21Shares submits SOL spot ETF application! Experts divided on SEC approval

21Shares specializes in crypto ETPs

21Shares is a Swiss company that specializes in providing cryptocurrency exchange-traded products (ETPs). Founded in 2018 and headquartered in Zurich.

21Shares has issued 40 crypto ETPs, listed on 13 exchanges, with assets under management of US$3.2 billion (excluding ARKB). Its most famous is the Bitcoin spot ETF ARKB, which is a partnership with Ark, with current asset size of US$2.78 billion. The Ethereum spot ETF that was originally applied for together with Ark was later reported to have been too low and unprofitable, leading to Ark’s withdrawal. Instead, 21Shares independently applied to issue the 21Shares Core Ethereum ETF.

21Shares provides a variety of crypto products, including more than 30 cryptocurrencies such as ADA, ARB, AAVE, and BNB. For example, it recently launched a Toncoin-staking exchange-traded product (ETP)-TONN on the Swiss SIX Exchange, giving back the staking rewards to investors.

21Shares SOL ETP launched in Europe

21Shares will launch Solana Staking ETP (code ASOL) in Europe in 2021, with an asset size of US$810 million, 100% supported by physical SOL, and through professional risk management Gain access to staking yields (its staking yield is now 4.44%), providing individual investors with better protection than custody options. ASOL is listed on six European exchanges at the same time, providing investment options in US dollars, British pounds, euros and Swiss francs.

VanEck filed for the first Solana exchange-traded fund (ETF) in the U.S. on June 27, with 21Shares not far behind.

Currently, the market has mixed opinions on the likelihood of the Solana ETF being approved. As the listing exchange for several Bitcoin spot ETFs, Cboe believes that it is impossible to create crypto ETFs other than Bitcoin and Ethereum without first establishing a futures market or changing regulatory conditions. JPMorgan and Bloomberg have also expressed doubts about the likelihood of approval, but Bernstein believes that the approval of the Ethereum ETF will pave the way for similar tokens such as Solana to gain commodity classification.

It’s worth noting that both 21Shares Core Solana ETF and VanEck Solana Trust choose to trade on the Cboe BZX exchange. According to the company's S-1 filing, the fund will be created and redeemed in cash, the same as other cash ETFs.

The above is the detailed content of 21Shares submits SOL spot ETF application! Experts divided on SEC approval. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1664

1664

14

14

1421

1421

52

52

1315

1315

25

25

1266

1266

29

29

1239

1239

24

24

SUPRA Coin Price Prediction for 2025

Dec 09, 2024 pm 12:11 PM

SUPRA Coin Price Prediction for 2025

Dec 09, 2024 pm 12:11 PM

SUPRA coin, a cryptocurrency that supports a wide range of decentralized applications, has attracted much attention from investors. Its potential price movement depends on factors such as team strength, ecosystem growth, market trends, regulatory environment and competitor performance. Experts predict that SUPRA coin may reach $0.60 to $1 in 2025. The project’s technical foundation, growing ecosystem, and market optimism provide support for its price increase.

The impact of Ethereum upgrade on ETH price: short-term volatility and long-term value

Feb 27, 2025 pm 04:51 PM

The impact of Ethereum upgrade on ETH price: short-term volatility and long-term value

Feb 27, 2025 pm 04:51 PM

There are two aspects of short-term volatility and long-term value in the impact of Ethereum upgrade on ETH price. In the short term, market expectations before upgrading will affect price rise and fall, technical problems during the upgrade process may lead to price plummeting, and after upgrading, the phenomenon of "selling expectations and buying facts" may occur. In the long run, successful upgrades will improve network performance, such as increasing throughput and reducing transaction fees, and optimizing economic models, such as achieving deflation, thereby increasing the scarcity of ETH and supporting price increases.

What are the Grayscale Encryption Trust Funds? Common Grayscale Encryption Trust Funds Inventory

Mar 05, 2025 pm 12:33 PM

What are the Grayscale Encryption Trust Funds? Common Grayscale Encryption Trust Funds Inventory

Mar 05, 2025 pm 12:33 PM

Grayscale Investment: The channel for institutional investors to enter the cryptocurrency market. Grayscale Investment Company provides digital currency investment services to institutions and investors. It allows investors to indirectly participate in cryptocurrency investment through the form of trust funds. The company has launched several crypto trusts, which has attracted widespread market attention, but the impact of these funds on token prices varies significantly. This article will introduce in detail some of Grayscale's major crypto trust funds. Grayscale Major Crypto Trust Funds Available at a glance Grayscale Investment (founded by DigitalCurrencyGroup in 2013) manages a variety of crypto asset trust funds, providing institutional investors and high-net-worth individuals with compliant investment channels. Its main funds include: Zcash (ZEC), SOL,

The latest version of the top ten exchanges in the currency circle 2025

Mar 05, 2025 pm 09:12 PM

The latest version of the top ten exchanges in the currency circle 2025

Mar 05, 2025 pm 09:12 PM

This article lists the top ten exchanges in the cryptocurrency circle in 2025, predicts that Binance, OKX, Bitget and Gate.io will become leading exchanges, and analyzes six potential exchanges including Coinbase, Kraken, Bybit, MEXC, Bitfinex and KuCoin. The article deeply explores the advantages, disadvantages and future development potential of each exchange, and looks forward to the four major development trends of currency exchanges in 2025: compliance, derivatives trading growth, social trading and communityization, and the integration of Web3 and meta-universe. Finally, the article reminds readers to pay attention to factors such as security, liquidity, transaction fees, trading products, user experience, customer service and regulatory environment when choosing an exchange, and emphasizes the number of investments.

Comprehensive interpretation of ETH upgrade: the technological revolution from PoW to PoS

Feb 27, 2025 pm 04:27 PM

Comprehensive interpretation of ETH upgrade: the technological revolution from PoW to PoS

Feb 27, 2025 pm 04:27 PM

This article comprehensively interprets the major upgrade of Ethereum from the Proof of Work (PoW) mechanism to the Proof of Stake (PoS) mechanism. Because the PoW mechanism has limitations such as high energy consumption and low efficiency, and cannot meet the industry's growing demand for blockchain scalability, speed and efficiency, Ethereum has launched this upgrade. The article compares the principles and advantages and disadvantages of the two mechanisms PoW and PoS, elaborates on the key upgrade processes such as "The Merge", Dencun upgrade and future sharding, and analyzes the impact of this upgrade on economic model, ecosystem, developers, users and miners, and finally discusses the technical, community and supervision challenges faced during the upgrade process.

All Things Flower creates the first AI music NFT wine label to set off a new height of integration of intelligent digitalization and culture

Mar 05, 2025 pm 05:42 PM

All Things Flower creates the first AI music NFT wine label to set off a new height of integration of intelligent digitalization and culture

Mar 05, 2025 pm 05:42 PM

AllThingsFlower: AI empowers and leads the digitalization 3.0 era of wine industry! AllThingsFlower has once again innovated the industry and launched innovative products that integrate AI music, mulberry purple wine and NFT digital wine labels, perfectly combining culture and technology, achieving a comprehensive upgrade from product to cultural output, and pointing out the direction for the future development of the wine industry. Each NFT wine label is generated by AIVA.ai's AI algorithm, perfectly integrating the mellow fragrance of mulberry purple wine, the heritage of Silk Road culture with the infinite possibilities of future technology. AI Manufacturing: The digital transformation of traditional wine industry is different from traditional wine brands. AllThingsFlower is committed to the in-depth binding of physical products and digital assets.

Ethereum 2.0 comprehensive analysis: The path to transformation from PoW to PoS

Feb 27, 2025 pm 05:03 PM

Ethereum 2.0 comprehensive analysis: The path to transformation from PoW to PoS

Feb 27, 2025 pm 05:03 PM

The transformation of Ethereum 2.0 from PoW to PoS is a major change in blockchain. The transformation stems from PoW's high energy consumption and poor transaction processing capabilities, which cannot meet the industry's development needs. The "merger" will be completed in September 2022, and there will be subsequent upgrade plans such as sharding. PoW and PoS have obvious differences in principle and advantages and disadvantages. Transformation affects economic models and ecosystems, and also faces challenges at technology, community, and regulatory levels, aiming to improve Ethereum's scalability, transaction speed and energy efficiency.

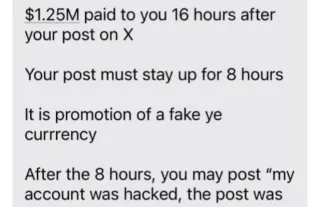

Singer Kanye's coin issuance: His attitude is reversed and his account is suspected of selling, is another careful 'harvest”?

Mar 04, 2025 pm 10:15 PM

Singer Kanye's coin issuance: His attitude is reversed and his account is suspected of selling, is another careful 'harvest”?

Mar 04, 2025 pm 10:15 PM

KanyeWest's cryptocurrency mystery: The game between traffic, capital and "harvest". Recently, the actions of the rap king KanyeWest (now named Ye) in the cryptocurrency field have caused an uproar, from publicly boycotting the Meme coin scam to suspected preparation of YZY tokens, to suspected X account being sold, their behavior is full of contradictions and doubts. Is he a victim of the celebrity effect or the trader behind this capital game? This article will deeply analyze Kanye's coin issuance storm and unveil this fascinating drama about the world of traffic, capital and crypto. KanyeWest is a legend in the music, business and fashion industry. He has won 24 Grammy Awards and was twice selected as one of the top 100 figures in Time magazine.