Will miners' profits decrease as Bitcoin plummets? How big is the impact?

The fourth Bitcoin halving will be completed on April 20, 2024, which means that the difficulty of Bitcoin mining will increase again. According to data from Blockchain.com, the daily income of miners has dropped to US$3 million after the Bitcoin halving, a significant drop of 50% compared to the previous income. However, the difficulty of mining increases and the decrease in income is understandable. So will the profits of miners decrease as Bitcoin plummets? This is a question that some investors are curious about. According to the current data analysis, miners' income will decrease if Bitcoin plummets. Next, the editor will tell you in detail to help you better understand Bitcoin mining.

Will miners’ profits decrease as Bitcoin plummets?

Miners’ income will decrease when Bitcoin plummets. Miners obtain Bitcoin rewards and transaction fee income through mining. When the price of Bitcoin drops, the market value of these Bitcoins also decreases, resulting in a reduction in miners’ income. Moreover, mining requires a large amount of electricity and hardware equipment, and operating costs are relatively fixed. When the price of Bitcoin plummets, miners' income decreases, but costs such as electricity and equipment maintenance do not decrease, thus compressing miners' profit margins.

The mining difficulty of the Bitcoin network is adjusted every approximately two weeks to keep block generation times around 10 minutes. When the price of Bitcoin drops sharply, some miners may shut down their mining machines, causing the network difficulty to drop. While a lower difficulty will make mining easier for remaining miners, it won’t be enough to completely offset the impact of falling prices on earnings.

When the price of Bitcoin plummets, some miners may sell their Bitcoins to pay for operating costs. This selling behavior may further aggravate the downward pressure on the market, causing prices to decline further, forming a vicious cycle.

During a price collapse, miners may take measures to reduce operating costs, such as finding areas with lower electricity prices, or upgrading equipment to improve mining efficiency. However, these measures usually require time and capital investment and do not immediately resolve reduced earnings. The problem.

In the long term, the volatility of Bitcoin prices may affect miners’ investment decisions. If prices remain depressed, some miners may exit the market, causing further network difficulty adjustments. Conversely, when prices recover, miners’ profits will also increase.

How much impact does the Bitcoin crash have on mining?

The plummeting price of Bitcoin has a significant impact on the Bitcoin mining industry, as mining activity is closely related to the price of Bitcoin. The profitability of Bitcoin mining is directly related to its price. When the price of Bitcoin plummets, mining profits may be significantly reduced because the value of new Bitcoin rewards miners receive decreases, which may cause some small-scale mining operations to become unavailable. Profit or even loss.

Mining requires dedicated hardware equipment, such as ASIC mining machines. When the price of Bitcoin falls, the value of these equipment may also fall because mining equipment becomes less profitable, which may cause the secondary market price of mining equipment to fall.

Mining is a key component of the Bitcoin network. It ensures the normal operation of the network by maintaining the security and stability of the blockchain. When the price of Bitcoin plummets and many miners exit the market, then the security of the entire network Performance may decrease as the network's hashrate decreases, thereby increasing the risk of potential attacks.

With the plunge in Bitcoin prices, some mining companies may face difficulties or even go bankrupt, which may lead to unemployment problems and regional mining industry instability. Miners may adjust their strategies, such as choosing to mine other cryptocurrencies to find opportunities with more profit potential, which may cause the mining difficulty of other cryptocurrencies to increase.

Will Bitcoin fail due to low mining fees?

Bitcoin may not necessarily fail due to low mining fees, but there is a possibility of failure. The long-term success of Bitcoin as a decentralized cryptocurrency depends on several factors, including the level of mining fees. Low miner fees may have some negative effects on the security and stability of the Bitcoin network, but this does not necessarily lead to the complete failure of Bitcoin. The following is a detailed analysis:

1. Mining fees and miner incentives: Miners gain income through block rewards and transaction fees (mining fees). Bitcoin's block rewards will gradually decrease over time (halving every four years), so miner fees will become an important part of miners' income. If the miner fee is too low, the total income of miners may not be enough to cover mining costs (such as electricity bills and hardware costs). Some miners may shut down their mining machines or exit the market, causing the network hash rate (computing power) to decrease. A decrease in hash rate makes the network more vulnerable to attacks (such as 51% attacks) because attackers require less computing power.

2. Transaction confirmation speed and network congestion: Low mining fees may affect the transaction confirmation speed. Miners prefer to prioritize transactions that pay higher fees. If miner fees are generally low, transaction confirmation may become slow, leading to network congestion and poor user experience.

3. Network difficulty adjustment: The Bitcoin network will adjust the mining difficulty every two weeks or so to keep the block generation time at approximately 10 minutes. If the number of miners decreases significantly, the mining difficulty will drop, making it easier for the remaining miners to mine. However, this adjustment has a certain lag and cannot immediately respond to the rapidly changing number of miners.

4. Miners’ adaptability: Miners have the ability to adapt to market changes, such as by finding areas with lower electricity costs, upgrading mining equipment to improve efficiency, or participating in the mining of other cryptocurrencies to maintain profitability. Therefore, miners may take steps to continue operations even if mining fees are low.

5. Responses from the Bitcoin community and developers: The Bitcoin community and developers can respond to the problem of low mining fees through protocol upgrades and improvements. For example, introducing second-layer solutions (such as Lightning Network) to improve transaction efficiency, or adjusting the Bitcoin protocol to incentivize miners to continue participating in network maintenance.

The above is the detailed content of Will miners' profits decrease as Bitcoin plummets? How big is the impact?. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1664

1664

14

14

1423

1423

52

52

1317

1317

25

25

1268

1268

29

29

1242

1242

24

24

Analyst: Trump's election may trigger global inflation again, which may not necessarily be beneficial to Bitcoin

Jul 19, 2024 am 02:20 AM

Analyst: Trump's election may trigger global inflation again, which may not necessarily be beneficial to Bitcoin

Jul 19, 2024 am 02:20 AM

This site (120btc.coM): The U.S. presidential election has entered the last four months, and the battle between former U.S. President Donald Trump and current U.S. President Joe Biden, representing the Republican Party, is heating up. But since Trump was shot last weekend, his support and exposure have soared rapidly in the community. Because of his pro-cryptocurrency stance, it has also stimulated the rise of Bitcoin, betting that Trump's victory will create a regulatory environment conducive to the growth of cryptocurrency. Analyst: Trump’s election may once again trigger global inflation. In addition to Trump possibly providing a friendly regulatory environment for cryptocurrencies, another possibility that the market generally believes will boost the sharp rise of cryptocurrencies is: the Federal Reserve is maintaining long time

SOL rises another 9 times? GSR Markets: Solana expected to outperform Bitcoin after launching spot ETF

Jun 29, 2024 am 07:07 AM

SOL rises another 9 times? GSR Markets: Solana expected to outperform Bitcoin after launching spot ETF

Jun 29, 2024 am 07:07 AM

This site (120Btc.coM) After asset management giant VanEck applied for Solana ETF to the US SEC yesterday (27th), cryptocurrency market maker GSRMarkets issued a report on the same day, bluntly stating that Solana has high potential to become the next digital asset spot ETF. The agency said: With other companies owning or about to launch ETFs, it may not only be a matter of time before Solana also obtains a spot ETF, but the impact on SOL may be the largest yet. Possibility Analysis of SolanaETF GSRMarkets believes that the two key factors that determine the next digital asset spot ETF are "degree of decentralization" and "potential demand", so digital assets will be based on these two factors.

U.S. Senator Cynthia Lummis proposes: Let the United States buy 1 million Bitcoins

Jul 29, 2024 am 07:04 AM

U.S. Senator Cynthia Lummis proposes: Let the United States buy 1 million Bitcoins

Jul 29, 2024 am 07:04 AM

This site (120BtC.coM): Republican Senator Cynthia Lummis of Wyoming, who has long supported the development of cryptocurrency, did not disappoint her supporters. She announced the latest legal proposal she is about to promote at Bitcoin 2024, the U.S. Bitcoin Conference, this morning (28): Let the U.S. Treasury Department buy 1 million Bitcoins within 5 years! One million Bitcoins, if converted using the current market price at the time of writing, is approximately US$68 billion. Cynthia Lummis stated that the main reason for listing BTC as a national reserve is to “offset the impact of the depreciation of the U.S. dollar.” Cynthia Lummis said: Bitcoin is a rapidly growing reserve of value. In the past four years, it has grown by about 55% per year. At the same time, the U.S. dollar has grown by about 55%.

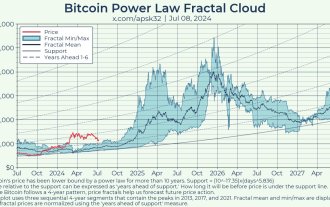

Bitcoin Power Law Indicator Prediction: The rise will accelerate in the coming months! It is expected to increase by 4 times by the end of 2025

Jul 16, 2024 pm 05:27 PM

Bitcoin Power Law Indicator Prediction: The rise will accelerate in the coming months! It is expected to increase by 4 times by the end of 2025

Jul 16, 2024 pm 05:27 PM

This site (120bTC.coM): Mt.Gox, once the world’s largest Bitcoin exchange, started repayment in July. In addition, the German and American governments have also recently transferred large amounts of Bitcoin to exchanges. The two are considered to be the most recent The two major factors that have dragged down the price of the crypto market have many analysts with different opinions on what the price trend of Bitcoin will be in the second half of 2024 and in the future. Recently, anonymous engineer Apsk32 analyzed the latest Bitcoin (BTC) price on the Gradually climb up within the support zone. End of 2025: Price expected to rise 4x Apsk32 points out that the price of Bitcoin seems to follow a certain weekly trend.

Bitcoin holds on to $65,000! Bernstein: Large institutions are expected to enter the market in the second half of the year

Jun 20, 2024 pm 12:33 PM

Bitcoin holds on to $65,000! Bernstein: Large institutions are expected to enter the market in the second half of the year

Jun 20, 2024 pm 12:33 PM

After Bitcoin hit a high of $65,722 at noon yesterday (19th), it started to fluctuate and fall again. It reached a low of $64,666 at around 4 o'clock this morning (20th) before starting to rebound. The current price of Bitcoin is $65,109 at the time of writing, holding on to its energy. Stand firm at the 65,000 level. On the other hand, the buying performance of the U.S. Bitcoin Spot ETF was also poor. According to Sosovalue data, as of June 18, it was the fourth consecutive day of net outflows. Bernstein, a well-known Wall Street investment bank, also pointed out in a report on Tuesday (18) that with the release of the earlier 13F institutional position report, analysts believe that the funds for Bitcoin spot ETFs still mainly come from retail investors and institutional investors. It only accounts for 22% of the overall share. and

NewStreet downgrades Nvidia! Analyst: The price has risen too fast and there is no room left! Will it crash Bitcoin?

Jul 12, 2024 pm 05:55 PM

NewStreet downgrades Nvidia! Analyst: The price has risen too fast and there is no room left! Will it crash Bitcoin?

Jul 12, 2024 pm 05:55 PM

This site (120BtC.coM): Amid the AI craze, the stock price of Nvidia, led by Jen-Hsun Huang, has soared by more than 161.22% this year, and its market value has exceeded US$3.1 trillion. It once overtook Apple and Microsoft and became the world's largest company by market value. It also led to the outstanding performance of the Taiwan stock market. The Taiwan Weighted Index hit a new high of 23,556.59 points this week, and TSMC exceeded the thousand-dollar mark. NewStreet lowered NVIDIA's rating. But on this occasion, NewStreet Research analyst Pierre Ferragu downgraded NVIDIA's rating from "buy" to "neutral." Ferragu said the stock is up nearly 240% in 2023 and soaring this year.

Is Bitcoin unable to rise? Nansen: The market has priced in two Fed rate cuts in 2024

Jun 10, 2024 pm 01:56 PM

Is Bitcoin unable to rise? Nansen: The market has priced in two Fed rate cuts in 2024

Jun 10, 2024 pm 01:56 PM

This site (120btC.coM): Yesterday (31st) night, the inflation indicator that the US Federal Reserve (Fed) paid attention to - the personal consumption expenditures price index (PCE) was released. The data showed that the overall PCE rose by 0.3% in April, an annual increase of 0.3%. 2.7%, both unchanged from the previous month. In addition, core PCE increased by 0.2% monthly in April, which was lower than the 0.3% monthly increase in March and was also in line with expectations. Although the annual growth rate of 2.8% has remained unchanged for three consecutive months, slightly higher than the expected 2.7%, it shows that inflation has not continued to worsen. After the data came out, the four major U.S. stock indexes were mixed. The Dow Jones and S&P 500 indexes rose by 1.51% and 0.8% respectively, while the Nasdaq and Philadelphia Semiconductor Index fell by 0.01% and 0.96% respectively. Nansen points

Robert Kiyosaki: Bitcoin, gold, and the stock market will face the biggest crash in history! There will be a new bull market in 2025

Jul 16, 2024 am 11:05 AM

Robert Kiyosaki: Bitcoin, gold, and the stock market will face the biggest crash in history! There will be a new bull market in 2025

Jul 16, 2024 am 11:05 AM

This site (120btC.coM): Robert Kiyosaki, author of the classic best-selling book "Rich Dad, Poor Dad", wrote another article this morning (4th) warning: "Technical charts show that the biggest crash in history is coming." "Prosperity turns to bust: Technical charts suggest the biggest crash in history is coming. Real estate, stocks, bonds, gold, silver and Bitcoin prices are about to plummet. "But he also pointed out that this also means that a good time to buy the dip is coming. The long-term bull market will start at the end of 2025. Robert Kiyosaki explained that technical charts show that a major long-term bull market cycle will follow. He predicts that a major bull market cycle will start at the end of 2025, when prices will continue to rise for several years, and it will also be the case for gold and silver. and bitcoin investors