Token Economics Overview: What Metrics to Look at Before Investing?

Compiled by: Felix, PANews

Good token economics can help a token grow hundreds of times within a year, while bad token economics may cause a token to fall by 90%. Understanding token economics is the most important skill in crypto. If you don’t understand token economics, it’s difficult to be a successful investor. Learning is crucial, don't trade blindly, otherwise you may suffer losses. Crypto KOL cyclop gave an overview of token economics, here is a complete guide to token economics.

When you first find a potential coin, for example on CMC, you will see the following:

- Market Cap (MC)

- Total Supply

- Float

- Fully Diluted Value (FDV )

These are the basic supply metrics:

- Circulation: tokens currently in circulation

- Total supply: total amount of tokens that can exist

- MC: total value of circulation (in USD

- FDV: Total Value of Total Supply (in USD)

Understanding these metrics allows you to evaluate a coin’s potential. But to do that, you need to understand more than just the nominal concepts. You also need to understand how they work and how they affect prices.

Start with supply first. There are two paths for a token:

- Inflation

- Deflation

Inflation Token: The supply of a token can increase, which is called a release.

Release is a negative factor as it usually results in a decrease in value. However, if the release is slow and in small amounts, it will not have a significant impact on value.

Deflationary Token: A situation where the supply of a token decreases over time. This happens when a project buys back tokens and burns them. In theory, reducing supply should increase value, but that's just theory.

Now discuss the main factors that determine the issuance and lifespan of a token: allocation and distribution.

There are two methods:

- Pre-mining (distributed among early investors, teams, advisors, etc.)

- Fair distribution (everyone has equal purchase qualifications)

Most projects adopt the pre-mining method .

Why is this approach important?

Because if TGE is 100% and 50% of the tokens are allocated to investors, then investors can sell tokens at any time, and retail investors may become the takers of exit liquidity. That’s why you need to know:

- TGE Allocation

- Vesting (Token Lock)

- Cliff (Cliff Period)

Token allocations usually have the following reception types:

- Private Sales (Investors, KOLs, etc.) )

- Public sale (retail investors)

- Marketing

- Ecosystem (stakes, rewards, etc.)

- Airdrop

How do they sell tokens?

The day the token is issued is called TGE.

- TGE allocation is the percentage of tokens (10-20%) allocated to all individuals mentioned above

- Cliff is the period after TGE and before the next Vesting

- Vesting refers to the gradual release of a certain percentage of tokens every month

Recently, some projects have adopted a method with a smaller TGE percentage (up to 20%), followed by a few months of cliff and more than 12 months of vesting.

This approach is more suitable for the long-term success of the project, so it is important to verify all these details before investing.

Another key factor for any coin to be successful today is demand. This is why projects incentivize retail investors to purchase specific tokens. For example, despite severe inflation, people still buy dollars because they need it to live.

Generally, there are 4 factors that drive demand for a token:

- Store of Value

- Community Driven

- Utility Effect

- Value Accumulation

Store of Value

Cryptocurrencies can serve as value means of storage. Many people buy cryptocurrencies just to put money in them, such as Bitcoin, which is often compared to gold.

Community Driven

As this cycle has shown the public, communities can strongly drive demand. The rise of Memecoins is all about community. People will buy things they think they can make money from.

Utility Effect

Demand is stimulated when holding a token provides some utility. For example, in order to stake tokens, you need tokens from a certain network, etc.

Value accumulation

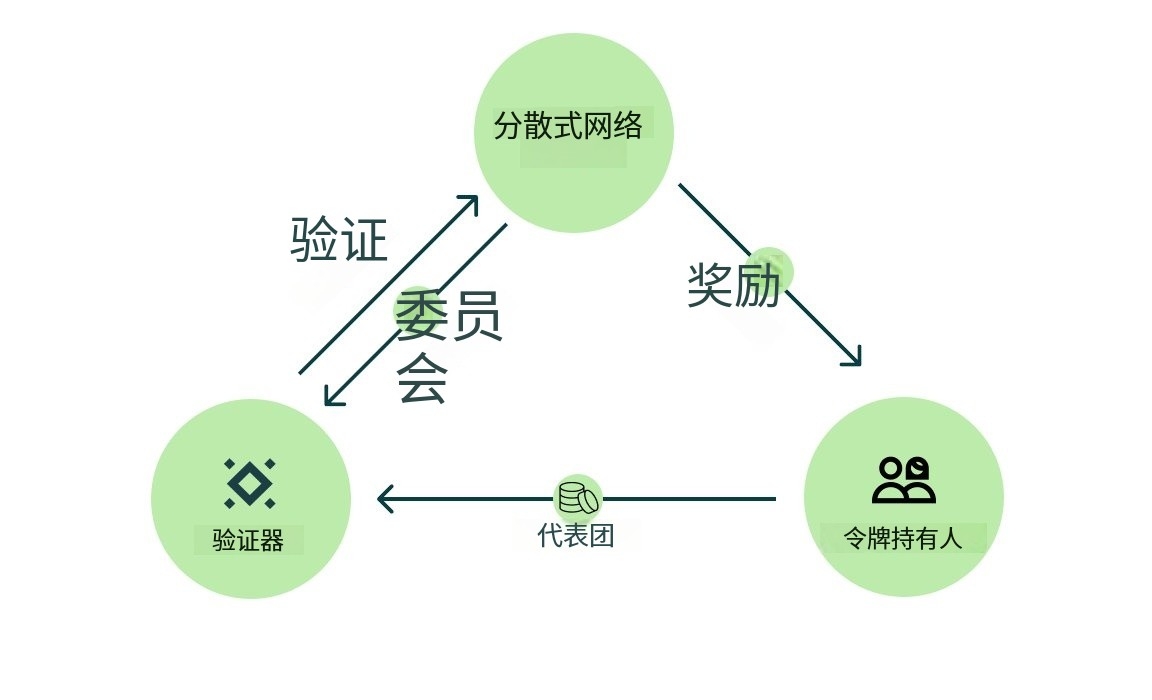

- Incentivize stake holders

People also hope that the token can provide some value. This is a pledge. You can lock up your positions to receive regular rewards. This benefits all parties and is relatively low risk.

Value accumulation

- Incentivizes holders

Another option is to hold. Projects usually provide rewards/airdrops etc. to holders, which is good for everyone. There are many ways to reduce selling pressure by holding:

VeToken

- VeToken can be obtained by holding tokens

- “Ve” stands for voting escrow, meaning that by locking your tokens, you Obtained voting rights

- The longer you hold, the greater the accumulated voting rights

Mining

- Holding can also improve your mining efficiency

- The more you hold, the more income you will earn The higher the ratio grows

Also understand that no matter how high the demand is, it is important to understand who is holding. A strong community or a dumper. It's more challenging to figure this out. You need to engage with the project's community and analyze it.

Also, despite the bad token economics, it is still possible for the token to rise and vice versa. Always consider this possibility. Here is a list of things to check before investing:

- Total supply and circulating supply

- Allocation and distribution

- Lock-up period/unlock date

- % release

- Demand

After such analysis, You can basically determine whether the project is worth investing in.

The above is the detailed content of Token Economics Overview: What Metrics to Look at Before Investing?. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1664

1664

14

14

1423

1423

52

52

1317

1317

25

25

1268

1268

29

29

1246

1246

24

24

Nasdaq Files to List VanEck Avalanche (AVAX) Trust ETF

Apr 11, 2025 am 11:04 AM

Nasdaq Files to List VanEck Avalanche (AVAX) Trust ETF

Apr 11, 2025 am 11:04 AM

This new financial instrument would track the token's market price, with a third-party custodian holding the underlying AVAX

OM Mantra Cryptocurrency Crashes 90%, Team Allegedly Dumps 90% of Token Supply

Apr 14, 2025 am 11:26 AM

OM Mantra Cryptocurrency Crashes 90%, Team Allegedly Dumps 90% of Token Supply

Apr 14, 2025 am 11:26 AM

In a devastating blow to investors, the OM Mantra cryptocurrency has collapsed by approximately 90% in the past 24 hours, with the price plummeting to $0.58.

TrollerCat ($TCAT) Stands Out as a Dominant Force in the Meme Coin Market

Apr 14, 2025 am 10:24 AM

TrollerCat ($TCAT) Stands Out as a Dominant Force in the Meme Coin Market

Apr 14, 2025 am 10:24 AM

Have you noticed the meteoric rise of meme coins in the cryptocurrency world? What started as an online joke has quickly evolved into a lucrative investment opportunity

Is Wall Street Quietly Backing Solana? $42 Million Bet Says Yes

Apr 10, 2025 pm 12:43 PM

Is Wall Street Quietly Backing Solana? $42 Million Bet Says Yes

Apr 10, 2025 pm 12:43 PM

A group of former Kraken executives acquired U.S.-listed company Janover, which secured $42 million in venture capital funding to begin building a Solana (SOL) treasury.

Bitcoin (BTC) Has Outperformed Ethereum by Over 85% in Realized Market Cap Growth

Apr 11, 2025 am 10:12 AM

Bitcoin (BTC) Has Outperformed Ethereum by Over 85% in Realized Market Cap Growth

Apr 11, 2025 am 10:12 AM

Bitcoin (BTC) has outperformed Ethereum by over 85% in realized market capitalization growth, according to data provided by on-chain analytics platform Glassnode on April 10.

US Senate Draft Legislation Threatens to Hit Data Centers Serving Blockchain Networks and Artificial Intelligence Models with Fees

Apr 12, 2025 am 09:54 AM

US Senate Draft Legislation Threatens to Hit Data Centers Serving Blockchain Networks and Artificial Intelligence Models with Fees

Apr 12, 2025 am 09:54 AM

The draft bill purportedly aims to address environmental impacts from rising energy demand and protect households from higher energy bills

The Crypto Market Has Witnessed a Rebound Following the Recent Sheer Downturn

Apr 13, 2025 am 11:40 AM

The Crypto Market Has Witnessed a Rebound Following the Recent Sheer Downturn

Apr 13, 2025 am 11:40 AM

The crypto market has witnessed a rebound following the recent sheer downturn. As per the exclusive market data, the total crypto market capitalization has reached $2.71Ts

As Fear Drives Selling, BlockDAG (BDAG) Stands Out from the Crowd

Apr 13, 2025 am 11:48 AM

As Fear Drives Selling, BlockDAG (BDAG) Stands Out from the Crowd

Apr 13, 2025 am 11:48 AM

As fear drives selling in the crypto market, major coins like Cardano and Solana face tough times.