Within the final two years, Bitcoin (BTC) has produced a powerful constructive worth efficiency gaining by over 300% for the reason that begin of 2023.

Bitcoin (BTC) worth has skilled a powerful constructive efficiency over the past two years, surging by over 300% for the reason that begin of 2023. In 2024 alone, the crypto market chief has surged by 40%, notably reaching a brand new all-time excessive of $73,750 in March. Nonetheless, latest worth developments point out that Bitcoin’s upward worth trajectory might expertise vital adjustments within the coming months.

Bitcoin Worth Dips Underneath 200-Day SMA; What Does It Imply?

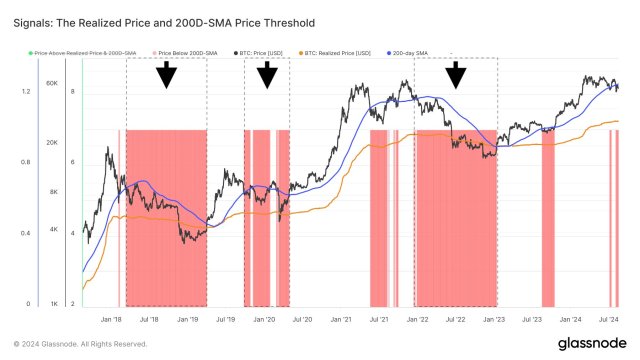

In an X publish on Saturday, standard crypto analyst Ali Martinez shared that the value of BTC has not too long ago dipped under its 200-day easy shifting common (SMA), indicating the asset is topic to a change in worth motion.

For context, the easy shifting common, some of the frequent buying and selling instruments, is used to establish tendencies in worth information over a particular time e.g. 200 days. Because the title implies, the indicator represents the common of all worth factors within the given interval, permitting merchants to gauge the overall path of the market.

Historically, when an asset’s worth crosses above the SMA, it signifies a worth change within the upward path though the truth of the anticipated worth rise depends upon the SMA’s time-frame. Alternatively, when a token’s worth dips under the SMA, it represents a promote sign as a decline in worth is predicted.

In mild of those observations, many merchants and buyers usually tend to purchase an asset when it trades above its SMA and promote the asset when it trades under the indicator.

However, on condition that completely different merchants might assign completely different worth interpretations to the SMA, the indicator is usually mixed with different buying and selling instruments to supply extra readability on the anticipated worth motion.

Coming again to Martinez’s evaluation, the analyst believes that BTC’s present dip under its 200-day SMA presents a shopping for alternative for buyers, contemplating the token’s potential to keep up its present bullish pattern.

In keeping with the analyst’s evaluation, Bitcoin’s worth might proceed to rally within Q3 2024, permitting the asset to realize one other leg up in its worth trajectory.

Albeit, in a scenario the place Bitcoin’s keep under the 200-day SMA turns into longer, resembling over a number of weeks or months, Martinez predicts such improvement might provoke a bear marketplace for the premier cryptocurrency.

Bitcoin Worth Overview

Based mostly on information from CoinMarketCap, BTC trades at $59,995 with a 1.77% decline within the final seven days. This destructive efficiency underlines the asset’s battle within the final month throughout which it misplaced over 8% of its worth, briefly falling under $50,000.

Albeit, group sentiment on Bitcoin stays largely bullish indicating that many buyers again the token to show worthwhile in the long run.

The premier cryptocurrency has been repeatedly tipped to hit six-figure values primarily based on historic worth information and different elements together with the Bitcoin spot ETF market and most not too long ago potential adjustments within the US authorities coverage on digital property.

Nonetheless, Bitcoin’s short-term worth targets for now lie at $62,000 and $70,000, each of which current vital resistance ranges for the crypto market chief.

Featured picture from Coinmonks, chart from Tradingview

The above is the detailed content of Bitcoin (BTC) Worth At Crossroads as 200-Day SMA Alerts Potential Adjustments in Trajectory. For more information, please follow other related articles on the PHP Chinese website!

How to create a new folder in webstorm

How to create a new folder in webstorm

How to solve the problem that document.cookie cannot be obtained

How to solve the problem that document.cookie cannot be obtained

How to read carriage return in java

How to read carriage return in java

cad break line command

cad break line command

Introduction to interface types

Introduction to interface types

Is Yiouoky a legal software?

Is Yiouoky a legal software?

What are the SEO keyword ranking tools?

What are the SEO keyword ranking tools?

What to do if the computer fakes death

What to do if the computer fakes death