web3.0

web3.0

The U.S. Ethereum spot ETF is listed, with long-term significance greater than short-term impact

The U.S. Ethereum spot ETF is listed, with long-term significance greater than short-term impact

The U.S. Ethereum spot ETF is listed, with long-term significance greater than short-term impact

Author: SoSoValue Research

On July 23, 2024, the U.S. Ethereum spot ETF was officially listed for trading, which is exactly 10 years since the first public offering (ICO) of Ethereum on July 22, 2014. Ethereum Whether the ETF's listing date is deliberately chosen at this monumental moment or it is a coincidence, this event will have epic significance for the future sustainable development of the entire crypto world because it has taken a step towards the POS public chain. This important step into the mainstream financial world will surely attract builders of more dimensions and numbers to join the construction of the Ethereum ecosystem. It will also pave the way for subsequent crypto-world infrastructure such as Solana to enter the mainstream world, which will have a great impact on the blockchain ecosystem. The popularization process is of substantial significance.

On the other hand, since Ethereum ETF currently does not allow staking from a regulatory perspective, investors holding ETFs will receive 3%-5% less staking mining income (Ether) than directly holding Ethereum tokens. The risk-free rate of return in the Ethereum world), and the public investors’ understanding threshold for Ethereum is higher than that of Bitcoin. Therefore, the short-term impact of the U.S. Ethereum spot ETF on the price of Ethereum may not be as strong as that of Bitcoin. After the spot ETF is approved, it will have a large impact on BTC prices in the short term.More importantly, it will improve the relative stability of Ethereum prices and reduce volatility. The following will analyze the short-term impact on the power of buyers and sellers of Ethereum tokens after the Ethereum spot ETF is listed, and the long-term impact on the encryption ecosystem. 1. In the short term: the power of buyers and sellers is less than that of Bitcoin ETF, and the impact of Ethereum ETF is expected to be less than that of Bitcoin

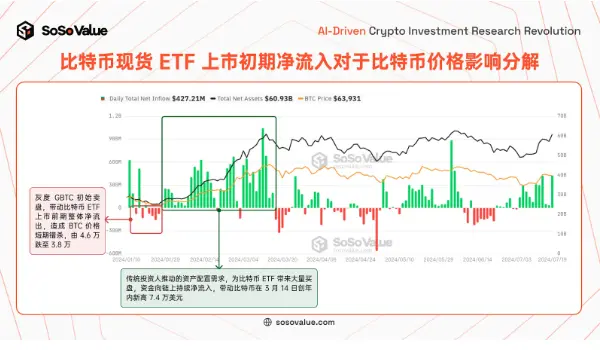

According to SoSoValue’s continuous tracking of Bitcoin spot ETF, the factors that have the greatest impact on currency prices It is the

single-day net inflow, which is the actual new buying/selling scale brought by Bitcoin spot ETF cash redemptions to the crypto world (see Figure 1 for details), thus affecting supply and demand and determining prices.

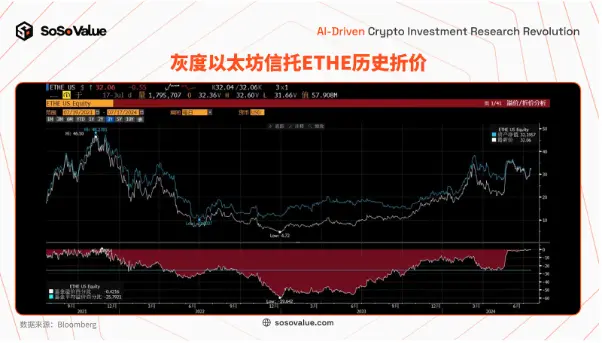

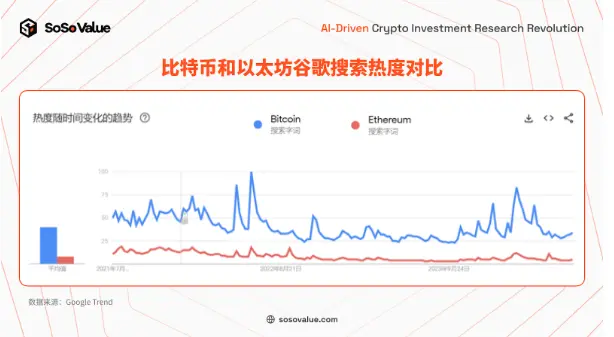

According to the S-1 document, the U.S. Ethereum spot ETF has the same subscription and redemption mechanism as the Bitcoin spot ETF, both of which only support cash subscriptions and redemptions. Therefore, the single-day net inflow will also be the most important observation for the Ethereum spot ETF. Indicators; there are two main differences: Figure 1: Decomposition of the impact of net outflows of Ethereum spot ETFs on Bitcoin prices in the early stages of listing (data source: SoSoValue) 1. Selling: Grayscale ETHE of $9.2 billion , the 10 times difference in management fees from competitors will still lead to early relocation selling, but the impact will be less than the outflow of GBTC Looking back The reasons why Grayscale Bitcoin ETF (GBTC) caused a large net outflow in the early stage , there are two: on the one hand, the management fee is significantly higher than that of competitors, which brings about a relocation effect. Investors redeem from the Grayscale Bitcoin ETF with a management fee of 1.5% and buy other ETFs with a management fee of about 0.2%; On the other hand, the trust discount arbitrage in the early stage was profit-taking after the ETF price leveled, resulting in selling. At the beginning of the year, the ETF directly converted from Grayscale Bitcoin Trust (GBTC asset management scale of US$28.4 billion) was listed and there was a sustained large-scale net outflow of funds. There are two main core reasons. First, the management fee of Grayscale GBTC is 1.5%, which is about 6 times that of competitors, which makes investors who are optimistic about Bitcoin assets in the long term move their positions to other ETFs; second, before GBTC is converted into ETF, The discount has remained around 20% for a long time, stimulating investors to arbitrage the discount rate by buying discounted GBTC and shorting BTC on the market. After the discount from trusts converted to ETFs basically disappeared, such arbitrage funds sold ETFs and took profits. According to SoSoValue data, the net outflow of GBTC lasted from January 11 to May 2, and then slowed down, during which its Bitcoin holdings decreased by 53%. Figure 2: Net outflow of GBTC since its listing (data source: SoSoValue) Different from the direct conversion of GBTC, during the process of converting the Ethereum Trust into ETF, Grayscale simultaneously split 10% of the net assets to establish a low-cost Ethereum mini ETF (stock code ETH), that is, Grayscale There will be two Ethereum ETFs under Du's umbrella, with management fees of 2.5% and 0.15% respectively, which slightly alleviates the pressure of moving positions and outflows caused by high rates. According to the S-1 filing, Grayscale Ethereum Trust (stock code: ETHE) will transfer approximately 10% of Ethereum to Grayscale Ethereum Mini Trust (stock code: ETH), as a mini Trust the initial funds of ETH; after that, the two Grayscale Ethereum ETFs will operate independently. For investors who already hold ETHE, On July 23, each Ethereum Trust ETHE they hold will automatically be allocated 1 share of Ethereum Mini Trust ETH, and the net value of ETHE will be adjusted to the previous 90%. Consider that the management fee of ETHE is 2.5%; the management fee of mini trust ETH is 0.15% (No management fee within US$2 billion in the first 6 months), In other words, for existing investors in ETHE, 10% of its assets will be automatically allocated in low-cost ETFs. With reference to the final fund relocation ratio of GBTC being about 50%, it is expected that the spin-off of Ethereum Mini Trust ETH and the early bird discount on management fees will alleviate the short-term capital outflow pressure of Grayscale ETHE. On the other hand, because the discount of ETHE has converged in advance, the outflow pressure caused by the liquidation of discount arbitrage is expected to be less than that of GBTC. Grayscale ETHE was once heavily discounted, with a discount of up to 60% at the end of 2022, and a discount of more than 20% from April to May of 24, but the discount converged to 1%-2% from the end of May, and converged to 1% in July Within %; and 2 days before GBTC was converted to ETF (January 9), the discount rate remained at 6.5%. Therefore, for arbitrage trading, ETHE's profit-taking motivation is greatly reduced. Figure 3: Ethereum spot ETF rate comparison (data source: S-1 filing) Figure 4: Grayscale Ethereum Trust ETHE history Discount (data source: Bloomberg) 2、來自股市的買盤力量:大眾對以太坊共識遠不如比特幣,資產配置動力小於BTC現貨ETF 一方面,從供給角度,以太坊原則上供應量無限,在最新的POS機制下,區塊獎勵帶來的質押收益驅動其供給量增加,鏈上生態活躍度影響的用戶交易Gas費燃燒驅動其供給量減少,進而形成動態的供需平衡機制;最新供應量約1.2億枚,近期年化通膨率在0.6%-0.8%。 另一方面,從常規的基本面角度,是其作為公鏈,面臨其他公鏈競爭,對於競爭終局大眾投資人並沒有信仰。 市場上目前有Solana、Ton等公鏈生態,也為大眾投資人所知,但是具體分析其競爭力,對於大眾投資人門檻極高,所以普通投資人如果看好加密貨幣的投資價值,可能還是會首選配置供給稀缺、沒有競爭的比特幣現貨ETF。 以太坊僅為比特幣的1/5左右(詳見圖5);而觀察此次以太坊ETF發行的種子基金(一般為基金管理人/承銷商出資),Fidelity給旗下以太坊ETF(股票代號FETH)的種子資金規模僅為其比特幣ETF(股票代號FBTC)的1/4,其他發行商如VanEck、Invesco等差距也較大(詳見圖6)。 Figure 5: Comparison of Google search popularity of Bitcoin and Ethereum (data source: Google Trend) Figure 6: Ethereum ETF and Bitcoin under the same issuer Comparison of currency ETF seed funding scale (data source: S-1 document) 3. Buying from the crypto circle: due to the lack of 3%-5% foundation on the ETH chain Staking yield, demand is basically non-existent Crypto investors also contributed part of the buying of Bitcoin spot ETFs, mainly due to the demand for real-world asset certification. Crypto investors who hold Bitcoin ETFs only need to pay an annual fee of 0.2%-0.25% to have asset certificates from the traditional financial market, which facilitates economic life in the public world and balances financial assets and Bitcoin holdings. And use this to carry out various leverage operations, such as mortgage lending, building structured products, etc., which is attractive to some high-net-worth crypto investors. Since Bitcoin is a POW computing power mining mechanism, there is no stable POS asset pledge income. Considering that the average deposit and withdrawal costs of cryptocurrency and legal currency are 0.2% and 2%, there is a gap between the income of holding Bitcoin ETFs and direct currency holdings. Not big. But for Ethereum spot ETFs, since regulation does not allow ETFs to obtain pledge income, for crypto investors, holding ETFs will result in 3%-5% less risk-free annualized returns than directly holding Ethereum spot. Ethereum adopts the PoS (Proof of Stake) mechanism, which uses validator nodes to pledge Ethereum assets to verify transactions and maintain the network, and obtain block rewards, which is the so-called POS mining mechanism. Since this income comes from the network protocol and the system’s built-in reward mechanism, it is regarded as Ethereum’s ecological, risk-free basic rate of return on the chain. Recently, the Ethereum staking yield has stabilized at above 3%. Therefore, if you implement Ethereum position allocation through ETF, you will receive at least 3% less annualized return than holding Ethereum spot directly. Therefore, the buying of Ethereum spot ETFs by high-net-worth people in the crypto circle can be ignored. Figure 7: Staking yield since Ethereum switched to POS mechanism (data source: The Staking Explorer) Ethereum is currently the largest public chain, and its spot ETF has been approved, which is the first step for public chains to integrate into the mainstream financial world. An important step. After sorting out the SEC's standards for approving cryptocurrency ETFs, Ethereum complies with SEC requirements in terms of anti-manipulation, liquidity, pricing transparency, etc. We can expect more crypto-assets that meet the requirements to pass through spot ETFs in the future. Enter the public eye of investors. , along with traditional financial markets such as cryptocurrency futures With the continuous enrichment of tools, we can expect more crypto-asset ETFs to be approved in the future, which will further occupy the minds of traditional investors and accelerate their development. Figure 8: Comparison of core data of representative Layer1 public chains (data source: public data compilation) To sum up, Since the buying and selling power of Ethereum spot ETF is weaker than that of Bitcoin ETF, and it has experienced the wrong killing of Bitcoin caused by the outflow of grayscale GBTC, the market is also prepared for the outflow of grayscale ETHE. It has been 6 months since the Bitcoin spot ETF was launched. The approval of the Ethereum spot ETF has been reflected in the existing Ethereum currency price to a large extent after repeated market transactions. It is expected that in the short term, there will be a positive impact on Ethereum The price impact will be less than the impact of the previous listing of Bitcoin spot ETFs on Bitcoin, and the fluctuations of Ethereum may also be smaller. If there is another wrongful sale due to grayscale outflow in the early stage of listing, it will be a good layout opportunity. Investors can pay attention through SoSoValue’s specially launched US Ethereum spot ETF dashboard (https://sosovalue.com/assets/etf/us-eth-spot). In the long term, the encryption ecosystem and the mainstream world are moving from their separate developments in the past to integration, and there will be a long process of cognitive adjustment. And The cognitive difference between old and new participants in the crypto ecosystem may be the core factor that affects cryptocurrency price fluctuations and creates investment opportunities in the next 1-2 years. Historically, the process of integrating emerging assets into the mainstream world has always resulted in disagreements and transactions, and large fluctuations have constantly brought investment opportunities, which is worth looking forward to. The approval of the Ethereum ETF further opens the way for crypto ecological applications to enter mainstream asset allocation. It is foreseeable that other public chains and other infrastructure with a large number of users and ecology, such as Solana, will also gradually integrate into the mainstream world. While the crypto world enters the mainstream world, the other side of the advancement of the times, that is, the process of the mainstream world entering the crypto world, is also quietly continuing to develop. Mainstream financial assets, mainly U.S. Treasury bonds, are also passing through the RWA (Real World Assets) token. Formally put on the chain, gradually enter the encryption world, and realize the efficient circulation of global financial assets. If the approval of the Bitcoin ETF opens the door to a new world after the integration of encryption and tradition, then the passage of the Ethereum ETF is the first step into the door.

2. In the long run: Ethereum ETF paves the way for other crypto assets to integrate into the mainstream world

Anti-manipulation:

In comparison, Solana in the public chain also meets the above indicators to a certain extent (see Figure 8 for details). Vaneck and 21Shares have successively submitted applications for Solana spot ETF

The above is the detailed content of The U.S. Ethereum spot ETF is listed, with long-term significance greater than short-term impact. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1664

1664

14

14

1421

1421

52

52

1315

1315

25

25

1266

1266

29

29

1239

1239

24

24

Nasdaq Files to List VanEck Avalanche (AVAX) Trust ETF

Apr 11, 2025 am 11:04 AM

Nasdaq Files to List VanEck Avalanche (AVAX) Trust ETF

Apr 11, 2025 am 11:04 AM

This new financial instrument would track the token's market price, with a third-party custodian holding the underlying AVAX

OM Mantra Cryptocurrency Crashes 90%, Team Allegedly Dumps 90% of Token Supply

Apr 14, 2025 am 11:26 AM

OM Mantra Cryptocurrency Crashes 90%, Team Allegedly Dumps 90% of Token Supply

Apr 14, 2025 am 11:26 AM

In a devastating blow to investors, the OM Mantra cryptocurrency has collapsed by approximately 90% in the past 24 hours, with the price plummeting to $0.58.

TrollerCat ($TCAT) Stands Out as a Dominant Force in the Meme Coin Market

Apr 14, 2025 am 10:24 AM

TrollerCat ($TCAT) Stands Out as a Dominant Force in the Meme Coin Market

Apr 14, 2025 am 10:24 AM

Have you noticed the meteoric rise of meme coins in the cryptocurrency world? What started as an online joke has quickly evolved into a lucrative investment opportunity

Zcash (ZEC) Reaches a High of $35.69 as a Record Amount of Tokens Move Out of Circulation

Apr 09, 2025 am 10:36 AM

Zcash (ZEC) Reaches a High of $35.69 as a Record Amount of Tokens Move Out of Circulation

Apr 09, 2025 am 10:36 AM

Zcash was one of the top gainers during the latest market rally, reaching a high of $35.69 as traders moved a record amount of tokens out of circulation.

Is Wall Street Quietly Backing Solana? $42 Million Bet Says Yes

Apr 10, 2025 pm 12:43 PM

Is Wall Street Quietly Backing Solana? $42 Million Bet Says Yes

Apr 10, 2025 pm 12:43 PM

A group of former Kraken executives acquired U.S.-listed company Janover, which secured $42 million in venture capital funding to begin building a Solana (SOL) treasury.

The Crypto Market Has Witnessed a Rebound Following the Recent Sheer Downturn

Apr 13, 2025 am 11:40 AM

The Crypto Market Has Witnessed a Rebound Following the Recent Sheer Downturn

Apr 13, 2025 am 11:40 AM

The crypto market has witnessed a rebound following the recent sheer downturn. As per the exclusive market data, the total crypto market capitalization has reached $2.71Ts

As Fear Drives Selling, BlockDAG (BDAG) Stands Out from the Crowd

Apr 13, 2025 am 11:48 AM

As Fear Drives Selling, BlockDAG (BDAG) Stands Out from the Crowd

Apr 13, 2025 am 11:48 AM

As fear drives selling in the crypto market, major coins like Cardano and Solana face tough times.

US Senate Draft Legislation Threatens to Hit Data Centers Serving Blockchain Networks and Artificial Intelligence Models with Fees

Apr 12, 2025 am 09:54 AM

US Senate Draft Legislation Threatens to Hit Data Centers Serving Blockchain Networks and Artificial Intelligence Models with Fees

Apr 12, 2025 am 09:54 AM

The draft bill purportedly aims to address environmental impacts from rising energy demand and protect households from higher energy bills