Stablecoins: The Future of Payments or a Ticking Regulatory Time Bomb?

Stablecoins have positioned themselves as game-changers — providing the bridge between traditional finance (TradFi) and the world of decentralized finance (DeFi).

Stablecoins, a bridge between traditional finance (TradFi) and decentralized finance (DeFi), have become essential in the crypto economy. Their role in payments is undeniable, but so is the global regulatory scrutiny they face.

What defines Stablecoins?

Stablecoins are digital currencies pegged to a stable asset, usually a fiat currency like the U.S. dollar, to minimize price volatility. Unlike Bitcoin or Ethereum, whose values fluctuate dramatically, Stablecoins provide the stability needed for payments and everyday transactions.

According to the International Monetary Fund (IMF), Stablecoins had a global market capitalization of over $130 billion in 2023, a 500 percent increase since 2020.

In the UAE, Stablecoins are particularly attractive for fast, cost-efficient cross-border payments. A 2024 Cointelegraph article indicated that nearly 50 percent of cross-border payments in the UAE’s fintech sector are now facilitated through Stablecoins, a significant rise from just 20 percent in 2020.

Disrupting traditional finance

Stablecoins promise to democratize payments on a global scale.

With transaction fees as low as 0.1 percent compared to the 1.5 percent to 3 percent charged by traditional financial institutions, they’re revolutionizing remittances, which are crucial for many developing economies.

According to the World Bank, remittance flows to low- and middle-income countries reached $840 billion globally in 2023, a significant portion of which was facilitated by Stablecoin transfers.

In the UAE, a key financial hub in the Middle East, Stablecoins are increasingly used for remittances. UAE expats sent over $47 billion in remittances in 2023, with Stablecoins playing an instrumental role in reducing costs and increasing transaction speed.

With over 200 nationalities in the UAE, this technology has the potential to reshape the region’s financial landscape, allowing migrants to send money back home at lower fees and in real time.

The regulatory spotlight: Friend or foe?

But this potential comes with challenges.

Globally, Stablecoins face intense regulatory scrutiny, with governments fearing they may undermine monetary sovereignty. Both the European Union and the U.S. Federal Reserve have expressed concerns about Stablecoins’ impact on financial stability. The TerraUSD (UST) algorithmic Stablecoin collapse in 2022 further exacerbated these concerns, triggering market-wide panic and raising questions about the viability of algorithmic Stablecoins.

In the UAE, the Dubai Virtual Asset Regulatory Authority (VARA) is leading the charge on Stablecoin regulations, ensuring their growth is sustainable.

VARA recently imposed new guidelines on asset-backed Stablecoins, requiring strict auditing and transparency and ensuring that each issued token is backed 1:1 by reserve assets. Additionally, foreign currency-backed Stablecoins like USDC can only be used for purchasing virtual assets within the UAE, while the new Dirham-backed Stablecoins offer enhanced transaction stability.

Moreover, the UAE Central Bank (CBUAE) is playing a crucial role. It oversees the issuance of Dirham-backed Stablecoins and implements frameworks for foreign Stablecoins to be used under specific conditions. With its comprehensive regulatory frameworks, the UAE is positioning itself as a leader in Stablecoin innovation.

The global view: Adoption versus risk

Globally, Stablecoin adoption is accelerating. According to Chainalysis, 60 percent of businesses involved in cross-border trade have now adopted Stablecoins for payments, up from 25 percent in 2021.

Stablecoins reduce the friction associated with traditional banking systems, particularly in regions with volatile currencies or limited banking infrastructure, offering an alternative that is fast, dependable and secure.

However, their rise isn’t without risk. The Bank for International Settlements (BIS) has warned of potential risks in using Stablecoins as they are often governed by private institutions, leading to questions of transparency and reserve adequacy. There’s also the risk of de-pegging, where the value of a Stablecoin might fall below its fiat equivalent, as seen in some algorithmic Stablecoin models. Globally, regulators are pushing for a common framework to ensure Stablecoins do not become ‘too big to fail’.

Future outlook: The UAE at the forefront

The UAE is uniquely positioned to lead in the Stablecoin revolution. With regulatory clarity and a forward-thinking approach, the country could become a global center for Stablecoin innovation. In fact, the Dubai International Financial Centre (DIFC) is actively working to create a regulatory sandbox for Stablecoins, allowing fintech firms to experiment with this technology under controlled conditions.

Globally, Stablecoins may be the harbingers of a new era in payments, offering speed, security and cost-effectiveness. However, their future hinges on regulators’ ability to strike the right balance between fostering innovation and ensuring stability.

The UAE, with its regulatory foresight, is already on that path.

The above is the detailed content of Stablecoins: The Future of Payments or a Ticking Regulatory Time Bomb?. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

BlockDAG CEO Antony Turner: Pioneering Partnerships in Crypto

Aug 01, 2024 am 03:47 AM

BlockDAG CEO Antony Turner: Pioneering Partnerships in Crypto

Aug 01, 2024 am 03:47 AM

Amid an ongoing $63.9 million presale, Turner's strategic vision for BlockDAG sets the stage for groundbreaking partnerships and technological advancements

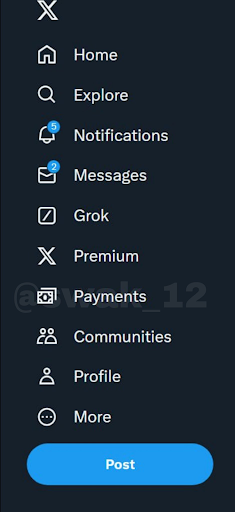

X (Formerly Twitter) Payments Feature Now In The Development Stage, Will Dogecoin Payments Be Included?

Aug 07, 2024 pm 12:46 PM

X (Formerly Twitter) Payments Feature Now In The Development Stage, Will Dogecoin Payments Be Included?

Aug 07, 2024 pm 12:46 PM

In a recent development, the X (formerly Twitter) platform has included the payments feature in its latest software release. This has once again

Stablecoins Increasingly Used for Savings, Payments in Emerging Countries, but Crypto Trading Still Leads: Report

Sep 13, 2024 am 03:27 AM

Stablecoins Increasingly Used for Savings, Payments in Emerging Countries, but Crypto Trading Still Leads: Report

Sep 13, 2024 am 03:27 AM

Commissioned by Brevan Howard and Castle Island Hill, the survey covered more than 2,500 crypto users in Brazil, Nigeria, Turkey, Indonesia and India.

Louisiana Becomes One of the Few US States to Allow Residents to Use Bitcoin (BTC) and Circle's USDC to Make Payments to State Agencies

Sep 21, 2024 am 06:30 AM

Louisiana Becomes One of the Few US States to Allow Residents to Use Bitcoin (BTC) and Circle's USDC to Make Payments to State Agencies

Sep 21, 2024 am 06:30 AM

This initiative aims to enhance customer service and may expand to other departments in the future.

Stablecoin Market Endured High Degrees of Volatility Over the Weekend as the Crypto Market Crashed

Aug 06, 2024 am 09:13 AM

Stablecoin Market Endured High Degrees of Volatility Over the Weekend as the Crypto Market Crashed

Aug 06, 2024 am 09:13 AM

Only two of the top 20 stablecoins by market capitalization lost their peg for more than an hour, and both of them rebounded back by 1:00 am EST Monday.

Stablecoins vs Tokenized Deposits: Why the Differences Matter

Sep 11, 2024 am 03:37 AM

Stablecoins vs Tokenized Deposits: Why the Differences Matter

Sep 11, 2024 am 03:37 AM

Tokenized deposits and stablecoins may sound like the same thing, given that they are both fiat-on-chain. But they are actually distinct concepts, and the difference matters not just for use cases and our understanding of blockchain potential, but al

Stablecoins: The Future of Payments or a Ticking Regulatory Time Bomb?

Nov 12, 2024 pm 03:12 PM

Stablecoins: The Future of Payments or a Ticking Regulatory Time Bomb?

Nov 12, 2024 pm 03:12 PM

Stablecoins have positioned themselves as game-changers — providing the bridge between traditional finance (TradFi) and the world of decentralized finance (DeFi).

Circle CEO Jeremy Allaire Says Stablecoins Will Become a Critical Part of Hong Kong's Trade Settlements

Oct 31, 2024 am 12:54 AM

Circle CEO Jeremy Allaire Says Stablecoins Will Become a Critical Part of Hong Kong's Trade Settlements

Oct 31, 2024 am 12:54 AM

According to an Oct. 30 report on South China Morning Post, Jeremy Allaire said Circle(cUSDC) is targeting Hong Kong for its “global network of stablecoins” that will make transactions cheaper and faster for markets trading through Hong Kong.