This article will explore the price trend of Ethereum (ETH) in 2025, analyze its potential catalysts and barriers, and provide different forecast ranges.

Review and Outlook: In the past year, ETH prices have fluctuated dramatically, exceeding US$4,000 in 2024, and then pulled back. This volatility highlights the importance of in-depth market analysis. In the future, prices will be affected by multiple factors such as technological upgrades (such as Ethereum 2.0), regulatory environment and market sentiment. Successful technology upgrades could drive ETH prices to reach or exceed $4,000 by 2025.

$4,000 Target: Drivers & Challenges:

Key drivers of ETH return and breaking through $4,000 include the booming development of decentralized finance (DeFi) and the continued growth in demand for ETH, as well as institutional investments brought about by the popularity of Ethereum ETFs.

However, scalability issues, high transaction fees, and competition from other smart contract platforms may hinder ETH prices. The implementation of EIP-1559 and the transition to a proof of stake mechanism are expected to alleviate some scalability issues and may bring about the deflation effect of ETH.

Market share: The way to survive under continuous competition:

ETH's market share has fallen below 10%, raising concerns about its long-term position. Nevertheless, a strong developer community and a wide decentralized application (dApps) ecosystem remain a solid foundation. Whether the technological advantages and ecosystem advantages can be used to regain market share will directly affect its price trend.

Institutional Investment: Potential Game Changeers:

The participation of institutional investors is a key factor in ETH's future price trend. The increasing recognition of blockchain technology by institutions has brought huge growth potential to Ethereum. The continued growth in institutional investment may become a key driver for ETH prices to exceed $4,000. However, regulatory reviews and compliance requirements can also present challenges.

Price forecast for 2025: Multiple perspectives gathered:

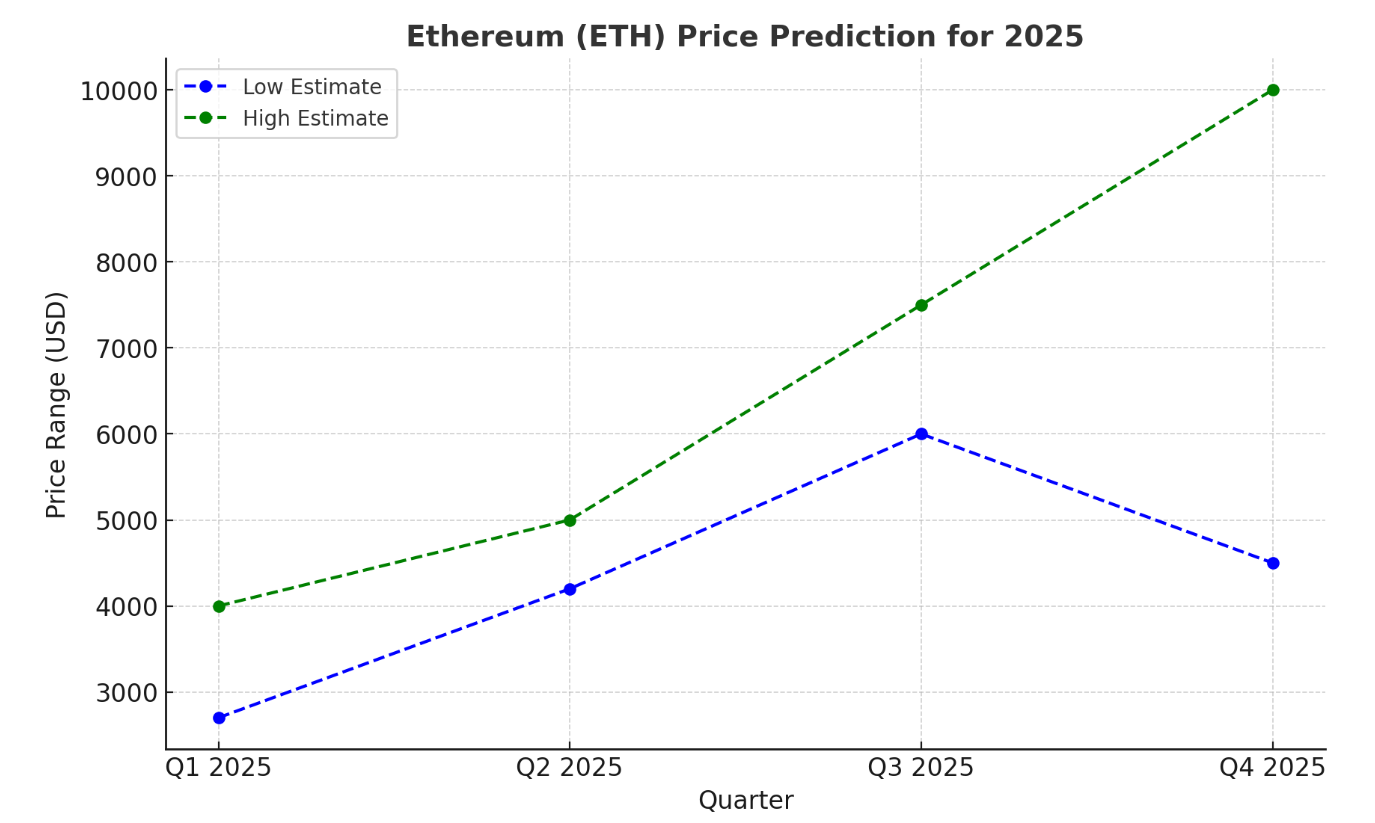

The forecasts for ETH prices in 2025 vary greatly, with an optimistic estimate that it may reach US$7500-10,000, while the more conservative forecast is between US$2670-5,990, with an average price of approximately US$4,330. Some analysts predict that the ETH price may reach $4184.11 in February 2025, with an average trading price of $3633.09.

Technical analysis:

Market sentiment:

The market sentiment is mixed, and long-term holders and institutional investors continue to increase their holdings, but short-term indicators show downward risks.

Quarterly Forecast:

Market analysis:

The future price of ETH will be affected by factors such as institutional investment, regulation and technology upgrades. The continued growth of institutional investment, favorable regulatory policies and successful technological upgrades will all benefit ETH prices.

Future Outlook:

ETH's development in 2025 is full of opportunities and challenges. While the $4,000 goal is challenging, its strong ecosystem and continuous innovation give it significant growth potential. Investors should pay close attention to key factors such as technology upgrades, market share and institutional investment.

The above is the detailed content of ETH2025 price forecast: market share falls below 10%, can ETH return to above $4,000?. For more information, please follow other related articles on the PHP Chinese website!