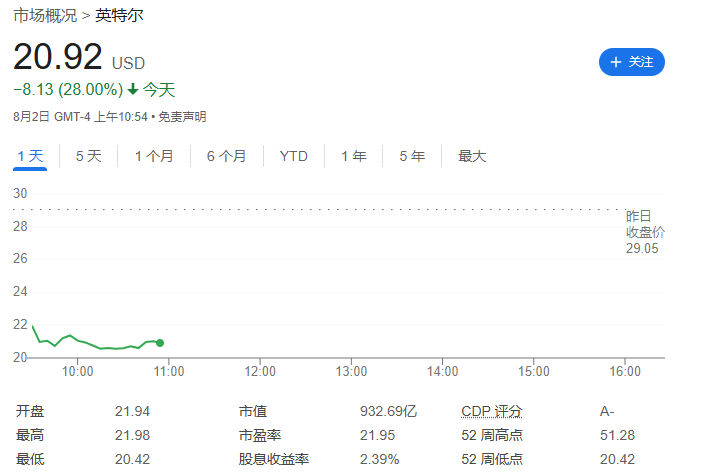

According to news from this website on August 2, when US stocks opened today, Intel plummeted by more than 28%, the largest decline since at least 1982. As of this writing, Intel's decline has shrunk to 28%, to US$20.92, with a market value of approximately US$93 billion.

Analyst price target and rating cut:

The above is the detailed content of Intel fell more than 28%, its biggest drop since 1982. For more information, please follow other related articles on the PHP Chinese website!

How to make gif animation in ps

How to make gif animation in ps

windows explorer has stopped working

windows explorer has stopped working

What are the DDoS attack tools?

What are the DDoS attack tools?

504 Gateway Time out causes and solutions

504 Gateway Time out causes and solutions

unicode to Chinese

unicode to Chinese

What is the shortcut key for copying and pasting ctrl?

What is the shortcut key for copying and pasting ctrl?

How to calculate the refund handling fee for Railway 12306

How to calculate the refund handling fee for Railway 12306

what is javaweb

what is javaweb

How to use the decode function

How to use the decode function