The Crypto Market's Bright Spots: MinePro, Avalanche, and Arbitrum

As the cryptocurrency market continues its rollercoaster ride, three projects are catching the eye of investors for their potential to deliver impressive returns.

As the cryptocurrency market continues to fluctuate, investors are keeping a close eye on promising projects that could potentially generate substantial returns. Among these ventures, three have garnered particular attention: MinePro, Avalanche (AVAX), and Arbitrum (ARB). Here's a closer look at each project's latest developments and what they hold for investors.

1. MinePro: Tokenized Bitcoin Mining for Passive Income

In the realm of cryptocurrency, MinePro is emerging as a pioneering project that combines the lucrative world of Bitcoin mining with the benefits of tokenization. This unique approach has captivated investors with its potential to yield 10-20% monthly profits in BTC by simply staking the native $MINE token.

Through a strategic partnership with Logic Mining, a renowned Bitcoin mining operation, MinePro gains access to some of the lowest power costs globally at an astonishing 0.02 cents per kWh. This incredibly low-cost advantage translates into a 95.71% higher profitability rate compared to typical Bitcoin mining operations.

As a tokenized Bitcoin mining project, MinePro presents a compelling proposition for investors seeking to capitalize on the appreciation of Bitcoin's value over time. Moreover, the $MINE token serves as a deflationary governance token that rewards stakers with Bitcoin every month. The longer the tokens are staked, the greater the payouts, encouraging long-term participation and investment.

2. Avalanche (AVAX) Shows Bullish Signs, Could Hit $30 in Q3 2024

Amidst the recent market downturns, Avalanche (AVAX) is showing signs of a strong comeback as the cryptocurrency market rebounds. After bottoming out at $19.54, AVAX surged to $21.75, quickly tapering back down slowly, currently hovering around the $20 range.

However, analysts remain bullish on AVAX, highlighting a positive outlook in the derivatives market, where the long/short ratio remains favorable and open interest nears $200 million. According to analysts, AVAX could surpass the $30 mark in Q3 2024, potentially reaching $50 by the end of the quarter.

Further down the line, some predictions suggest that AVAX could even hit the psychological $100 mark during an October rally if market conditions remain favorable. However, a pullback to $62 by year-end is anticipated as the market consolidates before a new-year rally. Despite these fluctuations, the long-term outlook for Avalanche remains positive, with the potential for AVAX to reach new highs by 2025.

3. Arbitrum (ARB) Faces Uncertainty as Token Unlocks Continue

As Ethereum's Layer-2 network, Arbitrum (ARB) has seen a spike in trading volume following a major event on August 16—the release of 2.77% of its circulating supply. This token unlock, valued at approximately $51.2 million, heightened investor interest, with trading volume peaking at over $260 million.

However, this event highlights a worrying pattern in Arbitrum's dynamics. While the price continues to decrease, the market cap increases—a trend that could be attributed to the constant token unlocks. Typically, these tokens are held by venture capital firms or angel investors who likely purchased ARB at a very low price during its early stages of launch, agreeing to a vesting schedule. Now, as we approach later stages, they are able to "cash out" their investments, leading to a constant state of sell pressure on retail investors.

If you're an Arbitrum investor, it's crucial to understand this mechanic and plan your investments accordingly. You can check out the vesting schedule for Arbitrum and learn more about this process to make informed decisions.

The above is the detailed content of The Crypto Market's Bright Spots: MinePro, Avalanche, and Arbitrum. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1664

1664

14

14

1423

1423

52

52

1317

1317

25

25

1268

1268

29

29

1242

1242

24

24

Pepe Loses Steam with a 15% Dip This Month after a 600% Rally—Time to Buy or Wait? New Rival Pepe Unchained Raises $24M in Presale

Nov 06, 2024 am 03:20 AM

Pepe Loses Steam with a 15% Dip This Month after a 600% Rally—Time to Buy or Wait? New Rival Pepe Unchained Raises $24M in Presale

Nov 06, 2024 am 03:20 AM

After rallying over 600% in the past year, Pepe has lost momentum with a 15% fall this month. Is it too late to buy, or is the next rally around the corner?

R0AR Token Presale Enters Final Stages, Offering Exclusive Benefits and Pre-DEX/CEX Listing Discounts

Nov 12, 2024 pm 09:28 PM

R0AR Token Presale Enters Final Stages, Offering Exclusive Benefits and Pre-DEX/CEX Listing Discounts

Nov 12, 2024 pm 09:28 PM

The R0AR token presale is moving into its final two stages, meaning that the amount of time left to snap up R0AR tokens prior to major DEX and CEX listings is running out.

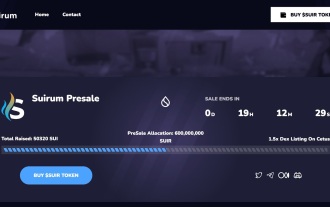

Suirum, The First SUI Memecoin Presale Raises Over 50,000 $SUI, Set To List On Cetus Protocol

Nov 10, 2024 am 09:06 AM

Suirum, The First SUI Memecoin Presale Raises Over 50,000 $SUI, Set To List On Cetus Protocol

Nov 10, 2024 am 09:06 AM

The Sui blockchain is on fire, with new accounts on the Sui network increasing by 5% in the past week, it’s clear that Sui is rapidly gaining momentum.

BlockDAG (BDAG) Dominates the Crypto Market, Rivaling Dogecoin and Shiba Inu

Nov 19, 2024 pm 03:08 PM

BlockDAG (BDAG) Dominates the Crypto Market, Rivaling Dogecoin and Shiba Inu

Nov 19, 2024 pm 03:08 PM

As the crypto market buzzes with activity from meme coins such as Dogecoin and Shiba Inu, BlockDAG (BDAG) is also gaining significant traction.

Shiba Shootout Play-to-Earn Opportunities Offer Fun and Passive Income: Presale Has Hit Over $1.2 Million Already

Nov 06, 2024 am 07:28 AM

Shiba Shootout Play-to-Earn Opportunities Offer Fun and Passive Income: Presale Has Hit Over $1.2 Million Already

Nov 06, 2024 am 07:28 AM

Shiba Shootout is a mobile game that brings the legendary doge icon to life in a wild western setting. In this Play-to-Earn (P2E) environment, players engage in gun battles in the town of Shiba Gulch.

BlockDAG (BDAG) Emerges as a Strong Contender for Top Crypto of 2024

Nov 08, 2024 am 04:28 AM

BlockDAG (BDAG) Emerges as a Strong Contender for Top Crypto of 2024

Nov 08, 2024 am 04:28 AM

Avalanche (AVAX) is eyeing a breakout to $40, with strong community support and a boost from its new Avalanche Card in partnership with Visa.

Peanut the Squirrel (PNUT) Price Plunged 19% in the Last 24 Hours to Trade at $1.67

Nov 15, 2024 pm 06:44 PM

Peanut the Squirrel (PNUT) Price Plunged 19% in the Last 24 Hours to Trade at $1.67

Nov 15, 2024 pm 06:44 PM

The Peanut the Squirrel price recently experienced a sharp upward movement, peaking near $2.5 before entering a consolidation phase

New ICO Token Lunex Network Breaks $1m Target as Bitcoin Dominance Continues to Narrow

Oct 28, 2024 pm 03:22 PM

New ICO Token Lunex Network Breaks $1m Target as Bitcoin Dominance Continues to Narrow

Oct 28, 2024 pm 03:22 PM

Lunex Network is a promising new player in the decentralized finance (DeFi) space and has shattered its initial fundraising goals, raising nearly $1.2 million.