Top Platforms for Token Deployment and Their Pros & Cons

When deploying tokens, selecting the right platform is a crucial decision that affects cost, scalability, speed, and security. Each blockchain platform has unique characteristics that cater to different types of token projects, from DeFi applications to NFTs and DAOs. Here’s a list of the top platforms for token deployment, along with their pros and cons.

When deploying tokens, selecting the right platform is a crucial decision that affects cost, scalability, speed, and security. Each blockchain platform has unique characteristics that cater to different types of token projects, from DeFi applications to NFTs and DAOs. Here’s a list of the top platforms for token deployment, along with their pros and cons.

1. Ethereum

Overview: Ethereum is the most established and widely used blockchain for token deployment, especially for ERC-20 (fungible) and ERC-721/ERC-1155 (non-fungible) tokens. It powers a significant portion of DeFi and NFT projects.

Pros:

Widespread Adoption: Largest developer community, extensive documentation, and robust infrastructure.

High Security: Strong security due to the large network of validators and historical resilience.

Interoperability: Supported by most crypto exchanges, wallets, and DeFi protocols.

Cons:

High Gas Fees: Transactions can be costly, especially during peak times.

Scalability Issues: Although Ethereum 2.0 is addressing scalability with Proof of Stake (PoS), high demand can lead to slower processing times.

Complexity: Development can be challenging for beginners due to intricate smart contract functionality.

2. Binance Smart Chain (BSC)

Overview: BSC is a blockchain developed by Binance to enable faster and cheaper transactions. It's compatible with Ethereum, making it easy for Ethereum-based projects to migrate or deploy on BSC.

Pros:

Low Fees: Significantly lower gas fees compared to Ethereum.

High Speed: Fast transaction processing due to a more centralized validator structure.

EVM Compatibility: Supports Ethereum-based smart contracts and dApps, allowing easy migration for developers.

Cons:

Centralization Concerns: BSC’s validators are controlled by Binance, raising concerns over decentralization.

Security: Past incidents have shown vulnerabilities in some BSC-based projects due to weaker security.

Limited Developer Community: Smaller community and fewer resources than Ethereum.

3. Solana

Overview: Solana is known for its high-performance blockchain that enables fast and low-cost transactions. It’s popular for applications requiring scalability, such as DeFi and NFT marketplaces.

Pros:

High Throughput: Capable of processing over 50,000 transactions per second (TPS).

Low Fees: Minimal transaction costs, making it attractive for micro-transactions and high-frequency trading.

Scalability: Designed for large-scale applications with rapid growth in the ecosystem.

Cons:

Network Outages: Solana has faced several outages due to high transaction volumes and technical issues.

Less Decentralized: Smaller validator set compared to Ethereum, raising questions about centralization.

Learning Curve: Uses the Rust programming language, which has a steeper learning curve than Solidity.

4. Polygon (formerly Matic Network)

Overview: Polygon is a Layer 2 scaling solution for Ethereum, providing a sidechain that improves Ethereum’s transaction speed and reduces costs.

Pros:

Low Transaction Fees: Much lower than Ethereum, suitable for high-volume transactions.

Fast Transactions: Higher throughput due to sidechain structure.

Ethereum-Compatible: Leverages Ethereum’s security while offering improved scalability.

Cons:

Limited Validators: Has fewer validators than Ethereum, affecting decentralization.

Reliance on Ethereum: Dependent on Ethereum’s main chain for final security, which may slow down in periods of congestion.

Security: Being a Layer 2 solution, it may not be as secure as deploying directly on Ethereum.

5. Avalanche

Overview: Avalanche is a high-speed, low-cost blockchain with subnets to customize blockchains for specific applications, making it flexible for DeFi, NFT, and enterprise solutions.

Pros:

Fast and Scalable: Can handle thousands of TPS with low latency.

Customizable Subnets: Allows developers to create custom blockchains tailored to their applications.

Low Transaction Costs: Low fees make it competitive for dApps and DeFi.

Cons:

Smaller Community: Newer ecosystem with a smaller developer base and limited resources compared to Ethereum.

Complex Development: Setting up subnets can be complex for developers unfamiliar with Avalanche.

Growing Pains: Limited history means less tested security and resilience in high-stakes scenarios.

6. Cardano

Overview: Cardano is a third-generation blockchain known for its research-driven approach and commitment to high security and scalability. Its native tokens use the “Cardano Native Tokens” standard.

Pros:

Scalable and Secure: Uses a PoS consensus model designed for high security and energy efficiency.

Research-Based: Developed through peer-reviewed research and rigorous academic testing.

Affordable Transactions: Lower transaction costs compared to Ethereum.

Cons:

Limited DeFi and NFT Support: Fewer DeFi projects and NFT platforms due to slower ecosystem growth.

Complex Programming Language: Cardano’s Plutus language (based on Haskell) has a steeper learning curve.

Slow Development: Due to its research-first approach, updates and new features are released slowly.

7. Polkadot

Overview: Polkadot enables interoperability between different blockchains and supports custom “parachains,” making it ideal for cross-chain projects.

Pros:

Interoperability: Allows for seamless communication and asset transfer between different blockchains.

Custom Parachains: Developers can create dedicated chains for specific applications, improving flexibility.

Scalable and Fast: Uses parallel processing, which boosts scalability.

Cons:

Complex Setup: Building parachains requires technical knowledge and can be resource-intensive.

Higher Costs for Parachain Slots: Leasing parachain slots can be expensive, making it less ideal for smaller projects.

Smaller Developer Ecosystem: Fewer resources and a smaller community compared to Ethereum and BSC.

8. Tezos

Overview: Tezos is a self-amending blockchain known for its focus on governance and on-chain upgrades, allowing it to adapt and improve over time without hard forks.

Pros:

Governance and Upgrades: Built-in governance system enables community-driven upgrades without forks.

Low Fees and Energy Efficient: Uses PoS, making it affordable and eco-friendly.

High Security: Formal verification for smart contracts ensures high security.

Cons:

Less Popular for DeFi and NFTs: Fewer DeFi and NFT projects than other blockchains.

Slow Adoption: Smaller user base and developer community, making it challenging to find support and resources.

Complex Development: Unique language (Michelson) can be challenging for developers familiar with Solidity.

9. Algorand

Overview: Algorand is a blockchain with a pure Proof-of-Stake consensus, offering fast transaction speeds and low fees. It’s well-suited for scalable dApps and DeFi projects.

Pros:

Fast and Affordable: High-speed transactions with low fees, making it ideal for high-volume applications.

Environmentally Friendly: Pure PoS model is energy-efficient.

Scalable: Designed to handle a high number of transactions per second.

Cons:

Smaller Ecosystem: Fewer dApps and resources than larger ecosystems like Ethereum.

Limited DeFi Presence: DeFi options are growing, but still limited compared to BSC or Ethereum.

Learning Curve: Uses a different programming language (Clarity), which may require additional learning.

Conclusion

Each of these platforms offers unique benefits, from Ethereum’s established ecosystem and security to Solana’s speed and low fees. Your choice of platform will largely depend on your project’s specific needs, such as cost efficiency, transaction speed, security, and community support. Evaluating the pros and cons of each platform will help you find the best fit for your token deployment, setting your project up for success in a competitive and evolving blockchain landscape.

DeployTokens Important Links

Website | Telegram | Twitter

The above is the detailed content of Top Platforms for Token Deployment and Their Pros & Cons. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1664

1664

14

14

1421

1421

52

52

1315

1315

25

25

1266

1266

29

29

1239

1239

24

24

Demystifying JavaScript: What It Does and Why It Matters

Apr 09, 2025 am 12:07 AM

Demystifying JavaScript: What It Does and Why It Matters

Apr 09, 2025 am 12:07 AM

JavaScript is the cornerstone of modern web development, and its main functions include event-driven programming, dynamic content generation and asynchronous programming. 1) Event-driven programming allows web pages to change dynamically according to user operations. 2) Dynamic content generation allows page content to be adjusted according to conditions. 3) Asynchronous programming ensures that the user interface is not blocked. JavaScript is widely used in web interaction, single-page application and server-side development, greatly improving the flexibility of user experience and cross-platform development.

The Evolution of JavaScript: Current Trends and Future Prospects

Apr 10, 2025 am 09:33 AM

The Evolution of JavaScript: Current Trends and Future Prospects

Apr 10, 2025 am 09:33 AM

The latest trends in JavaScript include the rise of TypeScript, the popularity of modern frameworks and libraries, and the application of WebAssembly. Future prospects cover more powerful type systems, the development of server-side JavaScript, the expansion of artificial intelligence and machine learning, and the potential of IoT and edge computing.

JavaScript Engines: Comparing Implementations

Apr 13, 2025 am 12:05 AM

JavaScript Engines: Comparing Implementations

Apr 13, 2025 am 12:05 AM

Different JavaScript engines have different effects when parsing and executing JavaScript code, because the implementation principles and optimization strategies of each engine differ. 1. Lexical analysis: convert source code into lexical unit. 2. Grammar analysis: Generate an abstract syntax tree. 3. Optimization and compilation: Generate machine code through the JIT compiler. 4. Execute: Run the machine code. V8 engine optimizes through instant compilation and hidden class, SpiderMonkey uses a type inference system, resulting in different performance performance on the same code.

Python vs. JavaScript: The Learning Curve and Ease of Use

Apr 16, 2025 am 12:12 AM

Python vs. JavaScript: The Learning Curve and Ease of Use

Apr 16, 2025 am 12:12 AM

Python is more suitable for beginners, with a smooth learning curve and concise syntax; JavaScript is suitable for front-end development, with a steep learning curve and flexible syntax. 1. Python syntax is intuitive and suitable for data science and back-end development. 2. JavaScript is flexible and widely used in front-end and server-side programming.

JavaScript: Exploring the Versatility of a Web Language

Apr 11, 2025 am 12:01 AM

JavaScript: Exploring the Versatility of a Web Language

Apr 11, 2025 am 12:01 AM

JavaScript is the core language of modern web development and is widely used for its diversity and flexibility. 1) Front-end development: build dynamic web pages and single-page applications through DOM operations and modern frameworks (such as React, Vue.js, Angular). 2) Server-side development: Node.js uses a non-blocking I/O model to handle high concurrency and real-time applications. 3) Mobile and desktop application development: cross-platform development is realized through ReactNative and Electron to improve development efficiency.

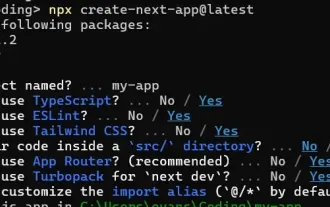

How to Build a Multi-Tenant SaaS Application with Next.js (Frontend Integration)

Apr 11, 2025 am 08:22 AM

How to Build a Multi-Tenant SaaS Application with Next.js (Frontend Integration)

Apr 11, 2025 am 08:22 AM

This article demonstrates frontend integration with a backend secured by Permit, building a functional EdTech SaaS application using Next.js. The frontend fetches user permissions to control UI visibility and ensures API requests adhere to role-base

From C/C to JavaScript: How It All Works

Apr 14, 2025 am 12:05 AM

From C/C to JavaScript: How It All Works

Apr 14, 2025 am 12:05 AM

The shift from C/C to JavaScript requires adapting to dynamic typing, garbage collection and asynchronous programming. 1) C/C is a statically typed language that requires manual memory management, while JavaScript is dynamically typed and garbage collection is automatically processed. 2) C/C needs to be compiled into machine code, while JavaScript is an interpreted language. 3) JavaScript introduces concepts such as closures, prototype chains and Promise, which enhances flexibility and asynchronous programming capabilities.

Building a Multi-Tenant SaaS Application with Next.js (Backend Integration)

Apr 11, 2025 am 08:23 AM

Building a Multi-Tenant SaaS Application with Next.js (Backend Integration)

Apr 11, 2025 am 08:23 AM

I built a functional multi-tenant SaaS application (an EdTech app) with your everyday tech tool and you can do the same. First, what’s a multi-tenant SaaS application? Multi-tenant SaaS applications let you serve multiple customers from a sing