What are the Bitcoin contract trading tips? How to play Bitcoin contract trading?

The continuous development of the Bitcoin market and the increase in the number of participants have made Bitcoin contracts an indispensable part of investors. When investors play Bitcoin contracts, they can make profits by going long or short on Bitcoin price changes. Because investors do not need to actually own Bitcoin, contract trading has high returns but also high risks. As a novice investor, you need to understand what are the Bitcoin contract trading techniques? Based on the analysis of existing data, investors need to have an in-depth understanding of the market, master trading skills and effective risk management, etc. The editor will explain in detail below.

What are the Bitcoin contract trading techniques?

Bitcoin contract trading skills mainly include familiarity with market dynamics, reasonable use of leverage, setting stop-profit and stop-loss, diversified investments, etc. Contract trading refers to buying or selling Bitcoin on the exchange at the contract price, not the actual price. The following is a detailed analysis of the techniques:

1. Familiar with market dynamics and seize the opportunity

To successfully play Bitcoin contracts, you first need to be familiar with market dynamics and understand market changes. Bitcoin price fluctuations are often affected by factors such as market hot spots, policies and regulations. For example, when favorable policies are introduced, its price may rise rapidly, which is a good time to buy at the bottom. Therefore, it is crucial to obtain and analyze market information in a timely manner and grasp the timing of transactions.

For example, the sharp rise and fall at the end of 2017 is a classic case. At that time, the price of Bitcoin once exceeded US$20,000, attracting the attention of a large number of investors. However, the price subsequently fell sharply, and many investors suffered huge losses without stopping their losses in time. This shows that even popular digital currencies still have huge market risks, and investors need to be cautious.

2. Use leverage rationally and control risks

In Bitcoin contract trading, leverage is a double-edged sword. Reasonable leverage operations can amplify profits, but excessive leverage can also bring huge risks. Therefore, investors need to carefully consider when choosing a leverage ratio and make reasonable allocations based on their own risk tolerance and market conditions.

For example, assuming you choose 10x leverage in Bitcoin contract trading, if the price fluctuates in your expected direction, it will bring considerable profits. However, if the market fluctuates violently, your losses will be magnified accordingly. Therefore, you must be cautious when using leverage and do not blindly pursue high-leverage operations to avoid irreparable losses.

3. Set stop-profit and stop-loss to protect the safety of funds

In Bitcoin contract trading, setting stop-profit and stop-loss is an important means to protect funds. Stop profit can help you lock in profits in time to avoid missing opportunities; stop loss can effectively control risks and avoid excessive losses. Properly setting take-profit and stop-loss points is a key step to ensure the steady progress of transactions.

For example, when you set a 50% take profit and a 20% stop loss in a Bitcoin contract transaction, it means that when the price rises to 50%, the position will be automatically closed to make a profit, and when the price falls to 20% will also automatically close the position and stop loss. Such an operation strategy can help you avoid risks caused by market fluctuations and protect the safety of your funds.

4. Diversified investment and diversified risks

Finally, if you want to obtain long-term stable returns in Bitcoin contract trading, diversified investment is one of the indispensable strategies. By diversifying investments in different digital currency contracts, you can effectively reduce the impact of single contract fluctuations on the overall investment portfolio, reduce risks, and improve the stability of returns.

For example, if you diversify your investment funds into multiple digital currency contracts such as Bitcoin, Ethereum, Litecoin, etc., when the price of a certain contract fluctuates greatly, the profits of other contracts may be offset to a certain extent effect, thereby reducing overall portfolio risk. This diversified investment strategy can help investors better withstand market fluctuations and achieve long-term stable returns.

How to trade Bitcoin contracts?

Bitcoin contract trading may be a bit troublesome. Currently, it is mainly conducted on exchanges such as OEX and Binance. The following is a tutorial on trading contracts on OEX:

1. Open the official website of OEX OKX exchange ( Click here to register), enter your email address on the homepage, click "Register", slide the slider to the right, complete the puzzle for verification, and then enter the verification code received by email. The verification code is valid for 10 minutes

2. Then Enter your mobile phone number, click "Verify Now", enter the six-digit verification code received on your mobile phone, the validity time is also 10 minutes

3. Select the country/region of residence, check the terms of service, "Risk and Compliance" Disclosure" and Privacy Policy and Statement

4. The password you create needs to be 8-32 characters in length, 1 lowercase letter, 1 uppercase letter, 1 number, 1 symbol, such as: !@ # $ % and other conditions

5. After logging in to your account, find the "User Center" icon on the homepage and enter the identity authentication page

6. Different levels of authentication can be carried out according to different needs (note: video authentication needs to be operated on the APP)

7. After completing the identity authentication, you can proceed with the transaction. Find "Buy Coins" on the homepage - "C2C Buy Coins"

8. Select the "Purchase" option, pay attention to select the purchase currency, and click " "All payment methods" to filter

9. After selecting the merchant, follow the merchant's message, then enter the purchase quantity, click "Buy USDT" to pay and wait for the merchant to release the currency (if the currency is not received after payment) , after negotiating with the merchant to no avail, you can click on the page Need help>Others>Get help>Initiate a complaint)

10. If you want to conduct contract transactions, you need to open the account mode and set it to single-currency margin mode or cross-currency margin mode. Currency margin mode.

11. You can continue to set up the contract, personalize the trading unit and order mode.

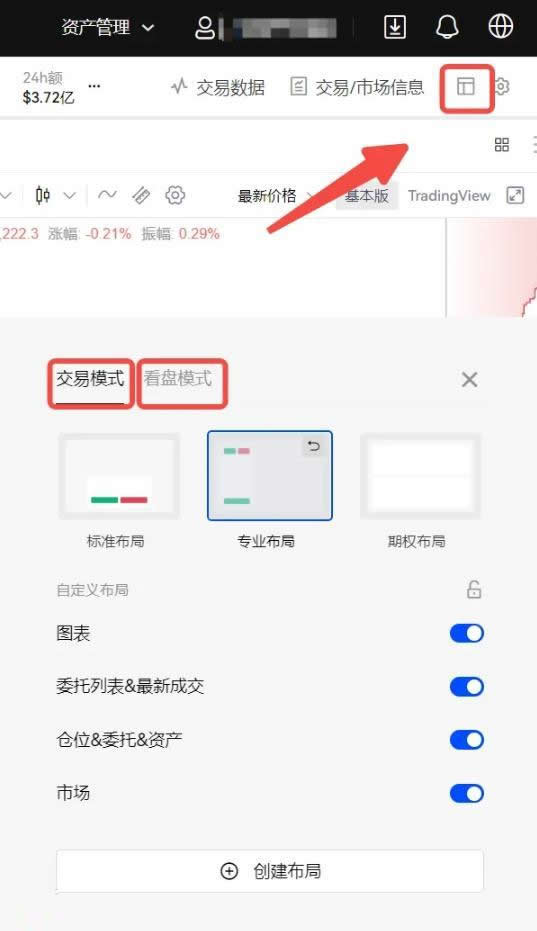

12. You can customize the trading mode and Kanban mode. Choose a professional layout here.

13. The delivery contract is divided into USDT margin delivery contract and currency-margin delivery contract. Here we take the coin-margin weekly delivery contract as an example. First, transfer our digital assets from the capital account to the trading account. If it has been completed, no additional transfer operations are required.

14. Click the drop-down button on the right side of the currency pair on the trading page, enter the currency in the search box, select delivery in the margin trading area, and select the currency with the contract period of the current week, next week, current quarter, or sub-quarter. Standard/U-based contracts. Here we take the current quarter currency-based contract as an example

15. Select the account mode and order type, enter the price and quantity, and click Buy to open long (bullish) or Sell to open short (short). For unfilled pending orders, you can click Cancel to cancel the order. Here we take opening a long position as an example.

16. After the pending order is completed, you can view the relevant data of the order in the position interface, such as margin, income, rate of return, estimated liquidation price, etc.

17. You can set stop-profit and stop-loss on the position interface. You can also choose to close the position, enter the closing price and quantity to confirm the closing, or select full market price to complete the closing operation.

18. Perpetual contracts are divided into USDT margin perpetual contracts and currency-margined perpetual contracts. Here we take the USDT margin perpetual contract as an example. Similarly, transfer our digital assets from the capital account to the trading account. If it has been completed, no additional transfer operations are required.

19. On the trading page, click the drop-down button on the right side of the currency pair, enter the currency in the search box, select Perpetual in the margin trading area, and select the currency-margined/U-margined contract corresponding to the currency. Here we take the U-standard contract as an example

20. Select the account mode and order type, enter the price and quantity, and click Buy to open long (bullish) or Sell to open short (short). For unfilled pending orders, you can click Cancel to cancel the order. Here we take opening a short position as an example.

21. After the pending order is completed, you can view the relevant data of the order in the position interface, such as margin, income, rate of return, estimated liquidation price, etc.

22. You can set stop-profit and stop-loss on the position interface. You can also choose to close the position, enter the closing price and quantity to confirm the closing, or select full market price to complete the closing operation.

The above is the detailed content of What are the Bitcoin contract trading tips? How to play Bitcoin contract trading?. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1664

1664

14

14

1423

1423

52

52

1317

1317

25

25

1268

1268

29

29

1246

1246

24

24

How much is Bitcoin worth

Apr 28, 2025 pm 07:42 PM

How much is Bitcoin worth

Apr 28, 2025 pm 07:42 PM

Bitcoin’s price ranges from $20,000 to $30,000. 1. Bitcoin’s price has fluctuated dramatically since 2009, reaching nearly $20,000 in 2017 and nearly $60,000 in 2021. 2. Prices are affected by factors such as market demand, supply, and macroeconomic environment. 3. Get real-time prices through exchanges, mobile apps and websites. 4. Bitcoin price is highly volatile, driven by market sentiment and external factors. 5. It has a certain relationship with traditional financial markets and is affected by global stock markets, the strength of the US dollar, etc. 6. The long-term trend is bullish, but risks need to be assessed with caution.

What currency does Ripple (XRP currency) belong to? Detailed tutorial for beginners

Apr 28, 2025 pm 07:57 PM

What currency does Ripple (XRP currency) belong to? Detailed tutorial for beginners

Apr 28, 2025 pm 07:57 PM

Created by Ripple, Ripple is used for cross-border payments, which are fast and low-cost and suitable for small transaction payments. After registering a wallet and exchange, purchase and storage can be made.

Sesame Open Door Official Website Entrance Sesame Open Door Official Latest Entrance 2025

Apr 28, 2025 pm 07:51 PM

Sesame Open Door Official Website Entrance Sesame Open Door Official Latest Entrance 2025

Apr 28, 2025 pm 07:51 PM

Sesame Open Door is a platform that focuses on cryptocurrency trading. Users can obtain portals through official websites or social media to ensure that the authenticity of SSL certificates and website content is verified during access.

What are the top currency trading platforms? The top 10 latest virtual currency exchanges

Apr 28, 2025 pm 08:06 PM

What are the top currency trading platforms? The top 10 latest virtual currency exchanges

Apr 28, 2025 pm 08:06 PM

Currently ranked among the top ten virtual currency exchanges: 1. Binance, 2. OKX, 3. Gate.io, 4. Coin library, 5. Siren, 6. Huobi Global Station, 7. Bybit, 8. Kucoin, 9. Bitcoin, 10. bit stamp.

Binance official website entrance Binance official latest entrance 2025

Apr 28, 2025 pm 07:54 PM

Binance official website entrance Binance official latest entrance 2025

Apr 28, 2025 pm 07:54 PM

Visit Binance official website and check HTTPS and green lock logos to avoid phishing websites, and official applications can also be accessed safely.

What are the top ten virtual currency trading apps? The latest digital currency exchange rankings

Apr 28, 2025 pm 08:03 PM

What are the top ten virtual currency trading apps? The latest digital currency exchange rankings

Apr 28, 2025 pm 08:03 PM

The top ten digital currency exchanges such as Binance, OKX, gate.io have improved their systems, efficient diversified transactions and strict security measures.

Bitcoin price today

Apr 28, 2025 pm 07:39 PM

Bitcoin price today

Apr 28, 2025 pm 07:39 PM

Bitcoin’s price fluctuations today are affected by many factors such as macroeconomics, policies, and market sentiment. Investors need to pay attention to technical and fundamental analysis to make informed decisions.

What kind of software is a digital currency app? Top 10 Apps for Digital Currencies in the World

Apr 30, 2025 pm 07:06 PM

What kind of software is a digital currency app? Top 10 Apps for Digital Currencies in the World

Apr 30, 2025 pm 07:06 PM

With the popularization and development of digital currency, more and more people are beginning to pay attention to and use digital currency apps. These applications provide users with a convenient way to manage and trade digital assets. So, what kind of software is a digital currency app? Let us have an in-depth understanding and take stock of the top ten digital currency apps in the world.