Bitcoin (BTC) Value Breaks Previous $64.9K: What's Subsequent?

Up to now few weeks, following a sequence of corrections, Bitcoin and the broader crypto market have skilled a major surge from the decrease costs of 2024.

Bitcoin Worth Surges Past $64K, Goal Ranges After LTHs Clock Beneficial properties

Up to now few weeks, following a sequence of corrections, Bitcoin and the broader crypto market have skilled a major surge from the decrease costs of 2024.

This momentum picked up notably on Friday after Jerome Powell, Chairman of the Board of Governors of the Federal Reserve System, introduced a shift in coverage, hinting at a possible rate of interest reduce in September. This announcement has fueled optimism amongst traders, leading to elevated market exercise.

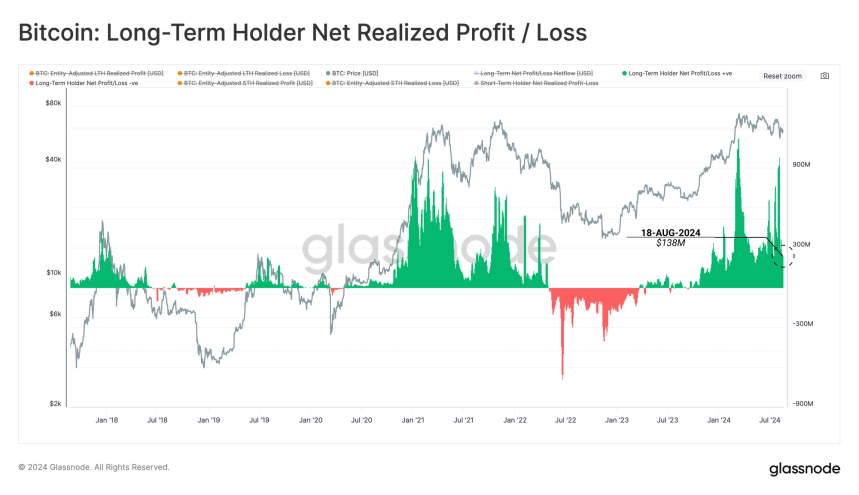

Moreover, beneficial knowledge from Glassnode reveals that long-term holders (LTH) are locking in constant beneficial properties of $138 million in revenue per day. However what does this imply for the market shifting ahead?

Bitcoin Every day Capital Inflows Essential For Value Stability

Bitcoin long-term holders (LTH) have been constantly locking in beneficial properties over the previous few months, even amid the market’s uncertainty and volatility. On this regard, the Bitcoin Lengthy-Time period Holder Web Realized Revenue/Loss chart from Glassnode, reveals that LTH are at present promoting Bitcoin at a price of roughly $138 million per day. This promoting strain serves as an important benchmark for the market, indicating the quantity of latest capital that must move into Bitcoin every day to counterbalance the promoting and stabilize the value.

If every day inflows into Bitcoin fall wanting this $138 million benchmark, the value may doubtlessly face downward strain resulting from LTH’s ongoing gross sales. This dynamic underscores the fragile steadiness between purchaser demand and LTH’s profit-taking actions.

As the market continues to navigate this section, Bitcoin’s value motion shall be significantly fascinating to look at within the coming weeks. Whether or not new investor inflows can match or exceed this promoting strain shall be key to figuring out BTC’s subsequent main transfer.

BTC Breaks Previous $64,900: What’s Subsequent?

Bitcoin is at present buying and selling at $64,360, on the time of this writing, after enduring weeks of aggressive promoting strain, concern, and uncertainty that brought about its value to dip to $49,577 simply 20 days in the past.

Now, BTC is flirting with the $65,000 mark following two profitable every day candles closing above the essential 200-day shifting common—a key indicator that traders use to establish a bullish or bearish market construction.

This growth means that Bitcoin is regaining power, however it must maintain above this indicator and ideally check it as help to maintain the uptrend.

If BTC can preserve this stage, breaking previous $65,000 must be a simple activity, with the subsequent goal possible round $67,000. Nonetheless, if the value fails to carry above the 200-day shifting common close to $63,000, Bitcoin could also be liable to retesting native demand ranges round $60,000.

Featured picture created with Dall-E, chart from Tradingview.com

The above is the detailed content of Bitcoin (BTC) Value Breaks Previous $64.9K: What's Subsequent?. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1664

1664

14

14

1421

1421

52

52

1315

1315

25

25

1266

1266

29

29

1239

1239

24

24

Bitcoin (BTC) Exchange Reserves Drop to November 2018 Lows, Raising Liquidity Concerns

Nov 17, 2024 am 09:58 AM

Bitcoin (BTC) Exchange Reserves Drop to November 2018 Lows, Raising Liquidity Concerns

Nov 17, 2024 am 09:58 AM

Bitcoin's (BTC) exchange reserves have dropped to their lowest level since November 2018, reflecting a significant shift in market dynamics.

Bitcoin (BTC) Poised for a 90% Rally as Puell Multiple Flashes Golden Cross

Nov 20, 2024 am 10:28 AM

Bitcoin (BTC) Poised for a 90% Rally as Puell Multiple Flashes Golden Cross

Nov 20, 2024 am 10:28 AM

Onchain data analytical platform CryptoQuant has flagged a key Bitcoin (BTC) metric that suggests a potential 90% rally for the leading cryptocurrency.

Bitcoin Surpasses $90,000, Shiba Inu Momentum Stalls, Solana Surges

Nov 20, 2024 am 11:21 AM

Bitcoin Surpasses $90,000, Shiba Inu Momentum Stalls, Solana Surges

Nov 20, 2024 am 11:21 AM

In addition to surpassing earlier highs, Bitcoin has reached a critical price level of $92,000, which has strengthened its position in the current bullish cycle.

Solidion Technology Follows MicroStrategy's Playbook, Allocates Bitcoin to Corporate Treasury

Nov 17, 2024 am 03:58 AM

Solidion Technology Follows MicroStrategy's Playbook, Allocates Bitcoin to Corporate Treasury

Nov 17, 2024 am 03:58 AM

Solidion Technology, Inc. (NASDAQ: STI), a leading provider of advanced battery materials, has announced a significant strategic allocation of Bitcoin within its corporate treasury.

Bitcoin (BTC) Set to Outperform Gold (XAU) Even Without US Government Backing, Says Luke Gromen

Nov 20, 2024 am 03:20 AM

Bitcoin (BTC) Set to Outperform Gold (XAU) Even Without US Government Backing, Says Luke Gromen

Nov 20, 2024 am 03:20 AM

Veteran macro investor Luke Gromen believes Bitcoin (BTC) is set to outperform gold even without the backing of the US government.

Bitcoin's Journey to $1M Relies on Scarcity, Adoption, and Market Dynamics, Not Magic

Nov 19, 2024 pm 09:36 PM

Bitcoin's Journey to $1M Relies on Scarcity, Adoption, and Market Dynamics, Not Magic

Nov 19, 2024 pm 09:36 PM

Bitcoin ETF inflows and treasury adoption push institutional confidence and price growth. Reaching 3% of global wealth could propel Bitcoin's market cap to $20 trillion.

When Will All Bitcoins Be Mined? Exploring the Finite Supply and Impacts of the Cryptocurrency

Nov 17, 2024 am 01:26 AM

When Will All Bitcoins Be Mined? Exploring the Finite Supply and Impacts of the Cryptocurrency

Nov 17, 2024 am 01:26 AM

Bitcoin has become a household name since its creation in 2009, capturing the attention of investors, technologists, and economists worldwide.

Could Bitcoin (BTC) Price Hit $100k This Month? Here's What the Charts Say

Nov 19, 2024 am 09:34 AM

Could Bitcoin (BTC) Price Hit $100k This Month? Here's What the Charts Say

Nov 19, 2024 am 09:34 AM

As Bitcoin continues its upward trajectory, analysts are increasingly discussing the possibility of it reaching $100k in November.