Technology peripherals

Technology peripherals

It Industry

It Industry

It is reported that Monster Charging, the 'biggest shared power bank', has turned to agency franchises, and only operations and maintenance are left in its direct business.

It is reported that Monster Charging, the 'biggest shared power bank', has turned to agency franchises, and only operations and maintenance are left in its direct business.

It is reported that Monster Charging, the 'biggest shared power bank', has turned to agency franchises, and only operations and maintenance are left in its direct business.

As the brand with the highest market share in the domestic shared power bank industry, Monster Charge is in a crisis situation with direct business cuts and frequent agency business problems. Recently, Sina Technology learned that Monster Charging is selling a large area of urban direct business and turning to an agency and franchise model. An insider from Monster Charging revealed: "Except for the high-quality locations in core cities such as Shanghai and Chengdu, which are still in operation and are currently not adding new ones, the directly operated locations in other cities are being packaged and sold to regional agents."

Abandon direct sales and "sell" in many cities

Currently, the business model of Monster Chargingis mainly based on "direct sales + agency".

A Monster Power Bank agent revealed to Sina Technology, “In the past few years, Monster Charging’s shared power bank business was mainly based on direct sales.” Under the direct sales model, Monster Charging itself The production equipment is then deployed to the cooperative merchant stores (locations) through employees and operated and maintained. Recently, Monster Charging has completely given up on the expansion of this direct business.

“Now all is based on agents, and direct sales are no longer done because there is no energy.” The above-mentioned Monster Chargingagency said that the agency model mainly involves recruiting agents to buy Monster Power Bankequipment, and then by The agent lays it out by himself, and Monster Charging is mainly responsible for providing preliminary equipment and software as well as necessary training and after-sales service in the later stage.

“At present, except for the direct operation teams in Shanghai and Chengdu that still do equipment operation and maintenance, the direct operations in other regions are basically being packaged and sold, most of which are resold to local regional agents. Some of the unsold ones are still being maintained and sold. "The agent said that the reasons for retention in Shanghai and Chengdu are also different. Shanghai has a good business environment, while Chengdu is the base camp of Meituan Power Bank. It is a battleground, so there are still some maintenance personnel in these two cities.

At the same time, another Monster Charging agent pointed out that the Chengdu area is not safe at present and has also begun to package and sell.

Regarding the no longer expansion of new direct sales locations, the agent’s explanation is: “Local agents must have much better control over local stores, or understanding of local relationships, than we do, so Now we have turned to the agency model. "In his view, "Since power banks need to be returned to designated points after being loaned, the coverage density of the points directly determines the degree of 'easy to borrow and return' of power banks, so through agents. A quick way to enter the market may bring quick results. "

Revenue has dropped three times in a row. Is there any problem with the agency model?

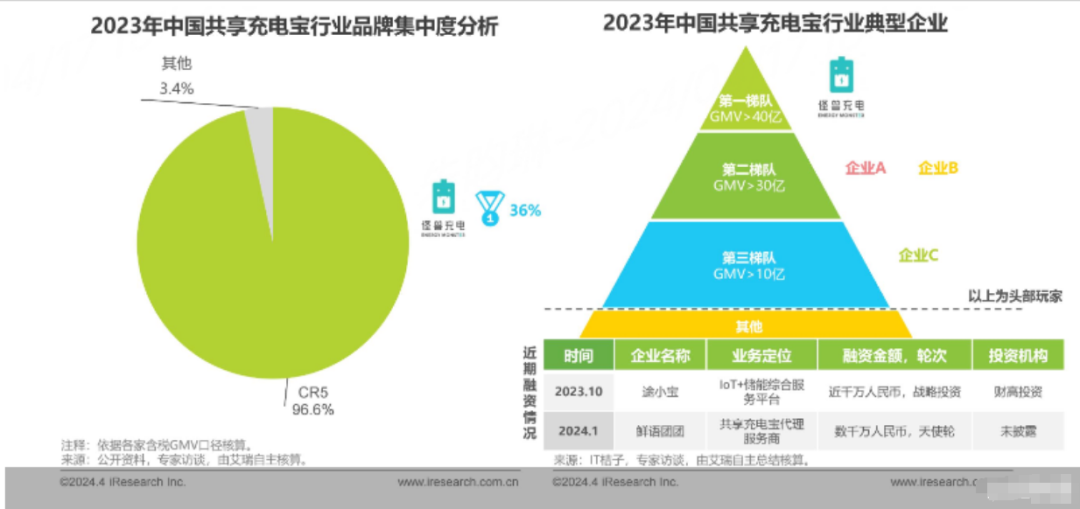

According to iResearch's "2024 China Shared Power Bank Industry Research Report", currently, the domestic shared power bank industry is highly concentrated, with the top five brands accounting for 96.6%. Among them, Monster Charge has the highest market share, reaching 36%. From the perspective of transaction scale, Monster Charging GMV exceeds 4 billion yuan, ranking first in the industry.

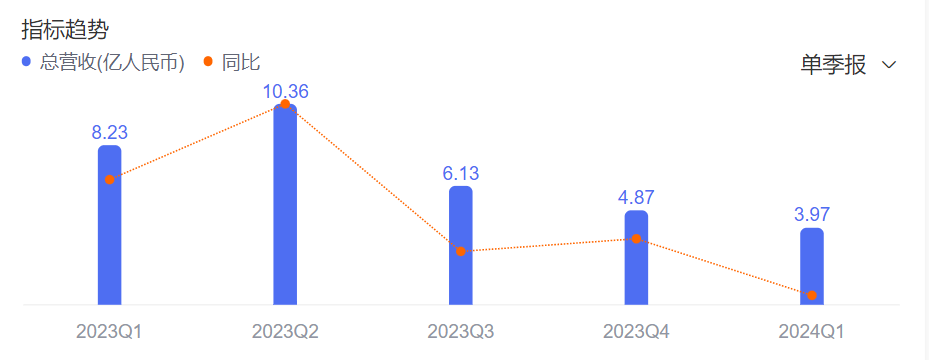

- According to Monster Charging’s first quarter 2024 financial report, Monster Charging’s revenue was 397.2 million yuan (US$55 million), a 51.7% decrease from the same period in 2023. Among them, the main reason for the decrease is -

Changes in contractual arrangements with network partners and reduced mobile device charging revenue. - It is worth noting that this is not Monster Charge’s first quarterly revenue decline. According to incomplete statistics from Sina Technology, since the second quarter of 2023, Monster Charge has experienced negative year-on-year revenue growth and sequential declines in net profit for three consecutive quarters.

In fact, the adjustment of Monster Charging’s business model can also be seen through the latest financial report performance. According to Monster's financial report for the first quarter of 2024, while the company's revenue has declined and contract arrangements with network partners have changed, the company's national agent point proportion has increased from 72.8% at the end of 2023 to 79.7%.

In fact, the adjustment of Monster Charging’s business model can also be seen through the latest financial report performance. According to Monster's financial report for the first quarter of 2024, while the company's revenue has declined and contract arrangements with network partners have changed, the company's national agent point proportion has increased from 72.8% at the end of 2023 to 79.7%.

對此,怪獸充電執行長蔡光淵的解釋是:「在維護直營模式下核心點位的同時,我們策略性地調整資源向代理模式發展。」怪獸充電財務長辛怡則進一步表示: 「營運模式的調整,雖會導致一次性成本的產生,但對於公司保持長期財務健康具有重要意義。」

怪獸充電的核心領導人並未言明「優化」直營業務的細節,但明確傳遞出了公司轉向代理模式的發展思維。但對於怪獸充電而言,在全力發展代理模式的同時,過度地向代理商讓利,也正在讓公司陷入營收和淨利潤下滑的處境中。

亂收費現象嚴重,代理糾紛突出

事實上,大力發展代理商導致的亂收費、過度收費問題,以及因市場誤判導致的經銷商損失等問題,也正成為桎梏怪獸充電長遠發展的關鍵。

一方面,由於怪獸充電為經銷商開放了自由設置運營價格權限,這導致了商家對於不同區域定價模式的差異,一些用戶往往消費後才發現扣款額度超出預期,因此產生了大量大額扣款的權益與投訴。在黑貓投訴平台上,近 30 天怪獸充電投訴案例達 280 件,其中大量是關於收費過高和代理糾紛的投訴。

另一方面,大力推動代理模式導致業務人員過度超前承諾,最終導致代理商進貨後卻無法鋪設設備,正引發一系列糾紛。

近期,有哈爾濱、武漢、長沙等地多家怪獸代理機構對新浪科技反饋,自己在怪獸充電採購了數十萬元的充電寶設備後,卻發現鋪設效果不及當初怪獸電銷人員承諾情況,但由於鋪設團隊解散和怪獸充電推諉解決等問題,如今雙方陷入極限拉扯當中。

逐步放棄直營,將共享行動電源生意重心轉向代理模式的怪獸充電,在減輕自己資產負債同時加速市場佈局,也正調動代理商口袋中的資金為自己進行市場實驗,與美團充電、街電、小電等同業競爭。

在這場點位覆蓋的比拼中,誰能最終勝出,仍在未知。在與新浪科技溝通中,有行動電源產業大型代理商直言:「未來這個產業的玩家只會有兩三家,怪獸雖然目前市佔最高,但他們的業務模式過於單一,在大眾認知中也弱於美團充電寶,地位也不穩固。維運,代理模式滋生嚴重亂收費》

The above is the detailed content of It is reported that Monster Charging, the 'biggest shared power bank', has turned to agency franchises, and only operations and maintenance are left in its direct business.. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1664

1664

14

14

1423

1423

52

52

1319

1319

25

25

1269

1269

29

29

1248

1248

24

24

The price surge of shared power banks has triggered heated discussions: the price has risen to 4 yuan per hour, and the price has increased nearly three times in 5 years

Aug 11, 2023 am 11:13 AM

The price surge of shared power banks has triggered heated discussions: the price has risen to 4 yuan per hour, and the price has increased nearly three times in 5 years

Aug 11, 2023 am 11:13 AM

According to news from this website on August 10, sometimes when going out, you will encounter the embarrassing situation of running out of power but forgetting to bring a mobile power supply. Faced with this situation, some people choose to endure the low-power mode, some choose to go back to the era without mobile phones to experience a simple life, and some choose to scan a shared power bank on the street to solve the problem of urgent charging. However, if you just scan like this, you may encounter "Power Bank Assassin". According to multiple sources such as The Paper, the price of shared power banks in China is currently facing a new round of "price increases." The price has risen from 1.5-2.5 yuan/hour to 4 yuan or even higher. This year's hot weather has reduced the cost of power supply. Continuing to rise, the cost of charging and discharging shared power bank hardware is increasing. In addition, small shared power bank companies have to "survive" and large shared power bank companies have to report financial reports.

Yuan Bingsong, the founder of Laidian Technology, was reported to have lost contact. The parent company responded that 'he has resigned long ago and has nothing to do with the company.'

Aug 20, 2024 am 07:32 AM

Yuan Bingsong, the founder of Laidian Technology, was reported to have lost contact. The parent company responded that 'he has resigned long ago and has nothing to do with the company.'

Aug 20, 2024 am 07:32 AM

According to news from this website on August 19, in response to the rumor that "Yuan Bingsong, the founder of Laidian Technology, has lost contact", a reporter from Nanduwan Financial Society called Pujiang Laidian Zhengqi Technology Co., Ltd., the parent company of Laidian Technology, today. A person in charge said that Yuan Bingsong resigned from the company a long time ago and currently has no relationship with the company and does not know his related situation. , ▲Screenshot of the official website of Laidian Technology. This site noticed that earlier on August 18, there were reports that Yuan Bingsong, the founder of Shenzhen Laidian Technology, a shared power bank company, had lost contact recently. Also missing at the same time was the first-hand person of Laidian Technology. The successor is Han Bing. The two were held accountable by a legal team hired by local state-owned assets due to their involvement in the loss of state-owned assets. Including Yuan Bingsong and Han Bing, a total of 6 people related to Shenzhen callers lost contact one after another. On the evening of August 18, Laidian Technology Innovation

It is reported that Monster Charging, the 'biggest shared power bank', has turned to agency franchises, and only operations and maintenance are left in its direct business.

Aug 13, 2024 pm 01:51 PM

It is reported that Monster Charging, the 'biggest shared power bank', has turned to agency franchises, and only operations and maintenance are left in its direct business.

Aug 13, 2024 pm 01:51 PM

As the brand with the highest market share in the domestic shared power bank industry, Monster Charge is in a crisis situation with direct business cuts and frequent agency business problems. Recently, Sina Technology learned that Monster Charging is selling a large area of urban direct sales business and fully turning to an agency franchise model. An insider from Monster Charging revealed: "Except for the high-quality locations in core cities such as Shanghai and Chengdu, which are still in operation and are currently not adding new ones, the directly operated locations in other cities are being packaged and sold to regional agents." According to reports, the reason for closing directly-operated stores is mainly due to the intensified competition in the industry and the choice to introduce local franchisees who have a better understanding of local conditions in an attempt to quickly seize the market. Behind this, the problem of arbitrary charging caused by direct decentralization has become a new "stumbling block" to the development of monster charging. Give up direct sales

Prices tripled in 5 years! I spent 1,200 yuan on a shared power bank for a year. Netizens complained about it being expensive and charging slowly.

Feb 18, 2024 pm 03:40 PM

Prices tripled in 5 years! I spent 1,200 yuan on a shared power bank for a year. Netizens complained about it being expensive and charging slowly.

Feb 18, 2024 pm 03:40 PM

News on February 18th, do you have the habit of bringing your own power bank when you go out? If so, you have actually saved a lot of money. Recently, some netizens reviewed the past year and found that they spent 1,200 yuan on a shared power bank. They were really shocked by the phone bill. What is the concept of 1,200 yuan? This netizen’s Bilibili membership fee, video platform membership fee, etc., all added up, actually cost less than 1,200 yuan. The expenditure of 1,200 yuan mainly came from platforms such as Meituan, Monster Charge, Jiedian, and Laiding. Among them, Meituan’s power bank cost 840 yuan. Twice, because I forgot to return the power bank, I was deducted 99 yuan from the charge. This made him crazy. Why did he have to return the power bank when he could spend 99 yuan to get the power bank in full? Such

In order to earn you 4 yuan, the shared power bank becomes a 'thief': the method is quite strange

Jul 18, 2024 pm 03:51 PM

In order to earn you 4 yuan, the shared power bank becomes a 'thief': the method is quite strange

Jul 18, 2024 pm 03:51 PM

Seven years ago, Wang Sicong publicly cheated on people in WeChat Moments and said directly that if shared power bank could be successful, he would just eat and drink. In the past few years, various people have been collecting debts online. It’s hard to say whether this shared power bank is a success. Anyway, Monster Charge, the first power bank listed on the market, turned a profit last year, while Wang Sicong’s Panda TV has two meters of grass on its grave. But then again, the reputation of shared power banks has become increasingly bad in recent years. From the price increase to 4 yuan, he was recognized as an assassin, and then he was criticized and ran 50 miles away for less than that. In fact, these are all operated by the agent behind the scenes. For example, after you borrow the money from the front, the helper hired by the agent will come to stuff the power bank with the back. The agent also has pricing power, whether it is 925 an hour or 4 yuan an hour, it is all up to them. Calculate. Book

After being reported to have lost contact, Yuan Bingsong, the founder of the shared power bank 'Laideng', spoke out on Moments

Aug 19, 2024 am 07:31 AM

After being reported to have lost contact, Yuan Bingsong, the founder of the shared power bank 'Laideng', spoke out on Moments

Aug 19, 2024 am 07:31 AM

According to the news from this website on August 18, according to "Shell Finance", this evening, Yuan Bingsong, the founder of Laiding Technology, posted on his circle of friends: "God is just and everything that happens is the best arrangement. Be conscientious and do things with your heart. If you don't do evil, God will bless you!" The reporter learned from people close to Yuan Bingsong that the circle of friends was posted by Yuan Bingsong, and Yuan Bingsong himself can currently be contacted. ▲Picture source The official website of Laidian Technology has noticed that earlier today it was reported that Yuan Bingsong, the founder of Shenzhen Laidian Technology Co., Ltd., has lost contact recently. Also missing at the same time was Han Bing, the first successor to Laidian Technology. The two were held accountable by a legal team hired by local state-owned assets for alleged losses of state-owned assets. Including Yuan Bingsong and Han Bing, a total of 6 people related to Shenzhen callers lost contact one after another. 2013

What should I do if the return order for the power bank is still in progress?

Sep 20, 2023 pm 03:45 PM

What should I do if the return order for the power bank is still in progress?

Sep 20, 2023 pm 03:45 PM

If the return order of the power bank is still in progress, you can contact the customer service department of the power bank provider, contact the physical store of the power bank provider, contact the customer service department of the power bank rental platform, or contact the power bank provider through social media platforms. Detailed introduction: 1. Contact the customer service department of the power bank provider, explain the situation to the customer service staff, and provide the order number and other necessary information; 2. Contact the physical store of the power bank provider. Before going to the store, we'd better advance Called the store to see if they could resolve our issue etc.

5 yuan for half an hour! The rent of shared power bank has caught up with the parking fee. Netizens complain that they can't afford it: Some people spend 1,200 yuan a year.

Aug 07, 2024 pm 10:17 PM

5 yuan for half an hour! The rent of shared power bank has caught up with the parking fee. Netizens complain that they can't afford it: Some people spend 1,200 yuan a year.

Aug 07, 2024 pm 10:17 PM

According to news on August 5, according to domestic media reports, recently, some netizens complained that the charging standard for some shared power banks is as high as 5 yuan/half an hour, which is almost the same as parking fees. Some netizens also said that "the charging standard for power banks is getting higher and higher." "It takes two more hours to buy a new one." Later, a relevant power bank party said: "5 yuan is available every half hour. Normally, according to Everyone’s rental orders have this unit price. Each pricing is subject to approval. There are different agents in each region, and the pricing is different. It depends on your rental order. "Before this, some netizens reviewed the past year and found that they spent 1