Compiled: Fairy, ChainCatcher

Last week, US Bitcoin spot ETFs had net outflows of funds for four consecutive trading days, with a total outflow of US$580 million, and the total net asset value remained at US$114.4 billion. The outflows of three ETFs, FBTC, ARKB and GBTC, were the most obvious, with outflows of $282 million, $162 million and $107 million respectively. It is worth noting that only BlackRock IBIT and Grayscale BTC ETFs showed a net inflow of funds.

Source of data: Farside Investors

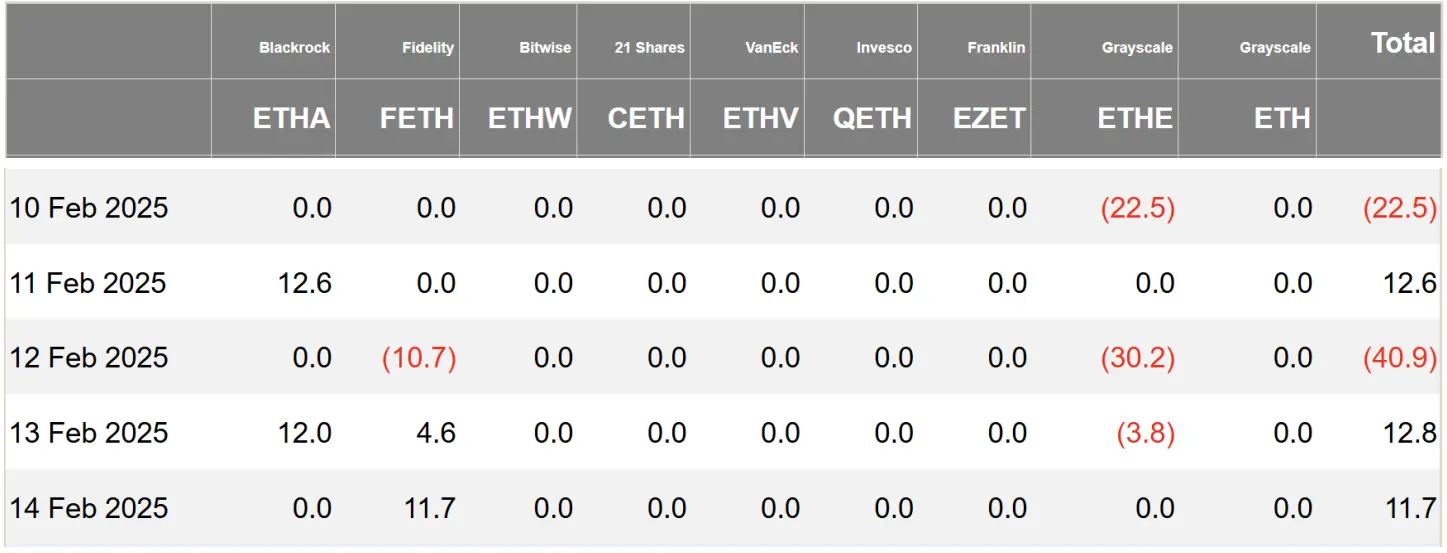

Last week, the U.S. spot ETF net outflow was US$26.3 million, with a total net asset value of US$10.35 billion, and an average daily turnover of US$273 million. Grayscale ETHE ETF outflows were the most significant, with a net outflow of $56.5 million. The remaining 6 Ethereum spot ETFs did not have capital flows.

Source of data: Farside Investors

Last week, Hong Kong Bitcoin Spot ETFs had a net outflow of 3.019 Bitcoins, with a net asset value of US$417 million. The holdings of Jiashishen Bitcoin ETFs fell to 354, while the holdings of Huaxia Bitcoin ETFs were 2340. At the same time, Hong Kong's Ethereum spot ETF had a net outflow of 401.27 ETH, with a net asset value of US$54.94 million.

Data source: SoSoValue

As of February 14, the nominal total transaction volume of Bitcoin spot ETF options in the United States reached US$1.58 billion, with a long-to-short ratio of 3.17. As of February 13, the total nominal holdings were US$11.94 billion, with a long-to-short ratio of 199. The market is active, and the overall sentiment is bullish, with an implied volatility of 54.7%.

Source of data: SoSoValue

The above is the detailed content of Crypto ETF Weekly Report | Last week, the net outflow of US Bitcoin spot ETFs was US$580 million, and the SEC has accepted Sol spot ETF applications such as 21Shares. For more information, please follow other related articles on the PHP Chinese website!