web3.0

web3.0

Open Intents: Can ERC-7683 become a 'Walmart' supermarket with the intention of synergy between Ethereum chains?

Open Intents: Can ERC-7683 become a 'Walmart' supermarket with the intention of synergy between Ethereum chains?

Open Intents: Can ERC-7683 become a 'Walmart' supermarket with the intention of synergy between Ethereum chains?

Written by YBB Capital Researcher Ac-Core:

Ethereum fragmentation puzzle and Open Intents framework: ERC-7683's way to break the deadlock

<code>图源:@ethereumfndn</code>

The booming development of L2 and DeFi has led to the increasing fragmentation of Ethereum's liquidity. Asset liquidity is scattered among L1 and many L2s, and there is a lack of effective interconnection between various platforms, like isolated "small pools", hindering the overall efficiency of Ethereum. In 2024, Ethereum added more than 100 new chains, which is like a large shopping mall with a wide range of products, but it requires settlement in different currencies. To solve this problem, the Ethereum Foundation released the Open Intents Framework (Open Intent Framework) on February 20, aiming to achieve a seamless transaction experience similar to "single-chain" and has quickly gained support from more than 50 protocols.

The core components of Open Intents Framework are as follows (see Extended Link 1 for details):

- Open source solver: Based on TypeScript development, it monitors on-chain events and processes intents. It has protocol independence, supports functions such as indexing, transaction submission and rebalancing, and can be flexibly customized.

- Composite smart contract: Based on the ERC-7683 standard, the interpretation, execution and settlement logic of intent is defined, and the limit order transactions and Hyperlane ISM settlement are supported by default.

- UI template: Provides a pre-built customizable user interface to enhance the user experience.

ERC-7683: General Standard for Cross-chain Intent

<code>图源:@KanishkKhurana_</code>

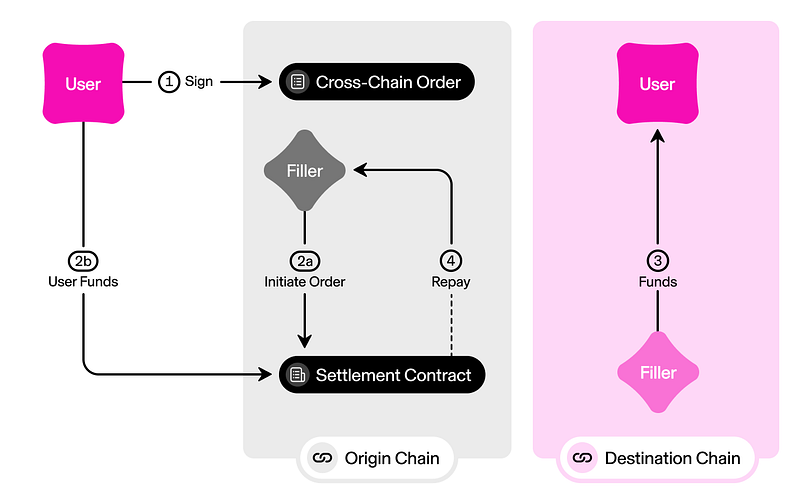

ERC-7683, developed by Across and Uniswap Labs, is a common standard for implementing the cross-chain intention of Ethereum and other blockchains. Its core components include:

- Cross-chain order structure: Defines the cross-chain order format to ensure interoperability between different chains.

- ISettlementContract interface: Standardized settlement process, supporting flexible transaction process customization.

- Fulfil mechanism: Allows participants to compete to complete cross-chain intentions, improve efficiency and reduce costs.

- Fill Deadline: Avoid long-term invalid transaction waiting.

- Order DataType: Use EIP-712 type hashing to standardize data format.

- Order Data: Contains the core parameters of cross-chain transactions (tokens, quantity, chain, receiver).

ERC-7683's advantage is that it simplifies cross-chain interaction, and users can perform cross-chain operations (such as token exchange or NFT transfer) without complex settings, and enhances cross-chain governance capabilities, which is especially conducive to efficient governance of DAO on multiple chains.

Intent and DeFAI: Abstract Boundaries

<code>图源:@ethereumfndn</code>

Intent and DeFAI are both extensions of DeFi, and their core goal is to solve the scalability and liquidity issues of DeFi. Intent to integrate liquidity through Uniswap and ERC-7683, DeFAI uses AI technology to improve user experience, optimize transaction execution, and enhance protocol stability and security. The two focus is different: the intention is to simplify user interaction, while DeFAI focuses on risk management and compliance. From account abstraction, chain abstraction to intention and DeFAI, abstraction is never ending, but the key is how to optimize existing protocols rather than increasing the abstraction level infinitely.

Uniswap: The key driving force in the development of ERC-7683

<code>图源:@KanishkKhurana_</code>

The author believes that the success of ERC-7683 depends on Uniswap's support. The reason is that the healthy development of DeFi relies on efficient liquidity supply and deeply integrated liquidity, while Uniswap V4's flexible liquidity pool management and Uniswap X's cross-chain interoperability potential can provide key support for ERC-7683 to ensure the stability and security of its cross-chain transactions.

The practical significance of intention and future prospects

Putting aside the abstract concept, "intention" represents a clear trading goal. The emergence of ERC-7683 has brought light to solving the problem of liquidity fragmentation. The ultimate goal is to inject vitality into Uniswap and promote a new round of DeFi craze. Through ERC-7683, Uniswap can improve cross-chain liquidity, reduce transaction costs, and increase transaction pairs and liquidity pools, thereby achieving richer functions and stronger cross-chain interoperability.

Extended link:

(1)https://www.php.cn/link/1efecd1fe0d67b4fb82c400a180be64b

The above is the detailed content of Open Intents: Can ERC-7683 become a 'Walmart' supermarket with the intention of synergy between Ethereum chains?. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1381

1381

52

52

Debian mail server firewall configuration tips

Apr 13, 2025 am 11:42 AM

Debian mail server firewall configuration tips

Apr 13, 2025 am 11:42 AM

Configuring a Debian mail server's firewall is an important step in ensuring server security. The following are several commonly used firewall configuration methods, including the use of iptables and firewalld. Use iptables to configure firewall to install iptables (if not already installed): sudoapt-getupdatesudoapt-getinstalliptablesView current iptables rules: sudoiptables-L configuration

How debian readdir integrates with other tools

Apr 13, 2025 am 09:42 AM

How debian readdir integrates with other tools

Apr 13, 2025 am 09:42 AM

The readdir function in the Debian system is a system call used to read directory contents and is often used in C programming. This article will explain how to integrate readdir with other tools to enhance its functionality. Method 1: Combining C language program and pipeline First, write a C program to call the readdir function and output the result: #include#include#include#includeintmain(intargc,char*argv[]){DIR*dir;structdirent*entry;if(argc!=2){

How to perform digital signature verification with Debian OpenSSL

Apr 13, 2025 am 11:09 AM

How to perform digital signature verification with Debian OpenSSL

Apr 13, 2025 am 11:09 AM

Using OpenSSL for digital signature verification on Debian systems, you can follow these steps: Preparation to install OpenSSL: Make sure your Debian system has OpenSSL installed. If not installed, you can use the following command to install it: sudoaptupdatesudoaptininstallopenssl to obtain the public key: digital signature verification requires the signer's public key. Typically, the public key will be provided in the form of a file, such as public_key.pe

Debian mail server SSL certificate installation method

Apr 13, 2025 am 11:39 AM

Debian mail server SSL certificate installation method

Apr 13, 2025 am 11:39 AM

The steps to install an SSL certificate on the Debian mail server are as follows: 1. Install the OpenSSL toolkit First, make sure that the OpenSSL toolkit is already installed on your system. If not installed, you can use the following command to install: sudoapt-getupdatesudoapt-getinstallopenssl2. Generate private key and certificate request Next, use OpenSSL to generate a 2048-bit RSA private key and a certificate request (CSR): openss

Centos shutdown command line

Apr 14, 2025 pm 09:12 PM

Centos shutdown command line

Apr 14, 2025 pm 09:12 PM

The CentOS shutdown command is shutdown, and the syntax is shutdown [Options] Time [Information]. Options include: -h Stop the system immediately; -P Turn off the power after shutdown; -r restart; -t Waiting time. Times can be specified as immediate (now), minutes ( minutes), or a specific time (hh:mm). Added information can be displayed in system messages.

How Debian OpenSSL prevents man-in-the-middle attacks

Apr 13, 2025 am 10:30 AM

How Debian OpenSSL prevents man-in-the-middle attacks

Apr 13, 2025 am 10:30 AM

In Debian systems, OpenSSL is an important library for encryption, decryption and certificate management. To prevent a man-in-the-middle attack (MITM), the following measures can be taken: Use HTTPS: Ensure that all network requests use the HTTPS protocol instead of HTTP. HTTPS uses TLS (Transport Layer Security Protocol) to encrypt communication data to ensure that the data is not stolen or tampered during transmission. Verify server certificate: Manually verify the server certificate on the client to ensure it is trustworthy. The server can be manually verified through the delegate method of URLSession

How to do Debian Hadoop log management

Apr 13, 2025 am 10:45 AM

How to do Debian Hadoop log management

Apr 13, 2025 am 10:45 AM

Managing Hadoop logs on Debian, you can follow the following steps and best practices: Log Aggregation Enable log aggregation: Set yarn.log-aggregation-enable to true in the yarn-site.xml file to enable log aggregation. Configure log retention policy: Set yarn.log-aggregation.retain-seconds to define the retention time of the log, such as 172800 seconds (2 days). Specify log storage path: via yarn.n

Sony confirms the possibility of using special GPUs on PS5 Pro to develop AI with AMD

Apr 13, 2025 pm 11:45 PM

Sony confirms the possibility of using special GPUs on PS5 Pro to develop AI with AMD

Apr 13, 2025 pm 11:45 PM

Mark Cerny, chief architect of SonyInteractiveEntertainment (SIE, Sony Interactive Entertainment), has released more hardware details of next-generation host PlayStation5Pro (PS5Pro), including a performance upgraded AMDRDNA2.x architecture GPU, and a machine learning/artificial intelligence program code-named "Amethylst" with AMD. The focus of PS5Pro performance improvement is still on three pillars, including a more powerful GPU, advanced ray tracing and AI-powered PSSR super-resolution function. GPU adopts a customized AMDRDNA2 architecture, which Sony named RDNA2.x, and it has some RDNA3 architecture.