The past month has indeed been a heavy loss for Bitcoin investors. The price of the currency has continued to decline from a high of close to 72,000 at the beginning of last month, and once fell below the 60,000 mark. As the beginning of July, ETF funds have gradually resumed positive inflows, and the price of BTC has also taken advantage of the trend to get rid of the 60,000-62,000 shock range at the end of last month, challenging $63,200 twice. This will be a witness to whether BTC can continue to regain its lost ground. The key, investors have high hopes for it. But if the challenge fails, BTC is likely to repeat the tragedy in June and fall below 61,000 again. At the same time, Federal Reserve Chairman Powell will give a speech on Tuesday. After that, many influential U.S. macro data will also be released to the market, such as Wednesday’s ADP, service industry PMI indicators, and Friday’s non-farm payrolls and hourly data. Wages will be closely watched by the market.

Source: SignalPlus, Economic Calendar

Source: Farside Investors; Trading View

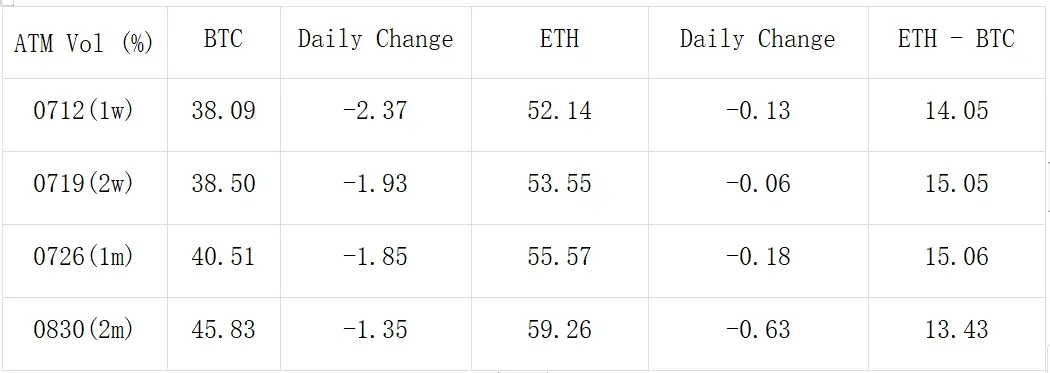

In terms of options, implied volatility is still declining, and BTC continues to break recent historical lows, ETH IV has experienced several sharp fluctuations under the impact of several ETF News, but the overall trend is still downward. It is currently around 50+%, and is generally 15% higher than BTC Vol during the same period. Returning to the Ethereum ETF, the U.S. SEC returned all S-1 forms to the issuers, and the market expects it to be approved within two weeks. In addition, judging from the published rates, in order to seize the market, Ethereum’s ETF rates will be lower than those of Bitcoin ETFs, both below 30 basis points.

Source: Deribit (as of 2JUL 16:00 UTC+8)

Source: SignalPlus

Data Source: Deribit, ETH transaction overall distribution

Data Source: Deribit, Overall distribution of BTC transactions

Source: Deribit Block Trade

Source: Deribit Block Trade

The above is the detailed content of SignalPlus Volatility Column (20240702): Can there be a rebound in July?. For more information, please follow other related articles on the PHP Chinese website!