In early 2025, against the backdrop of US stocks hitting a new high and the crypto market was sluggish, Sonic ($S) became the focus of market attention with its price increase and technology upgrade. This article will conduct in-depth analysis of its performance and future potential.

This Monday, due to the closing of Washington's birthday in the United States, the overall sentiment of the US stock market was optimistic after the opening on Tuesday. The S&P 500 rose 0.24%, setting a new high; the Nasdaq Composite Index also rose slightly by 0.07%.

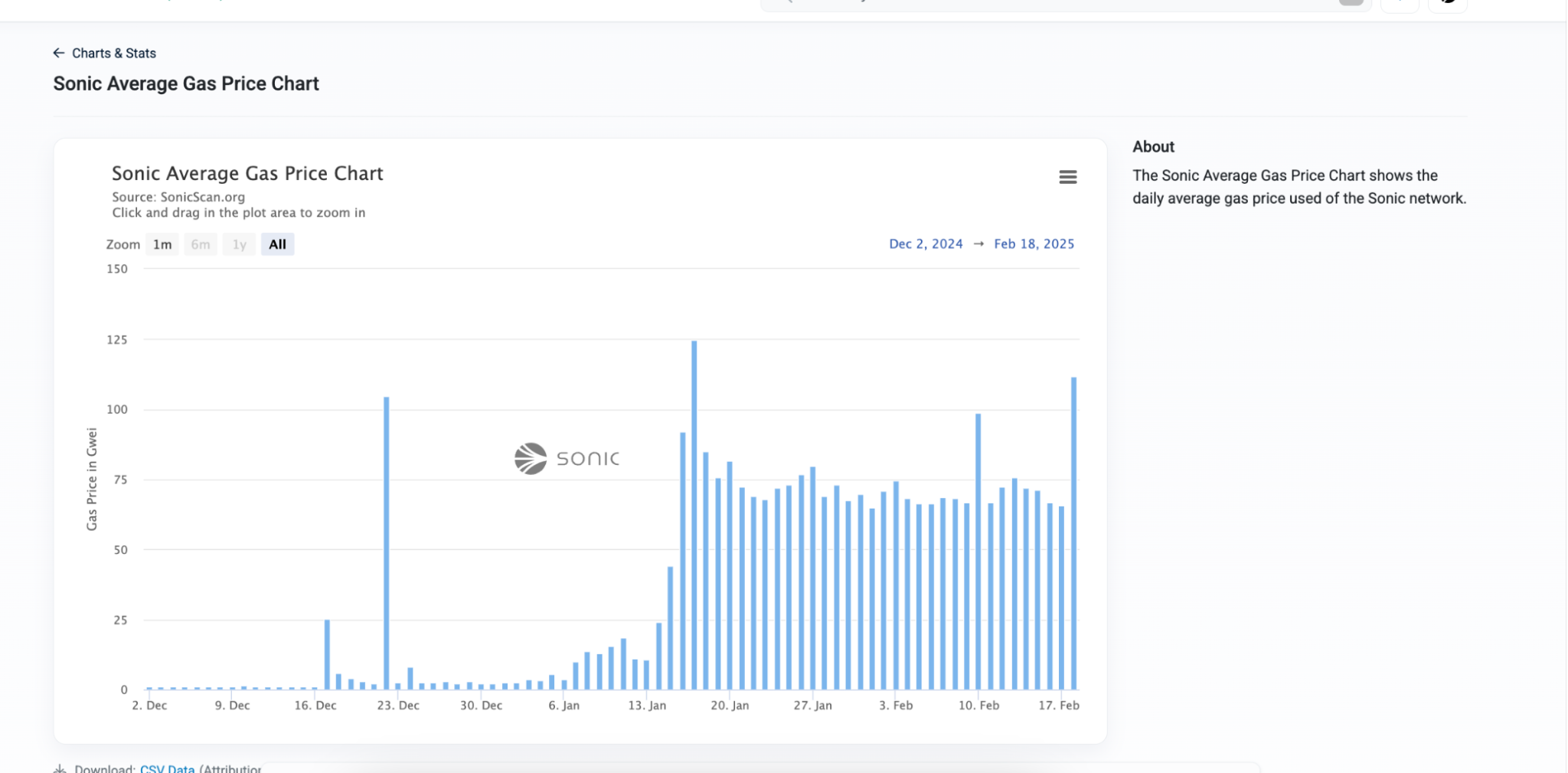

However, the cryptocurrency market is showing a pullback. The market has continued to be sluggish recently, with trading volume and investor confidence both affected, and meme coin has fluctuated violently. Against this background, the $S token rose against the trend, showing strong growth momentum, and the community activity and support also significantly increased, becoming a bright color in the market.

Sonic is the first-layer blockchain platform of EVM evolved based on Fantom, committed to providing high performance and scalability for decentralized applications. The platform native token $S is used for transaction fees, staking, governance and validator runs. Old FTM token holders can be converted to $S in a 1:1 ratio.

Main advantages:

The upgrade covers three aspects: Fantom virtual machine (FVM), storage system (database) and cross-chain bridge (Sonic Gateway).

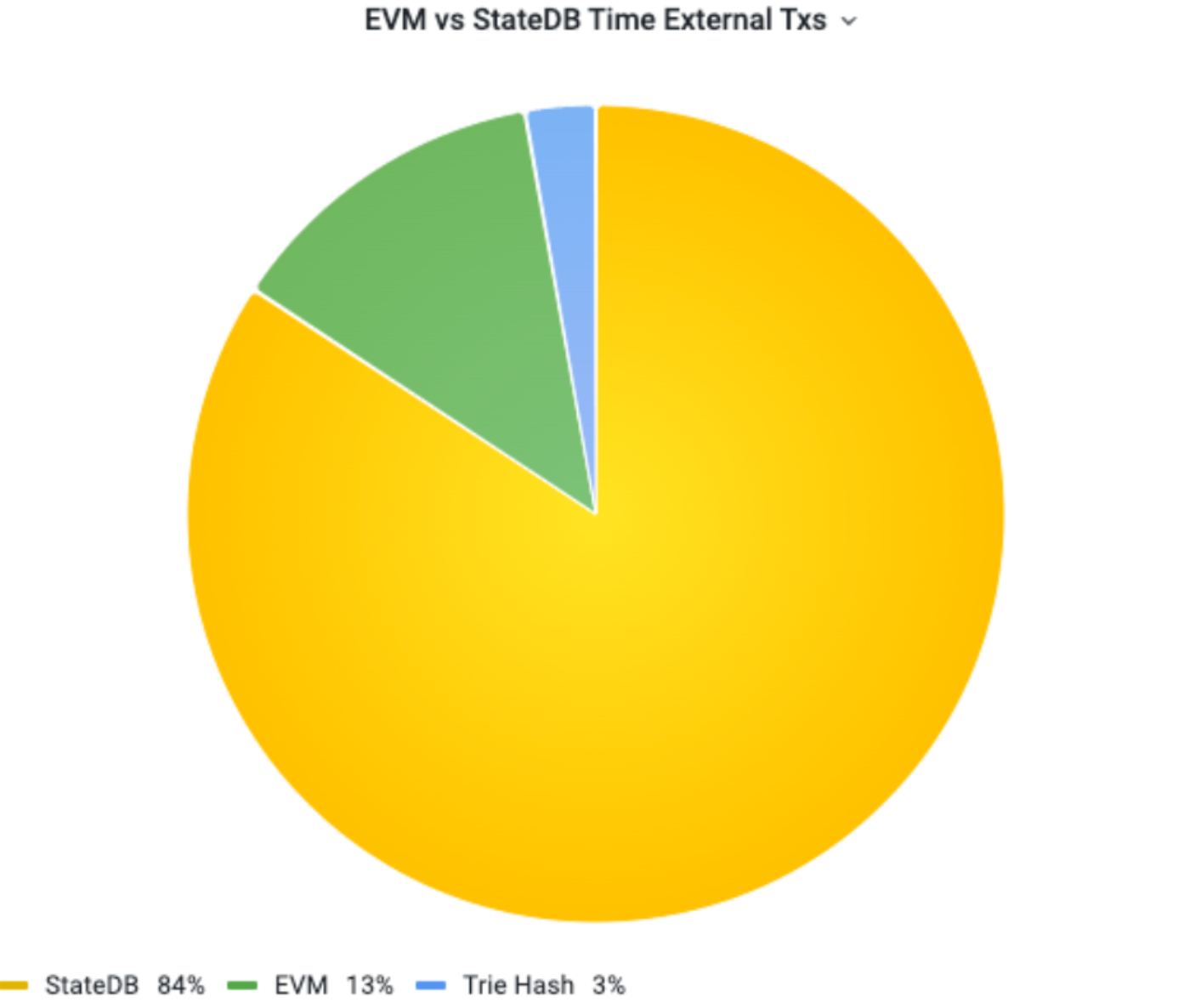

On-chain optimization:

Test results: FVM increases transaction speed by 8.1 times, reduces storage usage by 98%, significantly optimizing network performance.

Off-chain optimization:

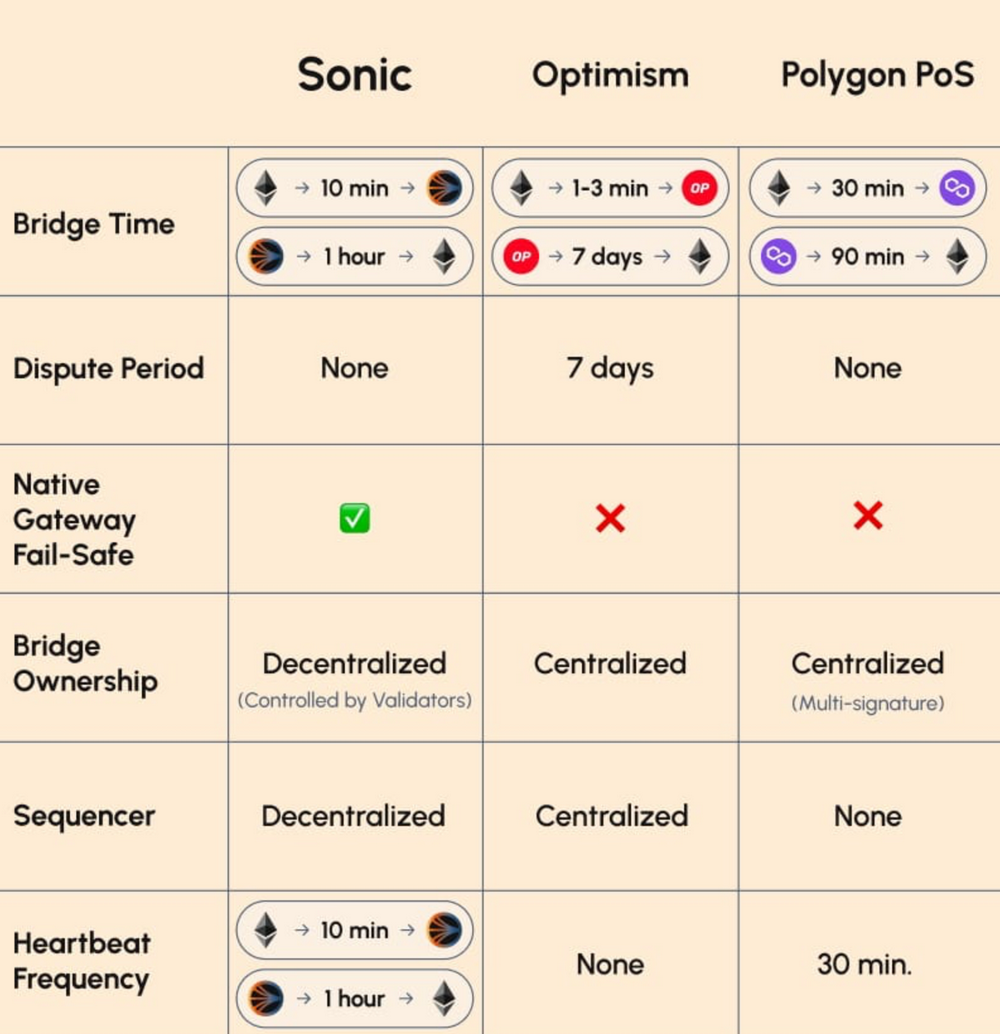

Sonic Gateway is a decentralized cross-chain bridge connecting Ethereum and Sonic networks to improve interoperability and eliminate hosting risks.

It takes about 10 minutes to transfer Ethereum to Sonic, and it takes about 1 hour to transfer the money in reverse.

Safety mechanism: built-in fault protection mechanism and inter-chain "heartbeat" signal monitoring. Compared with Layer-2 solution: Sonic provides a faster transfer experience, no challenge period required, and has immediate endurance.

User income: Allows users to directly access native assets (such as BTC, ETH, SOL) without relying on encapsulated assets.

Unlike Layer-2: Sonic runs as Layer-1 and uses Merkle proof to verify asset status.

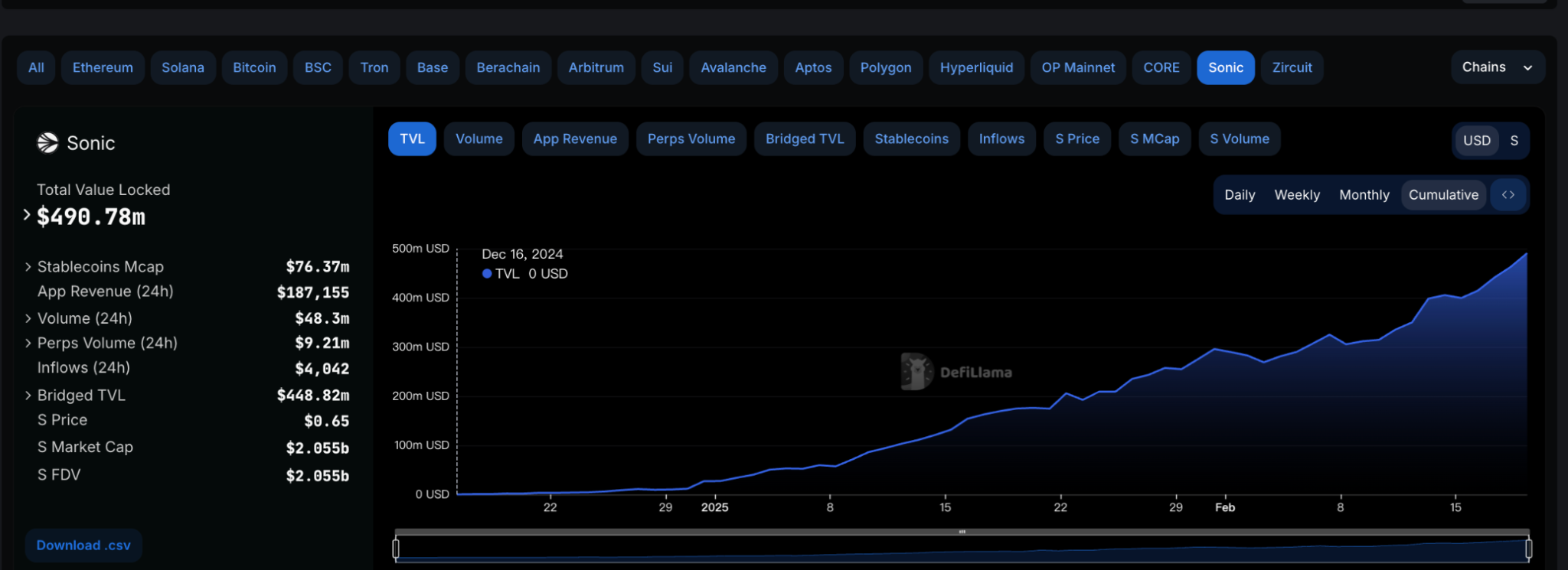

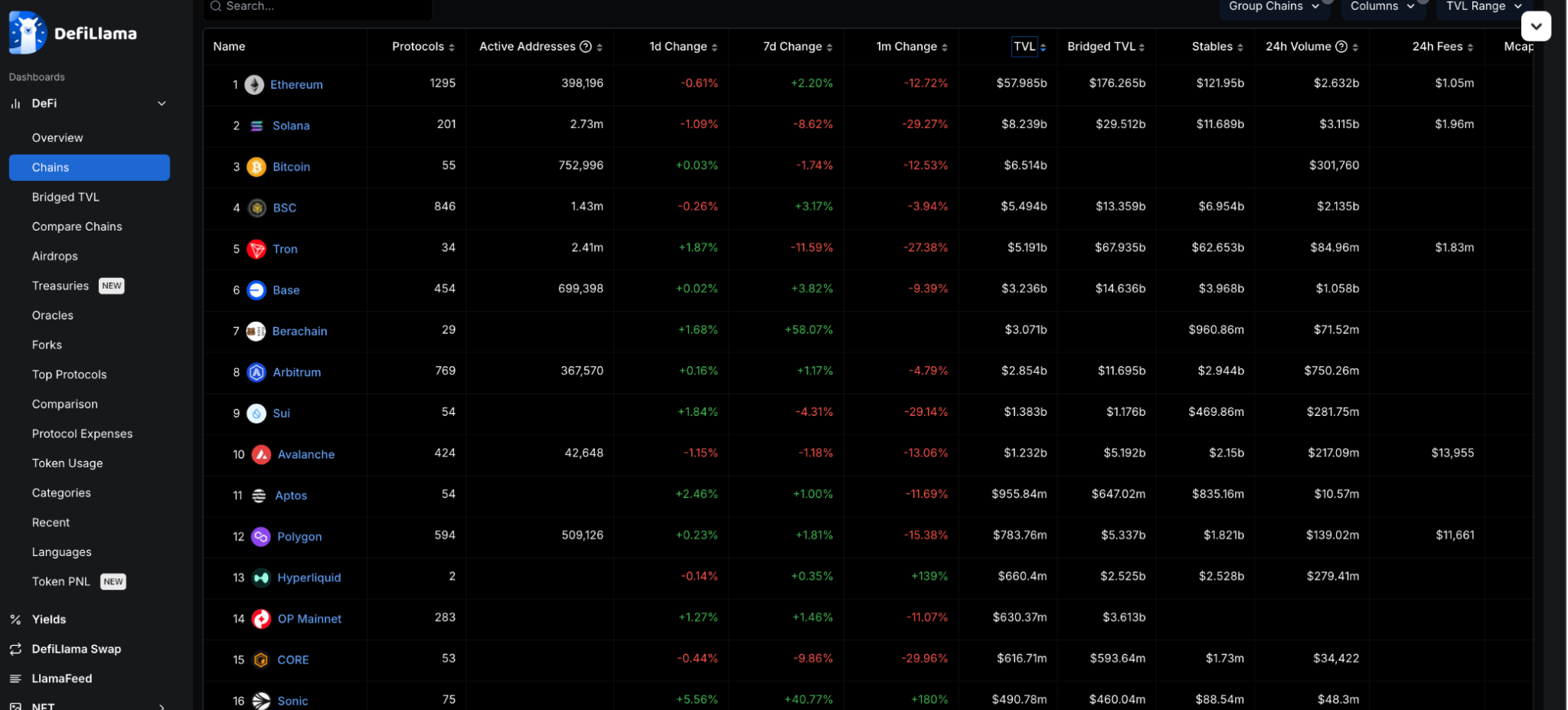

Summary: Sonic has developed rapidly since its name change, TVL has grown significantly, on-chain data is active, and the ecosystem has expanded rapidly. Although prices have not yet fully reflected the improvement of fundamentals, as market attention increases and continuous optimization, the price of $S is expected to rise further in the future. Investors should pay close attention to market trends and on-chain data to seize potential opportunities.

The above is the detailed content of Market value is close to the previous high, and in-depth analysis of the fundamental factors of Sonic's counter-trend rise. For more information, please follow other related articles on the PHP Chinese website!