web3.0

web3.0

JPMorgan Chase: Bitcoin liquidation activity ends this month! The market will rebound in August

JPMorgan Chase: Bitcoin liquidation activity ends this month! The market will rebound in August

JPMorgan Chase: Bitcoin liquidation activity ends this month! The market will rebound in August

This site (120bTC.coM): JPMorgan Chase and Bitfinex both issued reports stating that with the end of liquidation activities and selling by short-term holders, the market is close to bottoming out and is expected to rebound in August.

JP Morgan: The market will rebound in August

CoinDesk quoted a JP Morgan research report stating that the crypto market is expected to start rebounding in August and liquidation activities will be completed by the end of July.

As Bitcoin reserves on major exchanges have declined over the past month, JPMorgan Chase also revised down its year-to-date net inflow forecast for the crypto market from $12 billion to $8 billion.

The report mentioned that the decline in Bitcoin reserves may be due to the Bitcoin liquidation by creditors of Gemini, bankrupt exchange Mt. Gox, or the sale of Bitcoin by the German government.

Is Bitcoin overvalued compared to gold?

A JP Morgan analyst team headed by Nikolaos Panigirtzoglou wrote in a report: The forecast net flow will decrease mainly due to the decline in Bitcoin reserves over the past month. And we are skeptical about the possibility that the previously expected net inflow of US$12 billion will continue throughout the year, because the cost of Bitcoin production is still high relative to the price of gold.

The report highlights that the crypto market is expected to begin to resume growth in August as liquidation activities end.

Bitfinex: Short-term holders have completed their selling

Bitfinex analysts also believe that the market is close to bottoming.

Citing derivatives market data, it pointed out that Bitcoin price volatility has begun to decrease because the spread between "implied volatility" and "historical volatility" has narrowed by nearly 90%, indicating that traders expect Bitcoin prices to Stable within the range.

Analysts pointed out: The sell-off by short-term holders may be nearing an end. We note that the short-term holders’ cost-to-profit ratio (SOPR) is 0.97, indicating that short-term holders are selling at a loss, which has happened in the past. In this case, as the selling pressure eases, the price will rebound.

Spent Output Profit Ratio (SOPR) is used to measure the realized profits and trends of Bitcoin. A SOPR value greater than 1 represents realized profits, less than 1 represents realized losses, and equal to 1 represents break-even. When SOPR is too low, it may indicate that the market is oversold and there is an opportunity for upside.

The above is the detailed content of JPMorgan Chase: Bitcoin liquidation activity ends this month! The market will rebound in August. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1664

1664

14

14

1422

1422

52

52

1316

1316

25

25

1266

1266

29

29

1239

1239

24

24

Analyst: Trump's election may trigger global inflation again, which may not necessarily be beneficial to Bitcoin

Jul 19, 2024 am 02:20 AM

Analyst: Trump's election may trigger global inflation again, which may not necessarily be beneficial to Bitcoin

Jul 19, 2024 am 02:20 AM

This site (120btc.coM): The U.S. presidential election has entered the last four months, and the battle between former U.S. President Donald Trump and current U.S. President Joe Biden, representing the Republican Party, is heating up. But since Trump was shot last weekend, his support and exposure have soared rapidly in the community. Because of his pro-cryptocurrency stance, it has also stimulated the rise of Bitcoin, betting that Trump's victory will create a regulatory environment conducive to the growth of cryptocurrency. Analyst: Trump’s election may once again trigger global inflation. In addition to Trump possibly providing a friendly regulatory environment for cryptocurrencies, another possibility that the market generally believes will boost the sharp rise of cryptocurrencies is: the Federal Reserve is maintaining long time

SOL rises another 9 times? GSR Markets: Solana expected to outperform Bitcoin after launching spot ETF

Jun 29, 2024 am 07:07 AM

SOL rises another 9 times? GSR Markets: Solana expected to outperform Bitcoin after launching spot ETF

Jun 29, 2024 am 07:07 AM

This site (120Btc.coM) After asset management giant VanEck applied for Solana ETF to the US SEC yesterday (27th), cryptocurrency market maker GSRMarkets issued a report on the same day, bluntly stating that Solana has high potential to become the next digital asset spot ETF. The agency said: With other companies owning or about to launch ETFs, it may not only be a matter of time before Solana also obtains a spot ETF, but the impact on SOL may be the largest yet. Possibility Analysis of SolanaETF GSRMarkets believes that the two key factors that determine the next digital asset spot ETF are "degree of decentralization" and "potential demand", so digital assets will be based on these two factors.

U.S. Senator Cynthia Lummis proposes: Let the United States buy 1 million Bitcoins

Jul 29, 2024 am 07:04 AM

U.S. Senator Cynthia Lummis proposes: Let the United States buy 1 million Bitcoins

Jul 29, 2024 am 07:04 AM

This site (120BtC.coM): Republican Senator Cynthia Lummis of Wyoming, who has long supported the development of cryptocurrency, did not disappoint her supporters. She announced the latest legal proposal she is about to promote at Bitcoin 2024, the U.S. Bitcoin Conference, this morning (28): Let the U.S. Treasury Department buy 1 million Bitcoins within 5 years! One million Bitcoins, if converted using the current market price at the time of writing, is approximately US$68 billion. Cynthia Lummis stated that the main reason for listing BTC as a national reserve is to “offset the impact of the depreciation of the U.S. dollar.” Cynthia Lummis said: Bitcoin is a rapidly growing reserve of value. In the past four years, it has grown by about 55% per year. At the same time, the U.S. dollar has grown by about 55%.

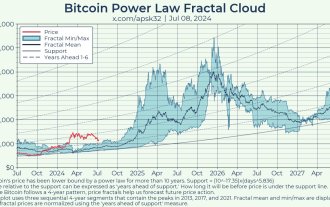

Bitcoin Power Law Indicator Prediction: The rise will accelerate in the coming months! It is expected to increase by 4 times by the end of 2025

Jul 16, 2024 pm 05:27 PM

Bitcoin Power Law Indicator Prediction: The rise will accelerate in the coming months! It is expected to increase by 4 times by the end of 2025

Jul 16, 2024 pm 05:27 PM

This site (120bTC.coM): Mt.Gox, once the world’s largest Bitcoin exchange, started repayment in July. In addition, the German and American governments have also recently transferred large amounts of Bitcoin to exchanges. The two are considered to be the most recent The two major factors that have dragged down the price of the crypto market have many analysts with different opinions on what the price trend of Bitcoin will be in the second half of 2024 and in the future. Recently, anonymous engineer Apsk32 analyzed the latest Bitcoin (BTC) price on the Gradually climb up within the support zone. End of 2025: Price expected to rise 4x Apsk32 points out that the price of Bitcoin seems to follow a certain weekly trend.

The whale wallet that has been dormant for 6 years transferred 1,000 Bitcoins to Coinbase! Value increased more than 9 times

Jun 29, 2024 am 06:54 AM

The whale wallet that has been dormant for 6 years transferred 1,000 Bitcoins to Coinbase! Value increased more than 9 times

Jun 29, 2024 am 06:54 AM

The giant whale wallet woke up and transferred 1,000 Bitcoins. Site (120btC.coM) reported: In the morning of today (28th), a Bitcoin wallet that had been dormant for 6 years was suddenly activated, and 1,000 Bitcoins were transferred out through a transaction. . 2. Transaction details: Data on the chain shows that the "giant whale" spent more than 6 million US dollars to purchase these Bitcoins in 2018, and their current value has increased more than 9 times. 3. Transaction records: According to data from Lookonchain and Arkham Intelligence, the wallet (address: 12EMDoUhaNCuWZeeT6ey61AkjKyzmjV2m3) transferred 1,000 Bitcoins to Coinbase Prime this morning, with a transaction value of

Bitcoin holds on to $65,000! Bernstein: Large institutions are expected to enter the market in the second half of the year

Jun 20, 2024 pm 12:33 PM

Bitcoin holds on to $65,000! Bernstein: Large institutions are expected to enter the market in the second half of the year

Jun 20, 2024 pm 12:33 PM

After Bitcoin hit a high of $65,722 at noon yesterday (19th), it started to fluctuate and fall again. It reached a low of $64,666 at around 4 o'clock this morning (20th) before starting to rebound. The current price of Bitcoin is $65,109 at the time of writing, holding on to its energy. Stand firm at the 65,000 level. On the other hand, the buying performance of the U.S. Bitcoin Spot ETF was also poor. According to Sosovalue data, as of June 18, it was the fourth consecutive day of net outflows. Bernstein, a well-known Wall Street investment bank, also pointed out in a report on Tuesday (18) that with the release of the earlier 13F institutional position report, analysts believe that the funds for Bitcoin spot ETFs still mainly come from retail investors and institutional investors. It only accounts for 22% of the overall share. and

NewStreet downgrades Nvidia! Analyst: The price has risen too fast and there is no room left! Will it crash Bitcoin?

Jul 12, 2024 pm 05:55 PM

NewStreet downgrades Nvidia! Analyst: The price has risen too fast and there is no room left! Will it crash Bitcoin?

Jul 12, 2024 pm 05:55 PM

This site (120BtC.coM): Amid the AI craze, the stock price of Nvidia, led by Jen-Hsun Huang, has soared by more than 161.22% this year, and its market value has exceeded US$3.1 trillion. It once overtook Apple and Microsoft and became the world's largest company by market value. It also led to the outstanding performance of the Taiwan stock market. The Taiwan Weighted Index hit a new high of 23,556.59 points this week, and TSMC exceeded the thousand-dollar mark. NewStreet lowered NVIDIA's rating. But on this occasion, NewStreet Research analyst Pierre Ferragu downgraded NVIDIA's rating from "buy" to "neutral." Ferragu said the stock is up nearly 240% in 2023 and soaring this year.

ApeCoinDAO proposes to open a Boring Ape themed hotel in Bangkok, Thailand! APE pays room fees and empowers BAYC

Jul 22, 2024 pm 03:36 PM

ApeCoinDAO proposes to open a Boring Ape themed hotel in Bangkok, Thailand! APE pays room fees and empowers BAYC

Jul 22, 2024 pm 03:36 PM

This site (120BTc.coM): ApeCoinDAO, the decentralized autonomous organization of the NFT blue chip project Bored Ape (BAYC) ecological token APE, launched a new proposal AIP-448 on the 19th, planning to build a prime location in the center of Bangkok, Thailand The goal of opening an ApeCoin themed hotel is to enhance the exposure of Boring Monkey IP, the popularity and practicality of ApeCoin, and create actual income for DAO. The current results show that more than 4.8 million APEs have agreed to the proposal, with a support rate of 89.47%, and only 565,000 APEs have voted against (10.53%). The voting is expected to close at 9 a.m. on August 1. The community plans to open an APE themed hotel, hoping to increase the popularity of Boring Ape.