Technology peripherals

Technology peripherals

It Industry

It Industry

Solve complex financial calculations with 3 Excel financial functions

Solve complex financial calculations with 3 Excel financial functions

Solve complex financial calculations with 3 Excel financial functions

Original title: "These 3 Excel financial functions are undervalued again!" 》

The author of this article: Xiaohua

The editor of this article: Yanlan

Recently, Xiaohua encountered an interesting question, which came from the soul of an old friend:

How to pay monthly annuity and private mutual insurance finance make a choice?

The basic information of these two financial products is as follows:

Monthly annuity:

Pay 1,000 yuan per month, annualized interest rate is 3%, 2-year term, and the principal and interest can be withdrawn in one go at maturity.

Mutual Insurance Finance:

Pay the principal of 1,000 yuan every month, and the monthly principal will be calculated at 10% interest, with a 2-year term. There are 24 people participating in the same product. Every month, one person must receive all the principal and interest paid by others. The next month after receiving the payment, one person must pay an interest of 100 yuan/month.

How to compare the pros and cons of these two financial products?

We can consider this issue from the terminal value method, rate of return method and IRR method, and by the way share with you some usage of financial functions.

1. Terminal value method

The terminal value analysis method is to calculate the final value of the net benefit of the plan (project) after determining the base year, conversion interest rate, and cash flow. The higher the terminal value, the greater the economic feasibility of the solution.

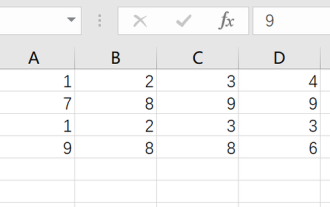

How much principal and interest can be received after the equal-amount annuity matures? This problem can be calculated using the final value function FV.

Annuity future value formula:

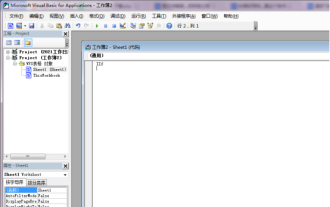

=-FV(B3/12,C3,A3)

It can be seen that if an annuity of 1,000 yuan is paid every month, the interest rate is calculated at 3%. After 2 years, a total of 24,703 yuan in principal and interest will be received.

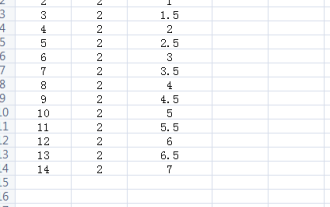

The final value of "Mutual Insurance Finance" (assuming no rolling investment) is related to the order in which the principal and interest are withdrawn. The later the withdrawal, the greater the income. The final value is calculated as follows:

=S2*U2+S2*T2*(V2-1)-S2*T2*(U2-V2)

From the perspective of the final value method, if you can ensure the receipt When the payment period is after 16 periods, the income of "Mutual Insurance Finance" is greater than the monthly annuity. When the receiving period is earlier than 16 periods, the income of "Mutual Insurance Finance" is less than the monthly annuity.

The terminal value method is suitable for investment plans with a comparable investment scale.

2. Rate of Return Method

When I told this preliminary conclusion to my old friend, he asked in disbelief:

Why is the nominal interest rate of "Mutual Insurance Finance" 10%? But only 1/3 of the participants’ income is higher than that of monthly annuity, which has a return rate of only 3%?

This involves the calculation of profitability.

The rate of return method is an investment decision-making method that compares the average annual net rate of return of an investment project with the capital cost of the investment to determine whether the investment is desirable, and then selects the investment plan with the highest rate of return among the available investment plans. .

Obviously, the monthly annuity yield is consistent with the nominal interest rate, which is 3%.

So, what is the return rate for each payment period of "Mutual Insurance Finance"?

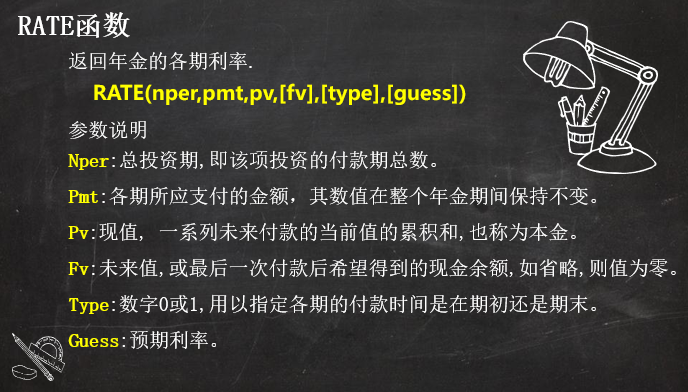

We can use the RATE function to calculate.

The rate of return of "Mutual Insurance Finance" is calculated as follows:

=RATE(U2-S2,0,W2,0)*12

From the rate of return method, although The nominal interest rate of "Mutual Insurance Finance" is as high as 10%, but in fact, only when participants receive principal and interest after 16 periods, the rate of return can reach 3%. If received before then, the rate of return is lower than the income of monthly annuity. The rate is 3%. It can be seen that the yield rate of "mutual insurance finance" is still high.

However, it is unfair to evaluate that the income of "Mutual Insurance Finance" is not as good as that of monthly annuity. The reason is that the principal and interest of monthly annuity cannot be recovered until it matures, while "Mutual Insurance Finance" may realize capital inflow in advance. If this part Funds will be used for investment again, and "mutual insurance finance" will be greatly improved.

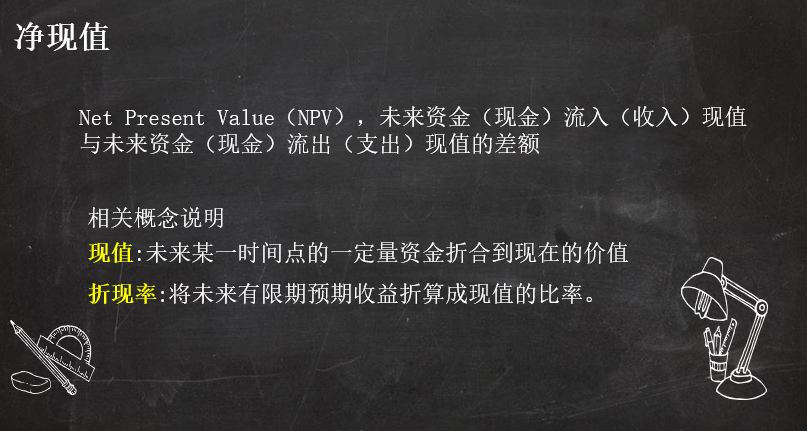

In financial management, time value is often used to explain this difference. The internal rate of return (IRR) and net present value (NPV) can be used to measure the dynamic return of an investment.

Below, we choose NPV to compare these two financial products. The IRR comparison method is not applicable to this case.

3. Net present value method

Before calculating the net present value, we need to list the cash flows of the two products in each period, and then use the NPV function to calculate.

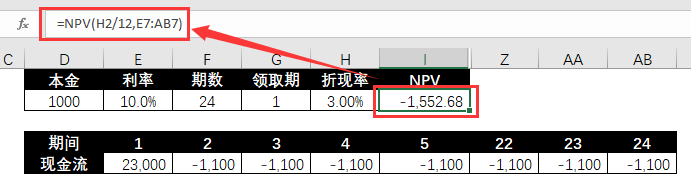

毎月1,000元の年金を24回支払うと、24,703元が一括で回収されます。キャッシュフローとNPVは次のように計算されます。

=NPV(B3) /12,B2:Y2)

ここでは、毎月の年金の金利が割引率として直接選択され、その正味現在価値は 0 になるはずです。 「相互保険金融」の正味現在価値を計算する際には、引き続きこの割引率を使用します。後者の正味現在価値が 0 より大きい場合は、後者の投資収益が優れていることを意味し、それ以外の場合は後者の方が悪いことを意味します。

「相互保険ファイナンス」には複数の引き出し期間があるため、この商品のIRRを計算する際には、それを実現するためのシミュレーションテーブルを使用する必要があります。

「共済金融」NPV計算:

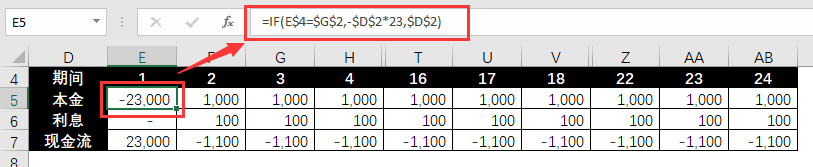

❶ 脱退期間を変数として、変数に基づいて計算された各期間のキャッシュフローをリスト化します。

元本のキャッシュフロー。正の数値は支払いを示し、負の数値は引き出しを示します。

=IF(E$4=$G$2,-$D$2*23,$D$2)

利息のキャッシュフロー。正の数値は支払いを示し、負の数値は受け取りを示します。

=IFS(E4$G$2,$D$2*$E$2)

連結キャッシュフロー:

❷ 単一引き出し期間でのIRRを計算します。

=NPV(H2/12,E7:AB7)

❸ シミュレーションテーブルを使用して、さまざまな抽出期間に対応するNPVを計算します。

① 必要な収集期間変数値をリストし、最初の行に対応する結果値をリンクします。

② リンク行、変数値領域、結果値領域を選択し、以下の手順に従ってシミュレーション操作を完了します。

シミュレーション計算結果は以下の通りです。

NPVの観点から見ると、「共済財政」と毎月の年金収入は同等です。

前者のすべての参加者の中で、相対的な収益はまちまちです。これは、より早い請求期間を持つ参加者は、高金利の損失をある程度回避できるローリング投資の方がより早くキャッシュインを獲得できるためです。

まとめると、ローリング投資の実現や確実性の追求が不可能な場合には、安定した運用収益とより高い平均静的収益が得られるこの商品を選択する必要があります。

より高い動的収益を追求する場合、または元本と利息を引き出した後に二次投資を行うことができる場合、財務管理には「相互保険ファイナンス」を選択する必要があります。後者には、より高い正味現在価値と静的収益を達成する機会があります。

上記は、金融商品選択問題からの Xiaohua の拡張であり、以下を含むいくつかの Excel 財務公式と関数の使用法を説明しています。あなたが財務会計士である場合、または財務計算が必要な場合や財務計算に興味がある場合は、これらの公式と実際の事例が役立つでしょう。Xiaohua は今後も Excel の金融収入計算の他の実践例を共有し、数式やツールの使用方法を理解できるよう実践的な経験を活用していきますので、ご期待ください。

The above is the detailed content of Solve complex financial calculations with 3 Excel financial functions. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1381

1381

52

52

What should I do if the frame line disappears when printing in Excel?

Mar 21, 2024 am 09:50 AM

What should I do if the frame line disappears when printing in Excel?

Mar 21, 2024 am 09:50 AM

If when opening a file that needs to be printed, we will find that the table frame line has disappeared for some reason in the print preview. When encountering such a situation, we must deal with it in time. If this also appears in your print file If you have questions like this, then join the editor to learn the following course: What should I do if the frame line disappears when printing a table in Excel? 1. Open a file that needs to be printed, as shown in the figure below. 2. Select all required content areas, as shown in the figure below. 3. Right-click the mouse and select the "Format Cells" option, as shown in the figure below. 4. Click the “Border” option at the top of the window, as shown in the figure below. 5. Select the thin solid line pattern in the line style on the left, as shown in the figure below. 6. Select "Outer Border"

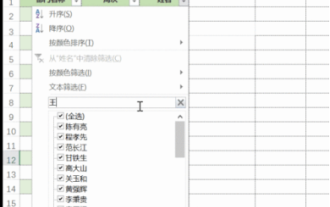

How to filter more than 3 keywords at the same time in excel

Mar 21, 2024 pm 03:16 PM

How to filter more than 3 keywords at the same time in excel

Mar 21, 2024 pm 03:16 PM

Excel is often used to process data in daily office work, and it is often necessary to use the "filter" function. When we choose to perform "filtering" in Excel, we can only filter up to two conditions for the same column. So, do you know how to filter more than 3 keywords at the same time in Excel? Next, let me demonstrate it to you. The first method is to gradually add the conditions to the filter. If you want to filter out three qualifying details at the same time, you first need to filter out one of them step by step. At the beginning, you can first filter out employees with the surname "Wang" based on the conditions. Then click [OK], and then check [Add current selection to filter] in the filter results. The steps are as follows. Similarly, perform filtering separately again

How to change excel table compatibility mode to normal mode

Mar 20, 2024 pm 08:01 PM

How to change excel table compatibility mode to normal mode

Mar 20, 2024 pm 08:01 PM

In our daily work and study, we copy Excel files from others, open them to add content or re-edit them, and then save them. Sometimes a compatibility check dialog box will appear, which is very troublesome. I don’t know Excel software. , can it be changed to normal mode? So below, the editor will bring you detailed steps to solve this problem, let us learn together. Finally, be sure to remember to save it. 1. Open a worksheet and display an additional compatibility mode in the name of the worksheet, as shown in the figure. 2. In this worksheet, after modifying the content and saving it, the dialog box of the compatibility checker always pops up. It is very troublesome to see this page, as shown in the figure. 3. Click the Office button, click Save As, and then

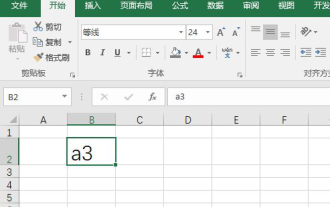

How to type subscript in excel

Mar 20, 2024 am 11:31 AM

How to type subscript in excel

Mar 20, 2024 am 11:31 AM

eWe often use Excel to make some data tables and the like. Sometimes when entering parameter values, we need to superscript or subscript a certain number. For example, mathematical formulas are often used. So how do you type the subscript in Excel? ?Let’s take a look at the detailed steps: 1. Superscript method: 1. First, enter a3 (3 is superscript) in Excel. 2. Select the number "3", right-click and select "Format Cells". 3. Click "Superscript" and then "OK". 4. Look, the effect is like this. 2. Subscript method: 1. Similar to the superscript setting method, enter "ln310" (3 is the subscript) in the cell, select the number "3", right-click and select "Format Cells". 2. Check "Subscript" and click "OK"

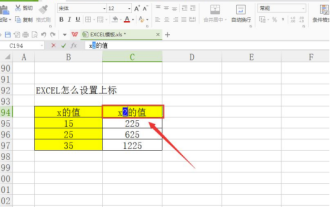

How to set superscript in excel

Mar 20, 2024 pm 04:30 PM

How to set superscript in excel

Mar 20, 2024 pm 04:30 PM

When processing data, sometimes we encounter data that contains various symbols such as multiples, temperatures, etc. Do you know how to set superscripts in Excel? When we use Excel to process data, if we do not set superscripts, it will make it more troublesome to enter a lot of our data. Today, the editor will bring you the specific setting method of excel superscript. 1. First, let us open the Microsoft Office Excel document on the desktop and select the text that needs to be modified into superscript, as shown in the figure. 2. Then, right-click and select the "Format Cells" option in the menu that appears after clicking, as shown in the figure. 3. Next, in the “Format Cells” dialog box that pops up automatically

How to use the iif function in excel

Mar 20, 2024 pm 06:10 PM

How to use the iif function in excel

Mar 20, 2024 pm 06:10 PM

Most users use Excel to process table data. In fact, Excel also has a VBA program. Apart from experts, not many users have used this function. The iif function is often used when writing in VBA. It is actually the same as if The functions of the functions are similar. Let me introduce to you the usage of the iif function. There are iif functions in SQL statements and VBA code in Excel. The iif function is similar to the IF function in the excel worksheet. It performs true and false value judgment and returns different results based on the logically calculated true and false values. IF function usage is (condition, yes, no). IF statement and IIF function in VBA. The former IF statement is a control statement that can execute different statements according to conditions. The latter

Where to set excel reading mode

Mar 21, 2024 am 08:40 AM

Where to set excel reading mode

Mar 21, 2024 am 08:40 AM

In the study of software, we are accustomed to using excel, not only because it is convenient, but also because it can meet a variety of formats needed in actual work, and excel is very flexible to use, and there is a mode that is convenient for reading. Today I brought For everyone: where to set the excel reading mode. 1. Turn on the computer, then open the Excel application and find the target data. 2. There are two ways to set the reading mode in Excel. The first one: In Excel, there are a large number of convenient processing methods distributed in the Excel layout. In the lower right corner of Excel, there is a shortcut to set the reading mode. Find the pattern of the cross mark and click it to enter the reading mode. There is a small three-dimensional mark on the right side of the cross mark.

How to insert excel icons into PPT slides

Mar 26, 2024 pm 05:40 PM

How to insert excel icons into PPT slides

Mar 26, 2024 pm 05:40 PM

1. Open the PPT and turn the page to the page where you need to insert the excel icon. Click the Insert tab. 2. Click [Object]. 3. The following dialog box will pop up. 4. Click [Create from file] and click [Browse]. 5. Select the excel table to be inserted. 6. Click OK and the following page will pop up. 7. Check [Show as icon]. 8. Click OK.