web3.0

web3.0

Metrics Ventures Alpha | In the fiercely competitive Solana LSD track, can Jito stand out?

Metrics Ventures Alpha | In the fiercely competitive Solana LSD track, can Jito stand out?

Metrics Ventures Alpha | In the fiercely competitive Solana LSD track, can Jito stand out?

Jito Network is the first protocol in the Solana ecosystem that has both MEV and liquidity staking services, and uses MEV income as staking rewards, increasing the protocol staking income. The figure below is a highly abstracted view of Solana’s capital flow in the Jito protocol. Jito occupies the absolute leading position in both the MEV and liquidity staking businesses of the Solana ecosystem. With the substantial growth of the Solana ecosystem in this round of the market, the MEV and liquidity staking businesses have also experienced rapid growth. This research report will analyze Jito’s technical principles and business progress from both MEV and liquidity staking, as well as Jito’s possible future business growth points and investment points

1 MEV leader: Reshaping Solana’s MEV landscape

1.1 Solana MEV dilemma and solution

MEV (Maximal Extractable Value) refers to the maximum value that miners can extract by moving the transaction sequence when generating blocks on the blockchain network. There are many examples of MEV, such as:

- Sandwich Attack: The most typical type of MEV, MEV searchers observe pending transactions that may affect the price of the asset, submit transactions before and after the transaction, and benefit by pushing up or down the price of the transaction token, also making the original transaction pay higher costs.

- Liquidation: Always monitor whether there are under-collateralized loan positions, and upon discovery, quickly seize the qualifications of the liquidator to complete the process.

- NFT Minting: Earn high-value NFTs by grabbing a spot as a front-row minter during the NFT minting event.

- Airdrop collection and selling: After the airdrop is open for collection, you can quickly receive the airdrop and sell it at a very early stage to get a relatively high selling price.

There are many examples of MEV, but essentially they are all about preempting the order of transactions to maximize personal profits. The discussion of MEV initially focused on Ethereum, but it also exists in blockchain networks such as Solana. Because of the transaction processing mechanism of the Solana network itself, the MEV problem on Solana is not exactly the same as on Ethereum.

Compared with Ethereum, the difference of Solana is:

(1) There is no public mempool: transactions are sent directly to the verifier, and the verifier will process the transaction immediately, while on Ethereum it will first be stored in a public mempool The transaction pool is waiting for miners to be included in the block;

(2) Transactions are processed according to the first-come-first-out (FIFO) principle, that is, transactions are processed in the order in which they arrive, while miners on Ethereum can freely choose and When sorting transactions, Ethereum will prioritize transactions with high gas fees for processing.

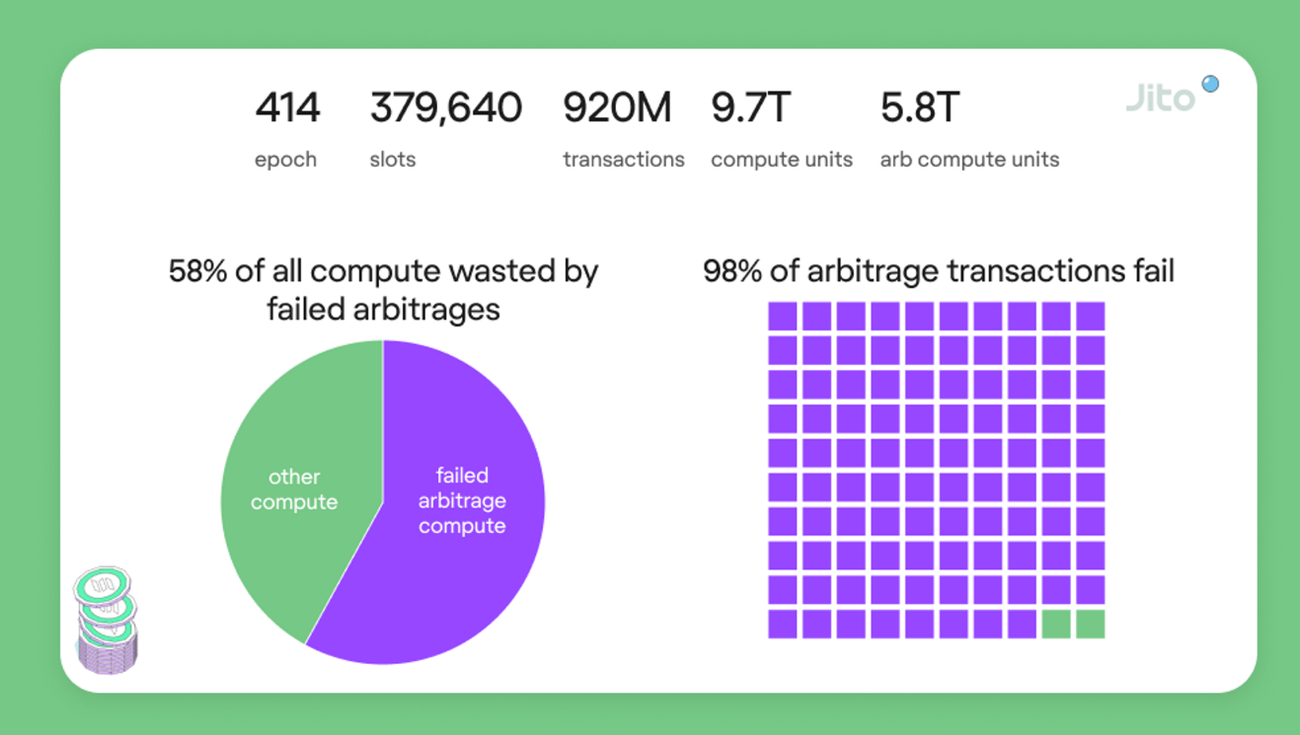

Therefore, Solana’s competition for transaction order has changed from “high fee” to “low latency”. It is not a competition through gas fees, but a competition to reach the validator first. In addition, Solana’s transaction fee is very low. In order to win priority Sorting, the robot will send a large number of junk transactions to Solana, and only the first executed transaction among the same transactions will be completed, and the remaining transactions will fail. According to statistics from Jito Network, in Epoch 414, 60% of block calculations were occupied by invalid arbitrage transactions, and more than 98% of arbitrage transactions failed, which caused Solana validators to use a large amount of computing resources for processing Failed transactions greatly waste computing resources and reduce network efficiency.

In order to reduce Solana being occupied by invalid junk transactions, Jito reshapes Solana’s MEV landscape by introducing mempool and block space auctions. The basic architecture of the Jito solution is shown in the figure below, which includes four main components: Searchers, Relayers, Block Engine and Jito-Solana verification client. The relayer first completes the filtering of transaction data and signature verification of the transaction, and then hands the transaction data to the block engine and verification client; the searcher submits the Bundles expected to be executed (a set of transactions that have been sequenced, and the verifier To execute this set of transactions completely in sequence, the execution of this set of transactions is atomic, that is, either all of them are executed. Once a transaction fails, the Bundle will not be executed) and Tips (that is, the fee to incentivize the verifier to execute the Bundle) ), the block engine searches for the most profitable one among the many submitted Bundles and hands it over to the verifier, who then completes the execution of the transaction.

1.2 MEV business data overview

From the data point of view, MEV revenue on the Solana chain is growing rapidly, and Jito’s MEV capture capability on Solana is also increasing.

According to Blockworks Research data, beginning in March 2024, the MEV income earned by validators on Solana began to exceed that of Ethereum, and began to lead significantly ahead of Ethereum in May. On May 12, the total economy generated by Solana in one day Value (transaction fees + MEV revenue) surpassed Ethereum for the first time. The craze for meme tokens on Solana has increased the opportunities for MEV, especially after the birth of pump.fun. The life cycle of a meme token may only be a few minutes, which makes the order of transactions particularly important. For example, some devs are creating tokens. You need to accumulate your own chips and buy in multiple wallets at the moment the token is created. This has strict requirements on the transaction sequence. When encountering the trading FOMO period, jito tip will also experience high fluctuations.

The growth of Solana MEV has been significantly captured by Jito Network. According to news data, the adoption rate of Jito-Solana client has exceeded 78%, while this figure was only 31% at the end of 2023, which means that most validators have adopted the MEV solution provided by Jito. Jito's MEV income also reflects this. The number of Bundles submitted daily on Jito is increasing rapidly, reaching more than 9M on June 14. The resulting daily Tips income and income rewards given to stakers are also rapidly increasing. The current number of daily tips has exceeded 10,000 SOL for many days, and even reached the level of 16,000 SOL on June 7.

The recovery of Solana ecology has brought about the recovery of MEV. The surge in transaction volume brought about by the MEME craze has directly promoted the surge in MEV revenue. However, the enthusiasm for MEME token transactions has not been affected by the recent months. The market suffered a setback due to the cold weather - taking pump.fun data as an example, the tokens deployed have been at a relatively high level since April, and transaction fees and income have also remained relatively stable. The enthusiasm for MEME token trading has ensured that MEV’s income has remained at a high level to a certain extent. On March 9, 2024, Jito Labs officially posted on social media that due to the negative external effects on users, Jito suspended the use of mempool, which reduced user losses caused by transaction ordering and sandwich attacks. From the data point of view, This move did not have much impact on Jito's MEV revenue.

2 Liquidity Staking: Quickly seize market share and become the leader

2.1 Solana Liquidity Staking Market Pattern

Compared to Ethereum, Solana’s liquidity staking track has developed quite slowly. Let’s look at a set of data: Solana’s staking ratio is more than 65%, while Ethereum’s staking ratio is only about 27% (Coinbase data), but about 95% of Solana’s staking is native staking, while nearly half of Staked ETH chose Liquidity staking and liquidity re-staking.

This difference is determined by the technical and ecological differences between the two chains:

(1) Ethereum has a minimum pledge amount requirement to become a validator: 32ETH, while Solana has no minimum pledge amount requirement, This lowers the threshold for becoming a validator;

(2) The native Ethereum protocol does not support entrusted pledge, that is, ordinary users cannot directly pledge to a validator through entrusted Ethereum, and can only achieve entrusted pledge through other third-party protocols. To achieve native staking, you can only run a validator yourself and need 32ETH;

(3) The Slashing mechanism has not yet taken effect on Solana, so for ordinary users, choosing a validator is not very important, and since there is Slashing mechanism, users must choose the validator carefully, otherwise they will pay the price for the validator’s mistakes, which requires a third-party agreement to provide this service to ordinary users, that is, a pledge pool;

(4) The DeFi ecosystem on Solana is still It is immature, so even if you hold LST assets, there are few channels for farming. Without the temptation of sufficient yield, users’ demand for holding LST assets is not strong, and the DeFi ecology on Ethereum is very rich, led by stETH. LST assets have been used as the basic underlying assets by most DeFi protocols. DeFi protocols are layered with Lego, and users’ leverage and yield can be doubled,

Therefore, users on Solana do not have strong demand for liquidity staking, and user habits have not yet been developed. However, judging from the existing data, the proportion of liquidity staking on Solana is steadily increasing, from about 2% in June 2023 to the current 6.38%, achieving an increase of about three times in one year. In terms of market share of LST assets, stSOL and mSOL were once divided. However, with Lido's withdrawal from the Solana ecosystem and Jito's rapid competition for market share, JitoSOL's current share has exceeded 40%, which is about 2.5 times that of the second mSOL. . Solana’s liquidity staking business landscape proves Jito’s dominance, and the data also proves that Jito still has huge room for growth in its liquidity staking business.

2.2 Overview of Jito’s liquidity staking business data

Jito’s liquidity staking business is growing rapidly – JitoSOL’s TVL and market share are both growing rapidly, September 15, 2023-2023 On November 25, Jito launched a points program to reward users who hold and use JitoSOL in the DeFi protocol, and issue corresponding airdrops. This will make JitoSOL TVL enter a period of rapid growth after September 2023, and also complete the market surpassing mSOL. , after the airdrop was released, TVL and market share fell slightly and then entered a relatively stable growth period. Currently, Jito’s TVL has exceeded 1.6 billion US dollars, becoming the agreement with the highest TVL in the Solana ecosystem.

JitoSOL’s staking APY is currently 8.26%. The APY is composed of two parts: Solana staking yield and MEV revenue sharing, of which 5% of the MEV Tips received by Jito belongs to the Jito protocol and 95% Attributed to the verifier, most of the MEV Tips obtained by the verifier will be given to the entrusted stakers. MEV APY is relatively unstable and can achieve a 1.5% rate of return when the transaction volume on the chain is large.

In terms of LST usage scenarios, JitoSOL’s DeFi protocol integration is rapidly expanding. Currently, the protocols with the highest TVL are Kamino and Drift. However, it is noted that more than 60% of JitoSOL still exists in wallets, which means liquidity The significance of pledged assets has not been fulfilled. If Jito wants to develop its business, its first priority is still to expand the channels and security of Farming and increase mining incentives.

2.3 Competitive landscape analysis

According to the market share of Solana ecological liquidity staking protocol, the current Longer protocol that is comparable to Jito is Marinade.Finance, while the proportions of bSOL, jupSOL and INF Both are about one-fifth of JitoSOL, and currently their competitiveness is relatively weak. Here we mainly conduct a comparative analysis between Marinade and Jito.

From the perspective of business differences, both Jito and Marinade support liquidity staking, and Marinade provides two service models: liquidity staking and native staking. Marinade’s native staking can help users choose better validators and reduce user screening costs, but Since Solana naturally supports native staking and has no penalty mechanism, third-party native staking services do not solve the pain points and cannot generate revenue for the protocol. Jito’s advantage is reflected in its leading position in the MEV field, but MEV income is not exclusive to JitoSOL holders. According to Marinade documents, users who pledge to the jito-solana validator through protocol delegation can obtain MEV income. However, considering the relationship between the jito-solana validator and Jito Labs, the relevant validators will still have stronger loyalty to Jito.

Judging from the changes in business data, jitoSOL has rapidly seized mSOL’s market share since August 2023. The airdrop points plan that started in September accelerated this trend, and jitoSOL’s market share will expand by the end of 2023. After the airdrop was issued, it entered a period of slowdown, but mSOL's market share continues to decline. There is currently no relief trend, and business expansion is obviously hindered.

From the perspective of yield, Jito currently provides users with 8.26% APY, while Marinade’s native staking APY is 8.18%. Since the protocol charges a 6% management fee for mSOL, the APY of liquidity staking is slightly lower, only 7.68%, which is relatively There's not much difference between the two.

In terms of the integration level of the DeFi protocol, the current total amount of mSOL is about 5.5M, of which 3.4M is distributed in wallets, accounting for about 61.8%. This data is not much different from JitoSOL. Since Solana has fewer DeFi ecological protocols, their main farming strategies are not much different. They both provide liquidity for each currency pair in major DEXs, use them as collateral assets in lending agreements, or lend mSOL. mSOL’s strategy is relatively more advanced. In order to enrich, for example, mSOL has integrated multiple CEX, including Coinbase, Gate, etc., making it more convenient to exchange with SOL. In addition, it also integrates option trading, NFT purchase, etc.

From the perspective of token economics, the uses of the two tokens are similar. They are both protocol-related governance functions and DeFi Farming’s liquidity mining emissions. Marinade Earn Season 3 is about to start and will provide 25M MNDE tokens incentivize users to participate in specific Farming strategies.

Finally, from the comparison of the valuation and TVL of the two, the TVL of Marinade and Jito are similar, but the market value is only less than one-tenth of Jito. From the perspective of business data, Marinade is relatively undervalued. However, judging from the currency price, MNDE has only doubled in the past year to the present, and has not kept up with the rising trend of SOL. It has even dropped by 50% in the past 6 months. The team and market makers have analyzed the currency price. The lack of maintenance also caused it to gradually lose market attention (data time: June 22).

| Project name | TVL | Market value | FDV |

|---|---|---|---|

| Marinade | 1.16B (394.3M for native pledge, 762.06M for liquid pledge) | $3 1,596,919 | $119,467,628 |

| Jito | 1.57B | $326,308,804 | $2,658,010,596 |

To sum up, Jito launched the airdrop points plan in September 2023, just when the Solana ecosystem was in a state of ruin. At that time, the only competitors were Lido and Marinade. As Lido withdrew from Solana, Jito quickly seized the opportunity. This part of the market share was captured, and the airdrop points plan was in line with Solana's recovery, so it captured new funds during this recovery and quickly surpassed Marinade. Marinade currently lacks the ability to compete with Jito in terms of business data and token prices. However, it is noted that the market is no longer a competition between Jito and Marinade at this time. Solana’s recovery has attracted more liquidity staking. Protocol, two new competitors, jupSOL and INF, have performed brilliantly. Their current APY exceeds 9%, leading among similar protocols, and they have quickly captured nearly 20% of the market share. Among them, jupSOL is backed by DeFi leader Jupiter, and the team provides 100k SOL pledge, and distributes pledge income to jupSOL holders to increase income; Sanctum, to which INF belongs, is an LST liquidity solution, and INF can share transactions on the Sanctum platform Handling fees, this unique business makes INF’s return rate ahead of other schemes, and is exclusive to INF holders. In contrast, although Jito has a leading MEV business, the MEV rewards are not for jitoSOL holders Exclusive benefits: After the completion of jitoSOL’s airdrop, TVL’s expansion is slightly weak. It is necessary to be wary of the market competition from new competitors and quickly adopt new incentives to ensure continued business expansion.

3 Token Economics and Price Performance

On November 25, 2023, the Jito Foundation announced the launch of the JTO governance token. The total supply of JTO is 1B, and the distribution is as shown in the figure below:

- 10% (100 million pieces) are used for retroactive airdrops, of which 80% (80 million pieces) are airdropped to JitoSOL point users, 15% (15 million pieces) ) will be airdropped to Jito-Solana validators, and 5% (5 million) will be allocated to Jito MEV searchers. 90% of these airdrops are unlocked immediately, and the remaining 10% will be released linearly within a year;

- 24.3% is determined by DAO governance to determine the usage and distribution speed;

- 25% is used for ecosystem development, including funding communities and contributors to help promote The expansion of the premier liquidity staking protocol on Solana and the advancement of related networks are under the control of the Jito Foundation;

- The rest are allocated to the team and investors, all with 1-year cliff and 3-year linear unlocking.

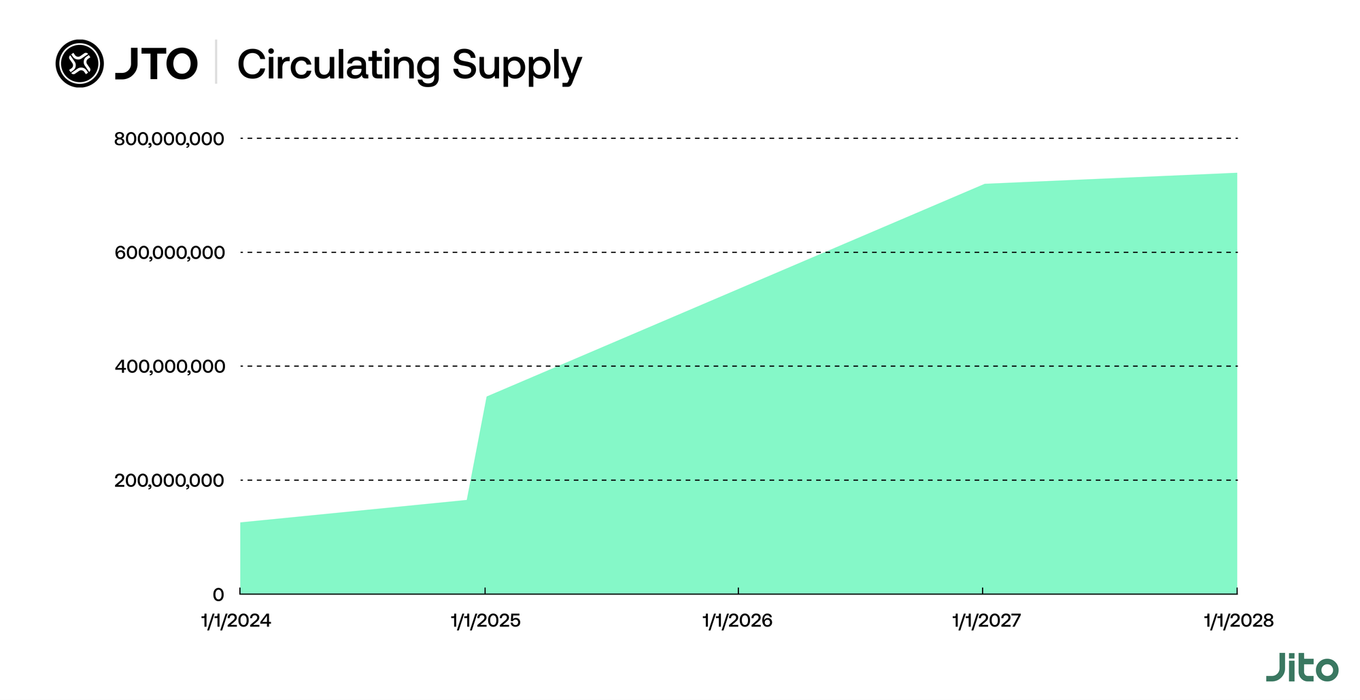

According to the distribution plan, the current main inflation of JTO comes from the linear unlocking of 10% in the airdrop and the linear release of tokens (25%) used for ecosystem development. According to Token Unlock data, the daily token release amount Approximately 198.44k JTO. Due to the one-year cliff for investors and teams, JTO will not receive large amounts of unlocking in the next six months, and the first unlocking will be in December 2024.

From the perspective of token usage, JTO currently does not have many practical functions and is mainly used for governance voting. In addition, JTO is used as an incentive for liquidity mining on Kamino and Meteora to increase JitoSOL’s DeFi income.

From the perspective of currency price performance, JTO basically maintains the same trend as SOL. Here we compare SOL, JTO and JUP, which is also regarded as Solana Beta. It can be seen that in the past three months, the trends of the three are basically similar, but the currency price fluctuation of JTO is significantly higher than that of the two. Using JTO as the investment target of Solana Beta will be a choice with higher risks and returns. The current overall weakening of Solana ecology is partly due to the expected hype of ETH ETF, which has changed the market focus. Judging from the trend of JTO, it began to break through growth after about two months of washout after being launched. It fell to the bottom twice. The area around 2.3-2.7, currently judging from the chip range and K-line trend, this range is a strong support level for JTO, and it is currently at the low level of this range (data time: June 22).

4 Summary: Jito’s investment points

Based on the above analysis, here is a summary of Jito’s investment points as follows:

- Business fundamentals: Jito’s core business is liquidity staking and MEV. The core data of concern include Solana’s overall MEV growth, Jito-Solana validator usage ratio and JitoSOL’s TVL and market share. MEV income increases the yield on liquidity staking, but this is not Jito’s monopoly advantage. Other LSD protocols pledged in the Jito-Solana validator can also obtain MEV income. The data growth of JitoSOL is the most important to Jito. With the LST APY not much different, the primary competitiveness is reflected in the DeFi protocol integration, strategy richness and security.

- Competitive landscape analysis: JitoSOL has experienced rapid market expansion in the past year, benefiting from (1) the points airdrop plan; (2) the rapid recovery of the Solana ecosystem; (3) the weak development of the early liquidity staking protocol, three factors The overlay in the same time period contributed to the success of JitoSOL. However, with the completion of the airdrop and the increase in competitors on the track, JitoSOL's market expansion is currently becoming more difficult, and it is necessary to continue to pay attention to the competition between Jito and emerging protocols.

- Token Economics and Price Analysis: As a governance token, JTO itself does not have much empowerment other than its governance function, and it does not have any means of value capture. JTO's current main inflation comes from liquidity mining on the DeFi protocol. The higher the incentive, the more users' demand for jitoSOL will increase, thereby raising the TVL to attract users to invest in JTO. Therefore, the team has a certain demand for investment. From the price analysis point of view, JTO basically maintains the same token trend as SOL, but the volatility is higher. Compared with JUP, which we have analyzed, JTO has stronger business growth and higher price volatility. It is an ideal investment in the Solana ecosystem. The risk and return rate may be higher. At present, the overall trend of altcoins and Solana ecology is not strong, and JTO has fallen below the main support level. Waiting for signs of reversal may be a better trading opportunity.

The above is the detailed content of Metrics Ventures Alpha | In the fiercely competitive Solana LSD track, can Jito stand out?. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

Pi Network (PI) Price Falls Despite Successful PiFest 2025 Event

Apr 03, 2025 am 10:08 AM

Pi Network (PI) Price Falls Despite Successful PiFest 2025 Event

Apr 03, 2025 am 10:08 AM

Pi Network recently held PiFest 2025, an event aimed at increasing the token's adoption. Over 125,000 sellers and 58,000 merchants participated

okx Ouyi Exchange web version enter link click to enter

Mar 31, 2025 pm 06:21 PM

okx Ouyi Exchange web version enter link click to enter

Mar 31, 2025 pm 06:21 PM

1. Enter the web version of okx Euyi Exchange ☜☜☜☜☜☜ Click to save 2. Click the link of okx Euyi Exchange app ☜☜☜☜ Click to save 3. After entering the official website, the clear interface provides a login and registration portal. Users can choose to log in to an existing account or register a new account according to their own situation. Whether it is viewing real-time market conditions, conducting transactions, or managing assets, the OKX web version provides a simple and smooth operating experience, suitable for beginners and veterans. Visit OKX official website now for easy experience

RUVI AI (RUVI) Token Presale Might 20X After an Explosive Launch

Apr 03, 2025 am 11:08 AM

RUVI AI (RUVI) Token Presale Might 20X After an Explosive Launch

Apr 03, 2025 am 11:08 AM

The crypto market continues to face turbulence, with Cardano (ADA) dropping 12% to $0.64, prompting concern across the altcoin sector.

Where to download the genuine Ouyi? Official website download. Global

Mar 31, 2025 pm 02:09 PM

Where to download the genuine Ouyi? Official website download. Global

Mar 31, 2025 pm 02:09 PM

Ouyi usually refers to Ouyi OKX. The global way to download Ouyi OKX APP is as follows: 1. Android device: Download the APK file through the official website and install it. 2. iOS device: access the official website through the browser and directly download the APP.

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

OKX is a global digital asset trading platform. Its main functions include: 1. Buying and selling digital assets (spot trading), 2. Trading between digital assets, 3. Providing market conditions and data, 4. Providing diversified trading products (such as derivatives), 5. Providing asset value-added services, 6. Convenient asset management.

BlockDAG Launches Beta Testnet With $200M Raised, Ethereum Approaches $2,000 & Tether Expands Into Media

Apr 03, 2025 am 10:34 AM

BlockDAG Launches Beta Testnet With $200M Raised, Ethereum Approaches $2,000 & Tether Expands Into Media

Apr 03, 2025 am 10:34 AM

Ethereum (ETH) price edges toward resistance, Tether news reveals a €10M media deal, and BlockDAG reaches new milestones with Beta Testnet and growing adoption.

gate.io latest registration tutorial for beginners

Mar 31, 2025 pm 11:12 PM

gate.io latest registration tutorial for beginners

Mar 31, 2025 pm 11:12 PM

This article provides newbies with detailed Gate.io registration tutorials, guiding them to gradually complete the registration process, including accessing the official website, filling in information, identity verification, etc., and emphasizes the security settings after registration. In addition, the article also mentioned other exchanges such as Binance, Ouyi and Sesame Open Door. It is recommended that novices choose the right platform according to their own needs, and remind readers that digital asset investment is risky and should invest rationally.

gate.io registration tutorial

Mar 31, 2025 pm 11:09 PM

gate.io registration tutorial

Mar 31, 2025 pm 11:09 PM

This article provides a detailed Gate.io registration tutorial, covering every step from accessing the official website to completing registration, including filling in registration information, verifying, reading user agreements, etc. The article also emphasizes security measures after successful registration, such as setting up secondary verification and completing real-name authentication, and gives tips from beginners to help users safely start their digital asset trading journey.