web3.0

web3.0

Nvidia Overtakes Apple to Become the World's Most Valuable Company, Triggering a Surge in AI-Related Cryptocurrencies

Nvidia Overtakes Apple to Become the World's Most Valuable Company, Triggering a Surge in AI-Related Cryptocurrencies

Nvidia Overtakes Apple to Become the World's Most Valuable Company, Triggering a Surge in AI-Related Cryptocurrencies

The milestone came after a 2.9% increase in the company's share price on Tuesday, pushing it past Apple's $3.38 trillion valuation.

Nvidia Surges Past Apple to Become World’s Most Valuable Company at $3.43 Trillion

In a historic shift in the technology sector, Nvidia (NASDAQ:NVDA) has overtaken Apple (NASDAQ:AAPL) to become the world's most valuable company, reaching a market capitalization of $3.43 trillion.

The milestone came after a 2.9% increase in the company’s share price on Tuesday, pushing it past Apple's $3.38 trillion valuation.

The semiconductor manufacturer's rise reflects its central role in the artificial intelligence boom, as its specialized chips have become essential components for major technology companies developing AI systems.

Since the end of 2022, Nvidia’s stock value has grown by more than 850%, largely driven by strong demand for its AI processors.

Major tech companies including Microsoft (NASDAQ:MSFT), Alphabet (NASDAQ:GOOGL), Amazon (NASDAQ:AMZN), and Meta (NASDAQ:META) heavily rely on Nvidia’s chips to power their AI systems.

This widespread adoption has helped fuel Nvidia’s rapid growth, with Wall Street analysts expecting the company to double its earnings this fiscal year.

The company’s success has created a ripple effect in the cryptocurrency market, particularly affecting digital currencies focused on artificial intelligence.

NEAR Protocol, a blockchain platform designed for AI applications, saw its value increase by 5.46%, reaching $3.81 with a daily trading volume of $222 million.

Internet Computer, another blockchain project centered on AI capabilities, experienced a 4.99% rise, trading at $7.37 with a $57 million trading volume. These gains show growing investor interest in cryptocurrencies linked to artificial intelligence technology.

Bittensor, a decentralized AI platform, recorded even stronger performance with a 14.65% increase, reaching $482.41. The growth suggests market confidence in decentralized artificial intelligence solutions.

The Artificial Superintelligence Alliance token also showed positive momentum, rising 10.96% to reach $1.25. Injective, a blockchain platform enabling decentralized AI applications, joined the upward trend with a 6.26% increase, trading at $17.34.

Nvidia's influence extends beyond its own stock price, as it now represents 7% of the S&P 500 Index's weight. The company has contributed to approximately one-quarter of the S&P 500's 21% gain this year, helping establish AI-related stocks among the top performers in 2024.

"Nvidia's position as the world's largest company reflects investors' anticipation of continued growth in the AI market," said Fall Ainina, director of research at James Investment Research.

"The surging prices of AI cryptocurrencies appear directly linked to Nvidia's market performance. As more companies integrate AI into their operations, we may continue to see both stock and crypto rallies driven by AI."

However, Nvidia faces some regulatory challenges in its expansion efforts. The European Commission has started reviewing the company’s planned $700 million acquisition of Israeli AI startup Run Labs Ltd, adding a note of caution to the company's growth trajectory.

The cryptocurrency market's response to Nvidia's success highlights the growing connection between traditional technology companies and digital assets.

AI-focused cryptocurrencies have emerged as a new category of digital assets attracting investors interested in both blockchain technology and artificial intelligence.

Trading volumes for AI-related cryptocurrencies have increased alongside their prices, indicating broader market participation in this sector.

The NEAR Protocol’s daily trading volume of $222 million demonstrates active trader interest in AI-blockchain combinations.

These market movements suggest that investors are seeking exposure to artificial intelligence technology through various investment vehicles, including both traditional stocks and cryptocurrencies. The parallel rise in Nvidia's stock price and AI cryptocurrency values indicates market-wide recognition of AI's growing importance.

Recent market data shows consistent trading patterns across AI-focused assets, with both traditional stocks and cryptocurrencies showing correlated price movements. This trend has been particularly evident in the days following Nvidia's market cap milestone.

The above is the detailed content of Nvidia Overtakes Apple to Become the World's Most Valuable Company, Triggering a Surge in AI-Related Cryptocurrencies. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1655

1655

14

14

1414

1414

52

52

1307

1307

25

25

1255

1255

29

29

1228

1228

24

24

How to solve the problem that the NVIDIA graphics card screen recording shortcut key cannot be used?

Mar 13, 2024 pm 03:52 PM

How to solve the problem that the NVIDIA graphics card screen recording shortcut key cannot be used?

Mar 13, 2024 pm 03:52 PM

NVIDIA graphics cards have their own screen recording function. Users can directly use shortcut keys to record the desktop or game screen. However, some users reported that the shortcut keys cannot be used. So what is going on? Now, let this site give users a detailed introduction to the problem of the N-card screen recording shortcut key not responding. Analysis of the problem of NVIDIA screen recording shortcut key not responding Method 1, automatic recording 1. Automatic recording and instant replay mode. Players can regard it as automatic recording mode. First, open NVIDIA GeForce Experience. 2. After calling out the software menu with the Alt+Z key, click the Open button under Instant Replay to start recording, or use the Alt+Shift+F10 shortcut key to start recording.

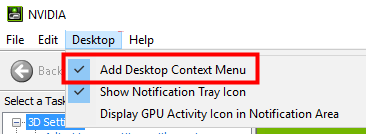

How to solve the problem of nvidia control panel when right-clicking in Win11?

Feb 20, 2024 am 10:20 AM

How to solve the problem of nvidia control panel when right-clicking in Win11?

Feb 20, 2024 am 10:20 AM

How to solve the problem of nvidia control panel when right-clicking in Win11? Many users often need to open the nvidia control panel when using their computers, but many users find that they cannot find the nvidia control panel. So what should they do? Let this site carefully introduce to users the solution to the problem that there is no nvidia control panel in Win11 right-click. Solution to Win11 right-click not having nvidia control panel 1. Make sure it is not hidden. Press Windows+R on the keyboard to open a new run box and enter control. In the upper right corner, under View by: select Large icons. Open the NVIDIA Control Panel and hover over the desktop options to view

Cyberpunk 2077 sees up to a 40% performance boost with new optimized path tracing mod

Aug 10, 2024 pm 09:45 PM

Cyberpunk 2077 sees up to a 40% performance boost with new optimized path tracing mod

Aug 10, 2024 pm 09:45 PM

One of the standout features ofCyberpunk 2077is path tracing, but it can put a heavy toll on performance. Even systems with reasonably capable graphics cards, such as the RTX 4080 (Gigabyte AERO OC curr. $949.99 on Amazon), struggle to offer a stable

AMD Radeon RX 7800M in OneXGPU 2 outperforms Nvidia RTX 4070 Laptop GPU

Sep 09, 2024 am 06:35 AM

AMD Radeon RX 7800M in OneXGPU 2 outperforms Nvidia RTX 4070 Laptop GPU

Sep 09, 2024 am 06:35 AM

OneXGPU 2 is the first eGPUto feature the Radeon RX 7800M, a GPU that even AMD hasn't announced yet. As revealed by One-Netbook, the manufacturer of the external graphics card solution, the new AMD GPU is based on RDNA 3 architecture and has the Navi

Detailed explanation of what to do if NVIDIA graphics card driver installation fails

Mar 14, 2024 am 08:43 AM

Detailed explanation of what to do if NVIDIA graphics card driver installation fails

Mar 14, 2024 am 08:43 AM

NVIDIA is currently the most popular graphics card manufacturer, and many users prefer to install NVIDIA graphics cards on their computers. However, you will inevitably encounter some problems during use, such as NVIDIA driver installation failure. How to solve this? There are many reasons for this situation. Let’s take a look at the specific solutions. Step 1: Download the latest graphics card driver You need to go to the NVIDIA official website to download the latest driver for your graphics card. Once on the driver page, select your product type, product series, product family, operating system, download type and language. After clicking search, the website will automatically query the driver version suitable for you. With GeForceRTX4090

Where is the preferred graphics processor in the nvidia control panel - Introduction to the location of the preferred graphics processor in the nvidia control panel

Mar 04, 2024 pm 01:50 PM

Where is the preferred graphics processor in the nvidia control panel - Introduction to the location of the preferred graphics processor in the nvidia control panel

Mar 04, 2024 pm 01:50 PM

Friends, do you know where the preferred graphics processor of the nvidia control panel is? Today I will explain the location of the preferred graphics processor of the nvidia control panel. If you are interested, come and take a look with the editor. I hope it can help you. . 1. We need to right-click a blank space on the desktop and open the "nvidia Control Panel" (as shown in the picture). 2. Then enter "Manage 3D Settings" under "3D Settings" on the left (as shown in the picture). 3. After entering, you can find "Preferred Graphics Processor" on the right (as shown in the picture).

How to solve unable to connect to nvidia

Dec 06, 2023 pm 03:18 PM

How to solve unable to connect to nvidia

Dec 06, 2023 pm 03:18 PM

Solutions for being unable to connect to nvidia: 1. Check the network connection; 2. Check the firewall settings; 3. Check the proxy settings; 4. Use other network connections; 5. Check the NVIDIA server status; 6. Update the driver; 7. Restart Start NVIDIA's network service. Detailed introduction: 1. Check the network connection to ensure that the computer is connected to the Internet normally. You can try to restart the router or adjust the network settings to ensure that you can connect to the NVIDIA service; 2. Check the firewall settings, the firewall may block the computer, etc.

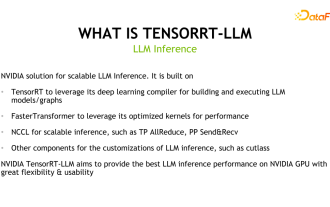

Uncovering the NVIDIA large model inference framework: TensorRT-LLM

Feb 01, 2024 pm 05:24 PM

Uncovering the NVIDIA large model inference framework: TensorRT-LLM

Feb 01, 2024 pm 05:24 PM

1. Product positioning of TensorRT-LLM TensorRT-LLM is a scalable inference solution developed by NVIDIA for large language models (LLM). It builds, compiles and executes calculation graphs based on the TensorRT deep learning compilation framework, and draws on the efficient Kernels implementation in FastTransformer. In addition, it utilizes NCCL for communication between devices. Developers can customize operators to meet specific needs based on technology development and demand differences, such as developing customized GEMM based on cutlass. TensorRT-LLM is NVIDIA's official inference solution, committed to providing high performance and continuously improving its practicality. TensorRT-LL