Original title: Grounding Through Confluence

When the price of Bitcoin fell into the $60,000 range, a degree of fear and bearish sentiment emerged among many digital asset investors. This is not uncommon when market volatility stalls and goes into hibernation, as apathy creeps in.

Nevertheless, overall investor profitability remains very strong from an MVRV ratio perspective, with the average still holding 2x profit per coin. This is often the indicator or rule that differentiates between "enthusiastic" and "manic" bull market phases.

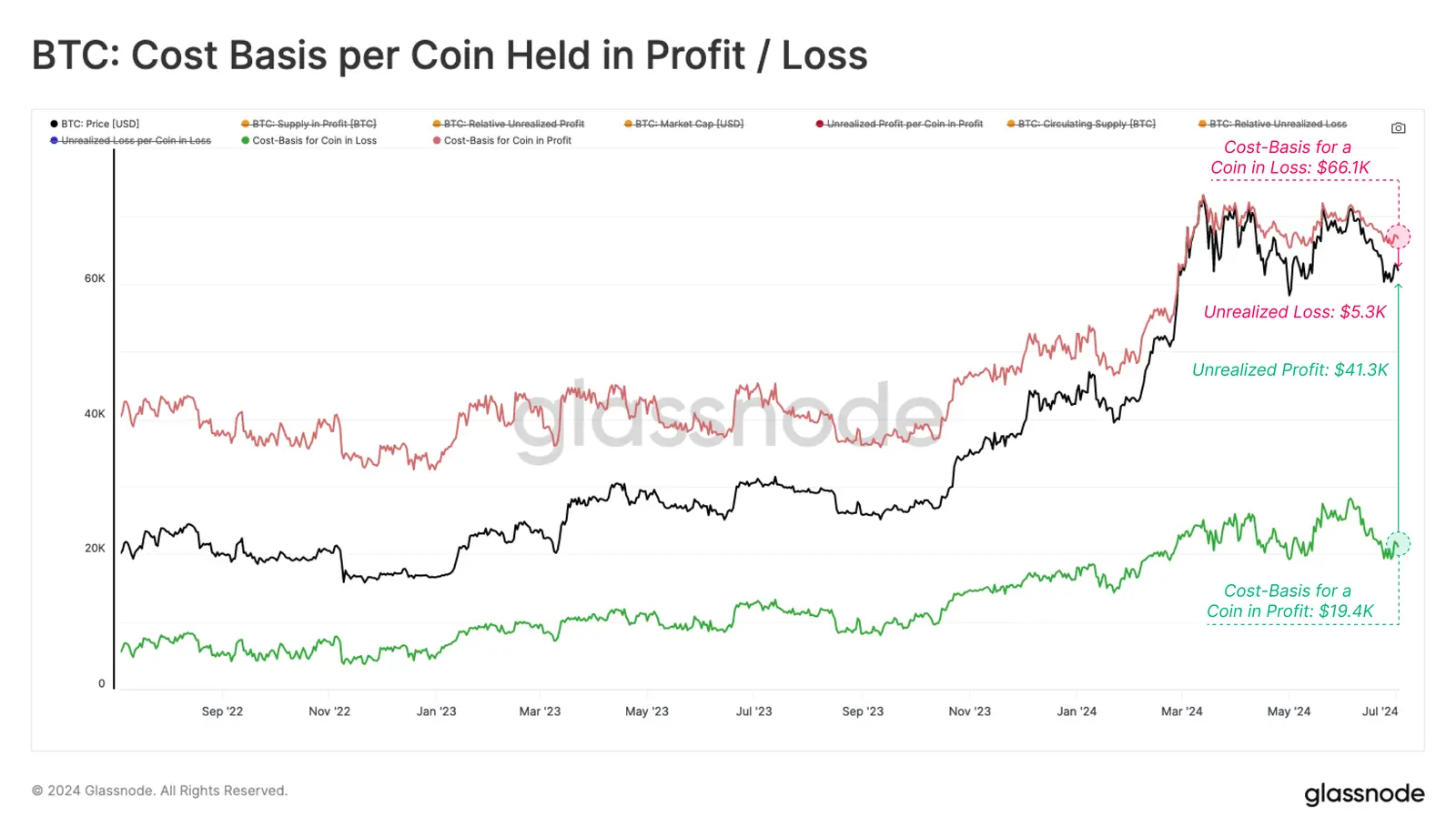

By dividing all holdings into unrealized profits or losses, we can evaluate the average cost basis of each group and the average magnitude of unrealized profits and losses per coin.

· The average profitable coin holding has an unrealized gain of $41.3k and a cost of approximately $19.4k. It’s worth noting that this data is distorted by coins that were moved earlier in the cycle, including Patoshi entities, early miners, and those coins that were lost.

· The average unrealized loss of a losing coin holding is $5. 3k, and the cost is approximately $66. 1k. These coins are primarily held by short-term holders, as few “top buyers” from the 2021 cycle are still holding.

These two indicators help identify potential selling pressure points as investors look to hold on to their gains or avoid larger unrealized losses.

By looking at the unrealized profit/loss ratio per coin, we can see that the magnitude of the paper gains from the holding was 8.2x the paper losses. Only 18% of trading days record greater relative value, and all of this data points to the fact that we are in a feverish bull phase.

It could be argued that March’s all-time high (ATH) was post-ETF approval with several characteristics consistent with historical bull market peaks.

Bitcoin price has been consolidating in the $60,000 to $70,000 range since its all-time high in March, with investor apathy and boredom spreading. This led to indecision among most investors and the market failed to establish a solid trend.

To determine where we are in the cycle, we will refer to a simplified framework for thinking about historical Bitcoin market cycles:

· Deep Bear Market: Price is below the realized price

· Early Bull Market: Price is between the realized price and the real market mean

· Enthusiastic Bull Market: The price is between the all-time high and the real market mean

· Frenzy Bull Market: The price is higher than the all-time high of the previous cycle

Currently, the price is still in the enthusiastic bull market stage, only A few very brief dips into the frenzy zone. The real market average is $50k, which represents the average cost basis of each active investor.

This level is a key pricing level for whether the market can continue the macro bull market.

Next we will look at the short-term holder group and overlay their cost basis with their levels of plus or minus 1 standard deviation. This provides an area where these price-sensitive holders may begin to react:

· Significant unrealized profits signal a potentially overheated market, currently valued at $92k.

· The short-term holder group has a breakeven level of $64k, spot prices are currently below this level but are trying to recapture it.

· Significant unrealized losses signal a potentially oversold market, currently valued at $50k. This is consistent with the real market mean serving as a bull market breakpoint.

It’s worth noting that only 7% of trading days record spot prices below the -1 standard deviation band, a relatively uncommon occurrence.

With prices below short-term holders’ cost basis, the level of financial stress among different subsets of this group needs to be examined. By segmenting the age metric, we can dissect and examine the cost basis of different age components within the short-term holder group.

Currently, the coin averages for 1 day-1 week, 1 week-1 month, and 1 month-3 months are at unrealized losses. This suggests that this consolidation range is mostly unproductive for traders and investors.

The 3 month-6 month group is the only subgroup still in unrealized profit with an average cost basis of $58k. This coincides with the price lows of this correction, once again marking it as a key area of interest.

Turning to technical indicators, we can use the Mayer Multiple indicator, which evaluates the ratio of price to the 200DMA (200-day moving average). The 200DMA is often used as a simple indicator to assess bullish or bearish momentum, making any break above or below a key market pivot point.

200DMA is currently valued at $58k, once again providing convergence with the on-chain price model.

We can use the URPD metric to further assess supply concentration around specific cost base clusters. Currently, spot prices are near the lower end of the large supply node between $60k and all-time highs. This is consistent with the short-term holder's cost basis model.

Currently, 2.63 million BTC (13.4% of circulating supply) sit in the $60k to $70k range, and small price fluctuations can significantly affect the profitability of the coin and investor portfolio.

Overall, this suggests that many investors may be sensitive to any price decline below $60k.

After several months of range-bound price action, we have noticed a significant decrease in volatility on many rolling window timeframes. To visualize this phenomenon, we introduce a simple tool to detect periods when volatility contraction is achieved, which often provides an indication of impending higher volatility.

The model evaluates 30-day changes in realized volatility on 1-week, 2-week, 1-month, 3-month, 6-month and 1-year timeframes. When all windows exhibit negative 30-day changes, a signal is triggered inferring that volatility is compressing and investors are reducing their expectations for future volatility.

We can also assess market volatility by measuring the percentage range of the highest and lowest price moves over the last 60 days. By this indicator, volatility continues to compress to levels that are rarely seen, but usually after prolonged consolidation and before larger market moves.

Finally, we can use sell-side risk ratios to enhance volatility assessment. This tool evaluates the absolute sum of realized profits and losses locked in by an investor, relative to the size of the asset (realized market capitalization). We can think of this indicator according to the following framework:

· High values indicate that investors are spending coins at a substantial profit or loss relative to their cost base. This situation indicates that the market may need to re-find its equilibrium, usually following a high-volatility price move.

· Low values indicate that most coins are being spent relative to their break-even cost base, indicating some degree of balance has been achieved. This situation typically indicates the exhaustion of "profits and losses" within the current price range, and often describes a low-volatility environment.

Notably, the short-term holder seller risk ratio contracted to an all-time low, with only 274 of 5,083 trading days recording lower values (5%). This suggests that some level of equilibrium has been established during this period of price consolidation and hints at expectations of high volatility in the near term.

The Bitcoin market is in an interesting phase, with apathy and boredom reigning supreme despite the price being 20% below its all-time high. The average coin still holds 2x unrealized profit, but new buyers are at a loss in their position.

We also explore the key factors behind possible shifts in investor behavior patterns. We looked for a level of convergence across on-chain and technical indicators and came up with three key areas of focus.

· A break below $58k to $60k would put a large number of short-term holders into the red and below the 200DMA price level.

· Price swings between $60k and $64k continue the current sideways trend where the market is hesitant.

· A break above $64k would return the coin to profitability for a large number of short-term holders, and investor sentiment may rise as a result.

Volatility continues to compress across multiple timeframes, both from a pricing and on-chain data perspective. Indicators such as the sell-side risk ratio and the 60-day price range have fallen to all-time lows. This suggests that the current trading range is in the late stages of expanding into the next range.

The above is the detailed content of Glassnode: Many indicators fell to historical lows, and there may be greater volatility in the short term.. For more information, please follow other related articles on the PHP Chinese website!