Is altcoin season here? Analysts say copycat market is nearing bottom of momentum

Jul 18, 2024 pm 06:25 PMAuthor: Nancy Lubale

Compiled by: Deng Tong, Golden Finance

Cryptocurrency analysts said that the altcoin market has been trending downward in the past two weeks, but a key Indicators suggest that the recent decline may signal a "relative momentum bottom," and if history repeats itself, a "coordinated takeoff" could soon follow.

Real Vision chief cryptocurrency analyst Jamie Coutts said the top 200 equally weighted index of cryptocurrencies "is still trending downwards, but altcoin seasonal indicators suggest that the recent 10% drop is likely a relative momentum bottom."

The Cryptocurrency Top 200 Equal Weight Index is an equally weighted index designed to track the performance of the top 200 cryptocurrencies by market capitalization relative to Bitcoin.

Coutts shared the chart below, which shows that the index has been trending downwards, with the altcoin season indicator reaching a low of 10%. This means that “only 10% of the top 200 outperformed BTC over a 90-day lookback,” the analysts explained.

Historically, this marks a market bottom, followed by continued altcoin gains.

"Altcoins are likely to remain volatile around these levels for a while before we see synergy take off, with many altcoins already starting to establish good fundamentals."

Cryptocurrency Top 200 Equal Weight Index vs .Daily Active Users vs.Copycat Season Metrics. Source: Jamie Coutts

Coutts also considered another metric within the overall cryptocurrency market – the number of daily active users (DAU) – to support his prediction of where the altcoin market will go.

DAU is a metric that reflects the number of unique public addresses transacting on the blockchain every day.

Coutts noted that the number of DAUs across all blockchains has increased by 97% so far this year, indicating that “growth momentum continues unabated.”

He said that more users means more user fees, which means "increased asset prices."

Prominent cryptocurrency analyst Mustache said in a July 15 article: “I think some altcoins are ready for the second round,” adding that the highly anticipated spot Ethereum ETF’s The rollout may provide the needed staying power.

In a previous article, Moustache shared the chart below, showing that altcoin market capitalization is repeating a similar trend to 2020 before embarking on “the strongest wave of the bull market.”

Source: Mustache

It’s still Bitcoin season

The Bitcoin dominance chart (which measures BTC’s market share relative to the overall cryptocurrency market) is commonly used to indicate whether altcoin season has begun One of the starting indicators. It provides traders with the overall investor sentiment and risk appetite in the market.

The indicator has been trending upward since the start of 2024, reaching a three-year high of 56.5% on April 13. As of the time of publication, BTC dominance stands at 54%, indicating that it is still Bitcoin season.

Bitcoin market dominance. Source: TradingView

This means that altcoins are still underperforming Bitcoin.

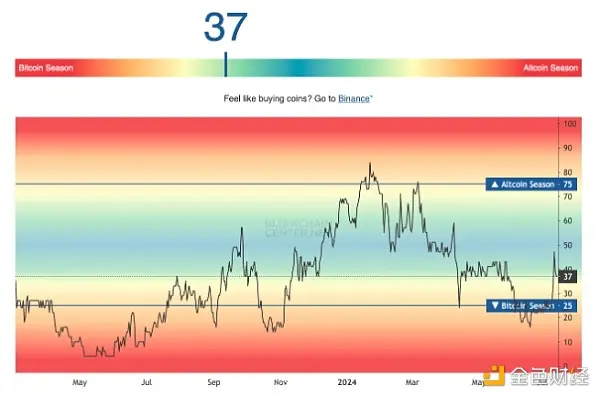

According to data from Blockchain Center, only 37% of the top 50 altcoins have performed better than BTC over the past three months. While this is a positive sign, it is not enough to declare altcoin season. To declare altcoin season, this percentage must exceed 75%.

Altcoin Seasonal Index. Source: Blockchain Center

This means that while the signs of altcoin season are starting to converge, it may be too early to judge.

The above is the detailed content of Is altcoin season here? Analysts say copycat market is nearing bottom of momentum. For more information, please follow other related articles on the PHP Chinese website!

Hot Article

Hot tools Tags

Hot Article

Hot Article Tags

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

Top 10 virtual digital currency app platforms in the world, the top ten virtual currency trading platforms in 2025

Mar 05, 2025 pm 08:00 PM

Top 10 virtual digital currency app platforms in the world, the top ten virtual currency trading platforms in 2025

Mar 05, 2025 pm 08:00 PM

Top 10 virtual digital currency app platforms in the world, the top ten virtual currency trading platforms in 2025

Pi Node Teaching: What is a Pi Node? How to install and set up Pi Node?

Mar 05, 2025 pm 05:57 PM

Pi Node Teaching: What is a Pi Node? How to install and set up Pi Node?

Mar 05, 2025 pm 05:57 PM

Pi Node Teaching: What is a Pi Node? How to install and set up Pi Node?

Various ETF issuers compete to apply for Solana ETF! But why is BlackRock still absent?

Mar 03, 2025 pm 06:33 PM

Various ETF issuers compete to apply for Solana ETF! But why is BlackRock still absent?

Mar 03, 2025 pm 06:33 PM

Various ETF issuers compete to apply for Solana ETF! But why is BlackRock still absent?

![Bitcoin [BTC] was on a downtrend after losing the $92,000-support level in the final week of February](https://img.php.cn/upload/article/001/246/273/174209101774967.jpg?x-oss-process=image/resize,m_fill,h_207,w_330) Bitcoin [BTC] was on a downtrend after losing the $92,000-support level in the final week of February

Mar 16, 2025 am 10:10 AM

Bitcoin [BTC] was on a downtrend after losing the $92,000-support level in the final week of February

Mar 16, 2025 am 10:10 AM

Bitcoin [BTC] was on a downtrend after losing the $92,000-support level in the final week of February

Understand the current situation and future of MEV on a single article

Mar 04, 2025 pm 05:06 PM

Understand the current situation and future of MEV on a single article

Mar 04, 2025 pm 05:06 PM

Understand the current situation and future of MEV on a single article

PI price forecast: How high can PI coins rise?

Mar 03, 2025 pm 07:27 PM

PI price forecast: How high can PI coins rise?

Mar 03, 2025 pm 07:27 PM

PI price forecast: How high can PI coins rise?

Does Bitcoin have stocks? Does Bitcoin have equity?

Mar 03, 2025 pm 06:42 PM

Does Bitcoin have stocks? Does Bitcoin have equity?

Mar 03, 2025 pm 06:42 PM

Does Bitcoin have stocks? Does Bitcoin have equity?

Top 10 Free Virtual Currency Exchanges Rankings The latest top ten virtual currency APP trading platforms

Mar 11, 2025 am 10:18 AM

Top 10 Free Virtual Currency Exchanges Rankings The latest top ten virtual currency APP trading platforms

Mar 11, 2025 am 10:18 AM

Top 10 Free Virtual Currency Exchanges Rankings The latest top ten virtual currency APP trading platforms