The Rise of UPI in India: Transforming Digital Payments

India has witnessed a remarkable transformation in its digital economy over the past decade. Among the pivotal innovations fueling this growth, the Unified Payments Interface (UPI) has emerged as a game-changer in how Indians conduct financial transactions. Developed by the National Payments Corporation of India (NPCI) and launched in 2016, UPI has revolutionized digital payments, driving inclusivity, convenience, and economic growth.

This blog explores the journey of UPI, its impact on India's financial ecosystem, and its promising future.

What is UPI?

The Unified Payments Interface (UPI) is a real-time payment system that facilitates inter-bank transactions. It allows users to send or receive money instantly using a mobile device. Unlike traditional payment methods, UPI eliminates the need for extensive bank account details. Instead, a simple Virtual Payment Address (VPA) or QR code is sufficient for seamless transactions.

Key features of UPI include:

- Instant transfer of funds 24/7.

- Interoperability between banks and payment platforms.

- Minimal transaction costs for users.

- Robust security protocols through two-factor authentication.

UPI's simplicity and versatility have made it a preferred payment method for millions of Indians.

The Evolution of UPI

1. Early Development and Launch

The NPCI launched UPI with the aim of creating a unified digital payment ecosystem. Initially, UPI had limited adoption, with only a handful of banks and users participating. However, its potential for convenience quickly caught the attention of individuals, businesses, and financial institutions.

2. Government Support and Policy Push

The Indian government's emphasis on digitization, particularly after the demonetization drive in 2016, gave UPI a significant boost. Initiatives like "Digital India" encouraged the use of digital payments, driving UPI's adoption among merchants and consumers.

3. Integration with Third-Party Apps

Collaboration with third-party apps such as Google Pay, PhonePe, and Paytm expanded UPI's reach exponentially. These apps integrated UPI into their platforms, making it accessible to millions of smartphone users.

4. Expanding Services

Over the years, UPI has evolved to include features like recurring payments, IPO applications, and international remittances. These innovations have further enhanced its utility and appeal.

How UPI Works

UPI operates through a simple and user-friendly process:

- Setup: Users download a UPI-enabled app, link their bank account, and create a Virtual Payment Address (VPA).

- Transactions: To send money, users enter the recipient's VPA, amount, and a personal identification number (PIN). Payments can also be made by scanning QR codes or entering mobile numbers.

- Security: Transactions are secured through two-factor authentication, including device binding and UPI PIN entry.

This straightforward process has democratized digital payments, enabling even first-time users to transact with ease.

Impact of UPI on India’s Economy

1. Financial Inclusion

UPI has significantly contributed to financial inclusion in India. By enabling seamless transactions on basic smartphones, UPI has brought banking services to the underbanked and unbanked populations. Its simplicity and accessibility have empowered rural and low-income users to participate in the digital economy.

2. Boost to Small Businesses

For small businesses and merchants, UPI has been a boon. It eliminates the need for expensive point-of-sale systems, allowing businesses to accept payments through QR codes or mobile apps. This has enabled many micro, small, and medium enterprises (MSMEs) to thrive in a competitive market.

3. Cashless Economy

UPI has played a pivotal role in reducing the reliance on cash. The ease of transferring money digitally has encouraged people to switch from cash-based transactions to digital payments, promoting transparency and reducing corruption.

4. Economic Growth

The widespread adoption of UPI has contributed to economic growth by facilitating faster and more efficient monetary transactions. It has also attracted investments in fintech and other digital payment technologies.

Challenges and Opportunities

While UPI's success story is remarkable, it faces several challenges:

Challenges

- Infrastructure Dependence: UPI requires stable internet connectivity, which can be a limitation in remote areas.

- Fraud and Security Concerns: Despite robust security protocols, instances of phishing and fraud highlight the need for continuous improvements in security measures.

- Interoperability Issues: While UPI is designed to be interoperable, some users still face compatibility issues between different apps or banks.

Opportunities

- Global Expansion: UPI has the potential to become a global payment standard. Efforts to integrate UPI with international payment systems are already underway.

- Innovative Features: Introducing features like voice-enabled transactions and AI-driven fraud detection can enhance the user experience.

- Increased Adoption: Continued efforts to raise awareness and educate users about UPI's benefits can drive adoption, particularly in rural areas.

Future of UPI

UPI's growth trajectory suggests a bright future with numerous possibilities:

- Expansion into New Markets: Partnerships with international entities could make UPI a global player in digital payments.

- Technological Advancements: Integration with emerging technologies like blockchain and AI will further strengthen its capabilities.

- Government Initiatives: Policies promoting digital payments will continue to support UPI's growth.

- Corporate Collaboration: Businesses can leverage UPI for innovative solutions such as embedded payments and loyalty programs.

As technology evolves, UPI is poised to remain at the forefront of

digital payment innovations.

Hexadecimal Software: Your Partner in Digital Transformation

At Hexadecimal Software, we specialize in developing innovative software solutions tailored to the unique needs of businesses. Whether you're looking to integrate UPI into your applications, enhance your fintech offerings, or explore new avenues in digital payments, our team of experts is here to help.

Our commitment to excellence and expertise in cutting-edge technologies make us the ideal partner for your software development journey.

Stay Updated with the Hexadecimal Software Blog

To explore more about digital transformation, fintech, and emerging technologies, visit our Hexadecimal Software Blog. Discover insights, trends, and solutions to stay ahead in the ever-evolving tech landscape.

visit HexaHome's blog on the WTC. This blog will delve into the significance of the WTC, its format, and the current standings as we approach the final stages of the 2023-2025 cycle.

The above is the detailed content of The Rise of UPI in India: Transforming Digital Payments. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1662

1662

14

14

1419

1419

52

52

1311

1311

25

25

1261

1261

29

29

1234

1234

24

24

Demystifying JavaScript: What It Does and Why It Matters

Apr 09, 2025 am 12:07 AM

Demystifying JavaScript: What It Does and Why It Matters

Apr 09, 2025 am 12:07 AM

JavaScript is the cornerstone of modern web development, and its main functions include event-driven programming, dynamic content generation and asynchronous programming. 1) Event-driven programming allows web pages to change dynamically according to user operations. 2) Dynamic content generation allows page content to be adjusted according to conditions. 3) Asynchronous programming ensures that the user interface is not blocked. JavaScript is widely used in web interaction, single-page application and server-side development, greatly improving the flexibility of user experience and cross-platform development.

The Evolution of JavaScript: Current Trends and Future Prospects

Apr 10, 2025 am 09:33 AM

The Evolution of JavaScript: Current Trends and Future Prospects

Apr 10, 2025 am 09:33 AM

The latest trends in JavaScript include the rise of TypeScript, the popularity of modern frameworks and libraries, and the application of WebAssembly. Future prospects cover more powerful type systems, the development of server-side JavaScript, the expansion of artificial intelligence and machine learning, and the potential of IoT and edge computing.

JavaScript Engines: Comparing Implementations

Apr 13, 2025 am 12:05 AM

JavaScript Engines: Comparing Implementations

Apr 13, 2025 am 12:05 AM

Different JavaScript engines have different effects when parsing and executing JavaScript code, because the implementation principles and optimization strategies of each engine differ. 1. Lexical analysis: convert source code into lexical unit. 2. Grammar analysis: Generate an abstract syntax tree. 3. Optimization and compilation: Generate machine code through the JIT compiler. 4. Execute: Run the machine code. V8 engine optimizes through instant compilation and hidden class, SpiderMonkey uses a type inference system, resulting in different performance performance on the same code.

JavaScript: Exploring the Versatility of a Web Language

Apr 11, 2025 am 12:01 AM

JavaScript: Exploring the Versatility of a Web Language

Apr 11, 2025 am 12:01 AM

JavaScript is the core language of modern web development and is widely used for its diversity and flexibility. 1) Front-end development: build dynamic web pages and single-page applications through DOM operations and modern frameworks (such as React, Vue.js, Angular). 2) Server-side development: Node.js uses a non-blocking I/O model to handle high concurrency and real-time applications. 3) Mobile and desktop application development: cross-platform development is realized through ReactNative and Electron to improve development efficiency.

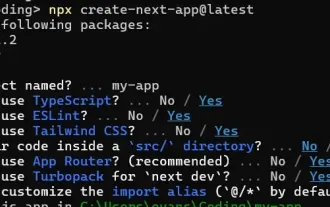

How to Build a Multi-Tenant SaaS Application with Next.js (Frontend Integration)

Apr 11, 2025 am 08:22 AM

How to Build a Multi-Tenant SaaS Application with Next.js (Frontend Integration)

Apr 11, 2025 am 08:22 AM

This article demonstrates frontend integration with a backend secured by Permit, building a functional EdTech SaaS application using Next.js. The frontend fetches user permissions to control UI visibility and ensures API requests adhere to role-base

Python vs. JavaScript: The Learning Curve and Ease of Use

Apr 16, 2025 am 12:12 AM

Python vs. JavaScript: The Learning Curve and Ease of Use

Apr 16, 2025 am 12:12 AM

Python is more suitable for beginners, with a smooth learning curve and concise syntax; JavaScript is suitable for front-end development, with a steep learning curve and flexible syntax. 1. Python syntax is intuitive and suitable for data science and back-end development. 2. JavaScript is flexible and widely used in front-end and server-side programming.

From C/C to JavaScript: How It All Works

Apr 14, 2025 am 12:05 AM

From C/C to JavaScript: How It All Works

Apr 14, 2025 am 12:05 AM

The shift from C/C to JavaScript requires adapting to dynamic typing, garbage collection and asynchronous programming. 1) C/C is a statically typed language that requires manual memory management, while JavaScript is dynamically typed and garbage collection is automatically processed. 2) C/C needs to be compiled into machine code, while JavaScript is an interpreted language. 3) JavaScript introduces concepts such as closures, prototype chains and Promise, which enhances flexibility and asynchronous programming capabilities.

Building a Multi-Tenant SaaS Application with Next.js (Backend Integration)

Apr 11, 2025 am 08:23 AM

Building a Multi-Tenant SaaS Application with Next.js (Backend Integration)

Apr 11, 2025 am 08:23 AM

I built a functional multi-tenant SaaS application (an EdTech app) with your everyday tech tool and you can do the same. First, what’s a multi-tenant SaaS application? Multi-tenant SaaS applications let you serve multiple customers from a sing