Popular understanding of liquidation and liquidation

Liquidation is an involuntary event in which the value of a position drops sharply, resulting in a loss of funds, while liquidation is when a trader actively closes a position. Liquidation is caused by insufficient funds, while liquidation can occur for a variety of reasons, such as profit taking, stop loss, and position adjustment. To avoid liquidating their positions, traders should use leverage carefully, set stop-loss orders, diversify their portfolios, and actively manage risk.

A brief explanation of liquidation and liquidation

liquidation

liquidation means that the value of a trader’s position drops sharply, resulting in insufficient collateral to maintain his position, and ultimately all funds loss situation.

Closing

Closing is the process by which traders close their existing positions (buy or sell). This can be for various reasons such as taking profit, stopping loss or adjusting a position.

The essential difference between liquidation and liquidation

A key difference between liquidation and liquidation is that liquidation is an involuntary event, while liquidation is a voluntary action. Liquidation occurs when traders do not have enough funds to maintain their positions, while liquidation is proactively performed by traders for specific reasons.

Another difference is that liquidation usually results in the loss of all investors' funds, while liquidation allows investors to realize profits or losses. In addition, liquidation usually occurs when the market experiences severe fluctuations or adverse circumstances, while liquidation can be executed under any market conditions.

Strategies to avoid liquidation

To avoid liquidation, traders should take the following measures:

- Be careful when using leverage

- Set stop-loss orders to limit losses

- Diversify your portfolio

- Manage risk

The above is the detailed content of Popular understanding of liquidation and liquidation. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1664

1664

14

14

1423

1423

52

52

1318

1318

25

25

1268

1268

29

29

1248

1248

24

24

Do I need to make up money if my position is liquidated in virtual currency leverage trading? Why does leverage trading lead to liquidation?

May 06, 2024 am 08:34 AM

Do I need to make up money if my position is liquidated in virtual currency leverage trading? Why does leverage trading lead to liquidation?

May 06, 2024 am 08:34 AM

In the virtual currency market, experienced investors are no longer satisfied with currency-to-crypto transactions. They are more engaged in leverage transactions, but even experienced investors are worried about the occurrence of liquidation. The so-called liquidation refers to the situation where the customer's equity in the investor's margin account becomes negative under certain special conditions. Liquidation will occur in the fields of virtual currency, futures, foreign exchange, stock market and other fields. As an investor, the issue that is most concerned about is Do I need to make up money if my position is liquidated in virtual currency leverage trading? Generally speaking, you will need to make up money, but the specific situation needs to be determined according to the situation. Next, the editor will tell you in detail about the virtual currency margin trading. Do you need to make up money if your position is liquidated? In virtual currency leveraged trading, if your trading position suffers a loss and the loss exceeds your margin, your position may be forced to be liquidated, which is often called liquidation.

What does closing a position mean?

Jul 30, 2024 pm 04:26 PM

What does closing a position mean?

Jul 30, 2024 pm 04:26 PM

Closing a position refers to closing an existing trading position, including a sell buy position or a buy sell position. The steps include: Determine the position type (buy or sell). Select the method of closing the position (market order, limit order or stop loss order). Determine the quantity. Execute the closing order. After confirmation is complete.

Is there any handling fee for cryptocurrency exchanges to liquidate? Are there any fees for cryptocurrency exchanges to liquidate?

Mar 05, 2025 pm 05:21 PM

Is there any handling fee for cryptocurrency exchanges to liquidate? Are there any fees for cryptocurrency exchanges to liquidate?

Mar 05, 2025 pm 05:21 PM

Detailed explanation of contract trading liquidation and related fees refers to the behavior of forced liquidation of positions in contract trading, where position losses lead to insufficient margin and the exchange can force the liquidation of positions. This is a risk management mechanism designed to protect exchanges and other traders from greater losses. Many investors are concerned about whether the liquidation will incur additional fees. Filing-out fee: Exchange rules determine that all filing-out fees for cryptocurrency exchanges are not uniform standards, but are stipulated by each exchange. A liquidation is essentially a forced liquidation, so the exchange usually charges a handling fee similar to a normal transaction. For example, the liquidation fee on Binance Exchange usually floats between 0.3% and 0.75%. It should be noted that this fee is calculated based on the position value rather than the principal. For example, if 125 times is used

What does liquidation mean?

Jan 31, 2024 pm 05:44 PM

What does liquidation mean?

Jan 31, 2024 pm 05:44 PM

Liquidation refers to the situation when investors are unable to continue to hold positions and meet the required margin requirements due to violent price fluctuations or accumulation of losses during leveraged trading or borrowing transactions. The exchange or trading company guarantees investors No further losses will occur and the position will be forcibly closed. Measures to avoid liquidation: 1. Control leverage; 2. Do a good job in risk management; 3. Fully understand the market; 4. Stay calm; 5. Avoid excessive trading; 6. Regular reviews.

What does Bitcoin liquidation mean?

Mar 20, 2025 pm 05:15 PM

What does Bitcoin liquidation mean?

Mar 20, 2025 pm 05:15 PM

Bitcoin liquidation refers to the phenomenon that in Bitcoin leverage or contract trading, the trading platform forces the position to close due to violent price fluctuations, due to the minimum required for maintaining the transaction. When investors use leverage trading, they only need to pay a small amount of margin to control a larger amount of Bitcoin. However, reverse price fluctuations will amplify losses. If the loss causes the margin to be lower than the specified ratio of the platform, the platform will issue an additional margin notice. If investors cannot make up for it in time, the platform will force the position to close, causing investors to lose margin or even invest all. This is the position to be liquidated.

What is the difference between liquidation and liquidation in the currency circle? Which is better?

Jun 15, 2024 am 09:56 AM

What is the difference between liquidation and liquidation in the currency circle? Which is better?

Jun 15, 2024 am 09:56 AM

As more and more people join the digital currency market, more and more currency trading methods are being explored. Many people are not satisfied with the spot trading in front of them, but also conduct futures trading. In the futures trading market, they often hear There are professional terms such as position liquidation and liquidation, or some people encounter forced liquidation when trading futures. The so-called forced liquidation also means liquidation. At this point, many people may have begun to get confused. So what exactly is the currency circle explosion? What is the difference between a position and a close position? To put it simply, liquidation is when traders actively choose to close their positions, while liquidation is a measure enforced by the exchange or trading platform when losses reach a critical point. Next, the editor will tell you in detail. What is the difference between liquidation and liquidation in the currency circle? The main difference between liquidation and liquidation in the currency circle is the liquidation method.

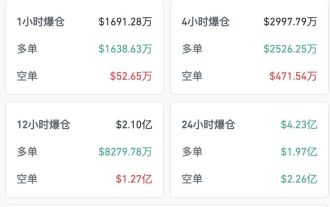

Cryptocurrency shakes again! More than 100,000 people have lost their positions, with a total amount of over 400 million US dollars

Apr 13, 2025 pm 10:45 PM

Cryptocurrency shakes again! More than 100,000 people have lost their positions, with a total amount of over 400 million US dollars

Apr 13, 2025 pm 10:45 PM

During the trading session of the US stock market, the price of Bitcoin exceeded US$107,000, setting a record high! As of now, the price has fallen slightly, maintaining around US$106,000. Coinglass data shows that in the past 24 hours, the number of people in the cryptocurrency market has reached 113,000, with a total amount of up to US$423 million. Among them, the long positions were liquidated by US$197 million and the short positions were liquidated by US$226 million. Affected by this, cryptocurrency concept stocks have generally risen. RiotPlatforms shares rose more than 8%, Bitdeer Technologies rose more than 10%, Canaan Technology rose more than 8%, and Coinbase shares rose 1.52%.

Is it possible to understand if cryptocurrency contract grid transactions will be inflated?

Mar 05, 2025 am 08:27 AM

Is it possible to understand if cryptocurrency contract grid transactions will be inflated?

Mar 05, 2025 am 08:27 AM

There is a significant difference between contract grid trading and spot grid trading strategies. The former is mainly used to trade derivative contracts, such as digital currency futures contracts and foreign exchange futures contracts, and usually uses leverage to amplify the transaction scale. Although contract grid transactions are relatively stable and the handling fees are low, the existence of leverage makes the risk of liquidation not neglected. This article will conduct in-depth discussion on the risk of liquidation and response strategies of contract grid transactions. Analysis of risk of liquidation of contract grid transactions. Cryptocurrency contract grid transactions are not zero risk, and the possibility of liquidation still exists. Contract grid trading captures market volatility by setting up a series of buy and sell orders, and automated trading is at its core. However, this strategy also has potential risks, including liquidation: Severe market fluctuations: Severe market fluctuations may trigger multiple grid orders