Nasdaq submitted its revised rule documents on January 24, seeking approval of BlackRock Bitcoin Spot ETF (IBIT) for the redemption and creation of physical Bitcoins.

According to Bloomberg ETF analyst James Seyffart, Nasdaq filed a 19b-4 revision application to allow IBIT to perform physical redemption and creation.

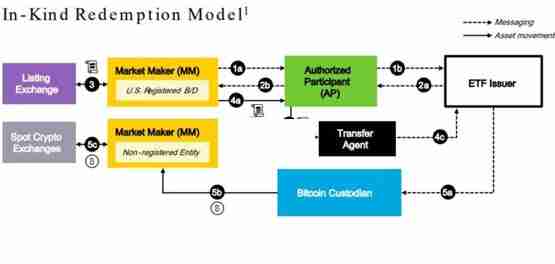

Previously, the U.S. Securities and Exchange Commission (SEC) and the issuer had discussed for a long time the redemption method (in physical or cash) of Bitcoin spot ETFs. Ultimately, due to concerns about the process of handling the Bitcoin by registered brokerage dealers, the issuer chose to go public in cash first.

However, ETFs that are redeemed and created in kind have theoretically higher trading efficiency. Taking gold ETFs as an example, most publishers adopt physical model, and the process is simpler.

Seyffart pointed out that the creation and redemption of physical Bitcoins is limited to authorized participants (APs) and retail investors cannot participate directly. But this means that the trading efficiency of ETFs will be improved, and the potential hidden fees and premium space may be reduced.

The above is the detailed content of Nasdaq Submit Application: Hope BlackRock Bitcoin ETF IBIT creates redemption in physical creation. For more information, please follow other related articles on the PHP Chinese website!