Why did Solana go bankrupt? Is the reason why PI coins are listed on Binance?

Solana's recent price decline may be related to the potential Binance listing speculation of Pi Coin (PI). Binance's poll showed that 86% of participants supported the listing of PI coins, which could attract a large amount of capital to flow into PI, causing some Solana investors to turn to PI.

Solana price plummeted: Will PI coins replace SOL and become the first choice for investors?

Solana (SOL) price has fallen sharply recently, falling 16% last week and 37% last month. Loss of key support levels has heightened investor concerns. While the overall crypto market downturn is partly responsible, the panic selling of traders has exacerbated the decline.

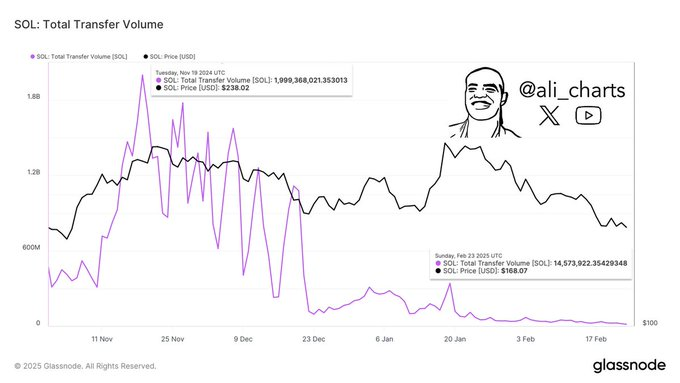

Solana network activity has dropped significantly, with transaction volume plummeting from $1.99 billion in November 2024 to $14.57 million (Glassnode data), raising concerns about the long-term prospects of SOL.

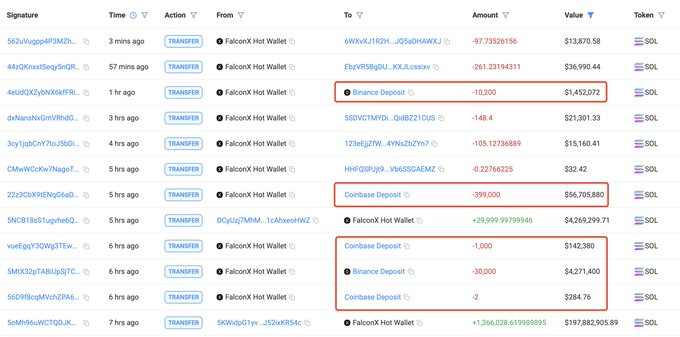

Whale Sale: A huge $198 million sale shocked the market

Solana Whales recently sold $198 million worth of $1,366,028 SOL and transferred to FalconX, which then transferred some of the SOLs to Binance and Coinbase, further exacerbating the market's selling pressure.

This large-scale sell-off triggered panic among retail investors, with trading volume falling 18% to $13 billion, and the market was highly bearish.

Solana faces a key support level of $130

Crypto analyst Ali Martinez pointed out that the SOL price trend is showing a bearish technical pattern. If the key support level of $130 cannot be maintained, it may fall further to $65.

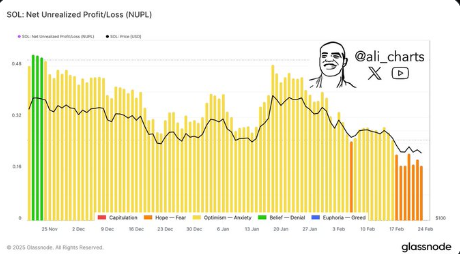

Glassnode's net unrealized profit/loss (NUPL) indicator shows that Solana investor sentiment has turned into "fear", in sharp contrast to optimism in the previous months.

Is the listing of PI currency Binance the reason for the decline of SOL?

The potential listing of Pi Coin (PI) may also be one of the factors behind Solana's decline. Binance poll showed that 86% of participants supported the listing of PI coins, which could cause funds to flow from Solana to PI. After the PI currency is listed, the expected return is 100 times.

Will traders abandon Solana and turn to Pi Coin?

Pi coin price has risen 21% to $1.90 recently, with trading volume soaring 22% to $878 million. Solana prices fell 50% from their 2024 high of $264, aggravating speculation that investors are shifting funds from SOL to PI. After Binance launched PI currency, more than 200 million users may drive the price of PI currency to soar further.

Solana Price Forecast: Key Support and Resistance Levels

Solana is currently close to the key support level of $103.84 (0.786 Fibonacci retracement). Holding this support level may rebound to $260.91 (short-term resistance), $314.58 (medium-term target) or even $377.29 (long-term bullish target). But if it falls below $103.84, it may accelerate to $65.

The future direction of Solana?

Solana prices fell sharply, affected by market downturn, whale sell-offs and changes in investor sentiment. The potential listing of PI coins may further divert investment in SOL. Whether Solana can rebound depends on whether it can hold the key support level and break through the resistance level. The listing of PI coins may further weaken the attractiveness of SOL. Investors need to pay close attention to Solana's price trend and judge whether it is a value investment opportunity or a sign of further decline.

Solana Long-term Price Forecast (2026-2036)

The following is Solana's long-term price forecast, for reference only and does not constitute investment advice:

(The content of the form is the same as the original form, omitted here)

Is SOL a good investment?

Investing in Solana depends on your risk tolerance. SOL has fluctuated significantly recently, so you need to study it carefully before investing.

The above is the detailed content of Why did Solana go bankrupt? Is the reason why PI coins are listed on Binance?. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1376

1376

52

52

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

OKX is a global digital asset trading platform. Its main functions include: 1. Buying and selling digital assets (spot trading), 2. Trading between digital assets, 3. Providing market conditions and data, 4. Providing diversified trading products (such as derivatives), 5. Providing asset value-added services, 6. Convenient asset management.

gate.io latest registration tutorial for beginners

Mar 31, 2025 pm 11:12 PM

gate.io latest registration tutorial for beginners

Mar 31, 2025 pm 11:12 PM

This article provides newbies with detailed Gate.io registration tutorials, guiding them to gradually complete the registration process, including accessing the official website, filling in information, identity verification, etc., and emphasizes the security settings after registration. In addition, the article also mentioned other exchanges such as Binance, Ouyi and Sesame Open Door. It is recommended that novices choose the right platform according to their own needs, and remind readers that digital asset investment is risky and should invest rationally.

The latest registration tutorial for gate.io web version

Mar 31, 2025 pm 11:15 PM

The latest registration tutorial for gate.io web version

Mar 31, 2025 pm 11:15 PM

This article provides a detailed Gate.io web version latest registration tutorial to help users easily get started with digital asset trading. The tutorial covers every step from accessing the official website to completing registration, and emphasizes security settings after registration. The article also briefly introduces other trading platforms such as Binance, Ouyi and Sesame Open Door. It is recommended that users choose the right platform according to their own needs and pay attention to investment risks.

How to roll positions in digital currency? What are the digital currency rolling platforms?

Mar 31, 2025 pm 07:36 PM

How to roll positions in digital currency? What are the digital currency rolling platforms?

Mar 31, 2025 pm 07:36 PM

Digital currency rolling positions is an investment strategy that uses lending to amplify trading leverage to increase returns. This article explains the digital currency rolling process in detail, including key steps such as selecting trading platforms that support rolling (such as Binance, OKEx, gate.io, Huobi, Bybit, etc.), opening a leverage account, setting a leverage multiple, borrowing funds for trading, and real-time monitoring of the market and adjusting positions or adding margin to avoid liquidation. However, rolling position trading is extremely risky, and investors need to operate with caution and formulate complete risk management strategies. To learn more about digital currency rolling tips, please continue reading.

What are the recommended websites for virtual currency app software?

Mar 31, 2025 pm 09:06 PM

What are the recommended websites for virtual currency app software?

Mar 31, 2025 pm 09:06 PM

This article recommends ten well-known virtual currency-related APP recommendation websites, including Binance Academy, OKX Learn, CoinGecko, CryptoSlate, CoinDesk, Investopedia, CoinMarketCap, Huobi University, Coinbase Learn and CryptoCompare. These websites not only provide information such as virtual currency market data, price trend analysis, etc., but also provide rich learning resources, including basic blockchain knowledge, trading strategies, and tutorials and reviews of various trading platform APPs, helping users better understand and make use of them

Top 10 popular web3 digital currency trading software download app

Mar 31, 2025 pm 08:00 PM

Top 10 popular web3 digital currency trading software download app

Mar 31, 2025 pm 08:00 PM

This article provides download methods for the top ten popular Web3 digital currency trading software APPs, including OKX, Binance, Gate.io, Coinbase, Huobi (now HTX), KuCoin, Kraken, Bitget, MEXC and Bybit. Users can search for download links by visiting the official websites of each platform, or search for platform names in mainstream application stores to download and install. The article introduces the download methods of each APP in detail, so that users can quickly and conveniently find the appropriate download method. Download the Web3 trading software you need now and start your digital currency investment journey!

On which platform is web3 transaction?

Mar 31, 2025 pm 07:54 PM

On which platform is web3 transaction?

Mar 31, 2025 pm 07:54 PM

This article lists the top ten well-known Web3 trading platforms, including Binance, OKX, Gate.io, Kraken, Bybit, Coinbase, KuCoin, Bitget, Gemini and Bitstamp. The article compares the characteristics of each platform in detail, such as the number of currencies, trading types (spot, futures, options, NFT, etc.), handling fees, security, compliance, user groups, etc., aiming to help investors choose the most suitable trading platform. Whether it is high-frequency traders, contract trading enthusiasts, or investors who focus on compliance and security, they can find reference information from it.

Currency Trading Network Official Website Collection 2025

Mar 31, 2025 pm 03:57 PM

Currency Trading Network Official Website Collection 2025

Mar 31, 2025 pm 03:57 PM

It ranks among the top in the world, supports all categories of transactions such as spot, contracts, and Web3 wallets. It has high security and low handling fees. A comprehensive trading platform with a long history, known for its compliance and high liquidity, supports multilingual services. The industry leader covers currency trading, leverage, options, etc., with strong liquidity and supports BNB deduction fees.