processes running in parallel, coordinated through native messaging standards, allowing processes to run independently and efficiently.

Resource Utilization: AO's architecture is based on the delay evaluation model of SmartWeave and LazyLedger. Nodes can reach consensus on program state transitions without performing calculations, and the status is prompted by the process message log hosted by Arweave.

Data storage: The AO process can load data of any size directly into memory for execution and write the results back to the network. This setting eliminates typical resource limitations and supports parallel execution of complex applications.

Modular: AO’s architecture allows users to choose the virtual machine, ordering model, messaging security guarantees and payment options that best suit them. All messages are ultimately settled into Arweave’s decentralized data layer, unifying this modular environment .

Economic Security Model: The network uses a token economic model to ensure process security. Users can customize the security mechanism to ensure economically reasonable security pricing and efficient resource allocation.

8 key facts and dates of AO tokens:

1. AO is a 100% fair issuance token that follows the Bitcoin economic model.

2. AO tokens will be used to protect messaging in its network.

3. The minting mechanism will run retroactively starting from 13:00 EST on February 27, 2024 (block 1372724). 100% of AO tokens minted during this period have been vested to Arweave token holders based on their respective balances held every 5 minutes. If users hold AR on an exchange or custodian, users should ask them how to receive their tokens.

4. In the future, one-third (33.3%) of the AO tokens will be minted to AR token holders according to their ownership every 5 minutes. Two-thirds (66.6%) of AO tokens will be minted in the future to transfer assets into AO to strongly stimulate economic growth.

5. The first phase of the bridge contract is online today. During this pre-bridge phase, your tokens will remain securely on their native network while you earn AO tokens. Once the second phase of the bridge goes live, you will be able to deposit your assets into the new bridge contract and use them on AO - while earning rewards. You can deposit staked Ethereum (stETH) tokens into the audited pre-bridge contract at https://ao.arweave.dev/#/mint/ethereum/.

6. Transition rewards will start at 11:00 am ET on June 18, 2024.

7. Users can withdraw tokens from the pre-bridge at any time, but they can only start earning AO after the rewards start on June 18. Rewards are distributed every 24 hours.

8. AO tokens will remain locked until approximately 15% of the supply is minted. This will happen around February 8, 2025.

AO is a 100% fair issuance token modeled after Bitcoin

Like Bitcoin, the total supply of AO is 21 million tokens, and the halving cycle is also 4 years. AO is distributed every 5 minutes, monthly The distribution amount is 1.425% of the remaining supply. As of June 13, the inventory of AO was 1.0387 million. This makes them extremely scarce. By comparison, Ethereum has 120 million, Solana has 461 million, and Ripple has 55 billion.

AO’s minting mechanism means that although the number of newly minted tokens will be halved every 4 years, there will not be a sudden “halving event”. Instead, the number of new tokens will decrease slightly each month, resulting in a smooth issuance schedule.

While most token distribution models favor insiders over the community, AO’s model adheres to the principles of fairness and equal access that are at the heart of the crypto revolution. There is no pre-sale or pre-allocation. Instead, the AO token reward mechanism incentivizes two key aspects of a successful ecosystem: economic growth and security of the base layer.

Summary

The above is the detailed content of How to get more AO tokens Tips for maximizing your AO tokens. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1664

1664

14

14

1421

1421

52

52

1315

1315

25

25

1266

1266

29

29

1239

1239

24

24

How to get file extension in Python?

Sep 08, 2023 pm 01:53 PM

How to get file extension in Python?

Sep 08, 2023 pm 01:53 PM

A file extension in Python is a suffix appended to the end of a file name to indicate the format or type of the file. It usually consists of three or four characters, a file name followed by a period, such as ".txt" or ".py". Operating systems and programs use file extensions to determine what type of file it is and how it should be processed. Recognized as a plain text file. File extensions in Python are crucial when reading or writing files because it establishes the file format and the best way to read and write data. For example, the ".csv" file extension is the extension used when reading CSV files, and the csv module is used to process the files. Algorithm for obtaining file extension in Python. Manipulate file name string in Python.

Use math.Max function to get the maximum value in a set of numbers

Jul 24, 2023 pm 01:24 PM

Use math.Max function to get the maximum value in a set of numbers

Jul 24, 2023 pm 01:24 PM

Use the math.Max function to obtain the maximum value in a set of numbers. In mathematics and programming, it is often necessary to find the maximum value in a set of numbers. In Go language, we can use the Max function in the math package to achieve this function. This article will introduce how to use the math.Max function to obtain the maximum value in a set of numbers, and provide corresponding code examples. First, we need to import the math package. In the Go language, you can use the import keyword to import a package, as shown below: import"mat

Where to get Google security code

Mar 30, 2024 am 11:11 AM

Where to get Google security code

Mar 30, 2024 am 11:11 AM

Google Authenticator is a tool used to protect the security of user accounts, and its key is important information used to generate dynamic verification codes. If you forget the key of Google Authenticator and can only verify it through the security code, then the editor of this website will bring you a detailed introduction on where to get the Google security code. I hope it can help you. If you want to know more Users please continue reading below! First open the phone settings and enter the settings page. Scroll down the page and find Google. Go to the Google page and click on Google Account. Enter the account page and click View under the verification code. Enter your password or use your fingerprint to verify your identity. Obtain a Google security code and use the security code to verify your Google identity.

How to get the last element of LinkedHashSet in Java?

Aug 27, 2023 pm 08:45 PM

How to get the last element of LinkedHashSet in Java?

Aug 27, 2023 pm 08:45 PM

Retrieving the last element from a LinkedHashSet in Java means retrieving the last element in its collection. Although Java has no built-in method to help retrieve the last item in LinkedHashSets, there are several effective techniques that provide flexibility and convenience to efficiently retrieve this last element without breaking the insertion order - a must for Java developers issues effectively addressed in its application. By effectively applying these strategies in their software projects, they can achieve the best solution for this requirement LinkedHashSetLinkedHashSet is an efficient data structure in Java that combines HashSet and

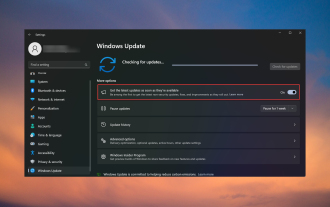

Get the latest updates now: Fix missing latest updates

Nov 08, 2023 pm 02:25 PM

Get the latest updates now: Fix missing latest updates

Nov 08, 2023 pm 02:25 PM

If the "Get the latest updates as soon as they become available" option is missing or grayed out, you may be running a Developer Channel Windows 11 build, and this is normal. For others, issues arise after installing the KB5026446 (22621.1778) update. Here's what you can do to get back the "Get the latest updates as soon as they become available" option. How do I get the "Get the latest updates as soon as they're available" option back? Before starting any of the solutions below, make sure to check for the latest Windows 11 updates and install them. 1. Use ViVeTool to go to the Microsoft Update Catalog page and look for the KB5026446 update. Download and reinstall the update on your PC

Simple JavaScript Tutorial: How to Get HTTP Status Code

Jan 05, 2024 pm 06:08 PM

Simple JavaScript Tutorial: How to Get HTTP Status Code

Jan 05, 2024 pm 06:08 PM

JavaScript tutorial: How to get HTTP status code, specific code examples are required. Preface: In web development, data interaction with the server is often involved. When communicating with the server, we often need to obtain the returned HTTP status code to determine whether the operation is successful, and perform corresponding processing based on different status codes. This article will teach you how to use JavaScript to obtain HTTP status codes and provide some practical code examples. Using XMLHttpRequest

C++ program to get the imaginary part of a given complex number

Sep 06, 2023 pm 06:05 PM

C++ program to get the imaginary part of a given complex number

Sep 06, 2023 pm 06:05 PM

Modern science relies heavily on the concept of plural numbers, which was first established in the early 17th century by Girolamo Cardano, who introduced it in the 16th century. The formula for complex numbers is a+ib, where a holds the html code and b is a real number. A complex number is said to have two parts: the real part <a> and the imaginary part (<ib>). The value of i or iota is √-1. The plural class in C++ is a class used to represent complex numbers. The complex class in C++ can represent and control several complex number operations. Let's take a look at how to represent and control the display of plural numbers. imag() member function As mentioned above, complex numbers are composed of real part and imaginary part. To display the real part we use real()

Java program to get the size of a given file in bytes, kilobytes and megabytes

Sep 06, 2023 am 10:13 AM

Java program to get the size of a given file in bytes, kilobytes and megabytes

Sep 06, 2023 am 10:13 AM

The size of a file is the amount of storage space that a specific file takes up on a specific storage device, such as a hard drive. The size of a file is measured in bytes. In this section, we will discuss how to implement a java program to get the size of a given file in bytes, kilobytes and megabytes. A byte is the smallest unit of digital information. One byte equals eight bits. One kilobyte (KB) = 1,024 bytes, one megabyte (MB) = 1,024KB, one gigabyte (GB) = 1,024MB and one terabyte (TB) = 1,024GB. The size of a file usually depends on the type of file and the amount of data it contains. Taking a text document as an example, the file size may be only a few kilobytes, while a high-resolution image or video file may be