Solana DeFi Ecosystem: Competitive Landscape and Investment Analysis

Solana's decentralized finance (DeFi) ecosystem experienced significant changes from the fourth quarter of 2024 to early 2025, mainly reflected in the rise of aggregators, user experience optimization, major integration, and the evolution of token economic models. These changes directly affect liquidity allocation, expense generation and market share. This article will conduct in-depth analysis of the liquidity status of Solana's major decentralized exchanges (DEXs) - Raydium, Jupiter, Orca and Meteora, and explore its competitive advantages, disadvantages and investment potential.

Investment Analysis Framework

Raydium (RAY): Prospects are promising

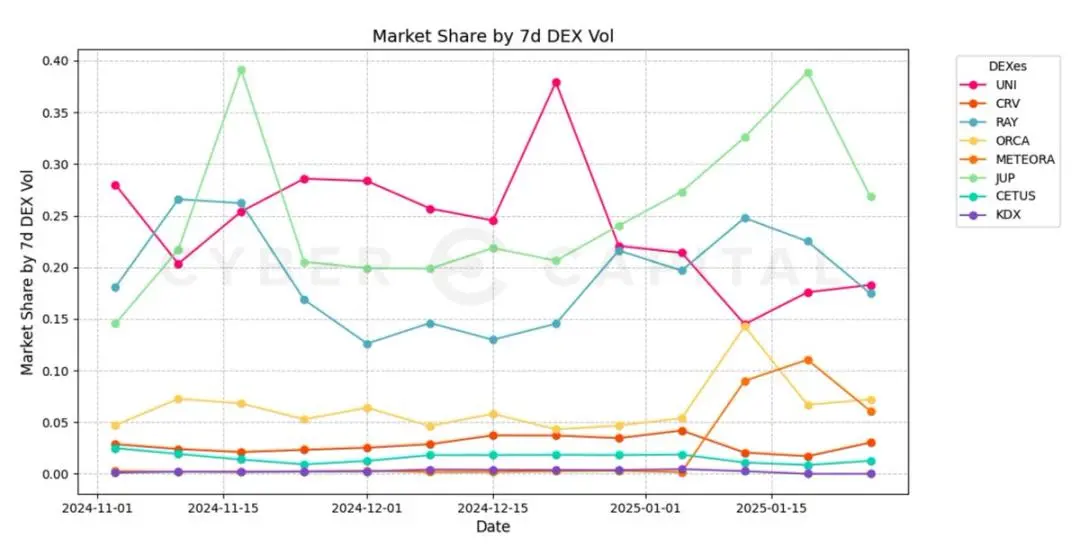

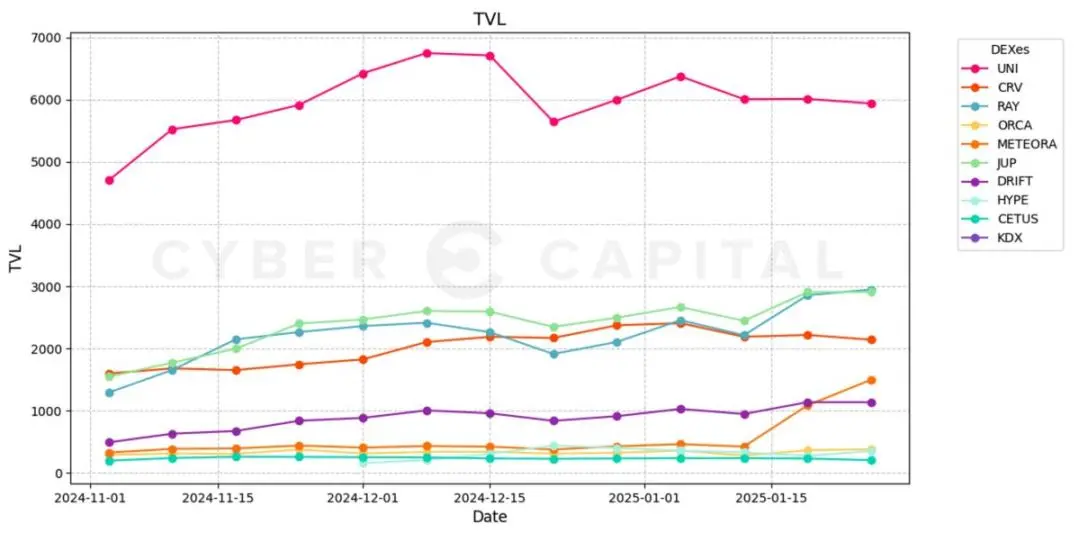

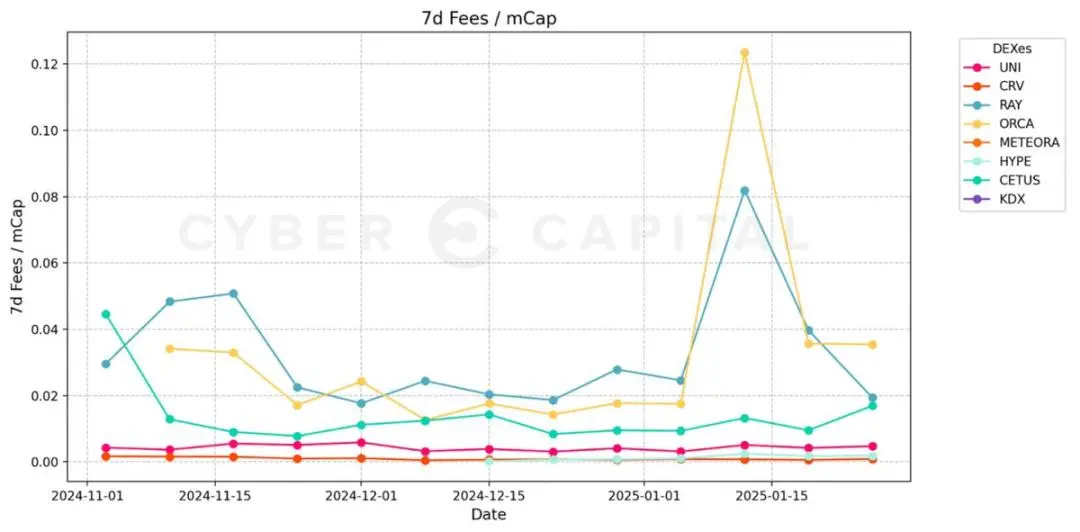

Leading liquidity and trading volume: Raydium remains the most liquid and trading DEX in the Solana ecosystem. More than 55% of transactions routed through Jupiter are ultimately settled on Raydium. Its market share competes with Uniswap, sometimes even surpassing the latter, while its Fully Dilution Valuation (FDV) and Market Cap are well below Uniswap.

Raydium/Uniswap FDV ratio: 31.5%

The integration with Pump.fun improves transaction volume and user stickiness.

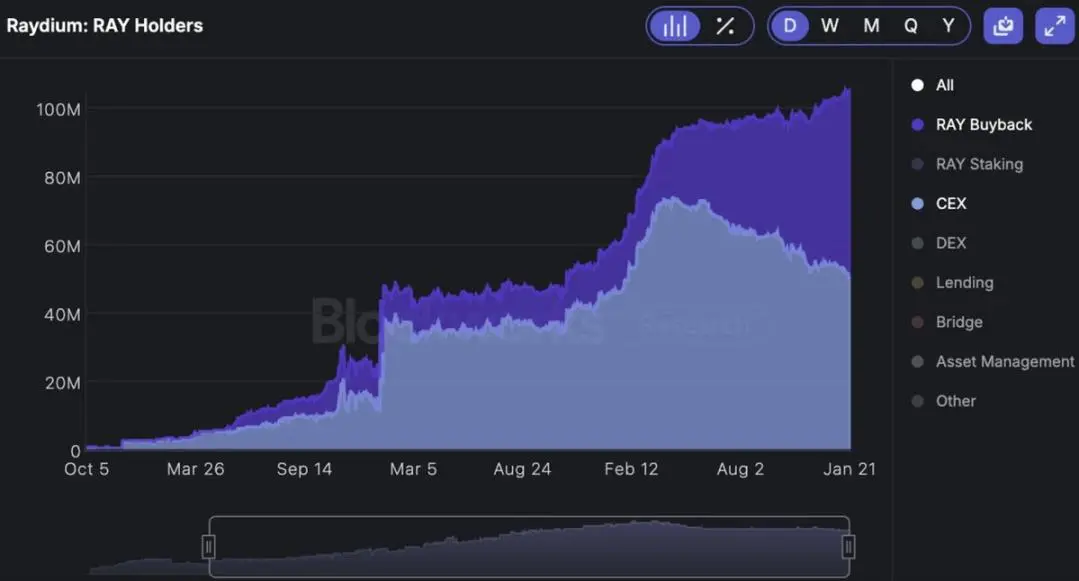

Raydium's 12% fee repurchase program has repurchased tokens that exceed 10% of the total supply, effectively alleviating the selling pressure, with repurchases significantly higher than the holdings of centralized exchanges.

Jupiter (JUP): Promising prospects

Leading aggregators: Jupiter occupies an important position as Solana's main DEX aggregator.

Acquisition of Moonshot: Acquisition of Moonshot improves user experience.

Token unlocking pressure: Token unlocking leads to a 127% increase in supply, bringing medium-term inflation risks. Although a repurchase mechanism was introduced, the annual repurchase rate was only 2.4%, which had limited effect on offsetting inflationary pressure.

Business Model Challenge: Aggregator fees are superimposed on the underlying protocol fees, and their competitiveness is limited in a low-cost environment.

Lack of strong competitors: Jupiter currently lacks strong competitors.

Meteora: Promising outlook

Efficient liquidity aggregation:

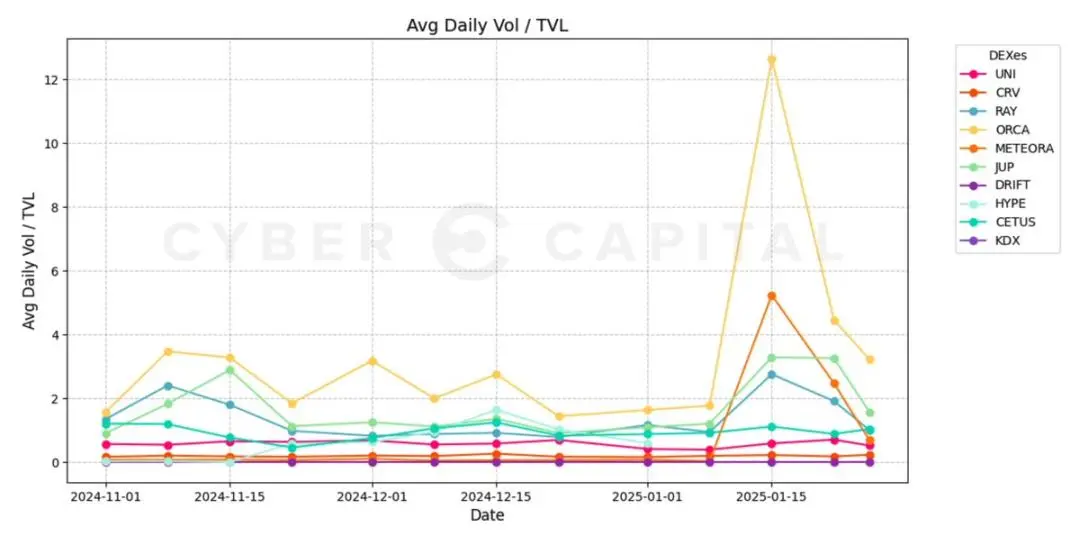

As an aggregator, Meteora has lower downside risks and higher capital efficiency. Token issuance Catalyst: Meteora Token issuance may change liquidity preferences and enhance its market position. The MET points system has not been fully disclosed and the airdrop plan has not been clarified.TVL Retention Rate: Meteora benefits from events such as Pengu Airdrop and Memecoin launch, and its TVL continues to grow after the event.

Integrated Development: Virtuals has been integrated with Meteora.

Orca: The prospect is pessimistic

Insufficient liquidity: Orca's liquidity pool size is smaller than Raydium, resulting in a higher slippage in large-value trading.

Market positioning issues: Jupiter's routing mechanism is biased towards a platform with deeper liquidity, limiting Orca's competitiveness. The emergence of Meteora further exacerbates this problem.

Inadequate incentives: Orca lacks effective liquidity mining strategies, resulting in low retention rates for liquidity providers.

Inefficient capital allocation: Orca lacks automation and benefits optimization, and has poor user experience.

Liquidity churn trend: Meteora token issuance may cause liquidity to flow further to Meteora.

Inadequate integration: Missed opportunities to collaborate with Pump.fun and Virtuals, further weakening competitiveness.

Key Catalysts and Risks

Catalyzer:

Risk:

Conclusion and Investment Outlook

Solana DEX The competitive landscape is moving towards higher efficiency and liquidity concentration. Raydium's liquidity, repurchase mechanisms and market position make it an attractive investment target. Jupiter has a solid aggregator status, but token dilution is a short-term risk. Orca faces serious challenges. Meteora tokens are expected to rise after they are issued. Investment should focus on leading DEXs, polymerizers and emerging players who meet catalyst standards.

The above is the detailed content of In-depth analysis of Solana's four major DEXs: Raydium, Jupiter, Orca and Meteora, who is better?. For more information, please follow other related articles on the PHP Chinese website!