Bitcoin (BTC) News and Price Data

The latest price moves in crypto markets in context for Aug. 20, 2024.

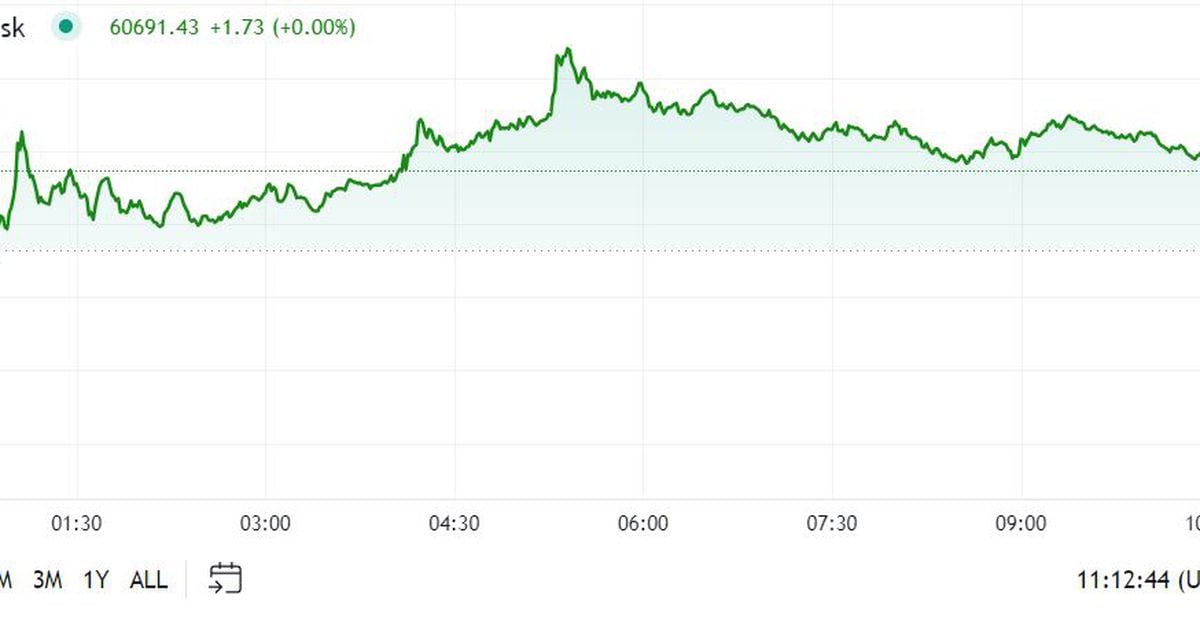

Bitcoin rose past $61,000 early Tuesday, outperforming the broader crypto market and recording a second-highest daily ETF inflow of the month.

The price of BTC rose 4.6% over 24 hours to $60,800 at press time, while the broader crypto market rose 4% and the S&P 500 rose 1%. The CoinDesk 20 Index measures the performance of the top 20 cryptocurrencies.

Bitcoin ETFs recorded over $61 million in net inflows, the highest since $192 million on Aug. 8, according to data from SoSoValue. BlackRock's IBIT ETF led with $92 million of inflows, while Bitwise's BITB ETF recorded $25 million of outflows.

Japanese financial services firm Metaplanet said it completed a BTC purchase worth $3.4 million, bringing its total holdings to 360.368 BTC. The firm began purchasing bitcoin in March 2022.

Among other coins, the price of ether rose 3% over 24 hours to $2,650. XRP rose 4.2% to $0.51, while dogecoin rose 3.8% to $0.18. Litecoin rose 3.3% to $186, and solana rose 3.2% to $106.

Fear and Greed IndexNow at: 64Extreme GreedGet up to speed on crypto’s essential topics with ourBeginner’s Guides.

Bitcoin options traders are locking up millions of dollars in anticipation of the U.S. election. Deribit began trading election expiry options a month ago with a notional open interest, or the dollar value of the number of active options contracts, of $345.83 million, according to Amberdata.

Call options, which offer an unlimited upside payoff potential at the expense of limited loss, accounted for 67% of the total open interest. The rest came from put options, amounting to a put-call ratio of less than 0.50. In other words, twice as many calls were open as puts, reflecting bullish expectations from the outcome of the elections.

State Street is partnering with digital asset custodian Taurus for its tokenization plans with the intention of extending to crypto custody once the U.S. regulatory environment improves.

State Street, which has $44.3 trillion in assets under management, began planning for its tokenization efforts in 2021 and plans to go live with tokenized versions of traditional assets such as exchange-traded funds (ETFs) and fixed-income instruments this year. The firm is also working on tokenizing private assets.

The bank has been “very vocal” about the need to change SAB 121, which could force banks seeking to hold crypto to maintain an onerous amount of capital to compensate for the risk, Donna Milrod, chief product officer and head of Digital Asset Solutions, said in an interview. “While we're starting with tokenization, that's not where we're ending. As soon as the U.S. regulations help us out, we will be providing digital custody services as well."

The above is the detailed content of Bitcoin (BTC) News and Price Data. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1670

1670

14

14

1428

1428

52

52

1329

1329

25

25

1273

1273

29

29

1256

1256

24

24

PEPE Coin Surge: Balancing Growth and Caution

Nov 16, 2024 am 01:30 AM

PEPE Coin Surge: Balancing Growth and Caution

Nov 16, 2024 am 01:30 AM

PEPE Coin made headlines yesterday for reaching a new all-time high (ATH) after being listed on Upbit, Coinbase, and Robinhood

Bitcoin (BTC) Exchange Reserves Drop to November 2018 Lows, Raising Liquidity Concerns

Nov 17, 2024 am 09:58 AM

Bitcoin (BTC) Exchange Reserves Drop to November 2018 Lows, Raising Liquidity Concerns

Nov 17, 2024 am 09:58 AM

Bitcoin's (BTC) exchange reserves have dropped to their lowest level since November 2018, reflecting a significant shift in market dynamics.

Bitcoin (BTC) Poised for a 90% Rally as Puell Multiple Flashes Golden Cross

Nov 20, 2024 am 10:28 AM

Bitcoin (BTC) Poised for a 90% Rally as Puell Multiple Flashes Golden Cross

Nov 20, 2024 am 10:28 AM

Onchain data analytical platform CryptoQuant has flagged a key Bitcoin (BTC) metric that suggests a potential 90% rally for the leading cryptocurrency.

Solidion Technology Follows MicroStrategy's Playbook, Allocates Bitcoin to Corporate Treasury

Nov 17, 2024 am 03:58 AM

Solidion Technology Follows MicroStrategy's Playbook, Allocates Bitcoin to Corporate Treasury

Nov 17, 2024 am 03:58 AM

Solidion Technology, Inc. (NASDAQ: STI), a leading provider of advanced battery materials, has announced a significant strategic allocation of Bitcoin within its corporate treasury.

Bitcoin (BTC) Set to Outperform Gold (XAU) Even Without US Government Backing, Says Luke Gromen

Nov 20, 2024 am 03:20 AM

Bitcoin (BTC) Set to Outperform Gold (XAU) Even Without US Government Backing, Says Luke Gromen

Nov 20, 2024 am 03:20 AM

Veteran macro investor Luke Gromen believes Bitcoin (BTC) is set to outperform gold even without the backing of the US government.

Bitcoin Surpasses $90,000, Shiba Inu Momentum Stalls, Solana Surges

Nov 20, 2024 am 11:21 AM

Bitcoin Surpasses $90,000, Shiba Inu Momentum Stalls, Solana Surges

Nov 20, 2024 am 11:21 AM

In addition to surpassing earlier highs, Bitcoin has reached a critical price level of $92,000, which has strengthened its position in the current bullish cycle.

When Will All Bitcoins Be Mined? Exploring the Finite Supply and Impacts of the Cryptocurrency

Nov 17, 2024 am 01:26 AM

When Will All Bitcoins Be Mined? Exploring the Finite Supply and Impacts of the Cryptocurrency

Nov 17, 2024 am 01:26 AM

Bitcoin has become a household name since its creation in 2009, capturing the attention of investors, technologists, and economists worldwide.

Bitcoin's Journey to $1M Relies on Scarcity, Adoption, and Market Dynamics, Not Magic

Nov 19, 2024 pm 09:36 PM

Bitcoin's Journey to $1M Relies on Scarcity, Adoption, and Market Dynamics, Not Magic

Nov 19, 2024 pm 09:36 PM

Bitcoin ETF inflows and treasury adoption push institutional confidence and price growth. Reaching 3% of global wealth could propel Bitcoin's market cap to $20 trillion.