Bitcoin Sees $543 Million in Inflows After Powell's Dovish Remarks

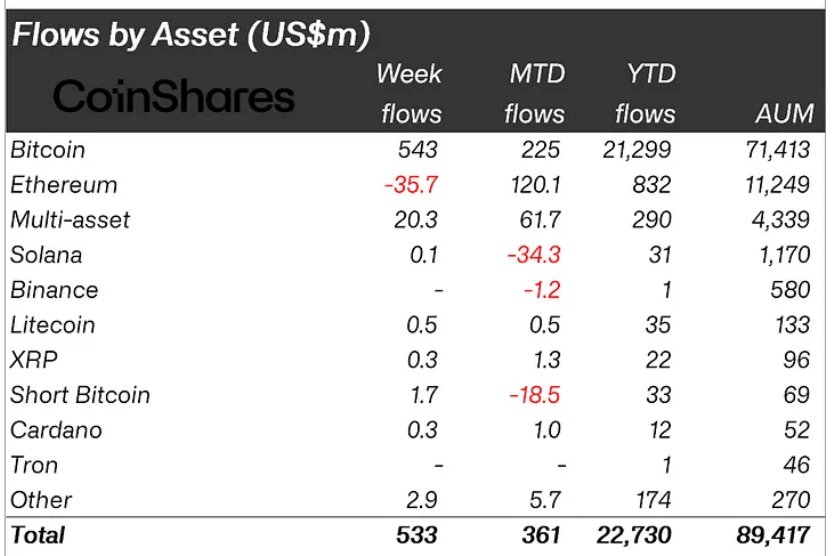

According to CoinShares’ latest weekly fund flow report, crypto investment products saw their largest inflows in five weeks, with $533 million pouring into the sector.

Crypto investment products saw their largest inflows in five weeks, as per CoinShares’ latest weekly fund flow report, with $533 million pouring into the sector.

According to the report, the inflows followed remarks by US Federal Reserve Chair Jerome Powell at the Jackson Hole Symposium last week.

At the event, Powell hinted that the market might expect interest rate cuts in September, which many market observers suggested were bullish for Bitcoin and other crypto.

This statement also appeared to have boosted trading volumes, with last week’s volume reaching $9 billion, significantly higher than in previous weeks.

Bitcoin, US lead

Bitcoin dominated the inflows, with $543 million, most of which occurred on Friday after Powell’s dovish comments. This further indicated Bitcoin’s sensitivity to interest rate expectations, Butterfill stated.

Interestingly, the bullish sentiment also attracted short trades, with $1.7 million flowing into Short BTC products.

Conversely, Ethereum faced outflows totaling $36 million last week. This may be due to continued investors’ exit from Grayscale’s Ethereum Trust.

“Although new issuers continue to see inflows with the Grayscale Ethereum trust offsetting this with $118 million outflows,” Butterfill wrote.

Despite this, the newly launched Ethereum ETFs in the US have seen inflows of $3.1 billion, which partially offsets the $2.5 billion outflow from the Grayscale Trust.

Meanwhile, blockchain equities recorded inflows for the third consecutive week, totaling $4.8 million. Other digital assets like Solana, XRP, and Litecoin saw combined inflows of around $1 million.

Across regions, the United States unsurprisingly accounted for the majority of the total inflows, with $498 million. Hong Kong and Switzerland also saw significant inflows, reaching $16 million and $14 million, respectively.

In contrast, Germany experienced minor outflows totaling $9 million, making it one of the few countries with a year-to-date net outflow.

The above is the detailed content of Bitcoin Sees $543 Million in Inflows After Powell's Dovish Remarks. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1392

1392

52

52

Bitcoin (BTC) Poised for a 90% Rally as Puell Multiple Flashes Golden Cross

Nov 20, 2024 am 10:28 AM

Bitcoin (BTC) Poised for a 90% Rally as Puell Multiple Flashes Golden Cross

Nov 20, 2024 am 10:28 AM

Onchain data analytical platform CryptoQuant has flagged a key Bitcoin (BTC) metric that suggests a potential 90% rally for the leading cryptocurrency.

Bitcoin (BTC) Exchange Reserves Drop to November 2018 Lows, Raising Liquidity Concerns

Nov 17, 2024 am 09:58 AM

Bitcoin (BTC) Exchange Reserves Drop to November 2018 Lows, Raising Liquidity Concerns

Nov 17, 2024 am 09:58 AM

Bitcoin's (BTC) exchange reserves have dropped to their lowest level since November 2018, reflecting a significant shift in market dynamics.

Bitcoin (BTC) Set to Outperform Gold (XAU) Even Without US Government Backing, Says Luke Gromen

Nov 20, 2024 am 03:20 AM

Bitcoin (BTC) Set to Outperform Gold (XAU) Even Without US Government Backing, Says Luke Gromen

Nov 20, 2024 am 03:20 AM

Veteran macro investor Luke Gromen believes Bitcoin (BTC) is set to outperform gold even without the backing of the US government.

Bitcoin Surpasses $90,000, Shiba Inu Momentum Stalls, Solana Surges

Nov 20, 2024 am 11:21 AM

Bitcoin Surpasses $90,000, Shiba Inu Momentum Stalls, Solana Surges

Nov 20, 2024 am 11:21 AM

In addition to surpassing earlier highs, Bitcoin has reached a critical price level of $92,000, which has strengthened its position in the current bullish cycle.

Solidion Technology Follows MicroStrategy's Playbook, Allocates Bitcoin to Corporate Treasury

Nov 17, 2024 am 03:58 AM

Solidion Technology Follows MicroStrategy's Playbook, Allocates Bitcoin to Corporate Treasury

Nov 17, 2024 am 03:58 AM

Solidion Technology, Inc. (NASDAQ: STI), a leading provider of advanced battery materials, has announced a significant strategic allocation of Bitcoin within its corporate treasury.

Bitcoin's Journey to $1M Relies on Scarcity, Adoption, and Market Dynamics, Not Magic

Nov 19, 2024 pm 09:36 PM

Bitcoin's Journey to $1M Relies on Scarcity, Adoption, and Market Dynamics, Not Magic

Nov 19, 2024 pm 09:36 PM

Bitcoin ETF inflows and treasury adoption push institutional confidence and price growth. Reaching 3% of global wealth could propel Bitcoin's market cap to $20 trillion.

Bitcoin (BTC) Price Analysis: Willy Woo Forecasts New All-Time Highs Above $100,000

Nov 16, 2024 am 12:14 AM

Bitcoin (BTC) Price Analysis: Willy Woo Forecasts New All-Time Highs Above $100,000

Nov 16, 2024 am 12:14 AM

Prominent Bitcoin analyst Willy Woo recently shared his insights on social media platform X (formerly Twitter), forecasting Bitcoin's upcoming price movements.

Could Bitcoin (BTC) Price Hit $100k This Month? Here's What the Charts Say

Nov 19, 2024 am 09:34 AM

Could Bitcoin (BTC) Price Hit $100k This Month? Here's What the Charts Say

Nov 19, 2024 am 09:34 AM

As Bitcoin continues its upward trajectory, analysts are increasingly discussing the possibility of it reaching $100k in November.