Is Bitcoin expected to rebound above $60,000? Analysts say gains may be short-lived

This site (120BTC.coM): The cryptocurrency market fluctuated and rose today (10th), temporarily bidding farewell to last week's heavy losses, but Bitcoin has "challenged the $58,000 level four times" since the early morning and has failed to stand firm. , analysts pointed out that although it is expected to return to $60,000, this wave of gains may only be short-lived.

There are downside risks to the mid-term trend

Markus Thielen, founder of cryptocurrency research company 10x Research, said that although Bitcoin may rise slowly and reach $60,000, this wave of gains may be short-lived and there is still a certain degree of uncertainty in the mid-term trend. Downside risks. He said:

From the perspective of technical analysis, the "$55,000 to $56,000 range" is forming a foundation. However, given the medium-term technical damage, we expect this to be only a short-term tactical rebound.

Markus Thielen added: "We expect that Bitcoin may rebound to close to $60,000 and then fall again until it breaks through the $50,000 range, which will create a complex trading environment."

Seasonal trend impact

Vetle Lunde, senior analyst at K33 Research, pointed out that "seasonal trends" are also quite detrimental to Bitcoin, because the third quarter of each year has historically been the period of weakest returns. This weak seasonal trend overlaps with selling pressure from German authorities selling confiscated assets and Mt. Gox compensation, he said.

According to estimates from K33 Research, the market will need to absorb selling pressure from German authorities and Mt. Gox customers in the summer, with the scale estimated to be 75,000 to 118,000 Bitcoins, which is approximately $4.3 billion to $6.8 billion at current prices. .

Vetle Lunde said: "We expect these sell-offs to weigh on market performance in the coming months, with volatile market conditions continuing into October this year."

Miner selling wave

Julius Baer analyst Manuel Villegas said: "Excess Bitcoin supply is expected to arrive at centralized exchanges in the next few days, which may put pressure on currency prices. The looming oversupply is a major factor affecting market confidence."

At the same time , miners are also facing the pressure of sharp decline in income after the halving, and it is expected that they will continue to sell the bitcoins they mine to cover operating costs. Manuel Villegas noted:

According to our estimates, the average total production cost for a Bitcoin miner is close to $54,500. When prices fall significantly below this threshold, miners may need to sell some of their token inventory to cover fiat-based costs.

The above is the detailed content of Is Bitcoin expected to rebound above $60,000? Analysts say gains may be short-lived. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1384

1384

52

52

Analyst: Trump's election may trigger global inflation again, which may not necessarily be beneficial to Bitcoin

Jul 19, 2024 am 02:20 AM

Analyst: Trump's election may trigger global inflation again, which may not necessarily be beneficial to Bitcoin

Jul 19, 2024 am 02:20 AM

This site (120btc.coM): The U.S. presidential election has entered the last four months, and the battle between former U.S. President Donald Trump and current U.S. President Joe Biden, representing the Republican Party, is heating up. But since Trump was shot last weekend, his support and exposure have soared rapidly in the community. Because of his pro-cryptocurrency stance, it has also stimulated the rise of Bitcoin, betting that Trump's victory will create a regulatory environment conducive to the growth of cryptocurrency. Analyst: Trump’s election may once again trigger global inflation. In addition to Trump possibly providing a friendly regulatory environment for cryptocurrencies, another possibility that the market generally believes will boost the sharp rise of cryptocurrencies is: the Federal Reserve is maintaining long time

U.S. Senator Cynthia Lummis proposes: Let the United States buy 1 million Bitcoins

Jul 29, 2024 am 07:04 AM

U.S. Senator Cynthia Lummis proposes: Let the United States buy 1 million Bitcoins

Jul 29, 2024 am 07:04 AM

This site (120BtC.coM): Republican Senator Cynthia Lummis of Wyoming, who has long supported the development of cryptocurrency, did not disappoint her supporters. She announced the latest legal proposal she is about to promote at Bitcoin 2024, the U.S. Bitcoin Conference, this morning (28): Let the U.S. Treasury Department buy 1 million Bitcoins within 5 years! One million Bitcoins, if converted using the current market price at the time of writing, is approximately US$68 billion. Cynthia Lummis stated that the main reason for listing BTC as a national reserve is to “offset the impact of the depreciation of the U.S. dollar.” Cynthia Lummis said: Bitcoin is a rapidly growing reserve of value. In the past four years, it has grown by about 55% per year. At the same time, the U.S. dollar has grown by about 55%.

SOL rises another 9 times? GSR Markets: Solana expected to outperform Bitcoin after launching spot ETF

Jun 29, 2024 am 07:07 AM

SOL rises another 9 times? GSR Markets: Solana expected to outperform Bitcoin after launching spot ETF

Jun 29, 2024 am 07:07 AM

This site (120Btc.coM) After asset management giant VanEck applied for Solana ETF to the US SEC yesterday (27th), cryptocurrency market maker GSRMarkets issued a report on the same day, bluntly stating that Solana has high potential to become the next digital asset spot ETF. The agency said: With other companies owning or about to launch ETFs, it may not only be a matter of time before Solana also obtains a spot ETF, but the impact on SOL may be the largest yet. Possibility Analysis of SolanaETF GSRMarkets believes that the two key factors that determine the next digital asset spot ETF are "degree of decentralization" and "potential demand", so digital assets will be based on these two factors.

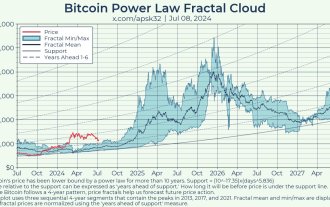

Bitcoin Power Law Indicator Prediction: The rise will accelerate in the coming months! It is expected to increase by 4 times by the end of 2025

Jul 16, 2024 pm 05:27 PM

Bitcoin Power Law Indicator Prediction: The rise will accelerate in the coming months! It is expected to increase by 4 times by the end of 2025

Jul 16, 2024 pm 05:27 PM

This site (120bTC.coM): Mt.Gox, once the world’s largest Bitcoin exchange, started repayment in July. In addition, the German and American governments have also recently transferred large amounts of Bitcoin to exchanges. The two are considered to be the most recent The two major factors that have dragged down the price of the crypto market have many analysts with different opinions on what the price trend of Bitcoin will be in the second half of 2024 and in the future. Recently, anonymous engineer Apsk32 analyzed the latest Bitcoin (BTC) price on the Gradually climb up within the support zone. End of 2025: Price expected to rise 4x Apsk32 points out that the price of Bitcoin seems to follow a certain weekly trend.

The whale wallet that has been dormant for 6 years transferred 1,000 Bitcoins to Coinbase! Value increased more than 9 times

Jun 29, 2024 am 06:54 AM

The whale wallet that has been dormant for 6 years transferred 1,000 Bitcoins to Coinbase! Value increased more than 9 times

Jun 29, 2024 am 06:54 AM

The giant whale wallet woke up and transferred 1,000 Bitcoins. Site (120btC.coM) reported: In the morning of today (28th), a Bitcoin wallet that had been dormant for 6 years was suddenly activated, and 1,000 Bitcoins were transferred out through a transaction. . 2. Transaction details: Data on the chain shows that the "giant whale" spent more than 6 million US dollars to purchase these Bitcoins in 2018, and their current value has increased more than 9 times. 3. Transaction records: According to data from Lookonchain and Arkham Intelligence, the wallet (address: 12EMDoUhaNCuWZeeT6ey61AkjKyzmjV2m3) transferred 1,000 Bitcoins to Coinbase Prime this morning, with a transaction value of

Bitcoin holds on to $65,000! Bernstein: Large institutions are expected to enter the market in the second half of the year

Jun 20, 2024 pm 12:33 PM

Bitcoin holds on to $65,000! Bernstein: Large institutions are expected to enter the market in the second half of the year

Jun 20, 2024 pm 12:33 PM

After Bitcoin hit a high of $65,722 at noon yesterday (19th), it started to fluctuate and fall again. It reached a low of $64,666 at around 4 o'clock this morning (20th) before starting to rebound. The current price of Bitcoin is $65,109 at the time of writing, holding on to its energy. Stand firm at the 65,000 level. On the other hand, the buying performance of the U.S. Bitcoin Spot ETF was also poor. According to Sosovalue data, as of June 18, it was the fourth consecutive day of net outflows. Bernstein, a well-known Wall Street investment bank, also pointed out in a report on Tuesday (18) that with the release of the earlier 13F institutional position report, analysts believe that the funds for Bitcoin spot ETFs still mainly come from retail investors and institutional investors. It only accounts for 22% of the overall share. and

NewStreet downgrades Nvidia! Analyst: The price has risen too fast and there is no room left! Will it crash Bitcoin?

Jul 12, 2024 pm 05:55 PM

NewStreet downgrades Nvidia! Analyst: The price has risen too fast and there is no room left! Will it crash Bitcoin?

Jul 12, 2024 pm 05:55 PM

This site (120BtC.coM): Amid the AI craze, the stock price of Nvidia, led by Jen-Hsun Huang, has soared by more than 161.22% this year, and its market value has exceeded US$3.1 trillion. It once overtook Apple and Microsoft and became the world's largest company by market value. It also led to the outstanding performance of the Taiwan stock market. The Taiwan Weighted Index hit a new high of 23,556.59 points this week, and TSMC exceeded the thousand-dollar mark. NewStreet lowered NVIDIA's rating. But on this occasion, NewStreet Research analyst Pierre Ferragu downgraded NVIDIA's rating from "buy" to "neutral." Ferragu said the stock is up nearly 240% in 2023 and soaring this year.

Trump confirmed to attend Tennessee Bitcoin Summit at the end of the month! Will deliver a 30-minute speech

Jul 16, 2024 am 10:04 AM

Trump confirmed to attend Tennessee Bitcoin Summit at the end of the month! Will deliver a 30-minute speech

Jul 16, 2024 am 10:04 AM

This site (120bTC.coM): US presidential candidate Trump has confirmed that he will attend the Bitcoin Conference (TheBitcoinConference2024) to be held at the end of the month. Industry insiders believe that this may be one of the major events that promotes the development of the encryption industry. The "mysterious guest" of the Bitcoin Summit is confirmed to be Trump. The Bitcoin Summit will be held in Tennessee, USA, from July 25 to 27. The summit speaker revealed to foreign media CoinDesk on the 10th that in order to make time for a "Very special guests" whose speeches have been rescheduled have sparked speculation that Trump will attend the summit. The organizers of the conference later announced that Trump would speak for 30 minutes on the last day of the summit, July 27.