2025 9 real-world asset RWA track potential projects

RWA (real world asset) track in-depth analysis and inventory of potential projects in 2025

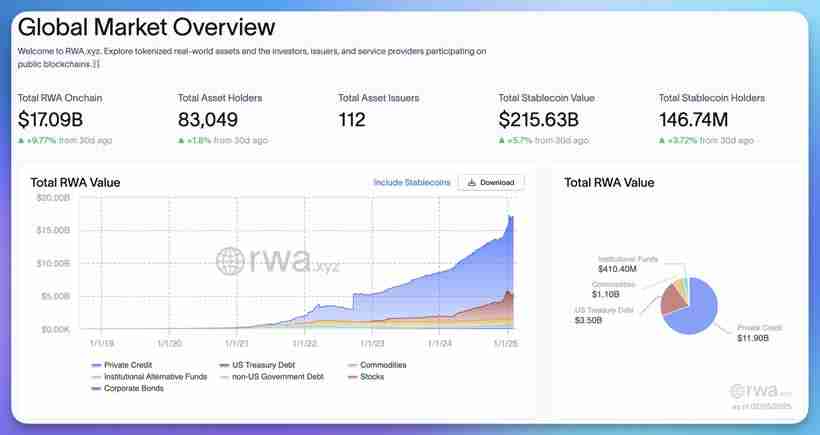

RWA (Real World Asset) tokenization is rapidly rising and its market size continues to expand. According to RWA.xyz data, TVL (total locked value) has increased by 95% in the past year, and has increased by 4 billion US dollars in the past three months, an increase of 26%. Currently, the market is mainly composed of private credit (70%) and tokenized assets backed by US Treasury bonds (21%), and the integration of traditional financial assets and blockchain technology is becoming increasingly deepening.

This article will focus on analyzing the opportunities of the RWA track and recommending nine potential projects worth paying attention to in 2025.

What is the RWA track?

RWA refers to assets with value in the real world, including both tangible assets (real estate, vehicles, artworks, etc.) and intangible assets (bonds, notes, carbon rights, etc.). RWA tokenization refers to digitizing these assets so that they can be traded on the blockchain and realize on-chain circulation of assets.

Advantages of RWA track:

- Lower the investment threshold: Investors can participate more easily in the investment of high-threshold assets (such as high-end real estate, artworks).

- Improving market liquidity: After asset tokenization, transactions are more flexible, small transactions can be conducted to improve market liquidity.

- Enhance transaction transparency: Blockchain technology ensures complete and transparent transaction records and reduces the risk of information asymmetry.

- Improve transaction efficiency and reduce costs: 24/7 settlement mechanism, reduce intermediary links, and reduce transaction costs and time.

- Diverable investment options: Cover various asset types such as stocks, bonds, real estate, gold, etc. to meet diversified investment needs.

- Promote financial innovation: Connect traditional finance and DeFi to give birth to more innovative applications.

The vigorous development of RWA will reshape the traditional financial system and bring unlimited possibilities to the global market.

2025 RWA track potential project:

The following nine projects are worth paying attention to in 2025:

-

Ondo Finance: Focus on tokenization of financial derivatives, providing tokenized products of US Treasury bonds and money market funds, and improving liquidity in the fixed income market.

-

Maple Finance: Decentralized corporate credit market, connecting crypto-native institutions and DeFi depositors, and providing institutional-level lending services.

-

Centrifuge: Decentralized RWA asset financing agreement supports the tokenization of assets such as accounts receivable, real estate, etc., and is deeply integrated with MakerDAO.

-

Goldfinch: Decentralized credit agreement allows users to borrow without collateral for crypto assets, focusing on financial services in developing countries.

-

RealT: Focus on US real estate investment, tokenize real estate investment, lower investment thresholds, and simplify investment processes.

-

Propy: Real estate technology company uses blockchain technology to simplify international real estate transaction processes and improve transaction efficiency and security.

-

Swarm: Focus on tokenization of stocks, bonds and commodities, providing a compliant decentralized trading experience.

-

Synthetix: Synthetix:

Synthetix issuance agreement that supports the trading of synthetic assets of multiple assets (fiat currency, commodities, stocks, etc.). -

Tokeny Solutions:

Provides enterprise-level tokenization services to help enterprises issue and manage blockchain assets in compliance.

RWA track prospect:

RWA is profoundly changing our understanding of physical assets. It combines asset stability and blockchain security, creating unprecedented opportunities for enterprises and investors. 2025 will be a key year for the development of the RWA track. Only by seizing opportunities can we gain the lead in future market competition.

The above is the detailed content of 2025 9 real-world asset RWA track potential projects. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1393

1393

52

52

1205

1205

24

24

What does cross-chain transaction mean? What are the cross-chain transactions?

Apr 21, 2025 pm 11:39 PM

What does cross-chain transaction mean? What are the cross-chain transactions?

Apr 21, 2025 pm 11:39 PM

Exchanges that support cross-chain transactions: 1. Binance, 2. Uniswap, 3. SushiSwap, 4. Curve Finance, 5. Thorchain, 6. 1inch Exchange, 7. DLN Trade, these platforms support multi-chain asset transactions through various technologies.

What is a quantum chain? What are the quantum chain transactions?

Apr 21, 2025 pm 11:51 PM

What is a quantum chain? What are the quantum chain transactions?

Apr 21, 2025 pm 11:51 PM

Quantum Chain (Qtum) is an open source decentralized smart contract platform and value transmission protocol. 1. Technical features: BIP-compatible POS smart contract platform, combining the advantages of Bitcoin and Ethereum, introduces off-chain factors and enhances the flexibility of consensus mechanisms. 2. Design principle: realize on-chain and off-chain data interaction through main control contracts, be compatible with different blockchain technologies, flexible consensus mechanisms, and consider industry compliance. 3. Team and Development: An international team led by Shuai Chu, 80% of the quantum coins are used in the community, and 20% rewards the team and investors. Quantum chains are traded on Binance, Gate.io, OKX, Bithumb and Matcha exchanges.

What are the hybrid blockchain trading platforms?

Apr 21, 2025 pm 11:36 PM

What are the hybrid blockchain trading platforms?

Apr 21, 2025 pm 11:36 PM

Suggestions for choosing a cryptocurrency exchange: 1. For liquidity requirements, priority is Binance, Gate.io or OKX, because of its order depth and strong volatility resistance. 2. Compliance and security, Coinbase, Kraken and Gemini have strict regulatory endorsement. 3. Innovative functions, KuCoin's soft staking and Bybit's derivative design are suitable for advanced users.

Recommend several apps to buy mainstream coins in 2025 latest release

Apr 21, 2025 pm 11:54 PM

Recommend several apps to buy mainstream coins in 2025 latest release

Apr 21, 2025 pm 11:54 PM

APP software that can purchase mainstream coins includes: 1. Binance, the world's leading, large transaction volume and fast speed; 2. OKX, innovative products, low fees, high security; 3. Gate.io, a variety of assets and trading options, focusing on security; 4. Huobi (HTX), low fees, good user experience; 5. Coinbase, suitable for novices, high security; 6. Kraken, safe and compliant, providing a variety of services; 7. KuCoin, low fees, suitable for professional traders; 8. Gemini, emphasizes compliance, and provides custodial services; 9. Crypto.com, providing a variety of offers and services; 10. Bitstamp, an old exchange, strong liquidity,

bitget new user registration guide 2025

Apr 21, 2025 pm 10:09 PM

bitget new user registration guide 2025

Apr 21, 2025 pm 10:09 PM

The steps to register for Bitget in 2025 include: 1. Prepare a valid email or mobile phone number and a stable network; 2. Visit the Bitget official website; 3. Enter the registration page; 4. Select the registration method; 5. Fill in the registration information; 6. Agree to the user agreement; 7. Complete verification; 8. Obtain and fill in the verification code; 9. Complete registration. After registering, it is recommended to log in to the account, perform KYC identity verification, and set up security measures to ensure the security of the account.

Quantum Chain Exchange Ranking Top 10 Recommended (Updated in 2025)

Apr 21, 2025 pm 11:48 PM

Quantum Chain Exchange Ranking Top 10 Recommended (Updated in 2025)

Apr 21, 2025 pm 11:48 PM

Quantum chains can be traded on the following exchanges: 1. Binance: One of the world's largest exchanges, with large trading volume, rich currency and high security. 2. Sesame Open Door (Gate.io): a large exchange, providing a variety of digital currency transactions, with good trading depth. 3. Ouyi (OKX): operated by OK Group, with strong comprehensive strength, large transaction volume, and complete safety measures. 4. Bitget: Fast development, provides quantum chain transactions, and improves security. 5. Bithumb: operated in Japan, supports transactions of multiple mainstream virtual currencies, and is safe and reliable. 6. Matcha Exchange: a well-known exchange with a friendly interface and supports quantum chain trading. 7. Huobi: a large exchange that provides quantum chain trading,

Popular science in the currency circle: What is the difference between decentralized exchanges and hybrid exchanges?

Apr 21, 2025 pm 11:30 PM

Popular science in the currency circle: What is the difference between decentralized exchanges and hybrid exchanges?

Apr 21, 2025 pm 11:30 PM

The difference between decentralized exchanges and hybrid exchanges is mainly reflected in: 1. Trading mechanism: Decentralized exchanges use smart contracts to match transactions, while hybrid exchanges combine centralized and decentralized mechanisms. 2. Asset control: Decentralized exchange users control assets, and mixed exchange ownership centralization and decentralization. 3. Privacy protection: Decentralized exchanges provide high anonymity, and hybrid exchanges require KYC in centralized mode. 4. Trading speed and liquidity: Decentralized exchanges are slower, liquidity depends on user pool, and hybrid exchanges are more fast and liquid in centralized mode. 5. Platform governance: Decentralized exchanges are governed by community governance, and hybrid exchanges are jointly governed by communities and centralized teams.

What are the quantum chain trading platforms?

Apr 21, 2025 pm 11:45 PM

What are the quantum chain trading platforms?

Apr 21, 2025 pm 11:45 PM

Platforms that support Qtum trading are: 1. Binance, 2. OKX Ouyi, 3. Huobi, 4. Gate.io Sesame Open Door, 5. Siren, 6. Coinku, 7. Bit stamp, 8. Coinku, 9. Bybit, 10. Gemini, these platforms have their own characteristics and advantages.