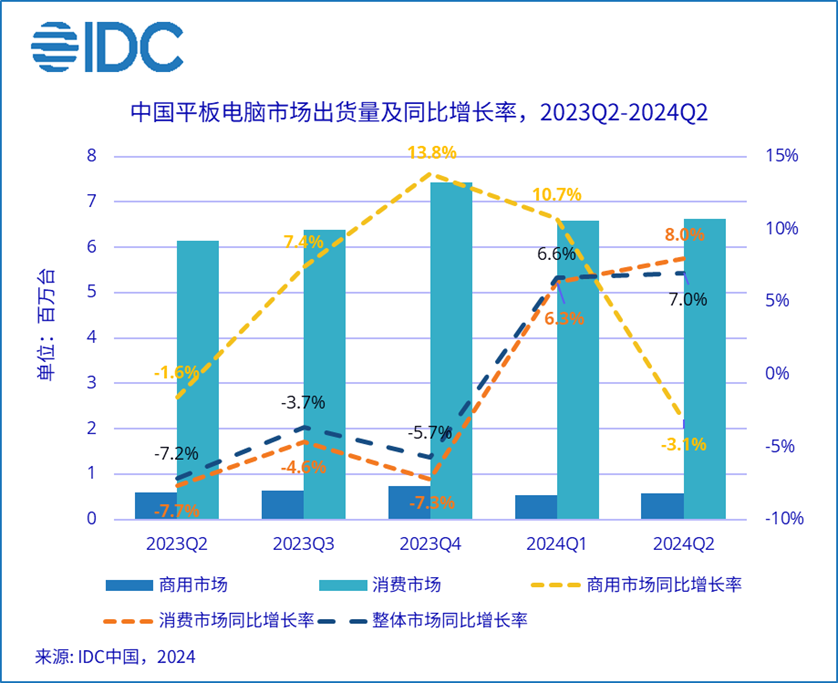

Recently, International Data Corporation (IDC) released the "China Tablet PC Market Quarterly Tracking Report for the Second Quarter of 2024". IDC data shows that China's tablet market shipments in the second quarter of 2024 were 7.2 million units, a year-on-year increase of 7.0 %, of which the consumer market increased by 8.0% year-on-year and the commercial market decreased by 3.1% year-on-year. After returning to growth last quarter, China's tablet shipments once again experienced a year-on-year increase, officially starting a new rotation and development cycle.

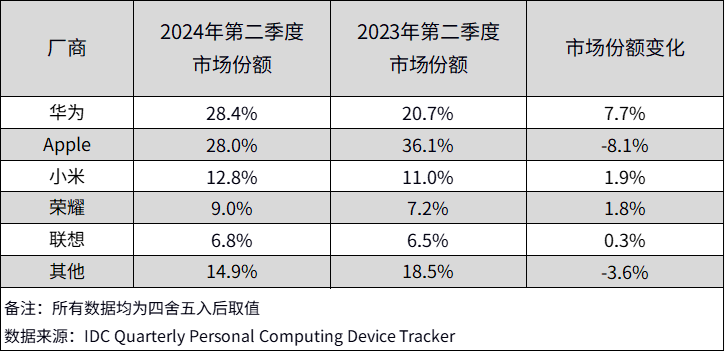

The market performance of the top five manufacturers in China's tablet market in the second quarter of 2024 is as follows:

Huawei ranks first in China's tablet market share, with shipments in the second quarter of 2024 year-on-year An increase of 46.9%. The MatePad 11.5S, which was launched in May, was the first new product after the external supply tightening. Sales were booming as soon as it was launched, driving Huawei's rapid growth in consumer market shipments in the quarter. In the commercial market, Huawei continues to maintain its lead, but there is a temporary gap in mid- to high-priced products during the transition period.

Apple ranks second. The launch of new products this quarter has driven Apple’s market share to rebound quarter-on-quarter and return to the top spot in the consumer market in terms of shipments. However, the higher pricing of the new generation iPad Air and iPad Pro series products makes it difficult for them to leverage mainstream market demand. During the 618 promotion period, Apple’s market share in China was still declining year-on-year in the face of fierce competition from domestic Android brands in terms of functionality and price.

Xiaomi ranks third in market share, and its shipments hit a new high this quarter driven by online promotions. In April, Xiaomi Redmi series launched the new product Redmi Pad Pro to enrich the product line, further attracting young consumer groups to purchase through large screen, cost-effectiveness and IP co-branding.

Honor ranks fourth, with product updates in both the consumer and commercial markets this quarter. Among them, Tablet 9 Pro is mainly aimed at the consumer market, helping Honor enrich its product layout in the mid-to-high price range. Compared with the previous two generations of products, Z7, a new product for the commercial market, has significantly improved screen size and performance, better meeting the needs of customers in mid-to-high-end industries.

Lenovo ranks fifth in market share, with both commercial and consumer markets showing double-digit growth. Thanks to the outstanding performance of Xiaoxin Pad 2024 on the e-commerce platform during the 618 promotion, Lenovo’s consumer tablet shipments have further increased, and the effective digestion of channel inventory has laid the foundation for market layout in the second half of the year.

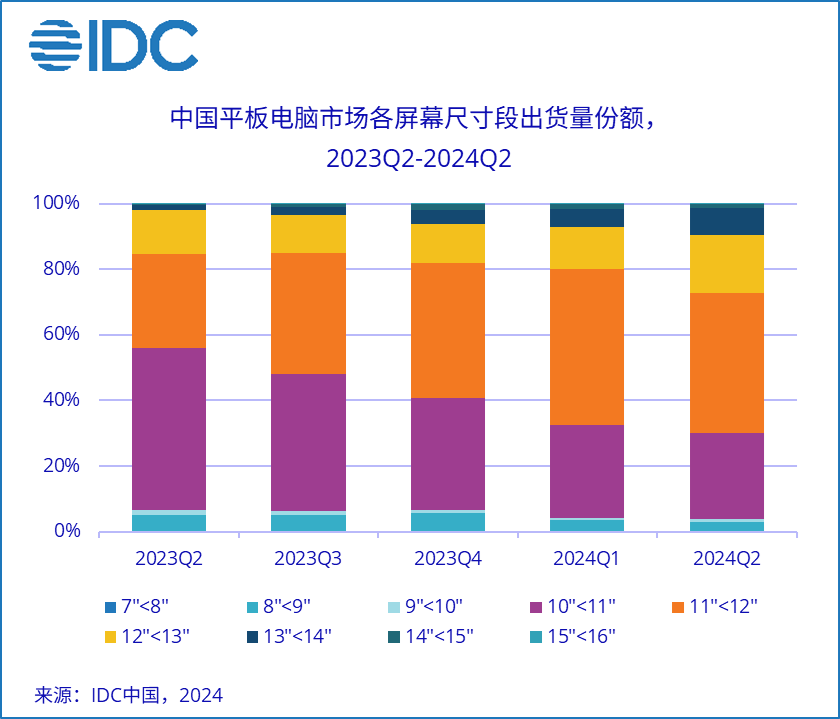

China’s tablet market continues the trend of upgrading to large screens. On the one hand, the upgrade and iteration from the traditional 10-11 inches to 11-12 inches continues to advance; on the other hand, the improvement in performance and functionality of tablets has prompted their application scenarios to continue to expand to more professional scenarios such as study and office. The rising demand for eye protection and operational convenience has pushed the market to upgrade to larger sizes, and continues to attract brand manufacturers to deploy here. Driven by new products, the 12-14-inch market share of China's tablet computer market increased significantly in the second quarter of 2024, with market shipments in the 13-14-inch size segment increasing by 582.2% year-on-year.

The above is the detailed content of IDC: China's tablet market shipments will increase by 7% year-on-year in the second quarter of 2024. For more information, please follow other related articles on the PHP Chinese website!

What is the difference between 5g and 4g

What is the difference between 5g and 4g

What is the difference between 4g and 5g mobile phones?

What is the difference between 4g and 5g mobile phones?

What are the applications of the Internet of Things?

What are the applications of the Internet of Things?

The latest prices of the top ten virtual currencies

The latest prices of the top ten virtual currencies

What to do if the CPU usage is too high

What to do if the CPU usage is too high

How to run code with vscode

How to run code with vscode

The difference between a++ and ++a

The difference between a++ and ++a

Why can't the QQ space web page be opened?

Why can't the QQ space web page be opened?