web3.0

web3.0

Crypto ETF Weekly Report | Last week, the net outflow of US Bitcoin Spot ETFs was $552 million, and the Canary Litecoin Spot ETFs are listed on the DTCC official website

Crypto ETF Weekly Report | Last week, the net outflow of US Bitcoin Spot ETFs was $552 million, and the Canary Litecoin Spot ETFs are listed on the DTCC official website

Crypto ETF Weekly Report | Last week, the net outflow of US Bitcoin Spot ETFs was $552 million, and the Canary Litecoin Spot ETFs are listed on the DTCC official website

Compiled: Jerry, ChainCatcher

Summary of market performance of crypto spot ETFs last week

U.S. Bitcoin Spot ETF: Net Outflow of Funds

Last week, US Bitcoin Spot ETFs experienced net outflow of funds for four consecutive trading days, with a total outflow of US$552 million and total net asset value remained at US$110.8 billion. The outflows of the three ETFs, FBTC, ARKB and BITB, were the most obvious, with outflows of $153 million, $107 million and $105 million respectively. It is worth noting that only the VanEck HODL ETF shows a net inflow of funds.

Source of Data: Farside Investors

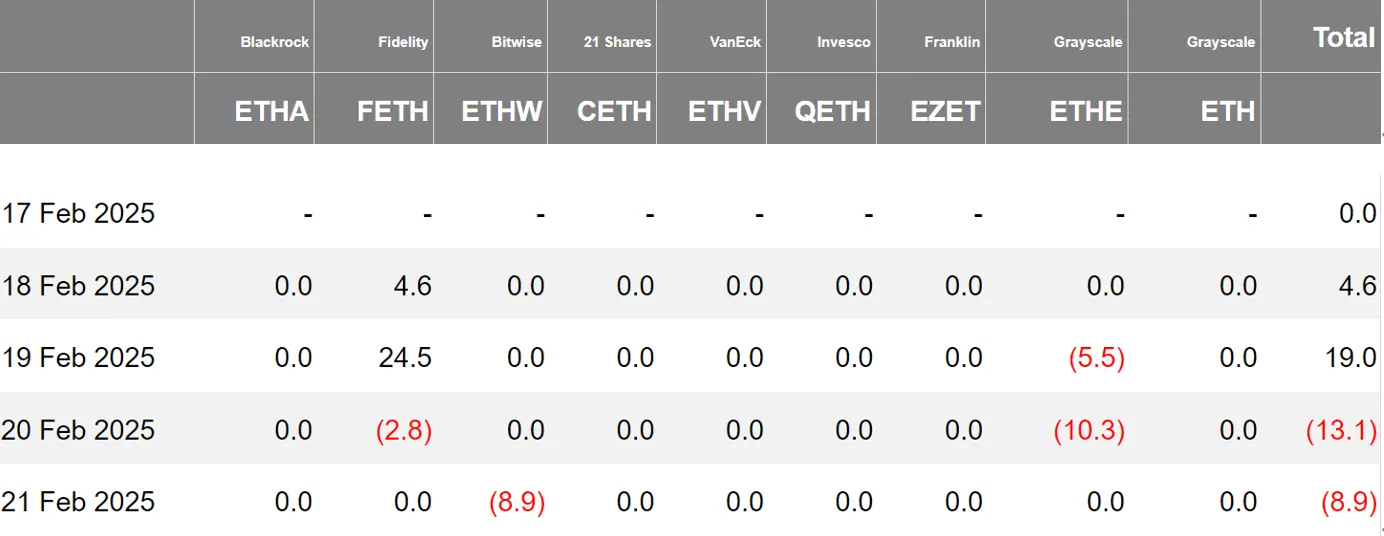

U.S. Ethereum Spot ETF: Net Outflow of Funds

Last week, the U.S. Ethereum Spot ETF had a net outflow of $1.6 million, with a total net asset value of about $9.98 billion, and an average daily turnover of $346 million. The most significant outflow of the Grayscale ETHE ETF, with a net outflow of $15.8 million. The remaining 6 Ethereum spot ETFs did not show significant capital flows.

Source of Data: Farside Investors

Hong Kong Bitcoin and Ethereum Spot ETF: Net Outflow of Funds

Last week, Hong Kong Bitcoin Spot ETF had a net outflow of 19.03 Bitcoins, with a net asset value of US$421 million. The holdings of Jiashishen Bitcoin ETFs increased to 357, while the holdings of Huaxia Bitcoin ETFs were 2,320. At the same time, Hong Kong Ethereum spot ETF funds had a net outflow of 401 ETH, with a net asset value of approximately US$55.29 million.

Data source: SoSoValue

Crypto Spot ETF Options Market Performance

As of February 20, the nominal total transaction volume of Bitcoin spot ETF options in the United States was US$577 million, with a long-to-short ratio of 1.88. As of February 13, the total nominal holdings reached US$13.45 billion, with a long-to-short ratio of 1.98. In the short term, the activity of Bitcoin spot ETF options trading has declined, but overall market sentiment is still bullish, with an implicit volatility of 53.28%.

Source of data: SoSoValue

Encrypted ETF industry trends last week

Canary Litecoin Spot ETF has been listed on the DTCC official website and the code is LTCC. Although this does not mean regulatory approval, inclusion in the DTCC website is a standard process introduced by the new ETF.

US SEC has confirmed that it has received a Bitwise XRP spot ETF application. The SEC requires that comments be submitted within 21 days of publication of the Federal Register, after which a decision will be made on approval. Bloomberg analysts predict that the probability of its approval is 65%.

SEC solicits public comment on Grayscale and Bitwise Ethereum ETF options trading. The SEC will accept comments within 21 days of the publication of the Federal Register before deciding whether to approve it.

Hashdex is approved to launch the world's first XRP spot ETF in Brazil. This ETF is now in the pre-operation stage and its official launch time is to be determined.

Grayscale Spot XRP ETF application has been submitted to the Federal Gazette, with the resolution ending October 18.

Franklin Templeton submitted spot Solana ETF S-1 documents to the US SEC.

XRP ETF and Solana ETF have applied for formal entry into the US SEC Federal Register, awaiting further approval.

Australian ETF operator BetaShares launches BTC ETF.

US Stock Exchange MEMX applied to the SEC to approve its listing of the 21Shares XRP ETF.

The US SEC confirmed that it had received a proposal by 21Shares to pledge Ethereum ETFs.

The US SEC seeks public comment on the WisdomTree XRP ETF proposal.

Market News: US SEC confirms that the COINSHARES SPOT XRP ETF application has been submitted.

US SEC has confirmed that it has received a Litecoin spot ETF application submitted by CoinShares.

Encryption ETF Market Perspectives and Analysis

Bloomberg Analyst: The probability of LTC ETF being approved is 90%, and the listing on the DTCC indicates that the issuer has begun to prepare.

Bloomberg analyst: PlanB's transfer of Bitcoin to ETF is enough to show that the convenience it provides is very powerful.

President of The ETF Store: Schwab Finance has established a digital asset manager position and may provide crypto spot trading services.

Bloomberg analyst: Compared with gold ETFs, the institutional holding ratio of Bitcoin ETFs still has room for growth of 10-15%.

Northstake executive: If the XRP ETF is approved, it is expected to flow between $400 million and $500 million in the first week. Bloomberg analysts predict a 65% chance of approval.

Analysts: The inflow of funds from Bitcoin and Ethereum ETFs has slowed significantly since the election, and the market is waiting for new catalysts.

The above is the detailed content of Crypto ETF Weekly Report | Last week, the net outflow of US Bitcoin Spot ETFs was $552 million, and the Canary Litecoin Spot ETFs are listed on the DTCC official website. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1662

1662

14

14

1419

1419

52

52

1311

1311

25

25

1261

1261

29

29

1234

1234

24

24

What kind of software is a digital currency app? Top 10 Apps for Digital Currencies in the World

Apr 30, 2025 pm 07:06 PM

What kind of software is a digital currency app? Top 10 Apps for Digital Currencies in the World

Apr 30, 2025 pm 07:06 PM

With the popularization and development of digital currency, more and more people are beginning to pay attention to and use digital currency apps. These applications provide users with a convenient way to manage and trade digital assets. So, what kind of software is a digital currency app? Let us have an in-depth understanding and take stock of the top ten digital currency apps in the world.

How to use MySQL functions for data processing and calculation

Apr 29, 2025 pm 04:21 PM

How to use MySQL functions for data processing and calculation

Apr 29, 2025 pm 04:21 PM

MySQL functions can be used for data processing and calculation. 1. Basic usage includes string processing, date calculation and mathematical operations. 2. Advanced usage involves combining multiple functions to implement complex operations. 3. Performance optimization requires avoiding the use of functions in the WHERE clause and using GROUPBY and temporary tables.

How does deepseek official website achieve the effect of penetrating mouse scroll event?

Apr 30, 2025 pm 03:21 PM

How does deepseek official website achieve the effect of penetrating mouse scroll event?

Apr 30, 2025 pm 03:21 PM

How to achieve the effect of mouse scrolling event penetration? When we browse the web, we often encounter some special interaction designs. For example, on deepseek official website, �...

Easeprotocol.com directly implements ISO 20022 message standard as a blockchain smart contract

Apr 30, 2025 pm 05:06 PM

Easeprotocol.com directly implements ISO 20022 message standard as a blockchain smart contract

Apr 30, 2025 pm 05:06 PM

This groundbreaking development will enable financial institutions to leverage the globally recognized ISO20022 standard to automate banking processes across different blockchain ecosystems. The Ease protocol is an enterprise-level blockchain platform designed to promote widespread adoption through easy-to-use methods. It announced today that it has successfully integrated the ISO20022 messaging standard and directly incorporated it into blockchain smart contracts. This development will enable financial institutions to easily automate banking processes in different blockchain ecosystems using the globally recognized ISO20022 standard, which is replacing the Swift messaging system. These features will be tried soon on "EaseTestnet". EaseProtocolArchitectDou

Quantitative Exchange Ranking 2025 Top 10 Recommendations for Digital Currency Quantitative Trading APPs

Apr 30, 2025 pm 07:24 PM

Quantitative Exchange Ranking 2025 Top 10 Recommendations for Digital Currency Quantitative Trading APPs

Apr 30, 2025 pm 07:24 PM

The built-in quantization tools on the exchange include: 1. Binance: Provides Binance Futures quantitative module, low handling fees, and supports AI-assisted transactions. 2. OKX (Ouyi): Supports multi-account management and intelligent order routing, and provides institutional-level risk control. The independent quantitative strategy platforms include: 3. 3Commas: drag-and-drop strategy generator, suitable for multi-platform hedging arbitrage. 4. Quadency: Professional-level algorithm strategy library, supporting customized risk thresholds. 5. Pionex: Built-in 16 preset strategy, low transaction fee. Vertical domain tools include: 6. Cryptohopper: cloud-based quantitative platform, supporting 150 technical indicators. 7. Bitsgap:

Top 10 cryptocurrency apps recommended in 2025 Virtual currency trading platform app rankings

Apr 30, 2025 am 10:33 AM

Top 10 cryptocurrency apps recommended in 2025 Virtual currency trading platform app rankings

Apr 30, 2025 am 10:33 AM

Recommended top ten cryptocurrency apps in 2025: 1. OKX, 2. Binance, 3. Coinbase. 1. OKX ranks first with its powerful features and user-friendly interface, supporting a variety of transactions and staking services. 2. Binance ranks second with its huge user base and rich trading pairs, providing a variety of trading and IEO services. 3. Coinbase ranks third with its user-friendly interface and powerful security measures, supporting a variety of mainstream virtual currency transactions.

Is the digital currency app formal? Top 10 formal and legal virtual currency trading apps in the world

Apr 30, 2025 pm 07:09 PM

Is the digital currency app formal? Top 10 formal and legal virtual currency trading apps in the world

Apr 30, 2025 pm 07:09 PM

Recommended cryptocurrency trading platforms include: 1. Binance: the world's largest trading volume, supports 1,400 currencies, FCA and MAS certification. 2. OKX: Strong technical strength, supports 400 currencies, approved by the Hong Kong Securities Regulatory Commission. 3. Coinbase: The largest compliance platform in the United States, suitable for beginners, SEC and FinCEN supervision. 4. Kraken: a veteran European brand, ISO 27001 certified, holds a US MSB and UK FCA license. 5. Gate.io: The most complete currency (800), low transaction fees, and obtained a license from multiple countries. 6. Huobi Global: an old platform that provides a variety of services, and holds Japanese FSA and Hong Kong TCSP licenses. 7. KuCoin

2025 Digital Currency Trading App Recommendation Top Ten Digital Currency Exchange App Ranking

Apr 30, 2025 am 11:00 AM

2025 Digital Currency Trading App Recommendation Top Ten Digital Currency Exchange App Ranking

Apr 30, 2025 am 11:00 AM

The top ten digital currency trading apps recommended in 2025 include: 1. Binance, 2. OKX, 3. Coinbase, 4. Kraken, 5. Huobi, 6. KuCoin, 7. Bitfinex, 8. Gemini, 9. Bybit, 10. Bitstamp, these platforms stand out in the market for their capabilities, user experience and security.