When is the fifth Bitcoin halving? Next halving time

The much-anticipated fourth Bitcoin halving has been completed on April 20, 2024. The main reason why Bitcoin halving has attracted attention is that in the past, Bitcoin halvings have had a great impact on the market. Some investors expect that the halving will There will be a rebound in the second half, and you can enter the market in advance to ambush. The halving is crucial to Bitcoin’s scarcity and inflation control, ensuring that its total supply never exceeds 21 million. With the completion of the fourth halving, some people are also curious about the year of Bitcoin’s fifth halving? According to data predictions, Bitcoin’s fifth halving may occur in 2028. The editor below will tell you in detail.

When is the fifth Bitcoin halving?

The fifth Bitcoin halving is expected to be in 2028, explaining that the Bitcoin block reward will be halved again to 1.5625 Bitcoins. The target block time of the Bitcoin mining algorithm is approximately 10 minutes. However, actual block times may vary, with some blocks taking longer or less than 10 minutes to mine. This difference may affect when the next halving occurs, which is expected to be in 2028.

Bitcoin halving is a pre-scheduled event where the rewards for mining and validating new blocks will be reduced by 50% and miners only get half the amount of BTC mined. Bitcoin halving is scheduled every 210,000 blocks or This occurs approximately every four years and continues until the total BTC supply reaches 21 million.

When the Bitcoin halving occurs, the rewards for mining new blocks will be reduced by half. This reduces the rate at which new Bitcoins are mined, effectively reducing their inflation rate. The halving event occurs approximately every four years and is part of the Bitcoin supply control mechanism designed to limit the total number of Bitcoins to 21 million.

How long will it take for Bitcoin to skyrocket after the halving?

The time for Bitcoin to surge after the halving should be analyzed based on market trends. Previously, some analysts in the circle predicted that Bitcoin would generally surge within half a year after the halving. However, this is only a prediction and cannot be used as an actual situation. refer to. Bitcoin’s halving event occurs roughly every four years, and the purpose of halving is to reduce the supply of Bitcoin to maintain its contraction characteristics.

After the Bitcoin halving, there will often be a surge in the price of Bitcoin. This is because the halving causes the supply of Bitcoin to decrease, while the demand does not decrease, and may even increase, thus driving the price of Bitcoin upward. A short-term surge may attract more investors into the market, driving prices up further.

The duration of a surge often depends on market conditions and external factors. Some surges may only be short-term, while others may last longer or even evolve into a sustained bull market. During the surge, investors should remain vigilant and adjust their positions in a timely manner to prevent losses caused by violent price fluctuations.

The above is the detailed content of When is the fifth Bitcoin halving? Next halving time. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1664

1664

14

14

1422

1422

52

52

1316

1316

25

25

1267

1267

29

29

1239

1239

24

24

Analyst: Trump's election may trigger global inflation again, which may not necessarily be beneficial to Bitcoin

Jul 19, 2024 am 02:20 AM

Analyst: Trump's election may trigger global inflation again, which may not necessarily be beneficial to Bitcoin

Jul 19, 2024 am 02:20 AM

This site (120btc.coM): The U.S. presidential election has entered the last four months, and the battle between former U.S. President Donald Trump and current U.S. President Joe Biden, representing the Republican Party, is heating up. But since Trump was shot last weekend, his support and exposure have soared rapidly in the community. Because of his pro-cryptocurrency stance, it has also stimulated the rise of Bitcoin, betting that Trump's victory will create a regulatory environment conducive to the growth of cryptocurrency. Analyst: Trump’s election may once again trigger global inflation. In addition to Trump possibly providing a friendly regulatory environment for cryptocurrencies, another possibility that the market generally believes will boost the sharp rise of cryptocurrencies is: the Federal Reserve is maintaining long time

SOL rises another 9 times? GSR Markets: Solana expected to outperform Bitcoin after launching spot ETF

Jun 29, 2024 am 07:07 AM

SOL rises another 9 times? GSR Markets: Solana expected to outperform Bitcoin after launching spot ETF

Jun 29, 2024 am 07:07 AM

This site (120Btc.coM) After asset management giant VanEck applied for Solana ETF to the US SEC yesterday (27th), cryptocurrency market maker GSRMarkets issued a report on the same day, bluntly stating that Solana has high potential to become the next digital asset spot ETF. The agency said: With other companies owning or about to launch ETFs, it may not only be a matter of time before Solana also obtains a spot ETF, but the impact on SOL may be the largest yet. Possibility Analysis of SolanaETF GSRMarkets believes that the two key factors that determine the next digital asset spot ETF are "degree of decentralization" and "potential demand", so digital assets will be based on these two factors.

U.S. Senator Cynthia Lummis proposes: Let the United States buy 1 million Bitcoins

Jul 29, 2024 am 07:04 AM

U.S. Senator Cynthia Lummis proposes: Let the United States buy 1 million Bitcoins

Jul 29, 2024 am 07:04 AM

This site (120BtC.coM): Republican Senator Cynthia Lummis of Wyoming, who has long supported the development of cryptocurrency, did not disappoint her supporters. She announced the latest legal proposal she is about to promote at Bitcoin 2024, the U.S. Bitcoin Conference, this morning (28): Let the U.S. Treasury Department buy 1 million Bitcoins within 5 years! One million Bitcoins, if converted using the current market price at the time of writing, is approximately US$68 billion. Cynthia Lummis stated that the main reason for listing BTC as a national reserve is to “offset the impact of the depreciation of the U.S. dollar.” Cynthia Lummis said: Bitcoin is a rapidly growing reserve of value. In the past four years, it has grown by about 55% per year. At the same time, the U.S. dollar has grown by about 55%.

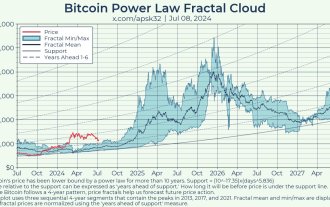

Bitcoin Power Law Indicator Prediction: The rise will accelerate in the coming months! It is expected to increase by 4 times by the end of 2025

Jul 16, 2024 pm 05:27 PM

Bitcoin Power Law Indicator Prediction: The rise will accelerate in the coming months! It is expected to increase by 4 times by the end of 2025

Jul 16, 2024 pm 05:27 PM

This site (120bTC.coM): Mt.Gox, once the world’s largest Bitcoin exchange, started repayment in July. In addition, the German and American governments have also recently transferred large amounts of Bitcoin to exchanges. The two are considered to be the most recent The two major factors that have dragged down the price of the crypto market have many analysts with different opinions on what the price trend of Bitcoin will be in the second half of 2024 and in the future. Recently, anonymous engineer Apsk32 analyzed the latest Bitcoin (BTC) price on the Gradually climb up within the support zone. End of 2025: Price expected to rise 4x Apsk32 points out that the price of Bitcoin seems to follow a certain weekly trend.

Bitcoin holds on to $65,000! Bernstein: Large institutions are expected to enter the market in the second half of the year

Jun 20, 2024 pm 12:33 PM

Bitcoin holds on to $65,000! Bernstein: Large institutions are expected to enter the market in the second half of the year

Jun 20, 2024 pm 12:33 PM

After Bitcoin hit a high of $65,722 at noon yesterday (19th), it started to fluctuate and fall again. It reached a low of $64,666 at around 4 o'clock this morning (20th) before starting to rebound. The current price of Bitcoin is $65,109 at the time of writing, holding on to its energy. Stand firm at the 65,000 level. On the other hand, the buying performance of the U.S. Bitcoin Spot ETF was also poor. According to Sosovalue data, as of June 18, it was the fourth consecutive day of net outflows. Bernstein, a well-known Wall Street investment bank, also pointed out in a report on Tuesday (18) that with the release of the earlier 13F institutional position report, analysts believe that the funds for Bitcoin spot ETFs still mainly come from retail investors and institutional investors. It only accounts for 22% of the overall share. and

NewStreet downgrades Nvidia! Analyst: The price has risen too fast and there is no room left! Will it crash Bitcoin?

Jul 12, 2024 pm 05:55 PM

NewStreet downgrades Nvidia! Analyst: The price has risen too fast and there is no room left! Will it crash Bitcoin?

Jul 12, 2024 pm 05:55 PM

This site (120BtC.coM): Amid the AI craze, the stock price of Nvidia, led by Jen-Hsun Huang, has soared by more than 161.22% this year, and its market value has exceeded US$3.1 trillion. It once overtook Apple and Microsoft and became the world's largest company by market value. It also led to the outstanding performance of the Taiwan stock market. The Taiwan Weighted Index hit a new high of 23,556.59 points this week, and TSMC exceeded the thousand-dollar mark. NewStreet lowered NVIDIA's rating. But on this occasion, NewStreet Research analyst Pierre Ferragu downgraded NVIDIA's rating from "buy" to "neutral." Ferragu said the stock is up nearly 240% in 2023 and soaring this year.

Is Bitcoin unable to rise? Nansen: The market has priced in two Fed rate cuts in 2024

Jun 10, 2024 pm 01:56 PM

Is Bitcoin unable to rise? Nansen: The market has priced in two Fed rate cuts in 2024

Jun 10, 2024 pm 01:56 PM

This site (120btC.coM): Yesterday (31st) night, the inflation indicator that the US Federal Reserve (Fed) paid attention to - the personal consumption expenditures price index (PCE) was released. The data showed that the overall PCE rose by 0.3% in April, an annual increase of 0.3%. 2.7%, both unchanged from the previous month. In addition, core PCE increased by 0.2% monthly in April, which was lower than the 0.3% monthly increase in March and was also in line with expectations. Although the annual growth rate of 2.8% has remained unchanged for three consecutive months, slightly higher than the expected 2.7%, it shows that inflation has not continued to worsen. After the data came out, the four major U.S. stock indexes were mixed. The Dow Jones and S&P 500 indexes rose by 1.51% and 0.8% respectively, while the Nasdaq and Philadelphia Semiconductor Index fell by 0.01% and 0.96% respectively. Nansen points

Robert Kiyosaki: Bitcoin, gold, and the stock market will face the biggest crash in history! There will be a new bull market in 2025

Jul 16, 2024 am 11:05 AM

Robert Kiyosaki: Bitcoin, gold, and the stock market will face the biggest crash in history! There will be a new bull market in 2025

Jul 16, 2024 am 11:05 AM

This site (120btC.coM): Robert Kiyosaki, author of the classic best-selling book "Rich Dad, Poor Dad", wrote another article this morning (4th) warning: "Technical charts show that the biggest crash in history is coming." "Prosperity turns to bust: Technical charts suggest the biggest crash in history is coming. Real estate, stocks, bonds, gold, silver and Bitcoin prices are about to plummet. "But he also pointed out that this also means that a good time to buy the dip is coming. The long-term bull market will start at the end of 2025. Robert Kiyosaki explained that technical charts show that a major long-term bull market cycle will follow. He predicts that a major bull market cycle will start at the end of 2025, when prices will continue to rise for several years, and it will also be the case for gold and silver. and bitcoin investors