Coinbase Q4 2024 Financial Report Forecast: Market Data Interpretation

As the North American trade dispute subsides and the global market recovers steadily, the United States actively prepares sovereign wealth funds, and crypto-regulator David Sacks predicts that digital assets will usher in a golden age. This week, we will conduct in-depth analysis of Coinbase's upcoming financial reports, USDC trading volume growth, and liquidity trends in the altcoin market.

Coinbase financial report: Market data comes first

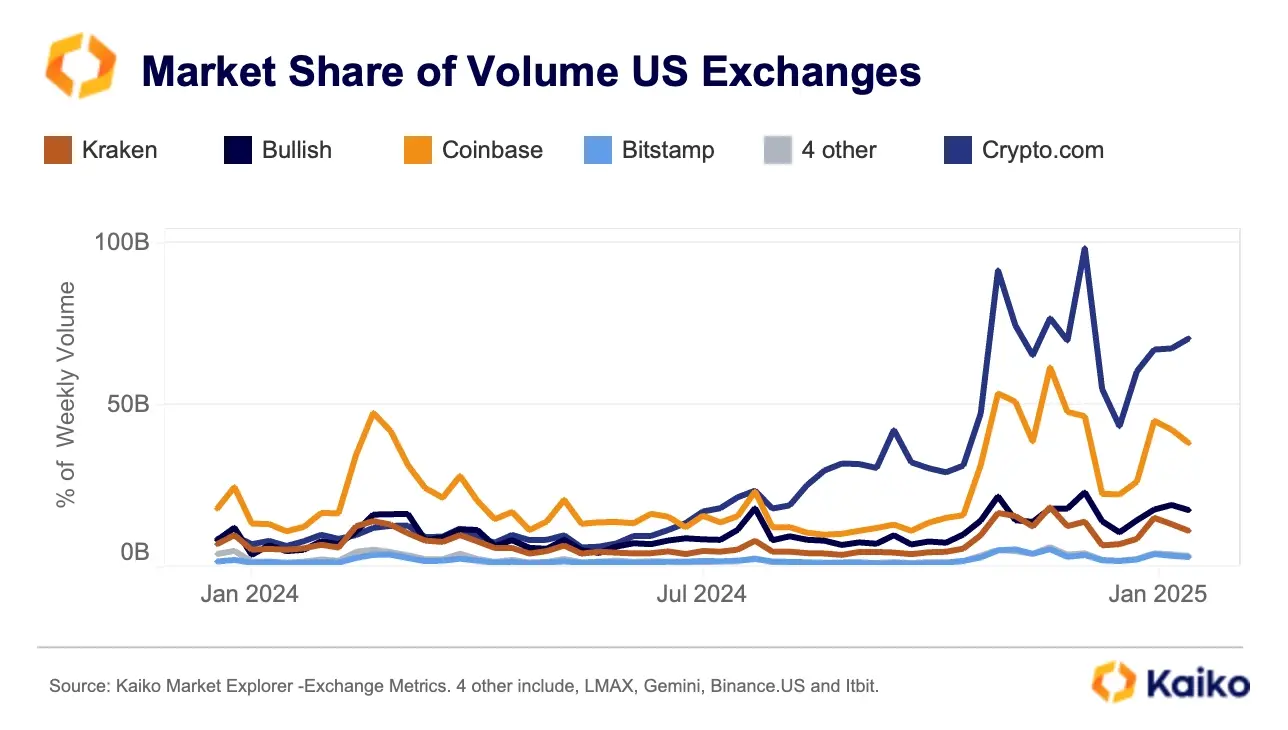

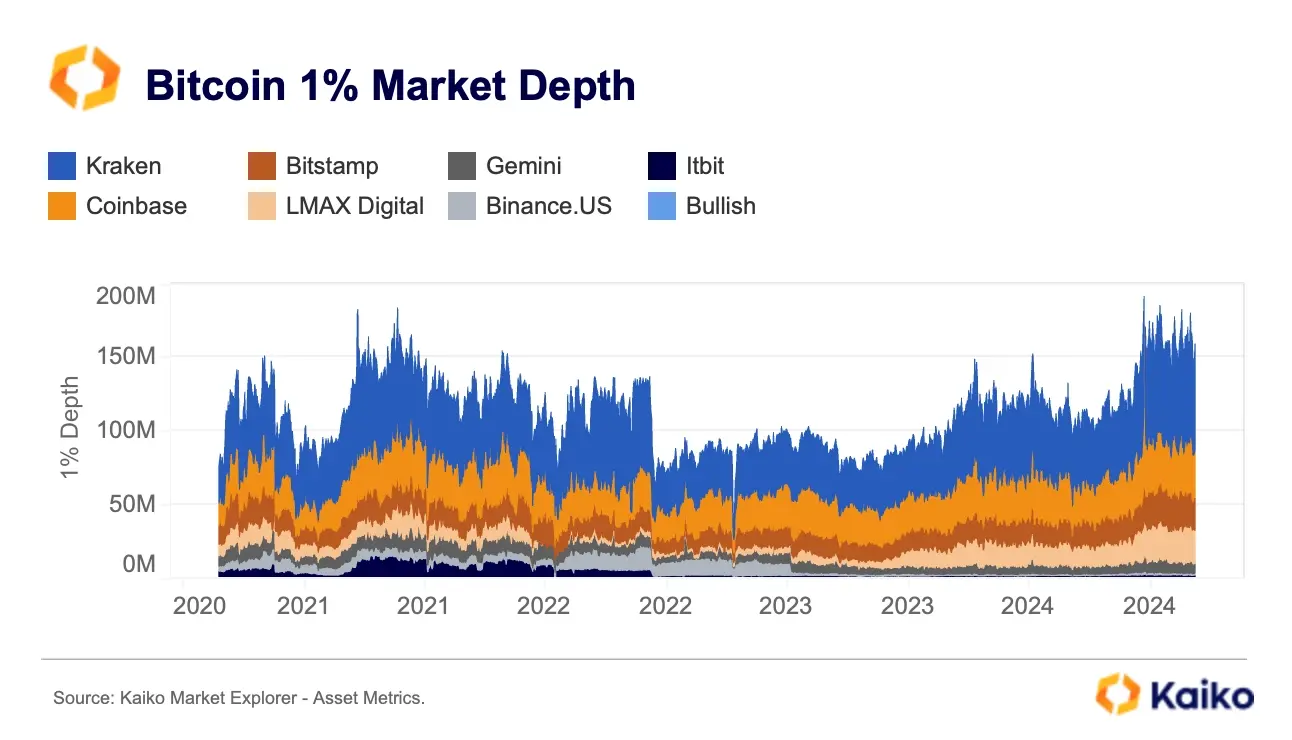

Coinbase will release its fourth quarter financial report for 2024 on February 13. Before the financial report is released, we can glimpse its performance through market data. While analysts predict that it will directly affect stock prices, encrypted market data often better predict the health of the exchange. Data shows that Coinbase's fourth-quarter weekly trading volume reached its highest in two years, indicating it benefited from a market rebound after the U.S. election.

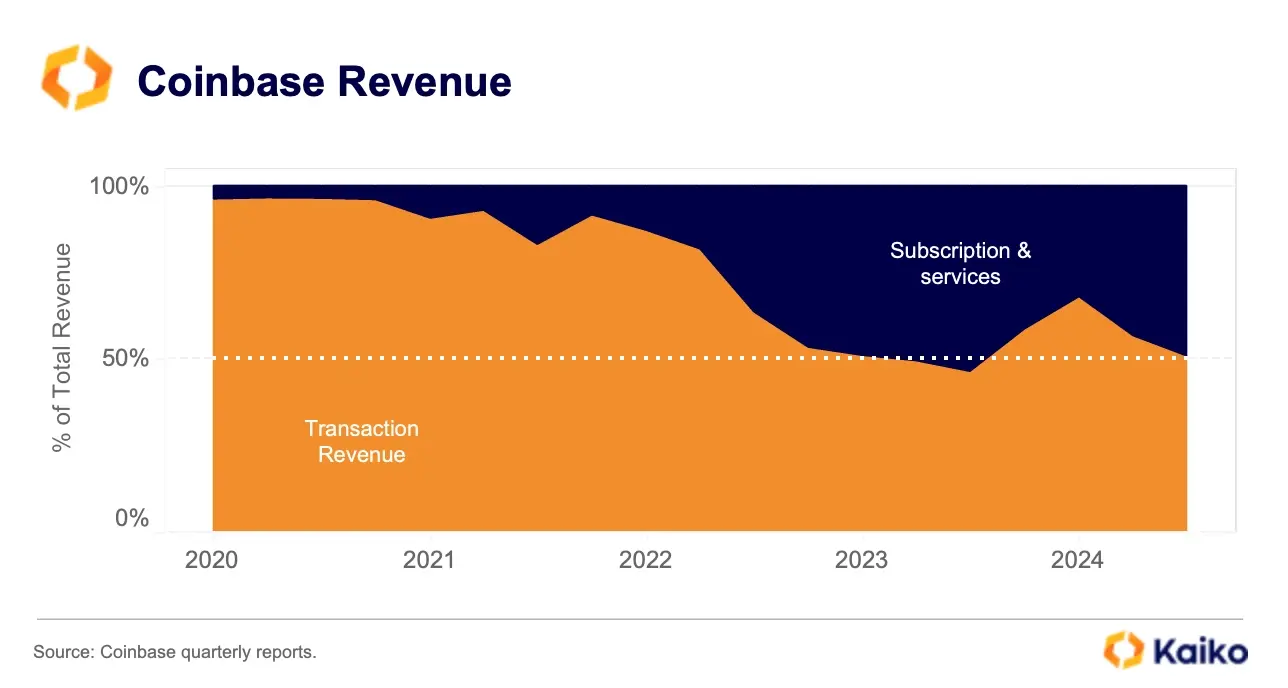

Coinbase's revenue sources are becoming increasingly diversified, and the proportion of "subscription and service" businesses (pled rewards, custody fees, USDC interest) has increased significantly. However, transaction revenue is still the core, and except for one quarter of 2023, it always accounts for more than 50% of the total revenue. However, subscription and service revenue is closely related to the activity of the crypto market and is not a real risk diversification method, and is also affected when the market is down.

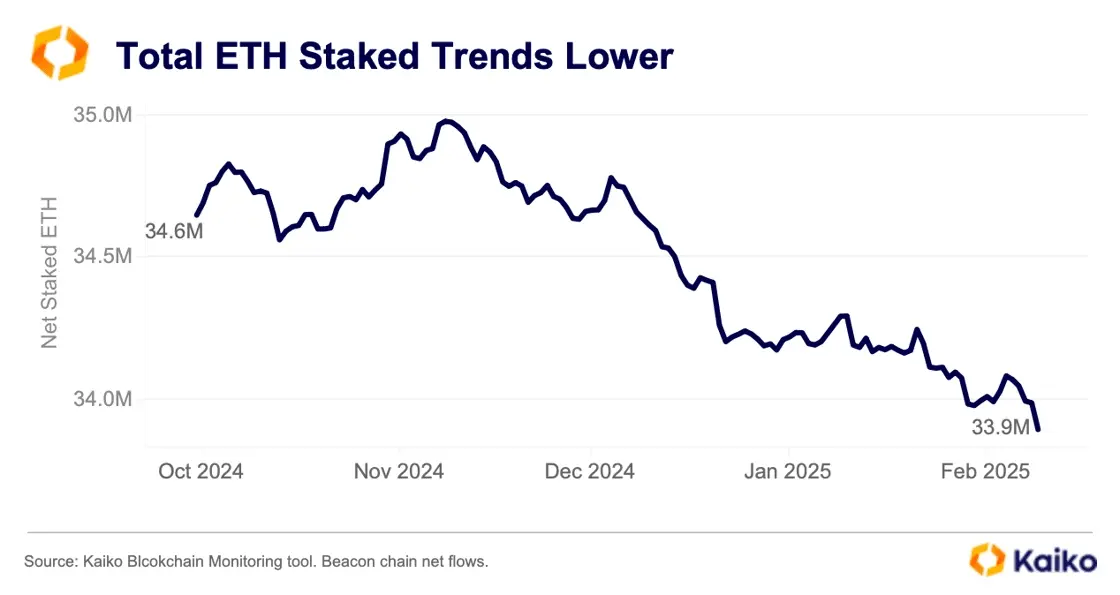

In the third quarter of 2024, the decline in ETH and SOL prices caused a 16% decline in Coinbase blockchain reward revenue. Kaiko data shows that net traffic on Ethereum beacon chain fell in the fourth quarter, and Coinbase, as the second largest ETH staking entity, is one of the main contributors. In the past six months, Coinbase's pledged market share has dropped by 3.8%, with a net outflow of 1.29 million ETH.

Although the rising ETH and SOL prices have eased the impact of the reduction in staking to some extent, Coinbase's blockchain reward revenue may still decline in the fourth quarter. The decline in its pledge market share directly affects the related income.

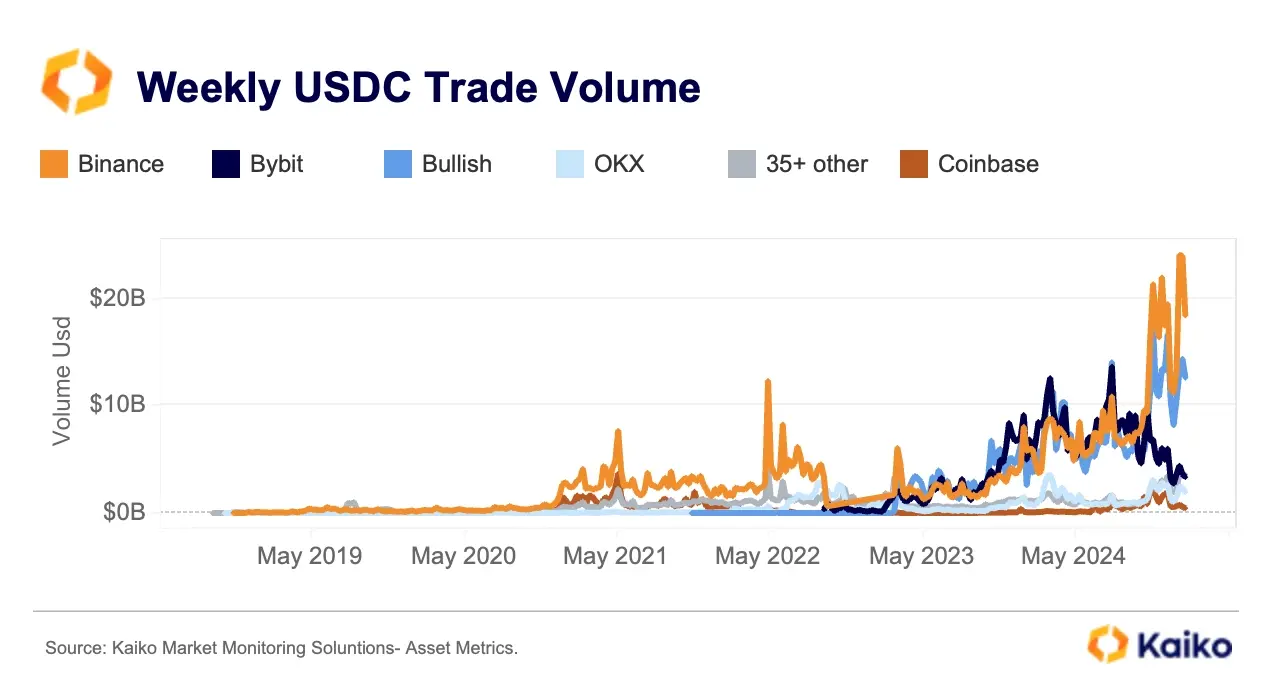

Coinbase's cooperation with Circle has enabled it to gain stable returns from USDC revenue. Circle's partnership with Binance and USDC's record trading volumes may offset the impact of a decline in staking revenue and provide an additional buffer for Coinbase.

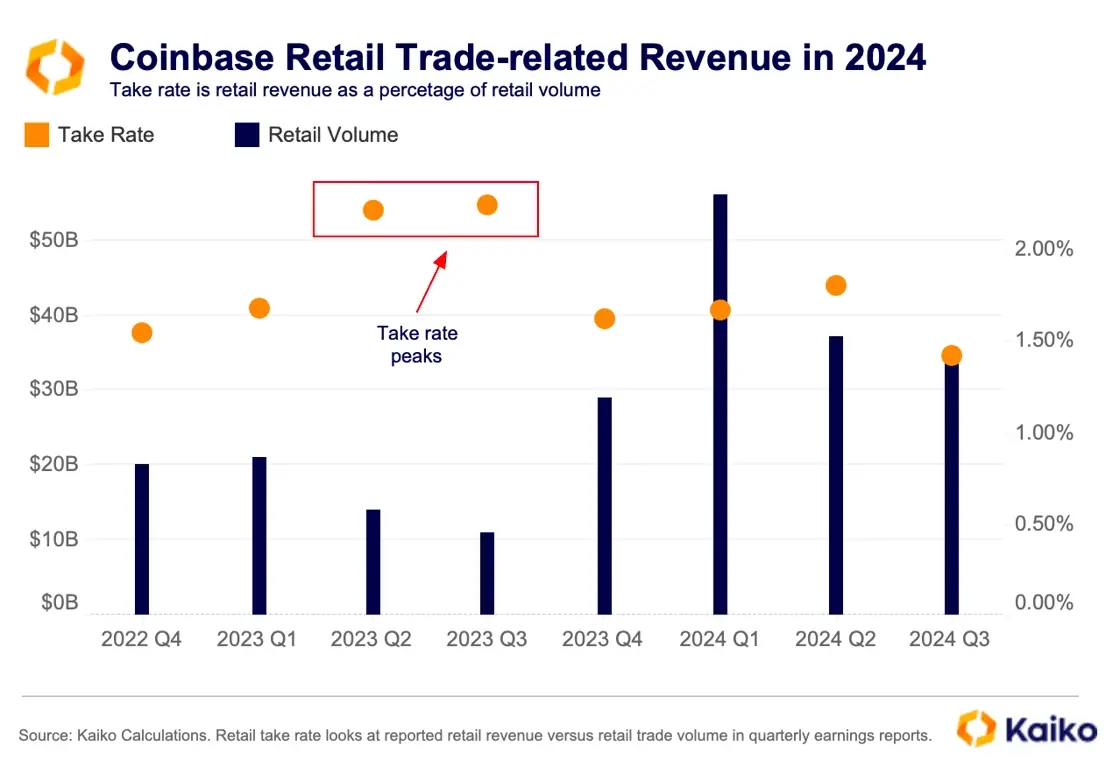

The proportion of retail traders' trading volume has dropped from 40% in 2021 to 18% at present. Although Coinbase subscription business has grown, retail churn still puts pressure on trading revenue. The “extraction rate” (the proportion of income obtained from retail investors) has dropped to its lowest point since the Terra Luna crash in 2022.

Competition in the US market has intensified, and some platforms have lowered transaction fees to attract users, further exacerbating the pressure on Coinbase. Although the Coinbase fee structure is relatively stable, the decrease in retail investors undoubtedly increases income pressure.

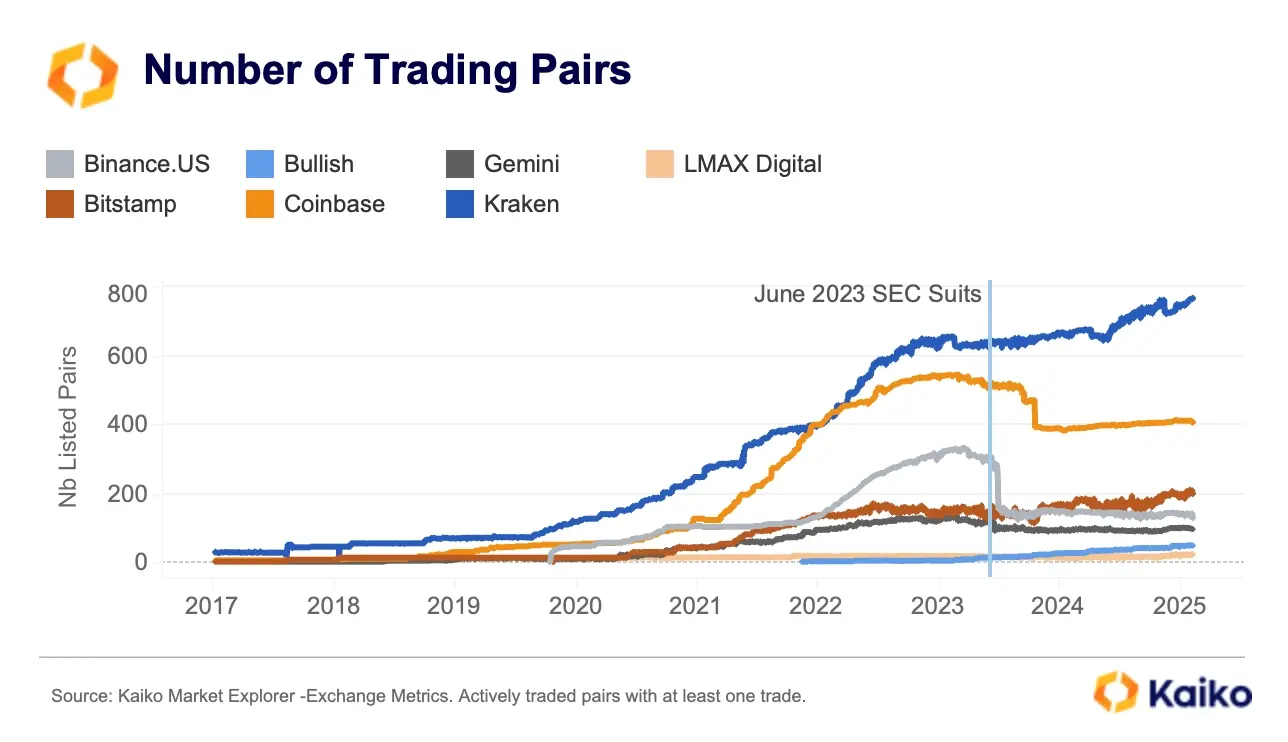

Affected by strict US regulations, the listing of new Coinbase assets has slowed down. The number of active trading pairs on both platforms has dropped significantly since the SEC filed a lawsuit against Binance.US and Coinbase in June 2023. With the improvement of the regulatory environment in the future, Coinbase may accelerate its listing and enhance its attractiveness to retail investors.

USDC trading volume hit a new high: Binance dominated

Binance became the world's largest USDC trading market, with weekly trading volume reaching US$24 billion in January 2025, accounting for 49% of the world, the highest market share since September 2022. This is thanks to Binance's strategic cooperation with Circle. Bybit's market share dropped significantly, while Bullish rose rapidly.

Competition for stablecoins is intensifying, and the proportion of USDT quotation transactions has declined. Euro-backed trading pairs have attracted attention, indicating that EU markets are recovering after the implementation of MiCA regulations.

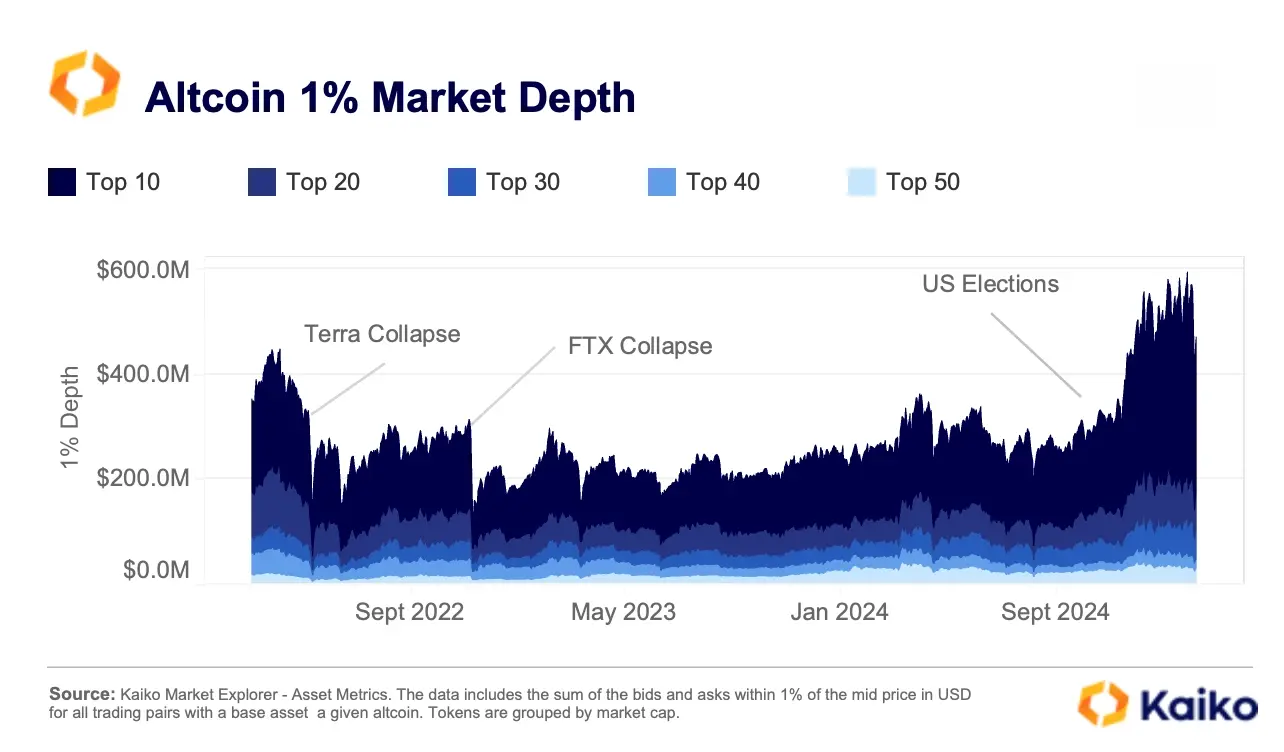

Altcoin liquidity: centralization and the rise of small tokens

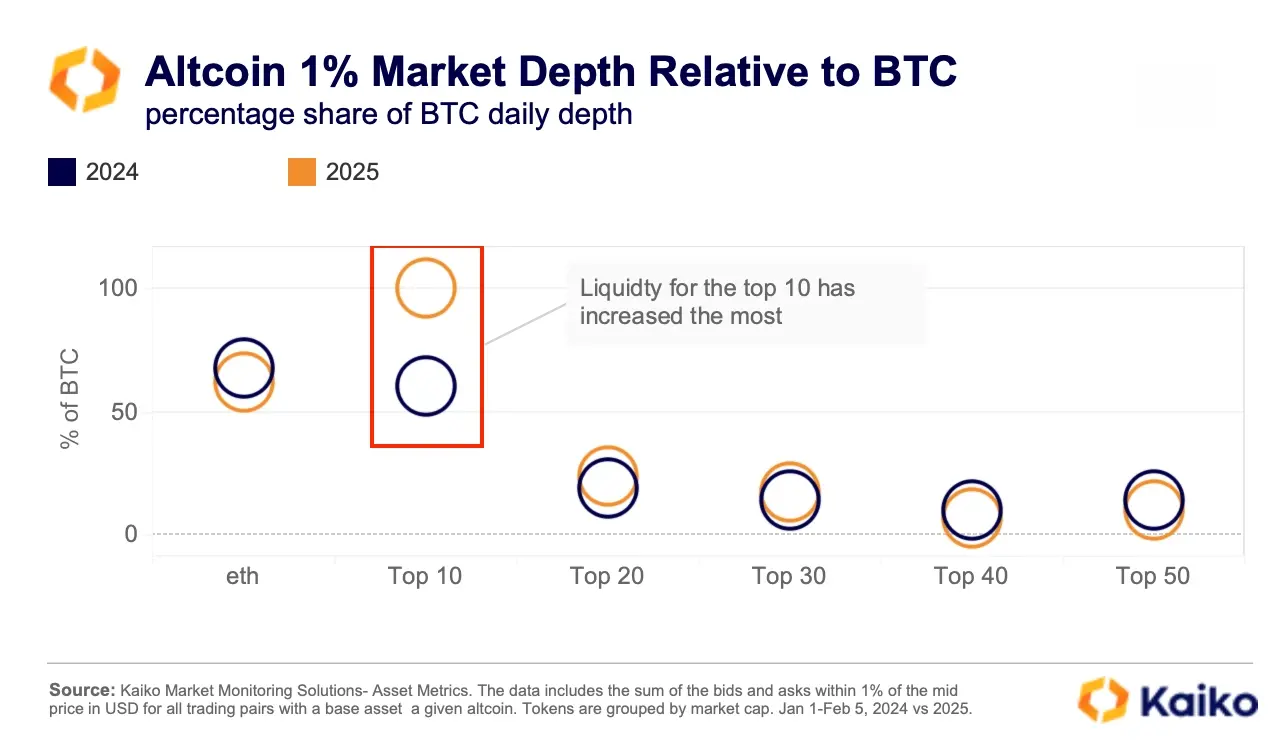

Since the US election, the market's sentiment towards altcoins has improved, driving a surge in a large number of altcoin ETF applications and trading activities. The daily altcoin liquidity indicator (1% market depth of the top 50 Tokens) has nearly doubled since September 2023 to $960 million.

However, liquidity is highly concentrated in the top 10 tokens, accounting for 64%. The liquidity share of medium-cap Tokens has decreased, while the small-cap Tokens have unexpectedly increased, even surpassing the higher market capitalization group.

The above is the detailed content of Judging from the data, the changes in crypto companies: Coinbase's transaction revenue accounts for more than 50%, and USDC's weekly trading volume reached US$24 billion.. For more information, please follow other related articles on the PHP Chinese website!