Ethereum Underperforming by 44%! The reasons for this drop compared to Bitcoin

Since Ethereum’s transition to the Proof-of-Stake (PoS) consensus model in September 2022, the crypto has underperformed compared to Bitcoin by 44%.

Since Ethereum's transition to the Proof-of-Stake (PoS) consensus model in September 2022, the crypto has indeed underperformed compared to Bitcoin (BTC) by 44%. This underperformance is particularly striking considering the high expectations surrounding “The Merge”, an event that was supposed to herald a new era of efficiency and sustainability for Ethereum.

One of the main reasons for this underperformance is the decline in Ethereum network activity compared to Bitcoin. Cumulative transaction fees on the Ethereum network have decreased, partly due to the Dencun update which reduced median transfer fees. In contrast, the Bitcoin network has seen unprecedented levels of transactional activity, mainly thanks to new Layer 2 solutions and inscriptions.

The ETH/BTC price ratio is currently at 0.0425, its lowest level since April 2021. This figure indicates that despite the technical improvements brought by “The Merge”, Ethereum has failed to dominate the market as expected. In July, even the approval of spot ETFs based on Ethereum in the United States wasn't enough to reverse this trend, with an additional 18% drop.

Unfavorable supply dynamics and lower transfer fees have also contributed to this underperformance. The ETH/BTC market value to realized value (MVRV) ratio is now 0.6, meaning Ethereum could still fall before hitting its undervaluation zone, identified at a ratio of 0.45. The last time Ethereum entered this zone, its price was 0.02 compared to Bitcoin, suggesting a potential further decline.

Interestingly, despite Ethereum's current underperformance, experts predict that this network could outperform Bitcoin by 2029, thanks to its technical improvements and growing adoption. Although “The Merge” was a technical success, it has not yet delivered the expected market performance benefits for Ethereum. Investors seem to prefer Bitcoin, as the data shows. The current situation thus highlights the importance of network activity and supply dynamics in the relative performance of cryptocurrencies.

The above is the detailed content of Ethereum Underperforming by 44%! The reasons for this drop compared to Bitcoin. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1376

1376

52

52

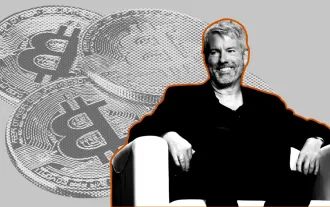

Just-In: MicroStrategy To Raise $1.75B Through Private Offering To Buy More Bitcoin

Nov 19, 2024 am 10:02 AM

Just-In: MicroStrategy To Raise $1.75B Through Private Offering To Buy More Bitcoin

Nov 19, 2024 am 10:02 AM

American business intelligence and software firm MicroStrategy Inc. has announced plans to offer the public up to $1.75 billion of its Convertible Senior Notes.

Glauber Contessoto Predicts Parabolic Rise for Ethereum ETH/USD, Targeting $15,000 This Cycle

Nov 20, 2024 am 10:08 AM

Glauber Contessoto Predicts Parabolic Rise for Ethereum ETH/USD, Targeting $15,000 This Cycle

Nov 20, 2024 am 10:08 AM

Glauber Contessoto, also known as "Dogecoin millionaire," expressed bullish sentiments on Ethereum ETH/USD, predicting a parabolic rise for the second-largest cryptocurrency.

MicroStrategy Announces Proposed Private Offering of $1.75B of Convertible Senior Notes.

Nov 19, 2024 am 09:54 AM

MicroStrategy Announces Proposed Private Offering of $1.75B of Convertible Senior Notes.

Nov 19, 2024 am 09:54 AM

MicroStrategy intends to use the net proceeds to acquire additional Bitcoin and for general corporate purposes. The offering will be available to institutional investors and certain non-US buyers.

Bitkey Introduces Inheritance Feature for Bitcoin Self-Custody

Nov 19, 2024 am 03:32 AM

Bitkey Introduces Inheritance Feature for Bitcoin Self-Custody

Nov 19, 2024 am 03:32 AM

Bitcoin is increasingly seen as a multi-generational asset, and the need for secure and user-friendly solutions to ensure its legacy is more important

Crypto Bitlord: The Man Who Mastered the Art of Influence in the Ever-Changing World of Cryptocurrency

Nov 16, 2024 am 04:34 AM

Crypto Bitlord: The Man Who Mastered the Art of Influence in the Ever-Changing World of Cryptocurrency

Nov 16, 2024 am 04:34 AM

Particularly in the world of meme coins, Bitlord—known for his honest attitude, keen insights, and open demeanor—has created a distinct niche for himself

Microstrategy's $26B Bitcoin Stash Is Larger Than the Cash and Marketable Securities of IBM, Nike, and J&J Combined

Nov 17, 2024 pm 09:42 PM

Microstrategy's $26B Bitcoin Stash Is Larger Than the Cash and Marketable Securities of IBM, Nike, and J&J Combined

Nov 17, 2024 pm 09:42 PM

Microstrategy has acquired 279,420 BTC, which represents roughly 1.33% of the total supply. The company's shares have surged by over 2,500% as the value of Bitcoin has soared around 700% since the middle of 2020.

Don't Miss the Opportunity to Invest in Top 5 New Crypto Coins for 100X Gains

Nov 17, 2024 am 01:30 AM

Don't Miss the Opportunity to Invest in Top 5 New Crypto Coins for 100X Gains

Nov 17, 2024 am 01:30 AM

Here is the list of the top five new cryptocurrencies to invest in before they skyrocket. These newly launched projects possess massive gains

Bitcoin ETF to Drive Market Momentum?

Nov 20, 2024 am 01:24 AM

Bitcoin ETF to Drive Market Momentum?

Nov 20, 2024 am 01:24 AM

The crypto market today has been showcasing an upbeat momentum since Asian trading hours, with the market cap climbing by 1.74% to $3.08 Trillion.