web3.0

web3.0

Token.io Forges Partnership with Santander UK to Enhance Customer Experience and Develop New Real-Time Payment Solutions

Token.io Forges Partnership with Santander UK to Enhance Customer Experience and Develop New Real-Time Payment Solutions

Token.io Forges Partnership with Santander UK to Enhance Customer Experience and Develop New Real-Time Payment Solutions

Account-to-account (A2A) payment infrastructure company Token.io has forged a partnership with Santander UK. The goal of the collaboration is for the bank to leverage

Account-to-account (A2A) payment infrastructure company Token.io has announced a partnership with Santander UK.

The collaboration will see the bank leverage Token.io’s open banking connectivity and infrastructure to enhance the customer experience and develop new, real-time payment solutions.

Santander will begin by using Token.io’s infrastructure to enable direct payments from external bank accounts as an option for credit card repayments, creating a more seamless payment experience compared to both direct debit and manual bank transfer.

These direct A2A payments for card repayments also support biometric Strong Customer Authentication (SCA) for payments made on mobile devices.

“We are thrilled to partner with Santander, a forward-thinking institution committed to driving open banking innovation and enhancing the experience of millions of customers,” Token.io CEO Todd Clyde said. “Token.io’s technology, combined with Santander’s dedication to exceptional service, will undoubtedly set new standards for how financial institutions leverage open banking to create innovative value propositions that meet the evolving needs of consumers and businesses.”

A subsidiary of Banco Santander, Santander UK has more than 14 million customers in the U.K. The bank offers mortgages, auto financing, unsecured loans, credit cards, banking, savings and investment accounts, as well as insurance products.

In addition to using Token.io’s technology to support its A2A offering, Santander UK also plans to leverage the fintech’s infrastructure to enhance its real-time money movement capabilities for its retail banking customers.

The news follows Token.io’s recent announcement that it had expanded its partnership with global payments platform Ecommpay.

The global payments platform added Token.io’s virtual accounts in four new markets — France, Ireland, the Netherlands, and Spain — to its Open Banking Advanced solution.

The virtual accounts will enable e-commerce companies to get real-time settlement confirmation and make API-powered refunds or payouts, boosting both the speed and efficiency of transactions.

“Our partnership with Ecommpay continues to demonstrate the immense potential of open banking in transforming payment experiences and also highlights the opportunities that PSPs can realize when they embrace innovative, customer-centric solutions,” Clyde said.

Token.io made its Finovate debut at FinovateSpring 2015 and returned to the Finovate stage two years later at FinovateEurope in London.

The company provides direct connectivity to more than 567 million bank accounts in 20 markets. Token.io’s customers include HSBC, BNP Paribas, and Global Payments, as well as fellow Finovate alums Mastercard and ACI Worldwide.

The company has raised $90 million in funding according to Crunchbase, most recently securing a Series C investment of $40 million in 2022.

The above is the detailed content of Token.io Forges Partnership with Santander UK to Enhance Customer Experience and Develop New Real-Time Payment Solutions. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1664

1664

14

14

1421

1421

52

52

1315

1315

25

25

1266

1266

29

29

1239

1239

24

24

BlockDAG CEO Antony Turner: Pioneering Partnerships in Crypto

Aug 01, 2024 am 03:47 AM

BlockDAG CEO Antony Turner: Pioneering Partnerships in Crypto

Aug 01, 2024 am 03:47 AM

Amid an ongoing $63.9 million presale, Turner's strategic vision for BlockDAG sets the stage for groundbreaking partnerships and technological advancements

Rollblock Innovation Bringing Design to Fruition With 1000x Potential Instigating Memecoin Mass Exodus For PEPE and DOGE Patrons

Aug 14, 2024 pm 03:24 PM

Rollblock Innovation Bringing Design to Fruition With 1000x Potential Instigating Memecoin Mass Exodus For PEPE and DOGE Patrons

Aug 14, 2024 pm 03:24 PM

Meme coins Pepe and Dogecoin have rebounded after a disappointing start to August. But this hasn’t stopped investors looking at alternatives.

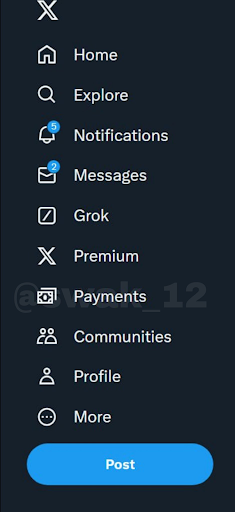

X (Formerly Twitter) Payments Feature Now In The Development Stage, Will Dogecoin Payments Be Included?

Aug 07, 2024 pm 12:46 PM

X (Formerly Twitter) Payments Feature Now In The Development Stage, Will Dogecoin Payments Be Included?

Aug 07, 2024 pm 12:46 PM

In a recent development, the X (formerly Twitter) platform has included the payments feature in its latest software release. This has once again

Renowned Developer Manu Kabrera Lauds the Incredible Evolution of the Hedera Blockchain (HBAR), Tipping It to Lead the Next Wave of Blockchain Innovation

Sep 08, 2024 pm 03:09 PM

Renowned Developer Manu Kabrera Lauds the Incredible Evolution of the Hedera Blockchain (HBAR), Tipping It to Lead the Next Wave of Blockchain Innovation

Sep 08, 2024 pm 03:09 PM

In a post dated September 5, Kabrera explained that his position is based on seven key undeniable factors ranging from enviable community support to building an industry standard foundation.

Cosmoverse, the Largest Interchain Conference, Returns to Dubai from October 21 - 27, 2024

Aug 08, 2024 pm 06:18 PM

Cosmoverse, the Largest Interchain Conference, Returns to Dubai from October 21 - 27, 2024

Aug 08, 2024 pm 06:18 PM

Cosmoverse provides the opportunity for new projects and builders to connect with enterprises, institutions, governments, and other like-minded individuals.

Stablecoins Increasingly Used for Savings, Payments in Emerging Countries, but Crypto Trading Still Leads: Report

Sep 13, 2024 am 03:27 AM

Stablecoins Increasingly Used for Savings, Payments in Emerging Countries, but Crypto Trading Still Leads: Report

Sep 13, 2024 am 03:27 AM

Commissioned by Brevan Howard and Castle Island Hill, the survey covered more than 2,500 crypto users in Brazil, Nigeria, Turkey, Indonesia and India.

How Is Blockchain Utilized in Journey?

Aug 12, 2024 pm 12:04 PM

How Is Blockchain Utilized in Journey?

Aug 12, 2024 pm 12:04 PM

Touring must be comfy, cost-effective, and, most significantly, fulfilling. Whereas charges, reserving irregularities, unhealthy opinions, and lengthy strains could also be symptomatic of the present journey atmosphere, blockchain is providing a appr

Louisiana Becomes One of the Few US States to Allow Residents to Use Bitcoin (BTC) and Circle's USDC to Make Payments to State Agencies

Sep 21, 2024 am 06:30 AM

Louisiana Becomes One of the Few US States to Allow Residents to Use Bitcoin (BTC) and Circle's USDC to Make Payments to State Agencies

Sep 21, 2024 am 06:30 AM

This initiative aims to enhance customer service and may expand to other departments in the future.