There are many cryptocurrency transactions, among which C2C transactions are favored by many users for their convenience. C2C, that is, individual transactions, allow users to directly buy and sell cryptocurrencies with currency vendors. This article will explore in-depth details of C2C currency trading, including transaction methods, price factors, and operation tutorials of Binance platform.

C2C Coin Merchant Trading: Is it to buy or sell?

In C2C transactions, coin vendors play the role of sellers, while users play the role of buyers. When you see the C2C coin vendor "selling coins", it actually means that the coin vendor publishes an order to sell cryptocurrencies on the platform, and users complete the transaction by clicking "buy". Therefore, for users, this is a "buy" behavior; for coin vendors, this is a "sell" behavior.

C2C currency price: Is it more expensive?

The cryptocurrency price of C2C coin vendors is not generalized. Prices are affected by various factors, such as market supply and demand relationship, platform handling fees, and pricing strategies of coin vendors. When market demand rises, the price may be slightly higher than other trading methods; otherwise, it may be lower. In addition, the handling fees and profit margins of coin vendors on different platforms will also affect the final price.

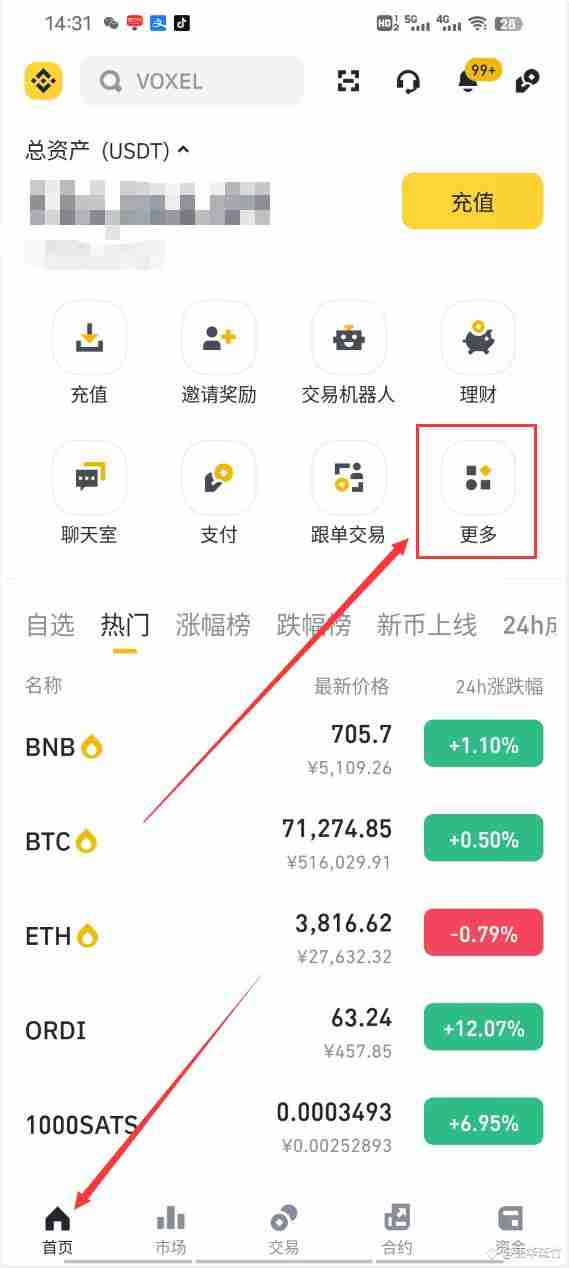

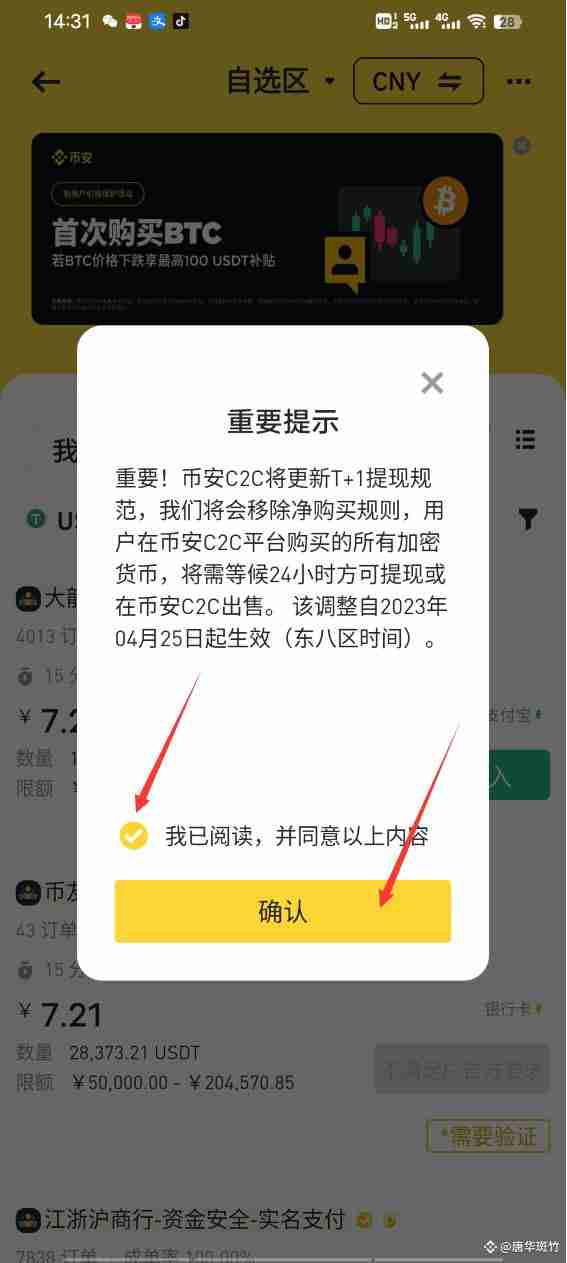

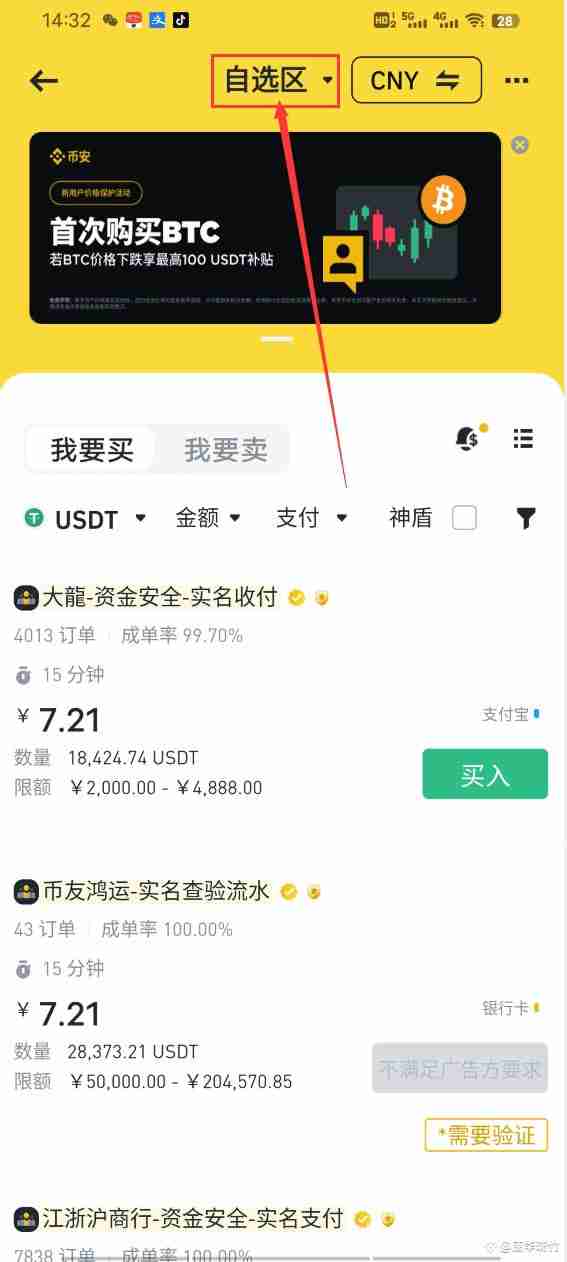

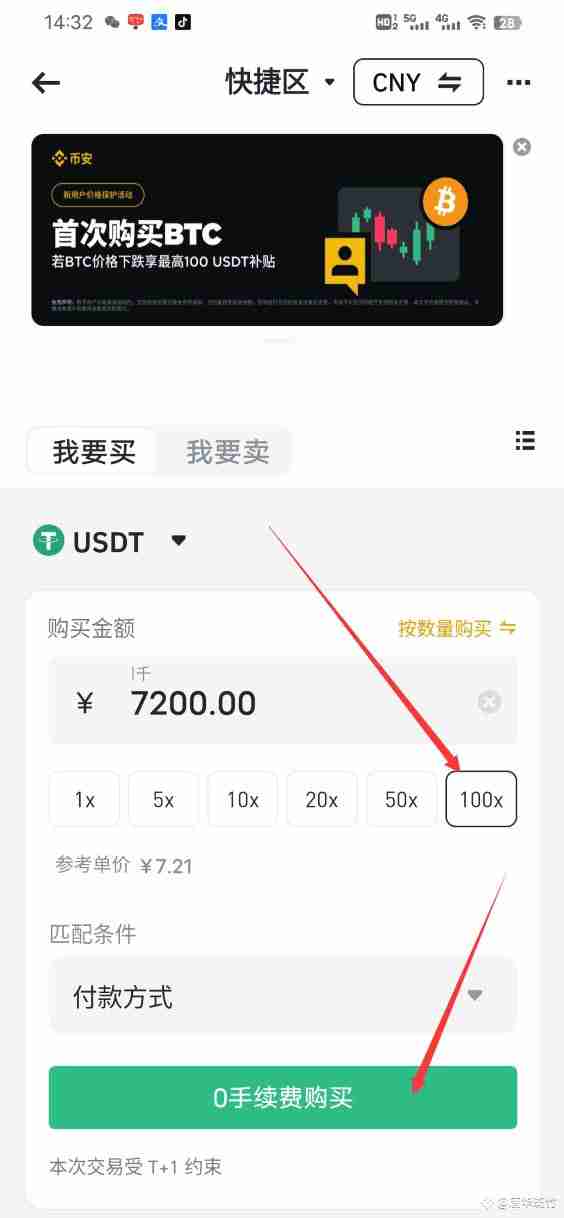

Binance C2C Trading Operation Guide

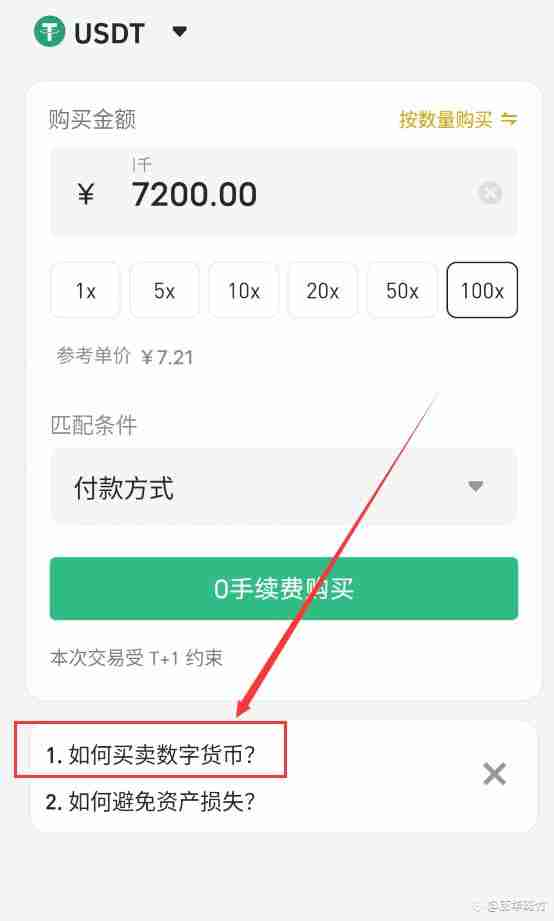

The following steps will guide you on how to conduct C2C trading on the Binance platform:

Safety Tips

I hope the above information can help you better understand and use the C2C currency trading function. Please be sure to trade on a formal platform and pay attention to protecting your own funds.

The above is the detailed content of Should C2C coin vendors buy or sell coins? How to sell coins on Binance C2C?. For more information, please follow other related articles on the PHP Chinese website!