Why is Bittensor said to be the 'bitcoin' in the AI track?

Original title: Bittensor = AI Bitcoin?

Original author: S4mmyEth, Decentralized AI Research

Original translation: zhouzhou, BlockBeats

Editor's note: This article discusses Bittensor, a decentralized AI platform, hoping to break the monopoly of centralized AI companies through blockchain technology and promote an open and collaborative AI ecosystem. Bittensor adopts a subnet model that allows the emergence of different AI solutions and inspires innovation through TAO tokens. Although the AI market is mature, Bittensor faces competitive risks and may be influenced by other open source AI frameworks. Continue to delve into subnets, analyze their application and development potential, and focus on how Bittensor can drive the future of decentralized AI.

The following is the original content (the original content has been compiled for easier reading comprehension):

As the first halving of Bittensor approaches in November 2025, more and more speculation is that this may be similar to Bitcoin’s historical price cycle - but this time, artificial intelligence has become the core.

Introduction

The rise of artificial intelligence has been dominated by centralized entities such as OpenAI, Google and Meta. While these companies drive incredible technological advances, they also maintain strict control over the development of AI, data access and monetization.

At this time, Bittensor (TAO) came into being - a decentralized AI market that aims to disrupt the traditional business model by creating a peer-to-peer economic model in which contributors (whether providing computing resources, AI models or data) can be directly rewarded.

Bittensor provides a transparent and inspiring innovative approach to AI with similar features to Bitcoin network incentives.

Its goal is to democratize AI and ensure that no single entity has too much control over machine intelligence.

This analysis will explore how Bittensor works, its unique subnet structure, token incentives, and why it may be one of the most attractive cases of decentralized AI development.

Catalog

What is Bittensor?

How Bittensor works

Comparison with Bitcoin

Subnet Ecosystem

Network Incentives and Dynamics TAO

Key Differences between Centralized AI Companies

Conclusion

What is Bittensor?

Bittensor is a decentralized blockchain-based network designed to facilitate collaborative development, sharing and improvement of AI models.

Why pay attention?

Unlike traditional centralized AI systems such as OpenAI, Bittensor creates an open peer-to-peer ecosystem. Participants are rewarded for their contributions such as computing resources, data, or AI models.

Bittensor’s mission is to democratize AI, make it easier to access, and reduce the control of a few large companies.

Comparison with Bitcoin

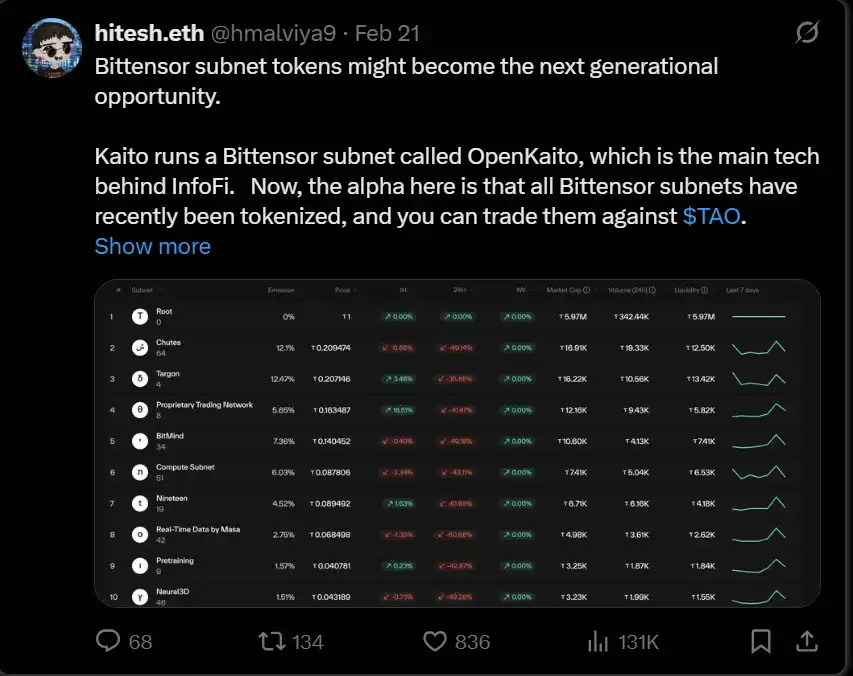

AI will not disappear, it is a macro trend that will be integrated into various industries. There is an opportunity hidden here. If Bittensor becomes the key decentralized network for open source AI and institutional investors are familiar with Bitcoin’s halving mechanism, then TAO could become a very attractive investment asset.

Bittensor adopts a halving mechanism similar to Bitcoin; TAO's first halving is expected to occur in November this year.

Bitcoin’s first halving occurred on November 28, 2012, and its market value has soared by 13,125 times since then:

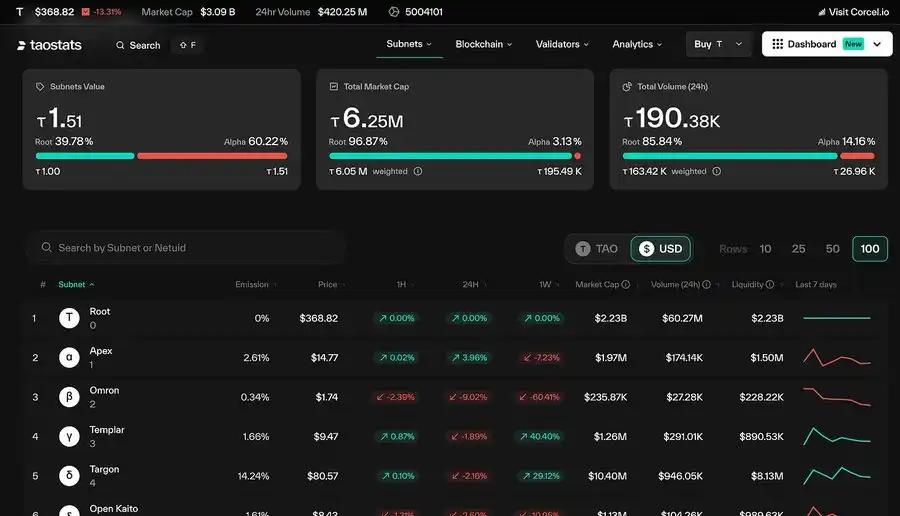

Indexing the TAO ecosystem is not easy, so a user interface (UI) like this aggregates data in a meaningful way for analysis. Key players in the TAO ecosystem can be classified into the following categories:

Indexing the TAO ecosystem is not easy, so a user interface (UI) like this aggregates data in a meaningful way for analysis. Key players in the TAO ecosystem can be classified into the following categories:

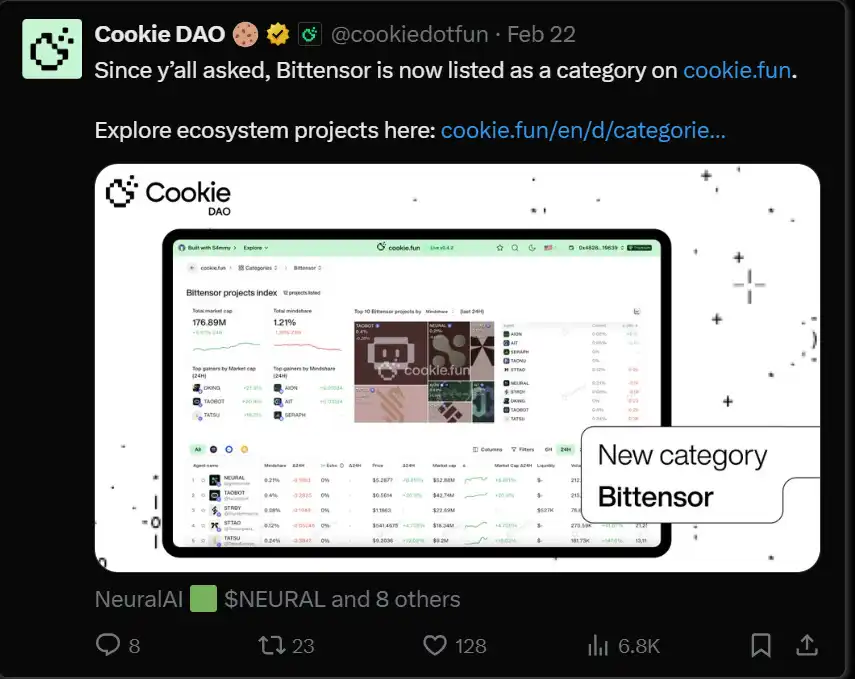

Ultimately, the accumulation of value comes from application developers and end users who create products that leverage the AI model of the Bittensor subnet. Cookiedotfun recently launched a dashboard highlighting some of the agents utilizing Bittensor:

However, the dashboards only cover agents utilizing Bittensor, and as they enter the market, more content will be gradually added in the future. Many protocols also use Bittensor for AI integration.

Subnet Ecosystem

Subnet 1 (root subnet) is specifically used for text prompts and is owned by the opentensor Foundation; it currently holds most of the pledged TAOs with a total market value of US$2.09 billion. In October 2023, the network expanded more subnets and now there are 69 subnets owned by third parties outside the foundation. Here is an exciting division of these subnets by old samster at Crucible Labs:

But before you go all out to buy subnet tokens, make sure you understand the emission mechanisms and core value propositions of each subnet. Currently, the total market capitalization of all 70 subnets is $72.5 million, and it currently takes 408 TAOs (approximately $151,000) to register a subnet and is now non-refundable:

But before you go all out to buy subnet tokens, make sure you understand the emission mechanisms and core value propositions of each subnet. Currently, the total market capitalization of all 70 subnets is $72.5 million, and it currently takes 408 TAOs (approximately $151,000) to register a subnet and is now non-refundable:

A little like locking Virtuals io's tokens in LP to serve a single agent. But in this case, each subnet has a unique value proposition that can be leveraged by real-world applications to improve efficiency.

Open Kaito ai (Subnet 5): Used to provide AI algorithm support for KAITO

- Sports Tensor (Subnet 41): Used to support agents such as askBillyBets

- Synth (Subnet 50): Used to predict the pricing of crypto assets and integrate into Modenetwork's DeFAI solution

- Network incentives

- TAO Token incentives are allocated based on the "Yuma Consensus" model. This model allocates rewards based on the activities of the subnet, further pushing each subnet to create real value for the applications it builds.

Dynamic TAO (which will be available on February 13, 2025) is a new tier for fine-tuning the economics of rewards, making emissions more flexible and linked to overall network activity, without relying solely on the previous “Bitcoin Half” mechanism.

Subnets must create actual demand for their Alpha tokens (subnet tokens) in order to earn more TAOs, thus creating a competitive environment where practicality drives success.

If you want to get a more comprehensive view of this, you can read the 0xprismatic article.

Key Differences from Centralized AI Companies

Why do we need to develop a decentralized alternative to challenge companies like OpenAI?

At the end of the day, centralized models rely on opaque black boxes, internal teams, and develop solutions in isolated environments. The decentralized model provides greater transparency and allows more contributors to participate in a collaborative way. Here is a more comprehensive comparison:

The above is the detailed content of Why is Bittensor said to be the 'bitcoin' in the AI track?. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1662

1662

14

14

1419

1419

52

52

1311

1311

25

25

1262

1262

29

29

1235

1235

24

24

What kind of software is a digital currency app? Top 10 Apps for Digital Currencies in the World

Apr 30, 2025 pm 07:06 PM

What kind of software is a digital currency app? Top 10 Apps for Digital Currencies in the World

Apr 30, 2025 pm 07:06 PM

With the popularization and development of digital currency, more and more people are beginning to pay attention to and use digital currency apps. These applications provide users with a convenient way to manage and trade digital assets. So, what kind of software is a digital currency app? Let us have an in-depth understanding and take stock of the top ten digital currency apps in the world.

How does deepseek official website achieve the effect of penetrating mouse scroll event?

Apr 30, 2025 pm 03:21 PM

How does deepseek official website achieve the effect of penetrating mouse scroll event?

Apr 30, 2025 pm 03:21 PM

How to achieve the effect of mouse scrolling event penetration? When we browse the web, we often encounter some special interaction designs. For example, on deepseek official website, �...

Easeprotocol.com directly implements ISO 20022 message standard as a blockchain smart contract

Apr 30, 2025 pm 05:06 PM

Easeprotocol.com directly implements ISO 20022 message standard as a blockchain smart contract

Apr 30, 2025 pm 05:06 PM

This groundbreaking development will enable financial institutions to leverage the globally recognized ISO20022 standard to automate banking processes across different blockchain ecosystems. The Ease protocol is an enterprise-level blockchain platform designed to promote widespread adoption through easy-to-use methods. It announced today that it has successfully integrated the ISO20022 messaging standard and directly incorporated it into blockchain smart contracts. This development will enable financial institutions to easily automate banking processes in different blockchain ecosystems using the globally recognized ISO20022 standard, which is replacing the Swift messaging system. These features will be tried soon on "EaseTestnet". EaseProtocolArchitectDou

Quantitative Exchange Ranking 2025 Top 10 Recommendations for Digital Currency Quantitative Trading APPs

Apr 30, 2025 pm 07:24 PM

Quantitative Exchange Ranking 2025 Top 10 Recommendations for Digital Currency Quantitative Trading APPs

Apr 30, 2025 pm 07:24 PM

The built-in quantization tools on the exchange include: 1. Binance: Provides Binance Futures quantitative module, low handling fees, and supports AI-assisted transactions. 2. OKX (Ouyi): Supports multi-account management and intelligent order routing, and provides institutional-level risk control. The independent quantitative strategy platforms include: 3. 3Commas: drag-and-drop strategy generator, suitable for multi-platform hedging arbitrage. 4. Quadency: Professional-level algorithm strategy library, supporting customized risk thresholds. 5. Pionex: Built-in 16 preset strategy, low transaction fee. Vertical domain tools include: 6. Cryptohopper: cloud-based quantitative platform, supporting 150 technical indicators. 7. Bitsgap:

Is the digital currency app formal? Top 10 formal and legal virtual currency trading apps in the world

Apr 30, 2025 pm 07:09 PM

Is the digital currency app formal? Top 10 formal and legal virtual currency trading apps in the world

Apr 30, 2025 pm 07:09 PM

Recommended cryptocurrency trading platforms include: 1. Binance: the world's largest trading volume, supports 1,400 currencies, FCA and MAS certification. 2. OKX: Strong technical strength, supports 400 currencies, approved by the Hong Kong Securities Regulatory Commission. 3. Coinbase: The largest compliance platform in the United States, suitable for beginners, SEC and FinCEN supervision. 4. Kraken: a veteran European brand, ISO 27001 certified, holds a US MSB and UK FCA license. 5. Gate.io: The most complete currency (800), low transaction fees, and obtained a license from multiple countries. 6. Huobi Global: an old platform that provides a variety of services, and holds Japanese FSA and Hong Kong TCSP licenses. 7. KuCoin

How to download, install and register the Hong Kong Digital Currency Exchange app 2025

Apr 30, 2025 pm 07:18 PM

How to download, install and register the Hong Kong Digital Currency Exchange app 2025

Apr 30, 2025 pm 07:18 PM

The download, installation and registration process of the Hong Kong Digital Currency Exchange app is very simple. Users can quickly obtain and use this app through the official app download link provided in this article. This article will introduce in detail how to download, install and register the Hong Kong Digital Currency Exchange app to ensure that every user can complete the operation smoothly.

uniswap on-chain withdrawal

Apr 30, 2025 pm 07:03 PM

uniswap on-chain withdrawal

Apr 30, 2025 pm 07:03 PM

Uniswap users can withdraw tokens from liquidity pools to their wallets to ensure asset security and liquidity. The process requires gas fees and is affected by network congestion.

Huobi Digital Currency Trading App Download Official Website. Correct Address. Domestic

Apr 30, 2025 pm 07:21 PM

Huobi Digital Currency Trading App Download Official Website. Correct Address. Domestic

Apr 30, 2025 pm 07:21 PM

Huobi Digital Currency Trading App is one of the world's leading digital asset trading platforms and is favored by the majority of users. In order to facilitate users to quickly and safely download and install Huobi app, this article will provide you with detailed download and installation tutorials. Please note that this article provides a download link to Huobi official app. Use the download link to this article to download safely to avoid mistakenly entering a copycat website or downloading to unofficial versions. Next, let us download and install Huobi app step by step.