Bitcoin Half, a major event that occurs every four years, has a profound impact on the cryptocurrency market. It cuts block rewards in half, thereby reducing the circulation of new Bitcoins, controlling inflation, and maintaining Bitcoin’s scarcity. On April 20, 2024, the latest halving reduced the block reward from 6.25 bitcoins to 3.125 bitcoins.

Analysis of historical halving data

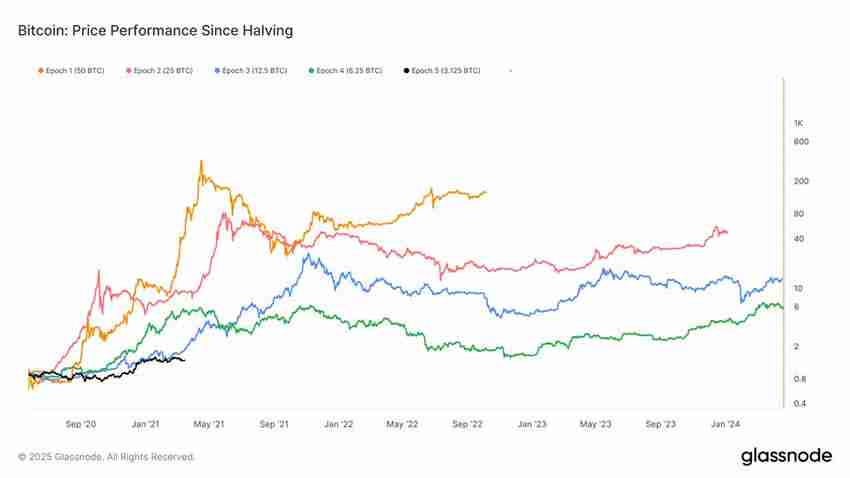

Reviewing historical Bitcoin halving, we can find significant patterns in price trends:

These historical data show that there is a significant correlation between halving events and price increases, fully demonstrating the importance of studying halving charts for investor decision-making.

Use the halving chart to develop an investment strategy

Bitcoin halving chart is a key tool for developing an effective investment strategy. By analyzing the charts, investors can:

Future Outlook: 2028 Half Prediction

The next halving is expected to occur around April 2028, and the block reward will further drop to 1.5625 Bitcoins. Investors and analysts will continue to pay attention to this event because its impact on the market cannot be ignored. Keeping abreast of halving chart information and related analysis is crucial to succeed in the turbulent cryptocurrency market.All in all, a deep understanding of the Bitcoin halving chart and mastering the supply mechanisms and potential price trends behind it is the key to investors developing smart strategies in the Bitcoin market. By analyzing historical data and predicting future halving events, investors can be at ease in the challenging cryptocurrency world.

The above is the detailed content of Bitcoin Half Chart: Historical Data and Future Trend Analysis. For more information, please follow other related articles on the PHP Chinese website!