web3.0

web3.0

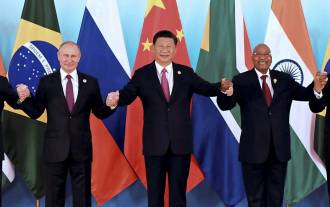

BRICS Plots to Dump the Dollar With Its Own SWIFT Alternative Targeting African Countries

BRICS Plots to Dump the Dollar With Its Own SWIFT Alternative Targeting African Countries

BRICS Plots to Dump the Dollar With Its Own SWIFT Alternative Targeting African Countries

Jul 30, 2024 pm 03:01 PMAccording to a top Russian official, African countries will not achieve their development goals under the current global financial system as this would take them out of neo-colonial control.

Top Russian official says African countries can't achieve development goals with current global financial system as this would take them out of neo-colonial control.

The official, who is Deputy Chairman of the Russian State Duma, made these remarks during a recent interview with Egypt Today.

In the interview, Babakov also discussed the importance of BRICS (Brazil, Russia, India, China, and South Africa) countries having their own financial messaging system.

He said that the creation of such a system would allow BRICS to reduce their dependence on Western financial institutions and increase national financial autonomy.

“Creating our own financial messaging system for the BRICS countries, similar to SWIFT, based on state-owned banks capable of clearing settlements of counterparties from the BRICS countries and the related role of the same bank,” Babakov said.

He added that the development and implementation of their own financial messaging system will allow BRICS to reduce their dependence on Western financial institutions and increase national financial autonomy.

This will enable countries to carry out financial transactions without the intervention of external parties.

“It is necessary to create a new system of financial institutions. The new system must be technically compatible with the existing financial infrastructures of the participating countries, which includes integration with national payment systems, banks, and other financial institutions.

At the same time, the system must ensure a high level of security and data protection to prevent cyber-attacks and un-authorized access to financial information,” he added.

According to recent financial reports, BRICS is already the world’s largest gross domestic product (GDP) bloc in the world, currently contributing 31.5% to the global GDP, ahead of the G7, which contributes 30.3%.

BRICS was established in 2006 as a forum for emerging economies to discuss common economic, political, and security issues.

The bloc has since expanded to include Egypt, Ethiopia, and South Africa, among other countries.

BRICS members have been critical of the existing global financial system, which they argue is dominated by the West and favors developed countries at the expense of developing nations.

The bloc has been exploring ways to create an alternative financial system that would be more equitable and inclusive.

In 2022, BRICS members agreed to establish a common development bank, the BRICS New Development Bank (NDB), and a currency reserve pool, the Contingent Reserve Arrangement (CRA).

The NDB is headquartered in Shanghai, China, and has an authorized capital of $100 billion.

The CRA is designed to provide financial assistance to BRICS members facing balance of payments difficulties.

The pool has a total size of $100 billion, with each member contributing $20 billion.

The above is the detailed content of BRICS Plots to Dump the Dollar With Its Own SWIFT Alternative Targeting African Countries. For more information, please follow other related articles on the PHP Chinese website!

Hot Article

Hot tools Tags

Hot Article

Hot Article Tags

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

Russian President Putin Emphasizes Gradual Approach to BRICS Currency, Alternative to Swift in Focus

Oct 21, 2024 pm 04:32 PM

Russian President Putin Emphasizes Gradual Approach to BRICS Currency, Alternative to Swift in Focus

Oct 21, 2024 pm 04:32 PM

Russian President Putin Emphasizes Gradual Approach to BRICS Currency, Alternative to Swift in Focus

BRICS Attempt to Dampen the Dollar's Primacy in International Trade Could Give Bitcoin Another Massive Macro Boost

Oct 26, 2024 am 03:52 AM

BRICS Attempt to Dampen the Dollar's Primacy in International Trade Could Give Bitcoin Another Massive Macro Boost

Oct 26, 2024 am 03:52 AM

BRICS Attempt to Dampen the Dollar's Primacy in International Trade Could Give Bitcoin Another Massive Macro Boost

BRICS Summit 2022: Could Bitcoin Help Russia Bypass Western Sanctions?

Oct 24, 2024 pm 06:50 PM

BRICS Summit 2022: Could Bitcoin Help Russia Bypass Western Sanctions?

Oct 24, 2024 pm 06:50 PM

BRICS Summit 2022: Could Bitcoin Help Russia Bypass Western Sanctions?

With Over 5,000 Delegates, BRICS Summit Sends a Message to the Dollar's Dominance

Oct 27, 2024 pm 12:40 PM

With Over 5,000 Delegates, BRICS Summit Sends a Message to the Dollar's Dominance

Oct 27, 2024 pm 12:40 PM

With Over 5,000 Delegates, BRICS Summit Sends a Message to the Dollar's Dominance

BRICS Powers Strengthen Resolve Amid Speculation on Trump's 2025 Impact

Nov 10, 2024 pm 07:20 PM

BRICS Powers Strengthen Resolve Amid Speculation on Trump's 2025 Impact

Nov 10, 2024 pm 07:20 PM

BRICS Powers Strengthen Resolve Amid Speculation on Trump's 2025 Impact

BRICS Alliance Closes Membership to the Block for 2024, Will Focus on De-Dollarization Agenda

Oct 25, 2024 am 03:34 AM

BRICS Alliance Closes Membership to the Block for 2024, Will Focus on De-Dollarization Agenda

Oct 25, 2024 am 03:34 AM

BRICS Alliance Closes Membership to the Block for 2024, Will Focus on De-Dollarization Agenda

BRICS Plots to Dump the Dollar With Its Own SWIFT Alternative Targeting African Countries

Jul 30, 2024 pm 03:01 PM

BRICS Plots to Dump the Dollar With Its Own SWIFT Alternative Targeting African Countries

Jul 30, 2024 pm 03:01 PM

BRICS Plots to Dump the Dollar With Its Own SWIFT Alternative Targeting African Countries

Former Russian PM Skeptical of Unified BRICS Currency

Aug 27, 2024 pm 03:42 PM

Former Russian PM Skeptical of Unified BRICS Currency

Aug 27, 2024 pm 03:42 PM

Former Russian PM Skeptical of Unified BRICS Currency