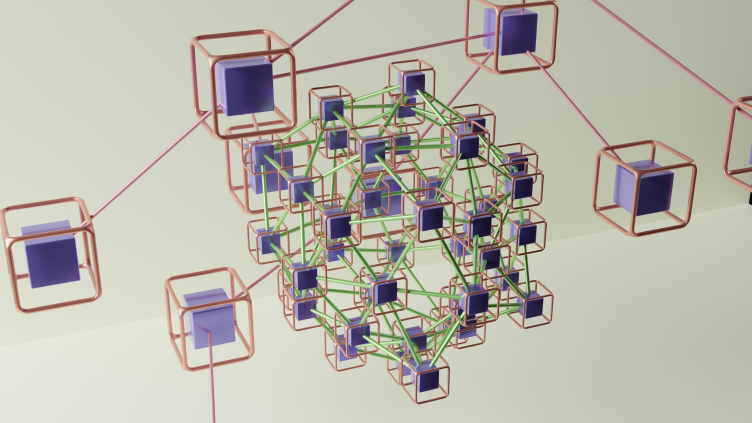

web3.0

web3.0

DeFi Technologies Announces Plans to Launch CoreFi Strategy, a New Investment Vehicle Targeting Bitcoin and Its Associated DeFi Ecosystem

DeFi Technologies Announces Plans to Launch CoreFi Strategy, a New Investment Vehicle Targeting Bitcoin and Its Associated DeFi Ecosystem

DeFi Technologies Announces Plans to Launch CoreFi Strategy, a New Investment Vehicle Targeting Bitcoin and Its Associated DeFi Ecosystem

Scheduled to debut in the first quarter of 2025, the initiative will operate on a Canadian stock exchange, according to a press release from the company.

Canadian DeFi firm DeFi Technologies (CBOE:DEFI) has announced its upcoming venture, CoreFi Strategy, designed to offer investors a path to Bitcoin and its decentralized finance (DeFi) ecosystem.

Scheduled to launch in Q1 2025 on a Canadian stock exchange, the initiative will provide exposure to Bitcoin staking, a key element in securing the network and generating rewards for those holding the cryptocurrency.

“This new CoreFi Strategy will provide investors with a compelling opportunity to gain exposure to the rapidly growing Bitcoin staking ecosystem through a first-of-its-kind investment vehicle trading on a Canadian stock exchange,” said Olivier Roussy Newton, CEO of DeFi Technologies.

The company noted the successful models that have achieved substantial stock price appreciation, highlighting MicroStrategy's shares rising over 500% in the past year and Bitcoin itself increasing by approximately 150%.

“This initiative aligns with our commitment to offering innovative and diversified investment products that cater to the evolving needs of investors,” added Newton.

DeFi Technologies currently operates two closed-end funds listed on the Canadian Stock Exchange. The funds, named Gamma and Eta, trade at a premium to their net asset value (NAV), offering investors a way to gain exposure to a basket of cryptocurrencies.

The firm's Gamma fund, which focuses on large-cap cryptocurrencies, has seen its NAV increase by 120% since its launch in December 2020. At the same time, the Eta fund, which invests in smaller-cap cryptocurrencies, has seen its NAV rise by over 300%.

The above is the detailed content of DeFi Technologies Announces Plans to Launch CoreFi Strategy, a New Investment Vehicle Targeting Bitcoin and Its Associated DeFi Ecosystem. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1378

1378

52

52

South Korea's Public Pension Fund Makes Indirect Bet on Bitcoin by Buying $34M of MicroStrategy Shares

Aug 16, 2024 pm 09:40 PM

South Korea's Public Pension Fund Makes Indirect Bet on Bitcoin by Buying $34M of MicroStrategy Shares

Aug 16, 2024 pm 09:40 PM

South Korea's National Pension Service (NPS) has purchased $34 million worth of shares in MicroStrategy, the business intelligence firm that has accumulated

MicroStrategy (MSTR) Stock Experiences Significant Pre-Market Drop of 14.71% on Monday

Aug 05, 2024 pm 09:38 PM

MicroStrategy (MSTR) Stock Experiences Significant Pre-Market Drop of 14.71% on Monday

Aug 05, 2024 pm 09:38 PM

MicroStrategy Inc. MSTR experienced a significant pre-market drop of 14.71% on Monday.

MicroStrategy Beats All Other Companies in S&P 500 With Bitcoin Strategy, Says Michael Saylor

Sep 10, 2024 am 12:30 AM

MicroStrategy Beats All Other Companies in S&P 500 With Bitcoin Strategy, Says Michael Saylor

Sep 10, 2024 am 12:30 AM

Michael Saylor, the co-creator and executive chairman of MicroStrategy business software-making giant, visited the CNBC studio to elaborate on how Bitcoin has helped the company to reach major milestones and surpass other companies in the S&P 500

Michael Saylor Predicts Bitcoin Could Reach $13 Million by 2045, But Challenges Remain

Jul 28, 2024 pm 09:28 PM

Michael Saylor Predicts Bitcoin Could Reach $13 Million by 2045, But Challenges Remain

Jul 28, 2024 pm 09:28 PM

On 27 July 2024, Michael Saylor, Co-Founder and Executive Chairman of MicroStrategy, appeared at the Bitcoin 2024 conference & predicted that Bitcoin

Bitcoin (BTC) Pre-Conference Rally Lifts MicroStrategy (MSTR), MARA (MARA) and Other Crypto Stocks

Jul 26, 2024 pm 09:46 PM

Bitcoin (BTC) Pre-Conference Rally Lifts MicroStrategy (MSTR), MARA (MARA) and Other Crypto Stocks

Jul 26, 2024 pm 09:46 PM

Cryptocurrency stocks rose higher in premarket trading Friday, tracking strong gains in Bitcoin (BTC). The world's largest crypto asset climbed more than 4.7% in the past 24 hours, trading at $67,346.0 as of 09:49 GMT.

Michael Saylor Thinks Bitcoin (BTC) Will Skyrocket Over 19,000% in About Two Decades

Jul 28, 2024 pm 06:16 PM

Michael Saylor Thinks Bitcoin (BTC) Will Skyrocket Over 19,000% in About Two Decades

Jul 28, 2024 pm 06:16 PM

MicroStrategy founder and executive chairman Michael Saylor thinks Bitcoin (BTC) will skyrocket over 19,000% in about two decades.

DeFi Technologies Announces Plans to Launch CoreFi Strategy, a New Investment Vehicle Targeting Bitcoin and Its Associated DeFi Ecosystem

Nov 15, 2024 am 03:40 AM

DeFi Technologies Announces Plans to Launch CoreFi Strategy, a New Investment Vehicle Targeting Bitcoin and Its Associated DeFi Ecosystem

Nov 15, 2024 am 03:40 AM

Scheduled to debut in the first quarter of 2025, the initiative will operate on a Canadian stock exchange, according to a press release from the company.

South Korea's National Pension Service Increases Its Indirect Investment in Bitcoin With a Fresh $33.75 Million in Microstrategy Shares

Aug 17, 2024 am 12:10 AM

South Korea's National Pension Service Increases Its Indirect Investment in Bitcoin With a Fresh $33.75 Million in Microstrategy Shares

Aug 17, 2024 am 12:10 AM

Data confirms the pension service purchased 24,500 shares of US-based software company MicroStrategy in the second quarter of the year.