Home

Mobile Tutorial

Mobile Tutorial

Mobile News

Mobile News

Southeast Asia smartphone Q1 shipment rankings released: Transsion grew 197% year-on-year

Southeast Asia smartphone Q1 shipment rankings released: Transsion grew 197% year-on-year

Mobile Tutorial

Mobile Tutorial

Mobile News

Mobile News

Southeast Asia smartphone Q1 shipment rankings released: Transsion grew 197% year-on-year

Southeast Asia smartphone Q1 shipment rankings released: Transsion grew 197% year-on-year

Southeast Asia smartphone Q1 shipment rankings released: Transsion grew 197% year-on-year

-

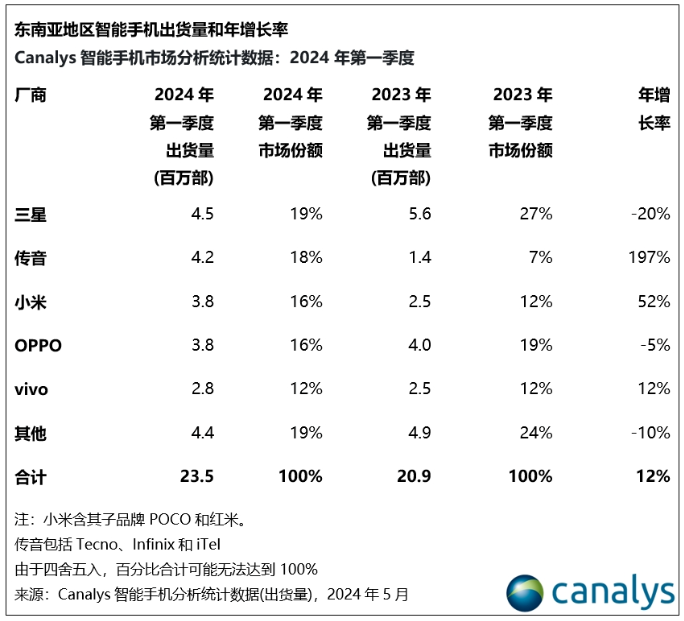

Samsung: 19%, down 20% year-on-year

- Priority to expand the mid-to-high-end market (Galaxy S, A5x, A3x)

- A1x, A0x, A2x are still the main players in the mass market

- Future growth is expected to come from the high-end market

1. Transsion occupies 18% of the market share, with an annual growth rate of 197%.

- Both Xiaomi and OPPO have a market share of 16%, but their development trajectories are different, with Xiaomi growing by 52% and OPPO falling by 5%.

- vivo occupies 12% of the market share, growing 12% year-on-year.

- In price-sensitive markets such as Indonesia and the Philippines, device shipments in the sub-$100 price segment have recovered.

- Transsion’s success in the Philippines is due to its three sub-brands: Infinix, Tecno and iTel.

With Galaxy S24, Samsung takes the leading position in the Southeast Asia market in the first quarter of 2024

- Thailand, Malaysia and Vietnam markets: Samsung’s success is attributed to its premiumization strategy and leveraging brand experience stores and telecommunications High-end channels such as the Samsung Galaxy S24 support the growth of flagship devices such as the Galaxy S24.

Southeast Asia Smartphone Market Forecast

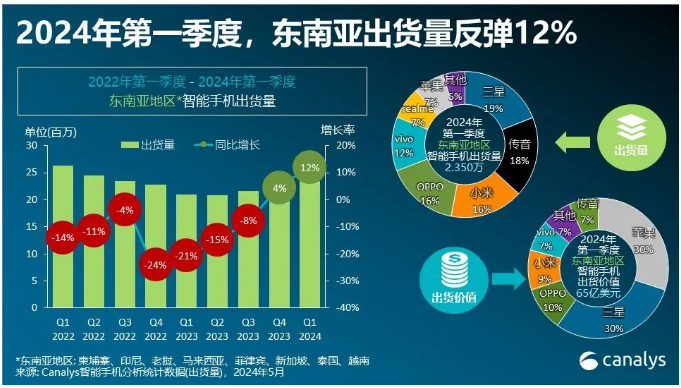

- 4% Growth: Canalys predicts that smartphone shipments in Southeast Asia will grow by 4% in 2024.

- External Sales: Most manufacturers are cautious about the substantial growth brought about by the natural refresh cycle.

- Q1 Rebound: While the market rebounded 12% in Q1 2024, most of the growth was concentrated in price-sensitive markets such as Indonesia and the Philippines.

- Challenges: Uncertain factors such as exchange rate fluctuations and component costs have brought new challenges.

- Success factors: Manufacturers with good supply chains and operational efficiency will be more likely to succeed.

The above is the detailed content of Southeast Asia smartphone Q1 shipment rankings released: Transsion grew 197% year-on-year. For more information, please follow other related articles on the PHP Chinese website!

Statement of this Website

The content of this article is voluntarily contributed by netizens, and the copyright belongs to the original author. This site does not assume corresponding legal responsibility. If you find any content suspected of plagiarism or infringement, please contact admin@php.cn

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Roblox: Grow A Garden - Complete Mutation Guide

3 weeks ago

By DDD

Roblox: Bubble Gum Simulator Infinity - How To Get And Use Royal Keys

3 weeks ago

By 尊渡假赌尊渡假赌尊渡假赌

How to fix KB5055612 fails to install in Windows 10?

3 weeks ago

By DDD

Blue Prince: How To Get To The Basement

1 months ago

By DDD

Nordhold: Fusion System, Explained

3 weeks ago

By 尊渡假赌尊渡假赌尊渡假赌

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

Java Tutorial

1664

1664

14

14

1664

1664

14

14

CakePHP Tutorial

1423

1423

52

52

1423

1423

52

52

Laravel Tutorial

1318

1318

25

25

1318

1318

25

25

PHP Tutorial

1269

1269

29

29

1269

1269

29

29

C# Tutorial

1248

1248

24

24

1248

1248

24

24